Dear readers/followers,

I’ve published separate articles on Prologis (PLD) and STAG Industrial (NYSE:STAG) a while ago, essentially highlighting my preference for the latter. With both REITs having reported their Q2 2023 earnings recently, today I want to write a comparison piece to show why I think STAG continues to be a better investment.

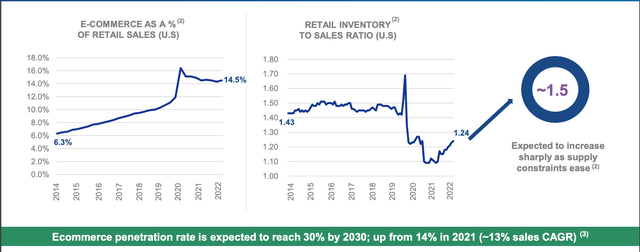

First off, both REITs are quality industrial space landlords operating in a growing sector. It’s no secret that logistics got a major boost during Covid and growth is expected to continue at a double-digit CAGR as e-commerce penetration increases from 14.5% currently to 30% by 2030.

Moreover, demand for industrial space will likely be increased further as companies return a healthy 1.5x inventory to sales ratio (note that the ratio fell close to one due to supply chain constraints, but with those largely out of the way it’s expected to return to pre-Covid levels).

STAG Presentation

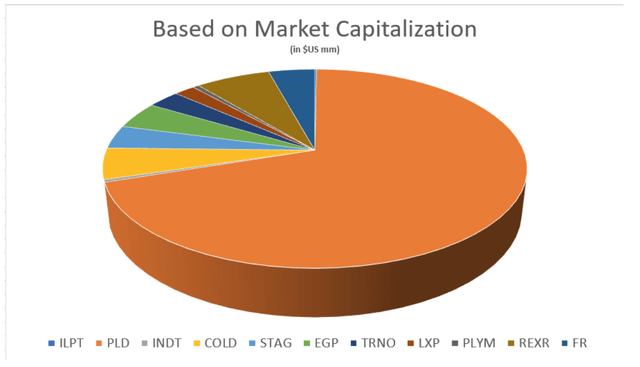

Before moving forward, it’s important to realize just how dominant Prologis is in the space. PLD currently has a market cap of $115.9 Billion which is triple that of the next ten largest competitors combined! STAG’s market cap currently stands at $6.5 Billion, which really makes this a battle of David and Goliath.

Brad Thomas, iREIT on Alpha

But the thing is that the larger a company gets, the more difficult it becomes to grow as any new acquisition and/or development barely moved the needle.

With that said let’s get straight into what makes STAG a better investment.

#1 location, location, location

PLD’s properties are heavily concentrated towards major port cities such as Los Angeles and San Francisco which where the majority of imports from Chine go through. These locations have indeed done very well historically, but new trends seem to be threatening the status quo.

In particular, government’s recent efforts to onshore manufacturing as well as increasing imports from Mexico (rather than China) are likely to benefit STAG’s portfolio much more, as the REIT has a high exposure to locations near the Mexican border.

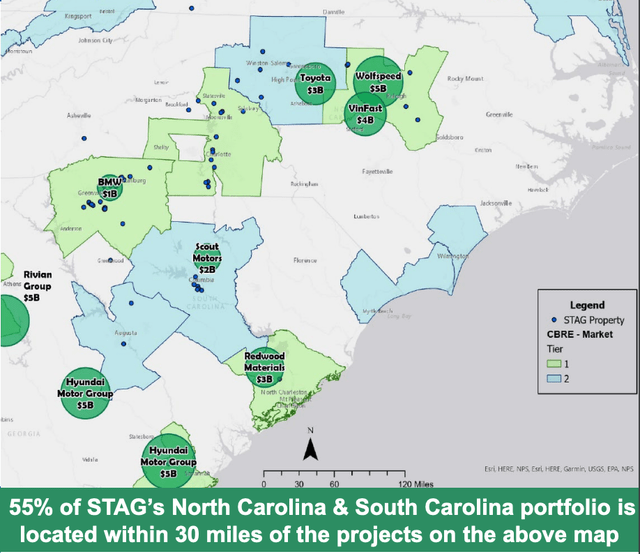

Moreover, many of the REITs properties are located strategically in close proximity to newly opening factories. Take North Carolina, for example, where over half of warehouses are within 30 miles of the newly on-shored projects.

STAG Presentation

#2 FFO and dividend growth

Over the short-term Prologis seems to be the winner as guidance for 2023 FFO calls for 10% YoY growth at midpoint, while STAG’s is at just 5%.

Over the medium to long-term, though, I expect PLP’s prospects to be somewhat limited by its size, since it’s about 20x bigger than STAG and already has a market cap >$100 Billion. This is in line with consensus as next year’s FFO is expected flat for PLD, while STAG’s is forecasted to grow by 5%.

Despite solid FFO growth, the share price of STAG has been held back, because the company has a reputation for not increasing its dividends. In a sector where most investors are very dividend-oriented, this is a huge problem. But from what I’ve seen I think that this might be a thing of the past.

The thing is that STAG hasn’t improved its dividend in over 5 years, because it was trying to de-leverage its balance sheet and lower its payout ratio. But that has been achieved. The REIT now has a very reasonable net debt/EBITDA of 4.9x and a 65% payout ratio, which means that there’s nothing stopping the dividend from increasing at least in line with FFO growth, if not more.

This could be a major catalyst for the stock and could really help it re-rate to a higher multiple. Frankly, I was expecting a dividend hike already during Q2. Sadly, it hasn’t come, but I believe that it may be in the cards for the rest of the year.

#3 balance sheet

Prologis wins hands down in terms of the strength of their balance sheet, but STAG’s isn’t bad either and it has improved significantly over the past couple of years.

| REIT | Rating | net debt/EBITDA | % fixed | avg. rate | % due before 2025 |

| PLD | A- | 4.2x | 92% | 2.9% | 1.5% |

| STAG | BBB | 4.9x | 91% | 3.6% | 17% |

#4 Valuation

So far, Prologis sure seems like a higher quality business, which it is. But the thing is that it also trades at a premium valuation of nearly 23x FFO and yields just 2.8%. STAG on the other hand is still a decent quality company, with a well-positioned portfolio, and trades at only 16x FFO and yields 4.1%.

| REIT | Dividend yield | P/FFO |

| PLD | 2.8% | 22.80x |

| STAG | 4.1% | 16.00x |

To pick a winner, let’s set 24 months price targets for both REITs.

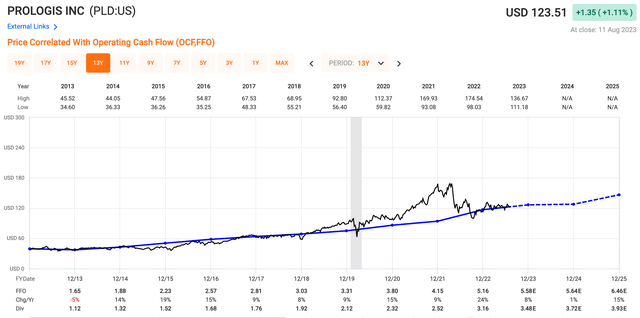

PLD is expected to grow its FFO per share by 8-10% this year with no growth next year. That’s FFO of $5.64 per share by the end of 2024. Historically the stock has traded at its current multiple of 23x, which leaves no space for multiple expansion. So with PLD we can expect a 2.8% dividend + about 5% average annual FFO growth, for a total expected return of 7.8%.

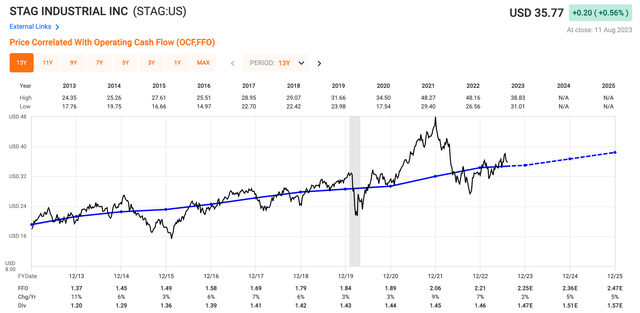

FAST Graphs

STAG is expected to grow its FFO per share by 5% this and next year. Historically, the stock has also traded near its current multiple of 16x FFO. If we assume no multiple expansion, STAG is likely to return 4.1% from dividends + 5% average annual FFO growth, for a total expected return of 9.1%.

FAST Graphs

That’s already better than Prologis, but the thing is that STAG also has potential catalysts that could help it re-rate to a higher multiple closer to PLD’s, perhaps 18-19x FFO. Which would imply further 15% upside and therefore push the stock into alpha territory with a double-digit expected return.

These catalysts, of course, include the potential dividend hike (discussed above), further balance sheet de-leveraging, as well as the market realizing just how well STAG’s properties are located.

I rate Prologis a HOLD here at $123 per share and STAG a BUY here at $36 per share.

Read the full article here