Standard Motor Products (NYSE:SMP) is in the Automotive After Market Sector and other companies in that sector include Genuine Parts (GPC) and Superior Industries International (SUP).

The auto aftermarket parts market is projected to grow at a CAGR of 3.5% between 2021 and 2030.

Verified Market Research

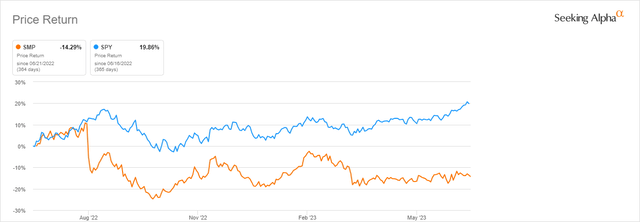

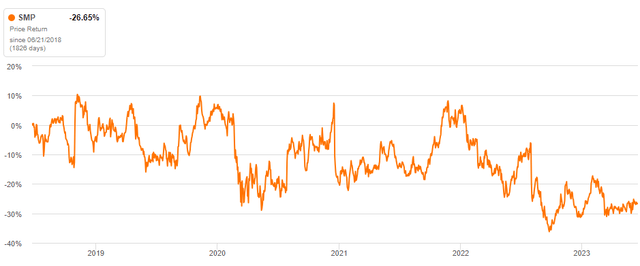

SMP’s total return (including dividends) of minus 14% for the last 12 months has underperformed the S&P 500’s (SPY) plus 19%.

Seeking Alpha

Some of SMP’s products are in the following visual.

SMP

In addition, SMP releases new products virtually every month:

SMP has released 222 new part numbers in its May new number announcement. This most recent release provides new coverage in 69 different product categories, and more than 60 part numbers for 2022 and 2023 model-year vehicles. Source: SMP

The question for investors at this point in time is, does SMP represent a reasonable potential investment return, including dividends, or should investors be on the lookout for better investment opportunities elsewhere?

In this article, we will look at SMP’s prospects for the next year to try and determine the price direction out to 2024 as compared to the last year.

Standard Motor Products Stock Key Metrics

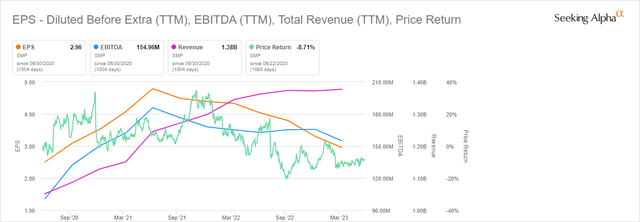

Let’s look at SMP’s financial metrics, comparing the last 3 years.

Seeking Alpha

One quick look at the financial metrics chart above comparing 2020 to 2023 shows that SMP has higher revenue, EBITDA, and earnings per share but the price is down 9% over that time period.

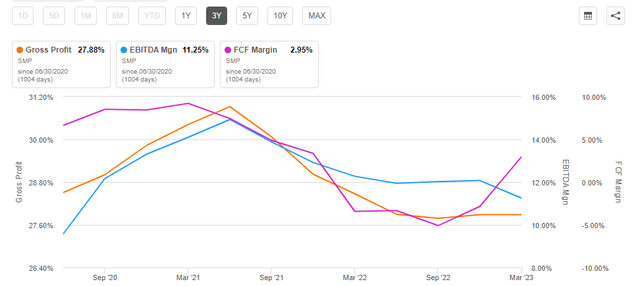

Seeking Alpha

But some of the problem may be related to margin percentages with gross margin and free cash flow margin down while EBITDA margin was up slightly. This could be due to the logistical problems that the world has had over the last 2-3 years and may be receding into the rearview mirror as we head towards 2024. That would definitely be a positive for SMP’s share price.

What Do Analysts Think Of Standard Motor Products?

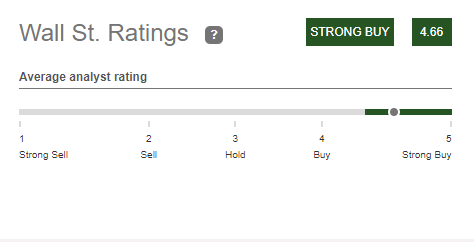

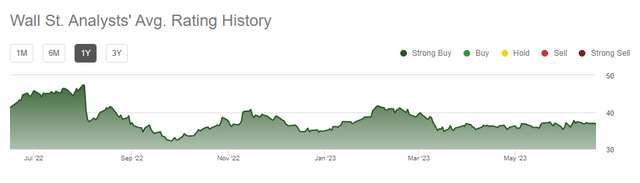

Wall Street analysts and quants have decidedly different viewpoints about Standard Motor Products.

Note how bullish Wall Street is of SMP’s prospects, with a terrific rating of 4.66 out of 5.00.

Seeking Alpha

And that’s not just the current rating, SMP has been on the analyst’s buy list for the entire year.

Seeking Alpha

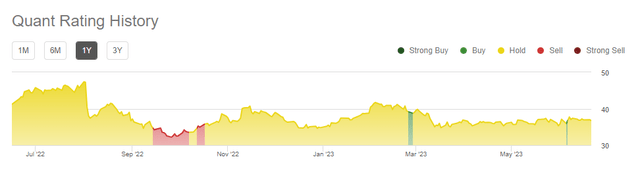

The quant rating has been very consistent in the last year too with a Hold rating for most of the year interspersed with a few buys and sells along the way.

Seeking Alpha

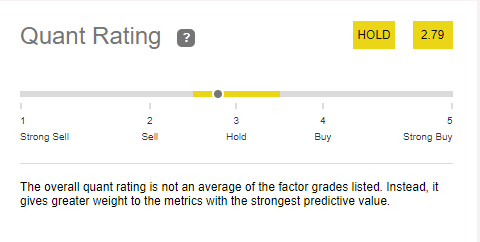

Overall, quants do not think much about SMP’s prospects with an overall rating of only 2.79 out of 5.00.

Seeking Alpha

So based on the above ratings I would have to agree with Wall Street analysts and rate Standard Motor Products as a buy.

How Does SMP’s Price Compare To Competitors?

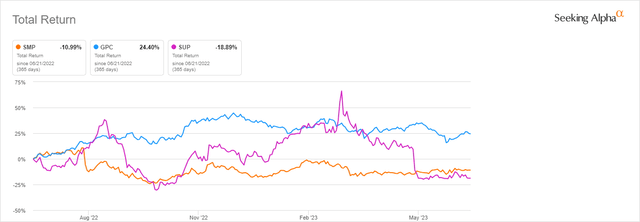

A legitimate question when looking at any stock is to compare its performance with other stocks in the same market sector. If we look at SMP’s performance over the last year and compare it to other stocks in the Automotive After Market Sector, we can see SMP has not performed well with a total return (including dividends) of minus 11%.

In the following chart, we can see that SMP has underperformed against GPC but outperformed SUP.

Seeking Alpha

This would imply the Automotive After Market Sector, in general, is underperforming the market. Again, this may be due to the global problems with logistics and the resulting increase in product costs.

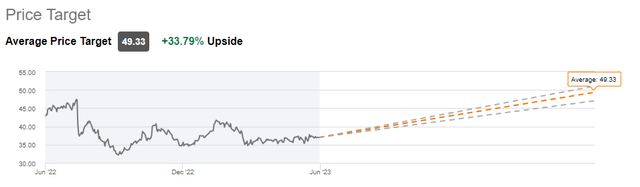

However, future projections by analysts are very positive with a projected average price increase of 33%.

Seeking Alpha

Standard Motor Products‘ Dividend

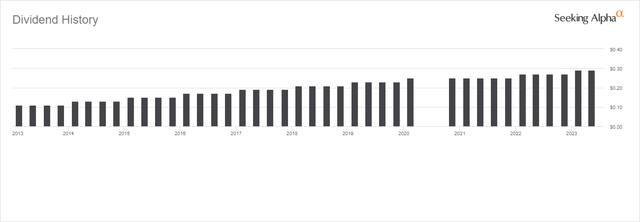

SMP’s dividend record for the last 10 years is excellent except for a brief period in 2020 during the COVID-19 recession when the dividend was suspended for 2 quarters.

The annual dividend growth rate over the last 10 years has been over 10%.

Seeking Alpha

Over the last 10 years, the payout ratio (relative to EPS) has only averaged 33%.

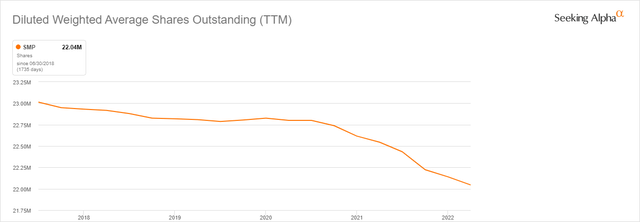

SMP is also buying back shares albeit at a slow rate of about 4% over the last 5 years.

Seeking Alpha

Is Standard Motor Products Stock A Buy, Sell, or Hold?

Obviously, there are risks with an SMP investment. Besides the day-to-day competitive risks, there are inflation and recession risks. Long term, say 10 years, you would need to consider the effect that EVs (Electric Vehicles), with many fewer parts than ICE (Internal Combustion Engine) vehicle, will have on the auto aftermarket.

But the outstanding record of dividend payments ameliorates some of that risk for long-term investors. And note that SMP’s current price is the lowest of the last 5 years except for a brief period in 2020 during the COVID-19 problem.

Seeking Alpha

This might imply that SMP is underpriced compared to historical data and would be another reason to consider an investment in Standard Motor Products.

Standard Motor Products is a buy because it has a solid dividend record, is in a recession-resistant industry, and is selling at a very low price relative to the last 5 years.

Read the full article here