SBLK’s Dry Bulk Investment Thesis Remains Viable, Despite The Normalized TCE Rates

We previously covered Star Bulk Carriers (NASDAQ:SBLK) in May 2023, discussing its mixed prospects thanks to China’s uncertain iron ore demand recovery.

While we might have rated the stock as a Buy, we had also cautioned investors that the economic downturn was unlikely to lift in the near term, with the volatile TCE rates likely to trigger underwhelming variable dividends.

For now, SBLK reported FQ2’23 TCE rates of $15.83K (+11.5% QoQ/ -48% YoY), improved compared to its dry bulker peers thanks to its fully scrubber-fitted vessels.

For example, Genco Shipping (GNK) reported FQ2’23 average TCE rates of $15.55K (+11.5% QoQ/ -45.9% YoY) and Eagle Bulk Shipping Inc. (EGLE) at $14.43K (+11.7% QoQ/ -52.2% YoY).

While SBLK naturally lags behind Golden Ocean Group Limited’s (GOGL) FQ2’23 TCE rates of $17.66K (+18.3% QoQ/ -39.9% YoY), we are not overly concerned, since the former operates with a much older fleet at 11.4 years, doubled compared to the latter at 6.9 years.

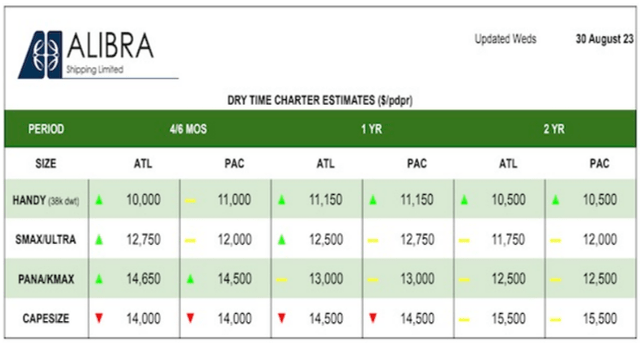

Dry-Bulk Market Rate

Alibra Shipping Ltd

In addition, SBLK has been able to command a much higher preliminary FQ3’23 average TCE rates of $14.65K, comprising $20.10K for Capesize (-2% QoQ/ -20.8% YoY), $13K for Panamax (-2.6% QoQ/ -40.7% YoY), and $11.50K for Supramax (-19.4% QoQ/ -56.2% YoY).

These numbers are stellar indeed, compared to GNK’s average contracted FQ3’23 TCE rates of $12.26K, EGLE at $10.90K, and GOGL at $18.3K for Capesize/ $13.51K for Panamax.

Even if we are to compare SBLK’s next quarter rates to the industry averages of $14K for Capesize as of August 30, 2023, it is apparent that we may still see the company bring forth excellent FQ3’23 results.

This is attributed to the management’s stellar cost control, with market leading daily OPEX per vessel of $4.91K (+1.2% QoQ/ -1.9% YoY) in FQ2’23. This is compared to GNK at $5.64K (-8.4% QoQ/ -23.2% YoY) and EGLE at $5.88K (-8.1% QoQ/ +5.3% YoY), with GOGL’s number not reported.

Due to the outsized top-line and highly efficient operations, it is unsurprising that SBLK has been able to report excellent adjusted EBITDA of $96.18M (+13.4% QoQ/ -63.2% YoY) and EBITDA margin of 40.2% (+2.4 points QoQ/ -21.6 YoY).

This is compared to GNK’s adj EBITDA margin at 33.3%, EGLE at 24.4%, and GOGL at 37.6% at the same time.

However, SBLK investors must also calibrate their expectations since we do not expect to see the hyper-pandemic rates occur again, due to the easing of the global supply chain. The dry bulk TCE rates are likely to stabilize at these levels moving forward, nearing its pre-pandemic levels.

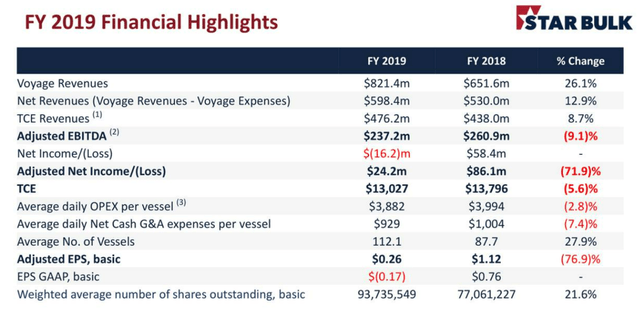

SBLK’s FY2019 Performance

Seeking Alpha

As a result of its normalization cadence, SBLK investors may want to refresh their memories of the company’s previous FY2019 financial highlights.

Observant investors may note that its FQ2’23 TCE and daily OPEX per vessel rates are not too far off from the FY2019 levels indeed. At the same time, its long-term debt has already been moderated to $779.09M (-10.4% QoQ/ -17.1% YoY/ -42.6% from FQ1’20 levels of $1.35B).

Despite the sustained fleet renewal, the SBLK management has also been able to repurchase $33.13M of shares since FQ2’22, keeping its shares outstanding count stable.

With the dry bulker’s balance sheet in much better shape post hyper pandemic windfall, we believe investors may still look forward to excellent payouts ahead, thanks to its improving profitability.

For example, based on SBLK’s FQ2’23 EPS of $0.43 and variable dividend of $0.40, we are looking at an approximate payout ratio of 93% and annualized yield of 9% based on the stock price of $17.62 at the time of writing.

Compared to the FY2019 payout ratio of 19.2% and dividend payout of $0.05, the payout improvement is highly encouraging indeed.

So, Is SBLK Stock A Buy, Sell, or Hold?

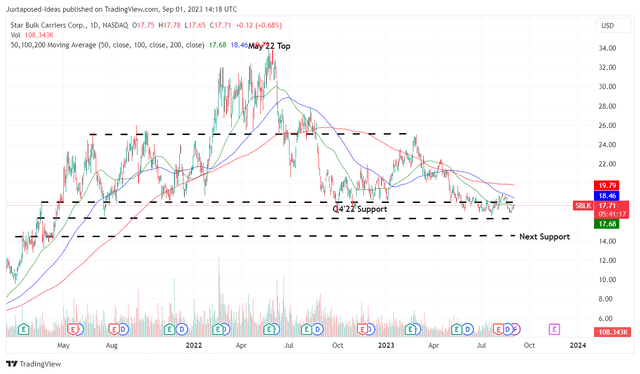

SBLK 3Y Stock Price

Trading View

The SBLK stock also remains well supported at the $17s suggesting an improved margin of safety for those looking to add, especially due to the improved dividend yield compared to GNK at 4.39%, EGLE at 5.3%, and GOGL at 5.47% at the same time.

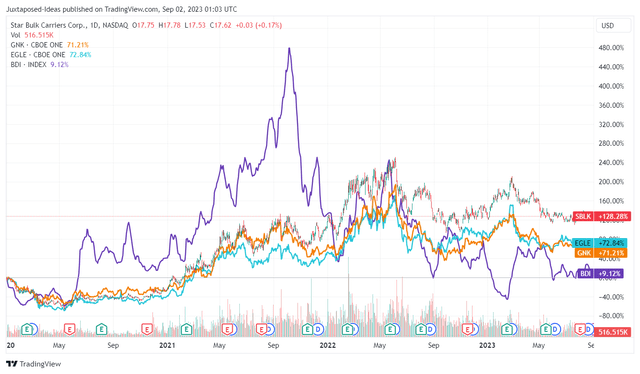

SBLK 3Y Total Returns Including Dividends

Trading View

Combined with the SBLK stock’s improved returns of +128.28% including dividends since the start of 2020, we remain confident about its future prospects.

Naturally, we must highlight that the dry bulker sector remains highly cyclical and therefore, volatile, since the global economic/ geopolitical activities dictate the global demand for commodities and consequently, its fleet utilization.

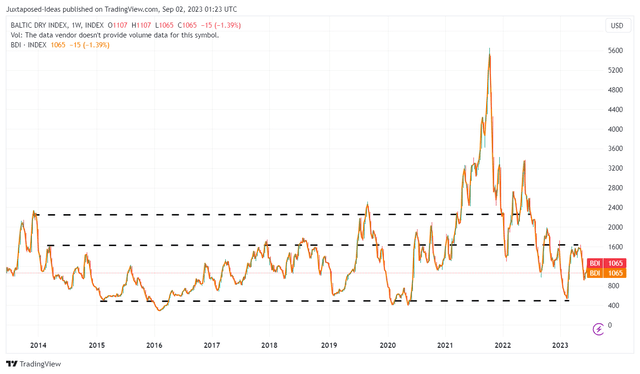

10Y Baltic Dry Index

Trading View

However, with the global economy currently already at its down cycle, we believe that there is an excellent upside to the intermediate-term demand recovery for dry bulk commodities, once the global macroeconomic outlook lifts and elevated interest rate environment normalizes.

For example, the Baltic Dry Index has already rebounded from its bottom and returned to its pre-pandemic trading range of between 500 points and 1,500 points over the past few months.

As a result of the highly attractive risk reward ratio, we continue to rate the SBLK stock as a Buy here.

Read the full article here