By Eli Pars

Chinese convertible bonds are making global news, with three companies defaulting in rapid succession. Not surprisingly, we’ve received questions about whether our global convertible strategies hold these securities (they do not) and whether this is a canary in the coal mine for the global convertible market (it’s not).

Importantly, these recent Chinese defaults were from a small corner of the convertible market –one that is closed to non-Chinese investors, like Calamos Investments. The companies in this market are materially smaller than Chinese issuers that we have access to, and if they carry credit ratings, those probably are not provided by S&P or Moody’s.

Here’s why we’re bullish on global convertibles and taking these defaults in stride.

-

-

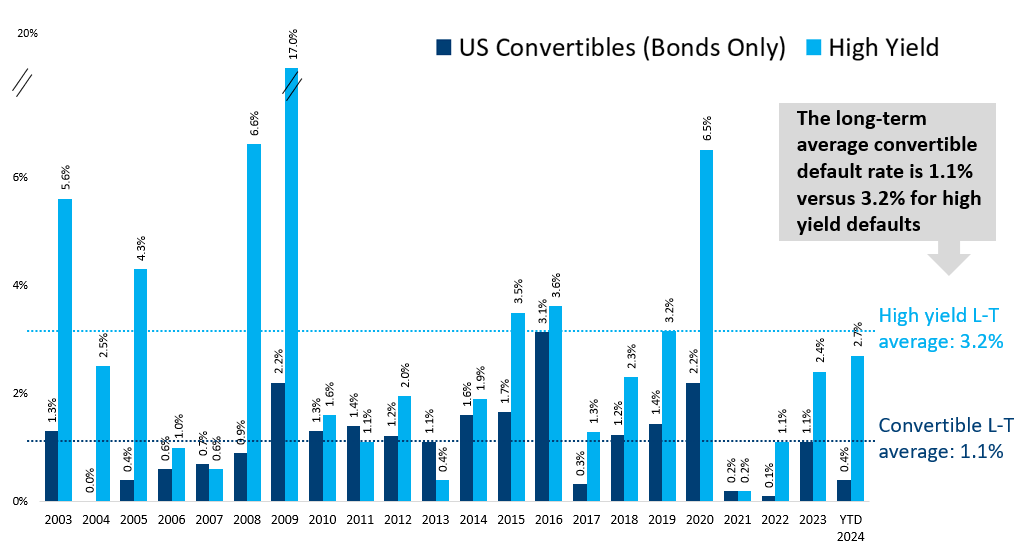

Convertible defaults have been low. For example, the chart below illustrates that the US convertible bond market has had a much lower default rate than the high yield market over the long term.

Low levels of defaults in convertibles

-

Past performance is no guarantee of future results. Source: Barclays Research as of May 31, 2024. US convertible bonds only.

- Default Rate, 2003-May 2024

- The fundamentals of the global convertible market are strong overall, in our view. For many convertible issuers, convertibles are the only debt on the balance sheet. Also, an increasing number of convertibles are investment-grade rated by globally recognized agencies.

- We invest in individual convertibles, not the convertible market. The global convertible market offers access to capital for a broad group of companies, and it is well diversified by region, market cap, and industry. We view the defaults in the Chinese market as company-specific. There are plenty of attractive convertibles in emerging markets, including emerging Asia. As fundamentally driven investors, we’re not choosing to overweight China; we’re choosing to overweight select Chinese companies that we believe are attractively valued, with good balance sheets, large market caps, and good convertible structures.*

-

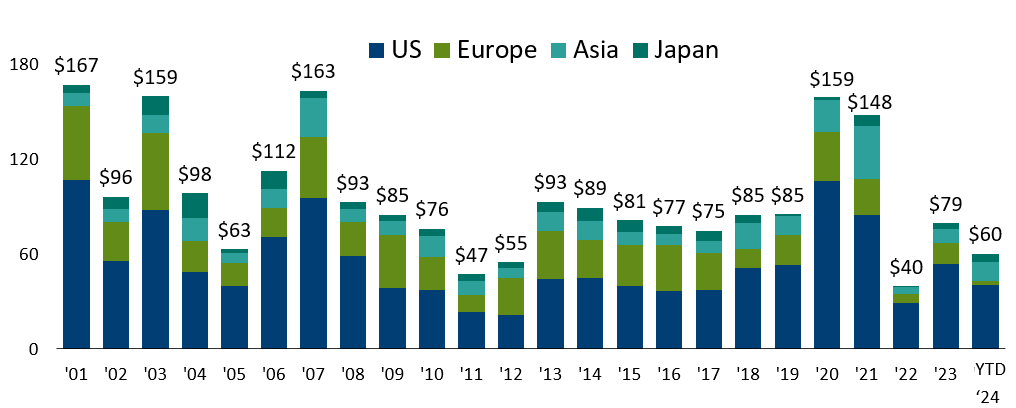

Global issuance is strong and gives us a lot of great choices. We continue to see deal terms that carry higher coupons and lower conversion premiums. We are also excited about the breadth of new issuers coming to market, including companies carrying investment-grade ratings from globally recognized agencies such as S&P and/or Moody’s. That said, even these ratings are no substitute for our credit work.

Global Convertible Issuance ($ bn)

As of June 30, 2024. Source: BofA Global Research. The ICE BofA Global 300 Convertible Index is a global convertible index composed of companies representative of the market structure of countries in North America, Europe and the Asia/Pacific region.

-

- Defaults are a fact of life in the credit markets, but fundamental analysis can help minimize the impact. While convert defaults are less than high yield, they are not zero. What matters in the end is good portfolio construction—the companies we select and their position sizes.

*Overweight relative to the global convertible market, as represented by the FTSE Global Convertible Index. The index is designed to broadly represent the global convertible bond market. Indexes are unmanaged, do not include fees or expenses, and are not available for direct investment.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The portfolio is actively managed and holdings are subject to change daily.

Convertible securities entail default risk and credit risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Calamos Advisors, LLC

024027 0824

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here