Investment Thesis

Stryker Corp. (NYSE:SYK) is a medical equipment technology company operating in the United States and sells its products internationally. It operates through two segments: Orthopedics and Spine and MedSurg and Neurotechnology, which provide various medical products, including implants, surgical navigation systems, and equipment, among others. Its subsidiaries, branches, and third-party dealers sell its products to healthcare facilities, doctors, and hospitals.

The company is well known for its quality medical technology in the medical sector. Its stock surged in value by 20.09% over the last twelve months. It is without surprise considering its reputation for new innovative products and its resilience against global macroeconomic pressures. The company registered enticing top and bottom lines in 2022.

The balance sheet is highly leveraged and has fairly high liquidity. Its operating leverage is also high, with its fixed costs exceeding the variable costs. Additionally, SYK’s dividends have steadily grown, and payments have been made consistently. I’m optimistic about the company’s performance and, therefore, bullish.

New Offerings

Insignia Hip Stem

SYK recently launched the Insignia Hip Stem, an implant designed to aid in optimizing patient fit and ease of implantation during total hip procedures. This new addition complements the company’s main hip portfolio. Its compatibility with Mako SmartRobotics enhances the procedures and the patient outcome.

Q Guidance System

This is a navigation software for spine applications that the FDA has granted approval for usage with pediatric patients 13 years old and above. The navigation software enhances computer-assisted surgeries by making preoperative planning, navigation, and execution simpler.

These two are just the tip of what Stryker offers, as it has an extensive portfolio. I mentioned these since they contributed to revenues in 2022, albeit unclearly defined, which are discussed later.

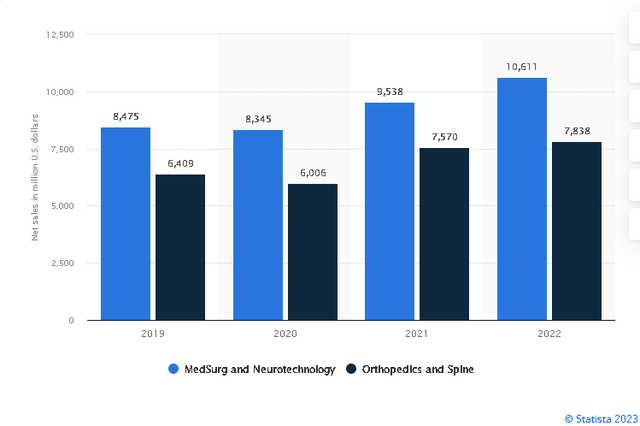

Enticing but Expected Incomes

Stryker has experienced increased revenues since 2019, except in 2020 due to Covid19, which would be safe to say had it not been for the unprecedented health crisis, revenues would be higher than in 2019. The company recorded attractive revenues during 2022, with its net sales at $18.4b, an 11% increase in constant currency (cc). As mentioned earlier, the company functions through two divisions, MedSurg and Neurotechnology, and Orthopedics and Spine. MedSurg and Neurotechnology had net sales amounting to $10.6b, a 14.1% increment in cc from 2021, and organic net sales increasing of 11.8% due to higher pricing and increased sales volume.

Statista

Orthopedics and Spine had net sales at $7.8b, an increase of 7% from the previous year, and organic net sales surged 7%. The organic net sales increase in this segment was also a result of higher sales volume, which was partly offset by lower pricing. In the most recent quarter, the hip, trauma, and Spine business grew organically, partially contributed by the new Stryker offerings. For example: Hip business grew 11.3%, driven partly by the newly launched Insignia Hip Stem, compatible with Mako Total Hip. Recently approved by the FDA, the freshly released Q Guidance navigation system helped the Spine business grow slightly by 0.5%.

The corporation reported a gross profit margin of 63.1% TTM, a decrease from the end of 2021’s profit margins at 65.8%. This can be traced to purchasing costly components and a price surge along the supply chain. However, its net income margin was 12.78%, an increase from 11.7%, and when evaluated against its peers, SYK performed better as the sector’s average gross profit and net income margin were 55.65% and -7.24%.

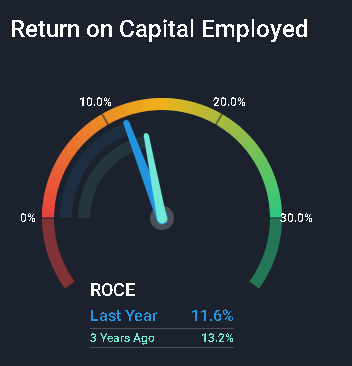

Stryker’s ROCE was 12%, which contrasted with the medical equipment 9.9% industry performed fairly well. This is also an improvement from the prior years’ 11.6%.

Simply Wall Street

SYK, therefore, utilizes its capital efficiently to generate profits in the full year 2022. On the flip side, looking at its trend, its ROCE has decreased from 14.5% over the past five years. The trend is not very reassuring, and I urge investors to closely monitor this.

Given the company’s broad portfolio of products and its continued innovations, it is set for a promising future. Considering its recently launched offerings chipped in its revenues, I am optimistic that SYK will continue with its unwavering growth in its revenues and profits.

Financials

In this section, I shall dive into debt, its corresponding ratios, and its operating leverage. The company has a debt of $13.526b and total shareholders’ equity of $16.616b. With these figures, the debt-to-equity ratio is 81.4%. It also has cash available at $1.93b. Assuming Stryker pays its debt with this cash balance, the net debt-to-equity ratio would be 69.7%. These ratios are considerably high, indicating that the company is highly leveraged. Moreover, over the last decade, the debt-to-equity ratio increased from 72.4% in 2017 to 81.4%, signaling that debt is not reducing.

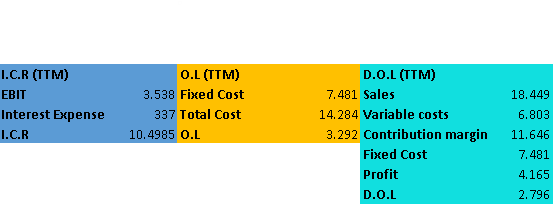

It is important to evaluate debt and interest coverage to know if the company can service its debt. The operating cash flow at $2.62b is 22% of its debt, the principal amount. This is a positive sign that the CFO well covers its debt. Interest expenses arising from debt amount to $337m. EBIT covers interest expenses at $3.5b; therefore, the interest coverage ratio is 10.5x. In light of this, SYK can cater to its debt arisen interest by approximately 10.5x.

The company has an operating leverage (O.L) and degree of operating leverage of 3.29 and 2.80. This means that the operating income is sensitive to change, and should its revenues increase, EBIT will also increase significantly and vice versa. As the fixed costs are more than the variable costs, this could be one of the reasons for the company’s ability to generate attractive margins.

Author computations

Dividends

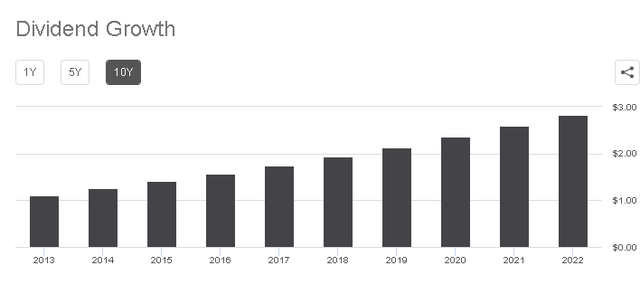

Stryker has upheld its image regarding consistently paying dividends to its shareholders. It has consecutively paid dividends for 29 years compared to the 11-year average in the sector. The company also boasts growing dividends as its payments have increased annually over the past ten years, suggesting that it is financially stable and generates sufficient cash flows to sustain and ramp up its dividend payments gradually.

Seeking Alpha

SYK has a reasonable payout ratio of 46.84% and a cash payout ratio of 51.62%, retaining significant margins for reinvestment. In my view, these proportions are feasible and sustainable. Recently, it increased its quarterly dividend to $0.75 per share, a 7.9% increase from $0.695 per share in the previous year. I have confidence in the company’s ability to sustain its dividend policy and growth, given its innovative path to growth that drives its success.

Conclusion

SYK specializes in medical equipment technology and is renowned for its innovative products. It has registered increasing revenues in the MedSurg, Neurotechnology, Orthopedics, and Spine segments. The company has alluring profitability ratios compared to its industry peers.

The balance sheet is highly leveraged, though its high debt level raises concern and should be monitored closely. It also has a high operating leverage which could contribute to its positive margins. Additionally, dividend payments have been made consistently and have grown over the past years, reassuring investors. Due to its excellence and consistency in dividend payments, I recommend SYK stock to potential investors in this industry.

Read the full article here