Suburban Propane Partners (NYSE:SPH) is a limited partnership that’s in the business of supplying propane, natural gas, fuel oils, and electricity across the Northeast and West Coast regions. SPH units are currently trading with a 19% free cash flow yield at an enterprise value of 9.86x EBITDA. Despite their deep value, there are some operational challenges Suburban will need to overcome to see their true value, including tighter margins due to a tighter natural gas market and a high leverage ratio of 5.53x that may deem SPH units a value trap. Despite their dependence on the commodities market, Suburban is making significant investments to differentiate their business in renewable energy sources that may yield value in FY24/25. Given the risks presented in this report, I give SPH a price target of $8.69/unit, or 8x EV/EBITDA.

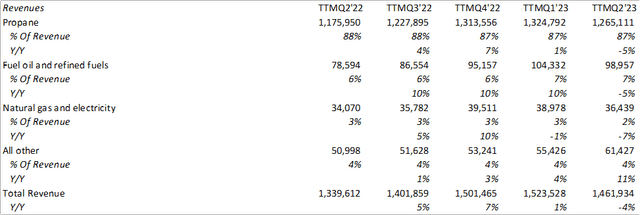

Company Financials

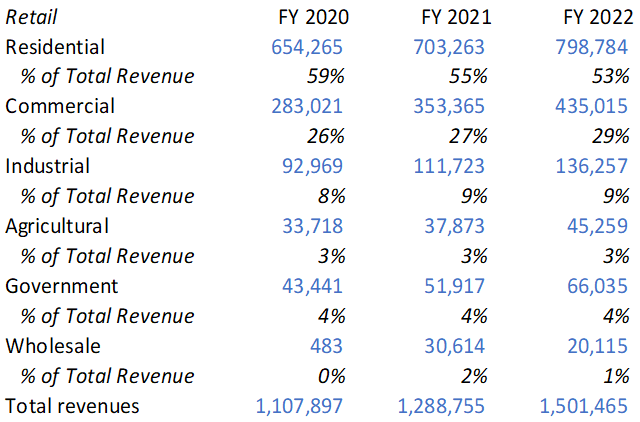

Suburban’s operations are primarily dependent on their ability to purchase and sell propane to the market. Their customer-base is primarily rural regions that utilize propane for heating and cooling their homes. Despite propane being a more expensive fuel source than natural gas, these clients don’t necessarily have access to the infrastructure to transport natural gas to their homes. This gives Suburban a stickier clientele in which it may not be feasible to switch from propane to other power sources.

Company Financials

At the end of FY22, SPH acquired RNG production assets from Equilibrium Capital Group for $190mm. The purchase included two operating facilities: a large-scape RNG production facility in Stanfield, AZ, and an operating facility in Columbus, OH. The Arizona facility includes seven anaerobic digesters, manure rights for 55,000 dairy cattle and a connection to a long-haul pipeline. The Ohio facility receives tipping fees from several large food and beverage providers to process waste into fertilizer and biogas. This acquisition was funded by drawing $112mm from their revolver and an issuance of $80mm in green bonds. This deal also created a JV with Equilibrium for future investments, with a 70% ownership by Suburban once fully funded.

Macroeconomics

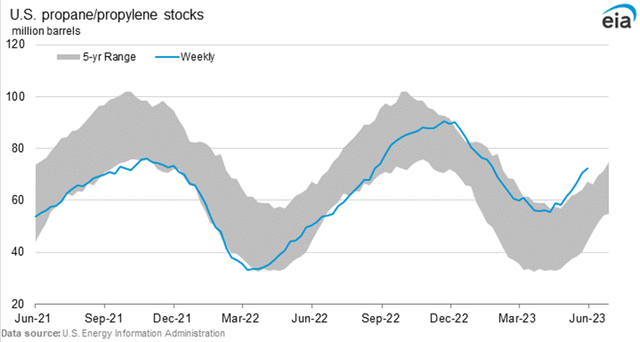

There are a number of factors that affect the price of propane that can be summarized on the basis of supply and demand. Supply for propane is a result of higher natural gas production and oil refining. Despite natural gas producers pulling back on production this year, the US storage of natural gas is currently sitting ~21% higher than the 5-year average (66% higher than this time 2022) due to greater associated gas production as a result of higher drilling in the Permian basin. This resulted in a 37% decline in the price of propane when compared to Q2’22.

EIA

As the chart depicts, US propane/propylene storage is well above the 5-year range. This has put significant pressure on propane/propylene prices, and this pricing pressure may not see an end in the near-term. To make matters worse, the demand for propane has significantly decreased from this time last year, from 2.067mmbpd to 1.035mmbpd. Despite this negative news on the domestic front, exports have hit record highs, up by 448,000bpd YTD from the same period last year.

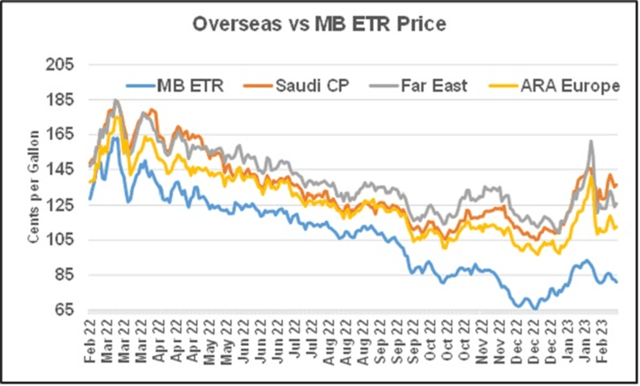

LPG Gas Magazine

Despite the optimism in foreign markets, Suburban solely caters to domestic demand for propane, limiting its ability to broker propane for higher prices in foreign regions. The only positive point to make is that this may create a supply constraint domestically and allow the price per gallon to increase as more gas is exported.

Operations

Futures contracts as reported by CME provide some insight into investors’ expectations for the pricing of propane for the next two years. The price of a gallon of propane is expected to remain sub-$0.70/gal throughout the next two years. This can have residual effects on Suburban’s traditional propane operating margins, given their fixed operating costs. Despite this, Suburban’s management does actively hedge their book in order to maintain more stable cash flow; however, Suburban experienced an unrealized loss on their hedge book for q2’23.

Company Financials

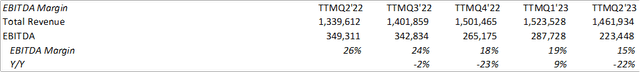

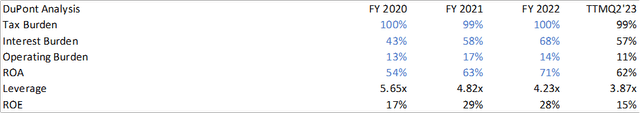

Suburban’s operations have absolutely felt the squeeze given domestic pricing for propane. Their EBITDA margin on a TTM basis has declined -22% given the new quarter, and this pain may persist given the strip price for propane. Much of their pain can be seen using a simple DuPont analysis, in which ROE has decreased from 28% for FY22 to 15% using TTM figures. Due to a more challenging commodities market, operational efficiency has only decreased by 3% while ROA dipped by 9%. Though financial leverage has improved, Suburban’s interest burden is taking a bigger chunk out of their performance.

Company Financials

To make matters worse, their retention ratio has taken a huge beating in the last two quarters, dropping down to 8% using TTM figures for q2’23 as compared to 50% from a year ago. Given these challenges, Suburban only has $7mm in cash on the balance sheet if the necessity to cover the dividend were to occur. Though that 8.71% dividend yield appears to be very appealing, it is likely that Suburban will need to cut their dividend rate if the price of propane doesn’t recover to a more sustainable price this year.

Lastly, Suburban’s cash conversion paints an interesting picture of operational deterioration in which days receivables, inventories, and payables are all significantly lower from a year ago figures, suggesting the necessity to pull in payments from customers and smaller cash balances for payments to suppliers. Though cash management is typical in commodities-dependent companies during a downcycle, considering the information presented above, there may be more to the story to be revealed in the coming quarters.

Final Thoughts

Suburban Propane trades at a discount to the market at 9.86x EV/EBITDA with a free cash flow yield of 19%. Though I’d categorize this company as a deep value play, there are some performance metrics that make me hesitant to acquire shares, specifically their high leverage ratio of 5.53x debt/EBITDA. Despite this high leverage ratio, it may be justified given management’s moves to turning Suburban into a more renewable resources-based company. With their acquisition of the RNG assets and their equity investments in Independence Hydrogen, Oberon Fuels, and Adirondack Farms, Suburban is actively transitioning their business away from a commodities-dependent business to more of a niche, renewable resource. Given the severe price decline in natural gas and propane, Suburban may run into challenges in their organic operations until more stringent GHG regulations take hold to benefit their renewable plays. Despite this, assuming everything works out for them perfectly, Suburban will not realize the benefits of their renewable investments until FY24/25. Despite the market trading at ~12x EV/EBITDA, this figure might be high for SPH given the risks presented in the commodities market, making the company more of a value trap. For now, I give Suburban a target multiple of 8x EV/EBITDA for a price target of $8.69/share. Given that 56% of their enterprise value derives from debt, I believe this is a prudent price target and will give a new investor breathing room for an initial unit purchase.

Read the full article here