Thesis

The low cost of photovoltaics is incentivizing us to install more renewables and providing sustained tailwinds to the solar industry and its ancillaries. I find myself hunting for companies which might be able to turn these tailwinds into sustained returns. While I don’t think panel manufacturers can ever become attractive long-term compounders, I believe many of the companies which stand to benefit from their widespread adoption will.

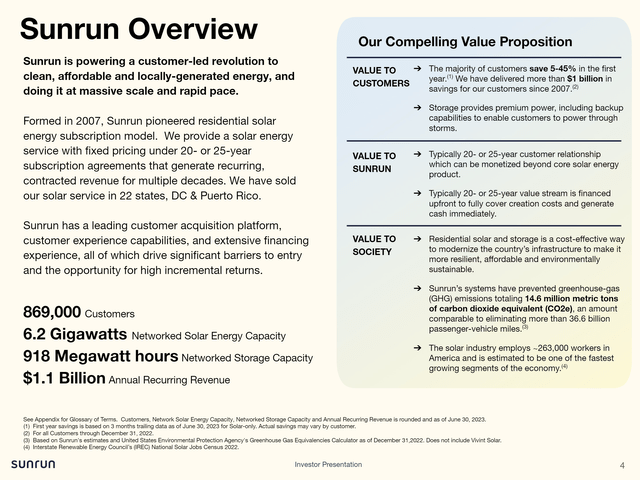

Sunrun Inc. (NASDAQ:RUN) is well positioned to experience significant demand increases over the coming decade. Unfortunately, their present business model is not profitable. However, they are making progress toward incorporating additional synergistic high-margin revenue streams into their portfolio of services. After looking over their financials and valuation, I presently rate Sunrun as a Hold.

Company Background

Sunrun Inc. provides photovoltaic services across the United States. The company enters into power purchase agreements where they install and maintain systems, typically selling power to the customer for a 20 or 25-year contract period. Their business model shifts virtually all the risk of the investment from property owners to themselves. They offer a full range of products and related services including panels, racking, and battery storage. The company was established in 2007 and is headquartered in San Francisco, California.

RUN Overview (Investor Presentation, August 2023, page 4)

Long-Term Trends

The global solar panel market has a projected CAGR of 18% until 2030. In the United States, the solar energy market is projected to have a CAGR of 16.48% through 2028.

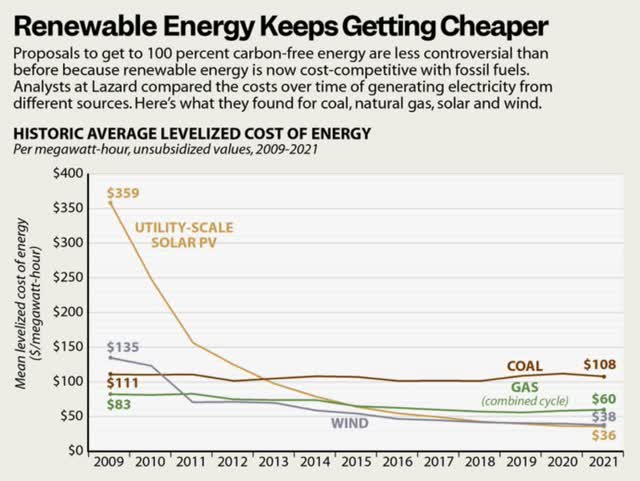

The levelized cost of solar fell below the cost of non-renewables around 2015. In 2018 or 2019, it fell also below the cost of wind. This low cost is forcing entire industries to adapt; we are financially incentivized to install solar over all other energy sources.

Levelized Cost Of Electricity (Lazard, Dan Gearino, Insideclimatenews.org)

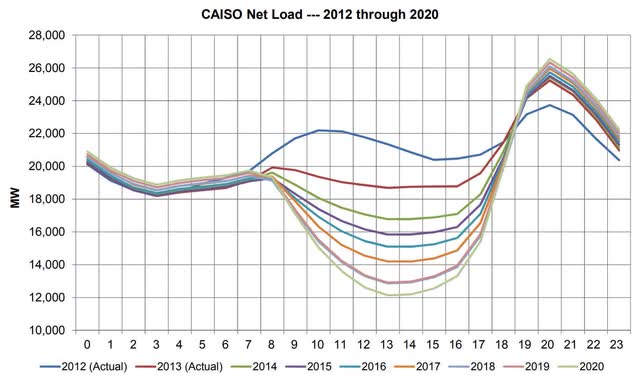

Photovoltaic panels have become so cheap that their commoditization is forcing us to develop better solutions for grid-scale storage. Our current electric grid operates on a purely continuous basis. Future demand must be correctly forecast, and we must intentionally overproduce to avoid shortfalls. Such a system is dependent on both base load and peaker plants. As we incorporate more solar into the grid, they are causing severe supply and demand imbalances. We refer to this as the Duck Curve and typically have to disconnect portions of commercial scale systems every afternoon to prevent damage to parts of the grid.

The Duck Curve (Brad Bouillon; Stanford University)

For many years now, the last barrier to a widespread adoption of renewables has been the high cost of batteries. However, the cost of solar is now cheap enough that we are willing to adopt previously overlooked metal-air battery technology. Iron-air batteries are less efficient then Li-ion, but are also roughly one tenth the cost.

The incorporation of storage into our grid and the development of smart grid technology is culminating into the emergence of an electricity arbitrage market. I believe this arbitrage market will be extremely profitable and its emergence will place a downward pressure on the price electricity providers receive.

Wholesale California Electricity Prices Over 24 Hrs. on a Spring Day (Charles W. Forsberg; ResearchGate, May 2020)

Guidance

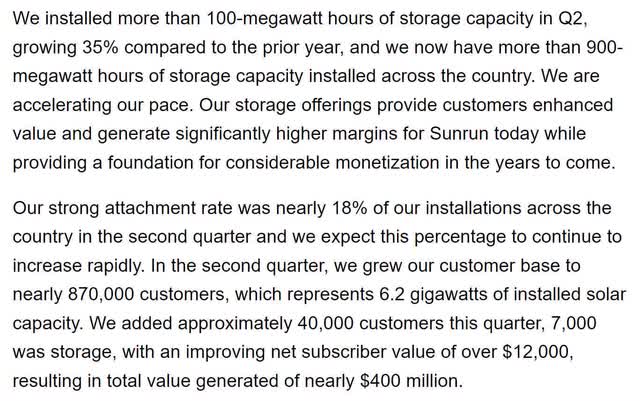

Their most recent earnings call transcript indicated that they had a strong second quarter.

RUN Strong Q2 (Earnings Call Transcript Q2 2023)

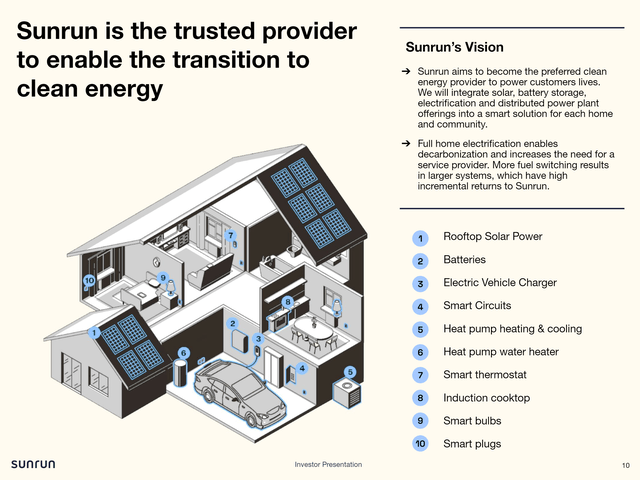

The company is in the process of expanding their capabilities. In addition to setting themselves up for total residential energy management services, they are also getting involved in advanced energy control.

RUN Business Model Adaptation (Earnings Call Transcript Q2 2023)

RUN Planned Future Capability (Investor Presentation, August 2023, page 10)

They continue taking steps toward profitability and have recently made an investment into artificial intelligence.

RUN Efficiency Improvements & AI Investment (Earnings Call Transcript Q2 2023)

Annual Financials

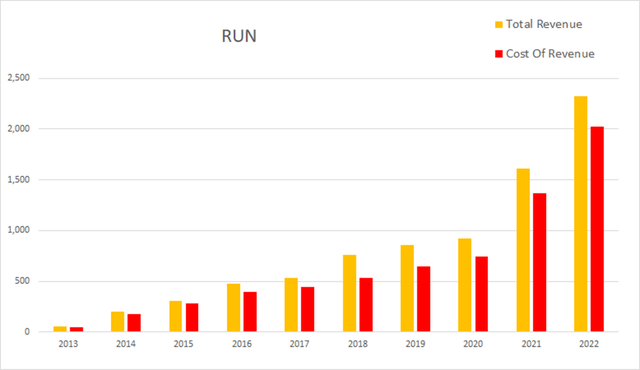

The company has experienced significant revenue increases over the last decade. In 2013 they had an annual revenue of $54.7M. By 2022 that had grown to $2,321.4M; this represents a total increase of 4143% at an average annual rate of 460.4%.

RUN Annual Revenue (By Author)

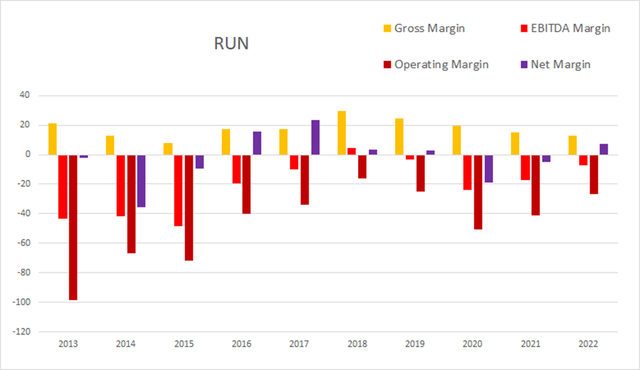

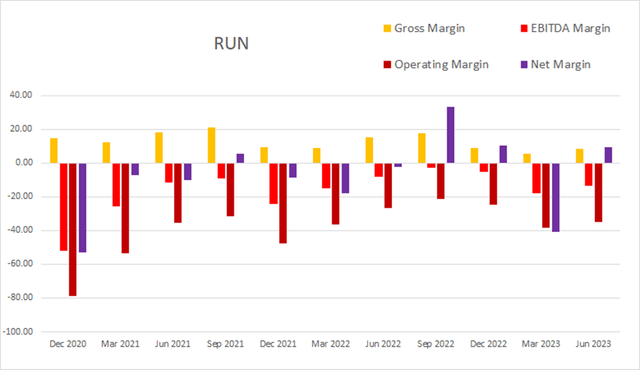

Their margins were improving from 2013 onward until they reached a high in 2018. Since then, the company has experienced a decline in their annual gross margins. The rest of their margins found a new low in 2020 but have been improving since then. As of the most recent annual report, gross margins were 12.87%, EBITDA margins were -7.43%, operating margins were -26.86%, and net margins were 7.47%.

RUN Annual Margins (By Author)

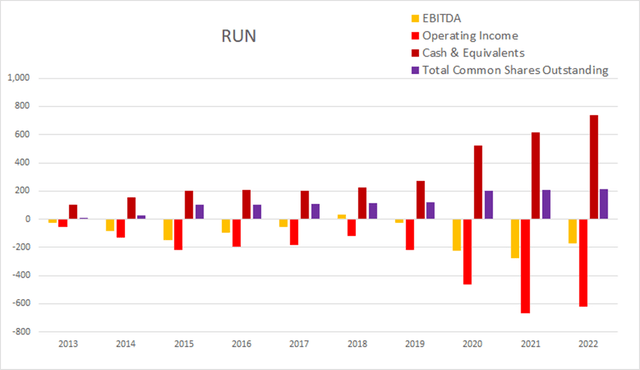

Sunrun has experienced significant dilution over the last decade. Total common shares outstanding was at 10.4M in 2013; by the end of 2022 that rose to 214.2M. This represents a 1959.6% increase in share count at an average annual rate of 217.7%. Over that same period, operating income reached positive values in 2018, but overall fell from -$54M to -$623.5M.

RUN Annual Share Count vs. Cash vs. Income (By Author)

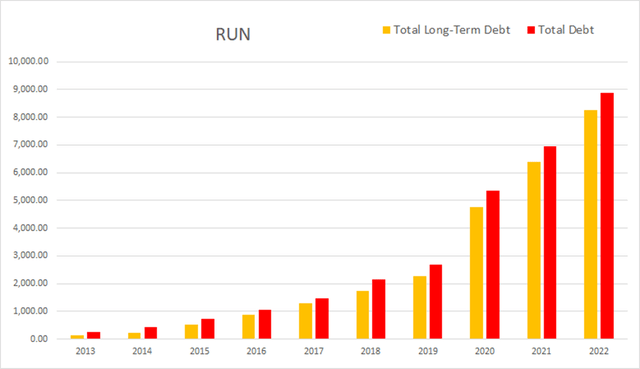

Their debt situation is extremely unattractive. As of the 2022 annual report, they had -$256.1M in net interest expense, total debt was $8,873.8M, and long-term debt was $8,249.6M.

RUN Annual Debt (By Author)

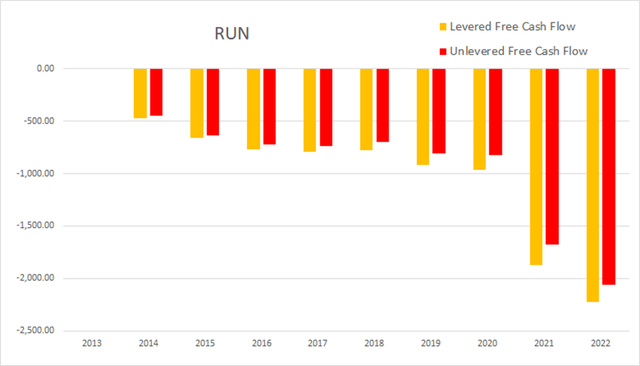

As of this most recent annual report, cash and equivalents were $740.5M, operating income was -$623.5M, EBITDA was -$172.4M, net income was $173.4M, unlevered free cash flow was-$2,062.40M and levered free cash flow was -$2,222.40M.

RUN Annual Cash Flow (By Author)

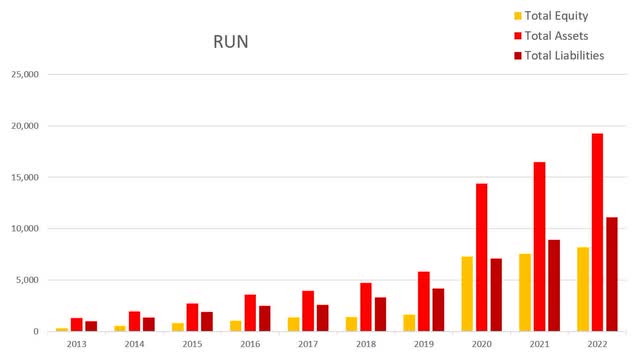

Their total equity has grown significantly.

RUN Annual Total Equity (By Author)

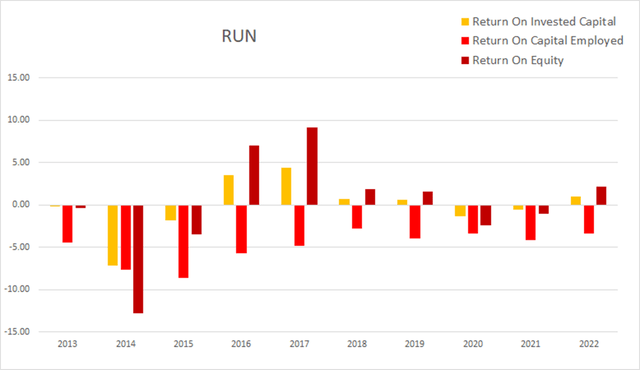

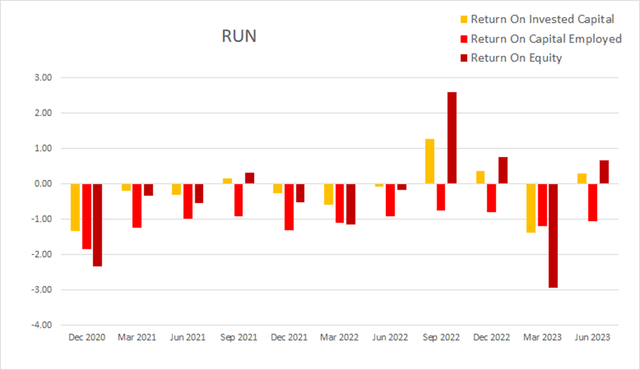

Over the last decade, Sunrun has struggled to produce attractive returns. As of the most recent annual report, ROIC was 1.02%, ROCE was -3.34%, and ROE was at 2.12%.

RUN Annual Returns (By Author)

Quarterly Financials

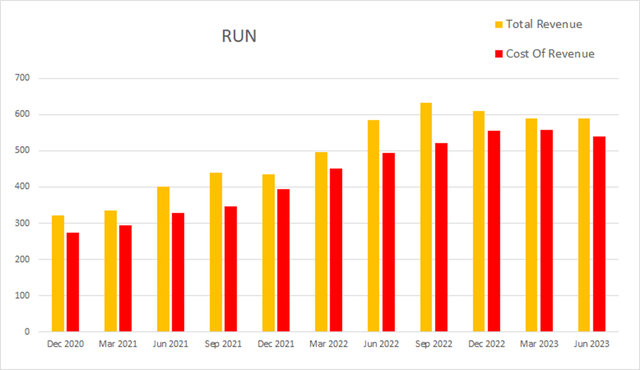

Their quarterly financials are showing a retraction of revenue growth over the last several quarters. I believe the current elevated interest rate environment is reducing demand for new installations. Eight quarters ago Sunrun had a quarterly revenue of $401.2M. Four quarters ago that had grown to $584.6M; by this most recent quarter that had further grown to $590.2M. This represents a total two-year increase] of 47.11% at an average quarterly rate of 5.89%.

RUN Quarterly Revenue (By Author)

As of the most recent, quarter gross margins were 8.64%, EBITDA margins were -13.42%, operating margins were -34.89%, and net margins were at 9.40%.

RUN Quarterly Margins (By Author)

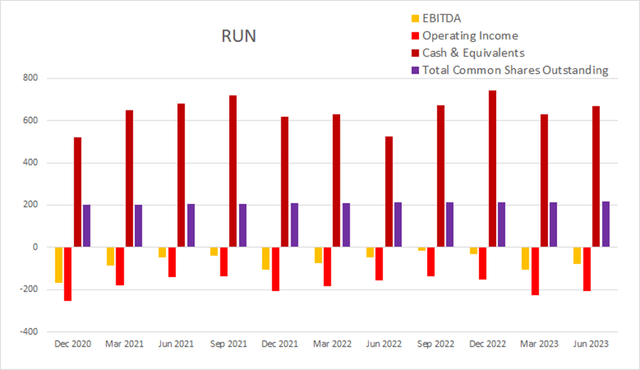

Their share count continues to slowly grow. Ten quarters ago they had 201.4M common shares outstanding; this most recent quarter that had risen to 215.2M

RUN Quarterly Share Count vs. Cash vs. Income (By Author)

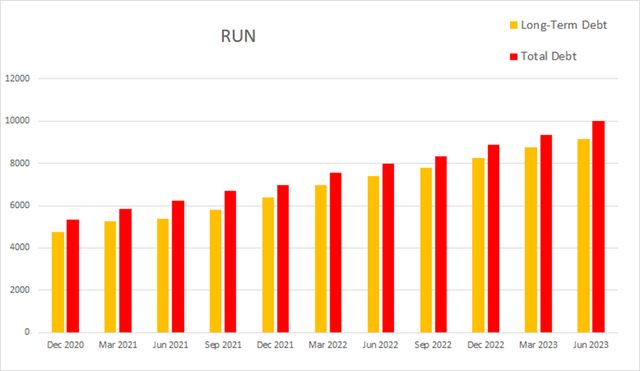

In the most recent quarter, Sunrun had -$114.5M in net interest expense, total debt was at $10.0161B, and long-term debt was at $9.1495B.

RUN Quarterly Debt (By Author)

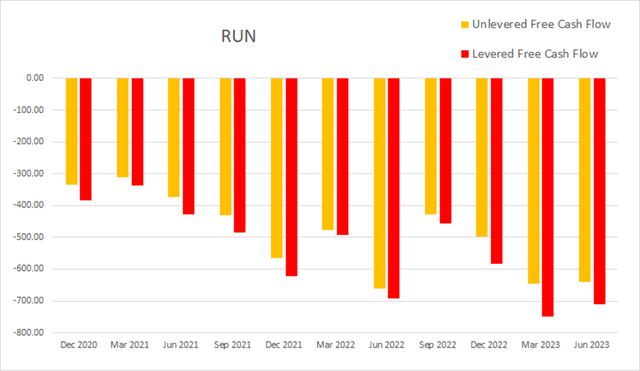

As of the most recent quarter, cash and equivalents was $669.1M, quarterly operating income was -$206M, net income was $55.5M, unlevered free cash flow was at -$639.7M, while levered free cash flow was at -$711.2M.

RUN Quarterly Cash Flow (By Author)

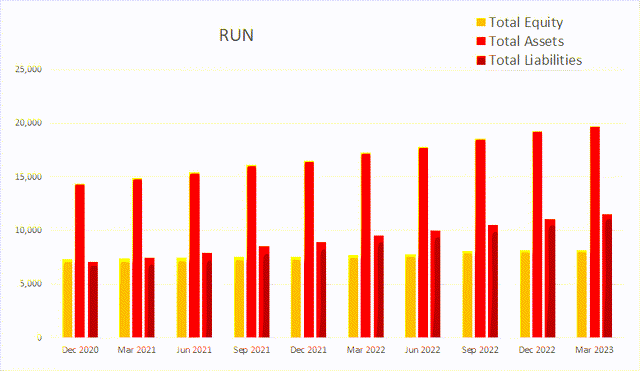

Even when looking at it on a quarterly basis, total equity continues to rise.

RUN Quarterly Total Equity (By Author)

Their returns continue to remain unattractive. As of the most recent earnings report ROIC was 0.30%, ROCE was -1.05%, and ROE was at 0.68%.

RUN Quarterly Returns (By Author)

Valuation

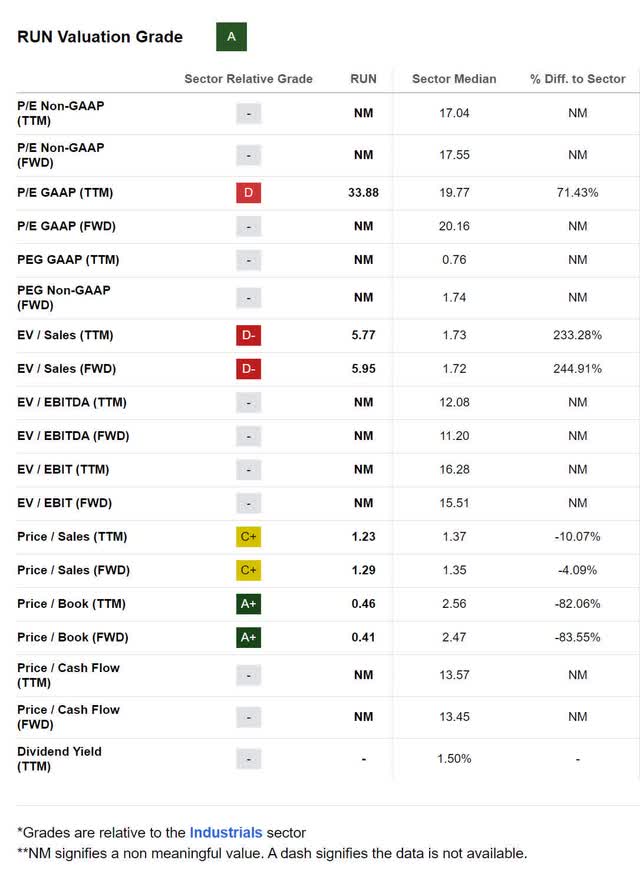

As of August 29th, 2023, Sunrun had a market capitalization of $3.03B and traded for $15.16 per share. They do not pay a dividend, and are not profitable, so I am unable to produce a PEGY value to determine intrinsic value. They do have a projected long-term EPS growth of 6%, so I view their TTM P/E of 33.88x, forward Price/Sales of 1.23x, and forward Price/Book of 0.41x as collectively showing the company as presently overvalued.

RUN Valuation (Seeking Alpha)

Risks

Sunrun faces risk from a further slackening in demand. The Fed is currently fighting hard to destroy the wealth effect and drive inflation back down. If they are forced to elevate rates even further or keep them ‘soaking’ at this elevated rate for a prolonged period, it would worsen Sunrun’s already considerable debt situation.

We may miss the soft landing entirely and are facing the possibility of a recession. With rates elevated and the bond market inverted, I am inclined to believe we will find ourselves in a minor one within the next year or so.

Sunrun is currently branching out its business model in a bid to find additional high margin revenue streams. While I consider this positive, it is always possible these endeavors will end up underperforming expectations and the capital invested into them ends up being poorly allocated.

Catalysts

The company faces sustained tailwinds driven by the low cost of photovoltaic panels. I expect that demand for their services will continue rising over the coming decade and beyond.

Elevated interest rates are currently worsening their debt situation. If the economy were to take a sudden downturn, and the Fed were forced to lower rates more quickly than expected, it would be a boon for Sunrun’s debt situation.

The widespread adoption of cheap grid scale storage will improve the total amount of solar our grid can efficiently support. I expect this to produce strong tailwinds for the entire photovoltaic industry.

It is difficult to tell what their recent acquisition of an AI software package will eventually evolve into, but I may eventually provide the company with significant moats. They are currently working toward providing fully integrated residential energy management systems; these will eventually be a critical part of our more decentralized future smart grid. They are also increasing their battery management capabilities; if Sunrun manages to become a player in either electricity arbitrage or holistic smart grid management, it could provide them with additional high margin revenue streams.

Conclusion

Sunrun is well positioned to benefit from a widespread adoption of photovoltaics currently driven by the low cost of solar. Unfortunately, their business model involves taking on debt and assuming the risk of the investment instead of allowing the homeowner to do so. As the Fed has been forced to raise rates and keep them elevated, this has not panned out well for the company and has burdened them with a significant debt obligation.

My personal long-term outlook on developments in the industry leads me to believe that the downward pressure arbitragers will eventually be able to place on the income of producers is a major drawback for Sunrun. This means the Power Purchase Agreements the company is signing now may end up significantly less attractive years from now if the wholesale cost of electricity goes down.

I refuse to participate in their cash burn rate and do not find their current cash situation attractive. With their cash and equivalents at $669.1M, unlevered free cash flow at -$639.7M and levered free cash flow at -$711.2M, I believe they may have to dilute soon. I do not have a position in RUN and do not plan on opening one in the near future, but I do believe they may be worth investing into at some point in the future, so I will keep them on my watch list and check in on them periodically.

Read the full article here