The AI Investment Thesis Is Promising, But SMCI’s Valuations Has Been Overly Boosted

It seems that Super Micro Computer, Inc. (NASDAQ:SMCI) is the new hot stock in town, thanks to the generative AI boom and Nvidia’s (NVDA) smashing FQ2’24 guidance. Much of this is attributed to the former’s offerings, which comprise the complete server assembly, system integration, and related infrastructure services.

While SMCI does not break down their revenue by chip suppliers, its 10K filings already highlights five key partners, including NVDA, Intel Corporation (INTC), Advanced Micro Devices (AMD), Samsung Electronics (OTCPK:SSNLF), and Micron Technology (MU), amongst others.

Most importantly, the SMCI management has shared that its “strong growth (in FQ4’23) has been driven by the demand for our leading AI platforms in plug-and-play rack-scale, especially for the large language model-optimized NVIDIA HGX-based Delta Next solution,” in the recent earnings call.

This alone suggest that SMCI’s prospects will be closely tied to NVDA’s performance and the consumer demand for generative AI infrastructures.

The company already reported an impressive FQ4’23 quarter, with revenues of $2.18B (+70.3% QoQ/ +33.7% YoY), despite the tougher YoY comparison from FQ4’22 revenues of $1.63B (+20.7% QoQ/ +53.7% YoY).

With improved economies of scale and higher Average Selling Prices, SMCI also recorded expanded gross margins of 18% (+2.6 points YoY) and operating margins of 10.7% for FY2023 (+4.2 points YoY), compared to pre-pandemic levels of 14.2% and 2.8%, respectively.

These are impressive numbers indeed, since there are already notable improvements to the company’s balance sheet, with net debts of -$320.28M (+167.3% YoY), thanks to the higher retained earnings of $1.43B in FY2023 (+52.1% YoY).

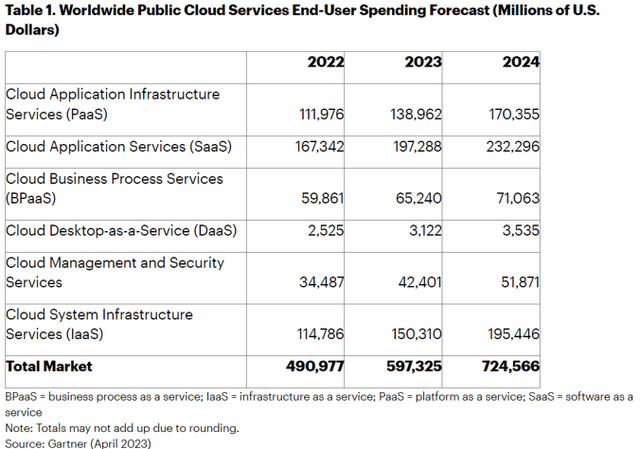

Gartner Worldwide Public Cloud Services End-User Spending Forecast

Gartner

The same AI boom has been projected by Gartner as well, with the global cloud market size expected to grow tremendously to $724.56B in 2024 (+21.3% YoY). The Cloud System Infrastructure Services [IaaS] is also projected to be one of the largest growth drivers with expanding end-user spending of $195.44B (+30% YoY), comprising 26.9% of the overall cloud market (+1.8 points YoY).

As more devices and platforms increasingly utilize AI tools and be connected to cloud, we expect SMCI’s top and bottom line to sustainably grow over the next few years, with the management already reporting “record-high backorders and new design wins/ customers” in the recent earnings call.

Despite the “temporal key components supply shortages,” the company has also committed to increased manufacturing footprint in North America, Taiwan, and Malaysia over the next fifteen months, working closely with its suppliers while nearly tripling its long-term production capacity.

Therefore, considering SMCI’s exposure to over 50% of the AI market (in FQ4’23), the non-cancelable/ non-reschedulable backlog, and the nascency of the Generative AI/ Metaverse market, we believe the company’s long-term revenues target of $20B is not overly ambitious.

So, Is SMCI Stock A Buy, Sell, or Hold?

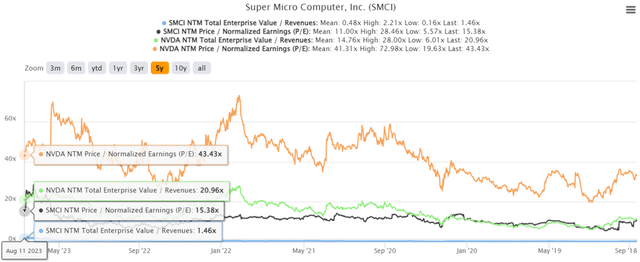

SMCI 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

However, these optimistic developments have also led SMCI to trade at inflated NTM EV/ Revenues of 1.46x and NTM P/E of 15.38x, compared to 1Y mean 0.90x/ 12.51x and 3Y pre-pandemic mean of 0.36x/ 11.09x. The same is also observed against its tech hardware median P/E of 11.80x, suggesting the stock’s lofty valuations and baked-in premium.

Based on its normalized valuations and the market analysts’ FY2025 adj EPS projections of $21.41, we are looking at a long-term price target of $252.63, implying that all of its upside potential is already pulled-forward.

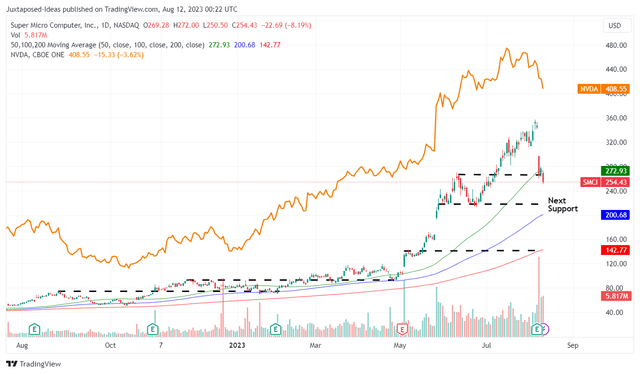

SMCI 5Y Stock Price

Trading View

Thanks to NVDA’s raised FQ2’24 guidance and the potential contribution to SMCI’s top/ bottom line performance, it is also apparent that Mr. Market’s expectations are through the roof, as demonstrated in their stock valuations and prices.

Therefore, while SMCI may have guided excellent FQ1’24 revenues of $2.05B (-5.9% QoQ/ +10.8% YoY) and adj EPS of $3.125 at the midpoint (-10.9% QoQ/ -8.6% YoY), with FY2024 revenues of $10B at the midpoint (+40.4% YoY), it is evident that market analysts are expecting a lot more.

Combined with the elevated short interest of 10.45% at the time of writing and the management’s commentary about the tight supply chain gating FY2024 revenues, it comes as no surprise that SMCI has plunged tremendously after its recent earnings call, dragging NVDA along with it.

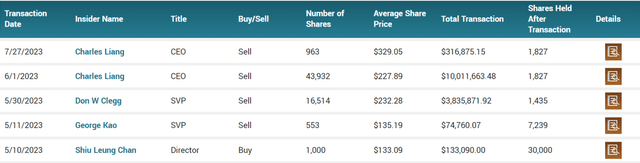

SMCI Insider Trading

Market Beat

With many traders likely already taking their gains off the table, as with the management during the run up, we may see the SMCI stock remain volatile over the next two weeks, depending on how market sentiments develop prior to NVDA’s earnings call on August 23, 2023.

As a result of the minimal margin of safety, we do not recommend anyone to add SMCI here.

In this case, patience will be a virtue indeed, since SMCI may potentially retrace to its previous support level of $210s, implying a painful -18% downside. The plunge may not be over yet.

Read the full article here