Swisscom (OTCPK:SCMWY) is the Swiss telecom player with also a decently large presence in Italy through FastWeb, which is one of the several main telecom brands that provide wireline services in Italy. The primary point we want to make is that compared to other plays in telecoms in Europe like Proximus (OTCPK:BGAOF), the CAPEX burden for Swisscom is thankfully quite low since a lot of the major rollouts of new connectivity infrastructure has already been done. Still, it’s not a particularly cheap company, and therefore, really not interesting considering the underlying economics and dynamics of telco, namely price competition. A pass.

Q2 Breakdown

Let’s begin with the results, starting with the CAPEX situation, which we believe is the most important and primary thing to look at when analysing a telco player in Europe, since fibre rollouts are expensive.

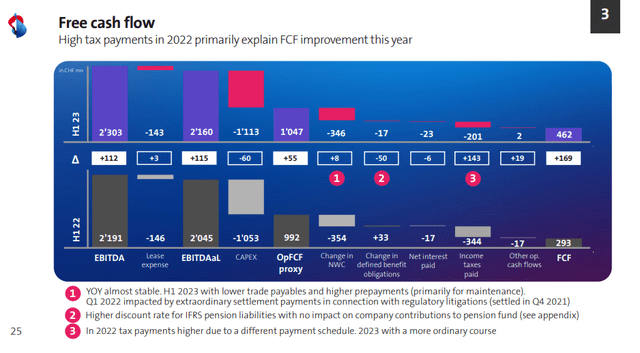

The situation with Swisscom is pretty good in terms of the CAPEX trends. The fibre rollout is actually done at this point, and FTTH targets have been fully achieved. They’re far into the 5G rollout as well, so extraordinary CAPEX associated with being an important utility provider to the public is basically over. However, the business is still very capitally intense on the fixed assets side, and FCF yields are pretty weak. While NWC effects will reverse for the FY, the FCFY is still far below the 5% mark. That’s not a good start in terms of cash generation or valuation, even if the CAPEX levels won’t grow too much.

FCF (Q2 2023 Pres)

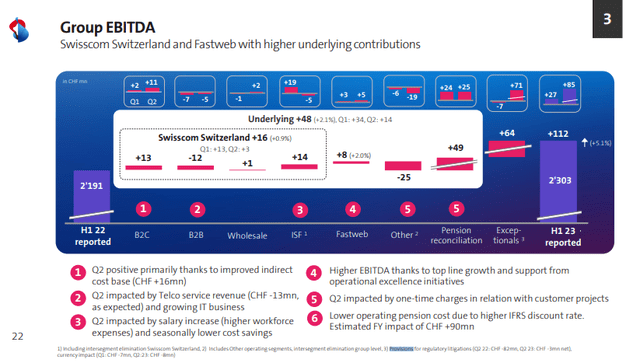

In terms of EBITDA and profitability, there is a general ARPU pressure mostly from idiosyncratic shift of focus to lower value brands, but that ultimately means it will come back as general price competition in the industry which remains a problem. Broadband price competition continues to be strong in broadband Italy with FastWeb, with more entrants into the market, and in general the competition regulation authorities are going to continue to make sure that there can be no favouring of incumbents, even those who operate the fibre infrastructure, that would otherwise be a way to stop new entrants even from outside the telco space like Sky and Enel (OTCPK:ENLAY). Still the company is managing a growth in group EBITDA, but much of it is being driven by the fact that there are less provisions this year for litigations compared to last. Actually, almost 4% of the growth relative to the 5% of EBITDA growth achieved on a headline basis is coming from those provision effects. These are contained in the ‘exceptionals’ element in the chart below.

EBITDA (Q2 2023 Pres)

The EBITDA strength is still positive and a good performance by the company, as fixed cost inflation, particularly salaries, is a relevant concern across industry. However, the salary increases took effect in April, and therefore only half of the impact is being seen in H1. Run-rate pressure is going to be higher. Nonetheless, the ability to stay ahead of that so far is already quite satisfying.

Bottom Line

Ultimately, Swissco is a telco player. It’s tough to grow the business, yet costs are growing on account of inflation. Generally, costs are growing in terms of marketing and promotion as well, since again the industry structure is not that great. These are commodifying services, and the government has a firm hand in these businesses as well which are always going to be regulated by national competition and telco specific authorities. Indeed, this is where the litigation provisions have come from – litigation with COMCO over some details about how they’ve deployed fibre infrastructure and some potential for gating the industry.

The PE is around 18-19x based on annualised figures, which are neither a conservative nor optimistic estimate given fixed cost inflation, pricing pressures in general against the cost saving programme that is already in effect and achieving run-rate savings. That PE is not compelling given current benchmark rates and the relatively lesser quality of the telco economics and industry structure. A pass.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here