The Future of Warehouse Automation

In the realm of warehouse automation, a name that’s quickly gaining prominence is Symbotic (NASDAQ:SYM). Established as an automation technology and growth enterprise, Symbotic has set its sights on revolutionizing the way modern warehouses operate.

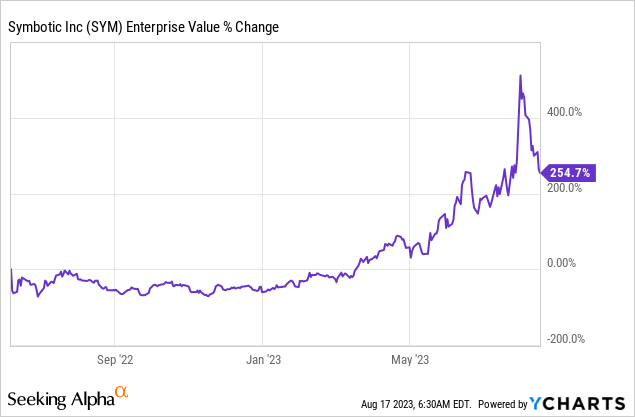

Stock Performance and Valuation

Coming into the market via a SPAC merger, Symbotic’s stock saw a whopping 500% increase. It further jumped 50% following the release of its second quarter earnings at the end of July. Since then, however, the stock has retraced amid broader market weakness. That retracement has taken the market valuation down to ~$25 billion. With $500 million in cash and investments, and a clean slate of no debt, the enterprise value stands at $24.5 billion.

Financial Overview

The revenue growth of Symbotic paints an optimistic picture. A surge of 78% in the latest quarter pushed its revenue to $312 million. Cumulatively, over the last twelve months, the company’s revenue surpassed $1 billion. It’s noteworthy to mention that this is a tenfold increase from its 2019 figures. More impressive, Symbotic has even managed to outperform projections laid out in its initial SPAC presentation.

Company SPAC presentation

Yet, Symbotic’s profitability is a concern. The last 12 months saw a net income loss of $216 million. Free cash flow is positive at $107 million but only after adjusting for stock-based compensation.

Technological Advancement and Solutions

Harnessing AI-powered software, Symbotic has introduced autonomous robots to warehouses that are capable of speeds up to 25 miles per hour.

Symbotic website

More broadly, this technology offers solutions to three pressing warehouse challenges:

1. Labor Costs: The need for human workers, particularly forklift operators, is substantially reduced when operators use Symbotic’s automated systems.2. Adaptability: The nature of Symbotic’s technology is flexible and feedback-driven. This means companies can more quickly modify their warehouse strategies for greater efficiency.3. SKU Management: Modern corporations thrive by incorporating the long tail and this has resulted in a surge of individual stock items (SKUs). Symbotic’s system is aptly designed to cater to this. 4. Error reduction: Robotic technology has been shown to produce fewer errors at a large number of warehouse tasks.

With giants like Walmart (WMT), Albertsons (ACI), Target (TGT), and Giant Tiger already on Symbotic’s partner list the company is well-equipped to cater for large customers. And a joint venture with Softbank is helping the company develop the capability for smaller customers too.

Market Valuation and Future Projections

Symbotic’s current stock price, trading at 25 times its revenue, is highly priced. A significant short interest (currently around 13%) also suggests that not everyone is bullish on the stock’s short-term future. There have been short reports too.

Detractors argue that Symbotic’s tech is not as groundbreaking as it claims, often pointing to competitors like Ocado, Dematic, Autostore, and the Amazon (AMZN)-acquired Kiva Systems. Moreover, insider trading patterns indicate that company officials have been offloading stocks at lower prices.

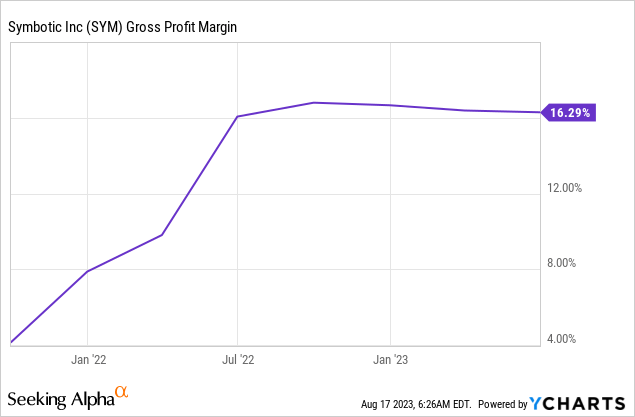

A pressing concern for Symbotic is its modest gross margin of 16%. If we were to project the company’s growth — 50% next year, decreasing by 5% annually for the next four years — by the end of the fifth year, revenues might touch $5.5 billion. Assuming net income margins of 15%, net income could amount to $820 million. If valued at a 35 times multiple, this would lead to a company valuation of $28.7 billion, marginally above the current market cap. In other words, a huge amount of growth is already priced in.

Revenue Streams and Customer Dependence

Symbotic’s primary revenue generation method involves designing and installing modular inventory management systems. The revenue from this “Systems” segment saw a 129% increase in the nine months leading up to June 24, 2023. The breakdown of revenue for the same period is as follows:

- Systems: $996 million (96.7%)

- Software maintenance & support: $5 million (0.5%)

- Operation services: $28 million (2.8%)

Analysts remain bullish but a significant chunk of Symbotic’s revenue, approximately 87%, comes from Walmart. This over-reliance poses a considerable risk and the loss of Walmart as a client could spell doom for Symbotic stock.

Closing Thoughts

Symbotic is on the frontier of warehouse automation, with blue-chip clientele and a promising technology stack. This sounds like a futuristic and cutting-edge technology but challenges remain. High valuation, low gross margins, and over-dependence on Walmart are significant concerns. Large insider selling is also concerning.

The crux of the matter lies in execution. Can Symbotic deliver on the high growth expectations and expand margins to warrant its current valuation?

There simply isn’t enough margin of safety to recommend a long here. However, betting against such a rapidly advancing company seems equally unwise.

Read the full article here