We present our note on Symrise (OTCPK:SYIEF) (OTCPK:SYIEY), a global diversified chemical manufacturer with a top three market position in the flavor and fragrances industry.

The recent share price performance has been underwhelming as a result of disappointing quarterly prints, concerns around organic sales growth and margins, and a recently launched cartel investigation. We will provide a brief overview of the business, analyze the main issues, and lay out our investment case and valuation.

Introduction To Symrise

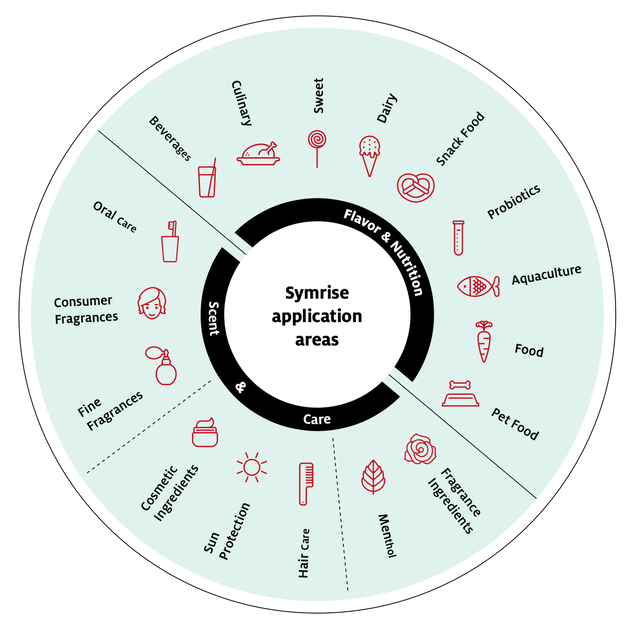

Symrise is a global supplier of fragrances, flavorings, cosmetic active ingredients, raw materials, and functional ingredients. Symrise’s customers manufacture perfumes, cosmetics, detergents, soap, food and beverages, pharmaceuticals, nutritional supplements, pet food, etc. The company works closely with clients to develop ideas and products. The group, headquartered in Germany, is present in more than one hundred countries in Europe, Middle East, Africa, Asia, the USA, and Latin America. Symrise is listed on the Frankfurt Stock Exchange and currently has a market capitalization of €12.7 billion.

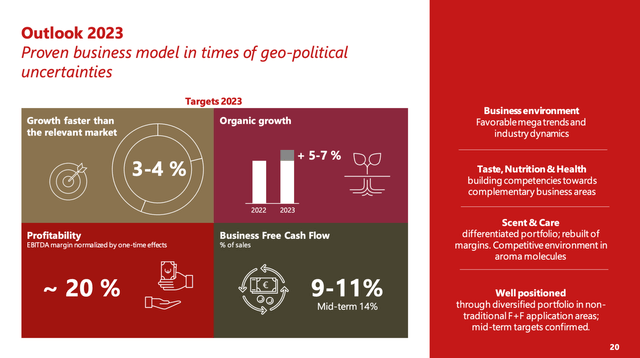

Symrise boasts a balanced portfolio with a wide range of products oriented toward defensive end markets. The company enjoys the benefits of backward integration and has a leading R&D division. The attractive fundamentals combined with solid execution allow Symrise to reach mid-single digits top line growth (industry leading) and an EBITDA margin in the range of 20%+.

Symrise Analyst Presentation

Q2 Results

Q2 sales print came in lower than consensus by over 150 basis points with Scent & Care missing as volumes were weaker in Aroma due to destocking, tougher markets, and the outage of the Colonel Islands production facility. Meanwhile, Taste, Nutrition, and Health were in line with consensus.

The in-line reported EBITDA was accompanied by significant one-offs. Otherwise, excluding one-offs EBITDA missed consensus estimates by mid/high single digits %. Moreover, the implied cut in full-year EBITDA margin guidance by 1% (the approximate size of one-offs) resembles a profit warning. While lower margins had already been discussed in the markets, concerns have now shifted more towards organic sales growth. Overall results were quite disappointing given Symrise’s standards, and this was reflected in the share price move.

Symrise Analyst Presentation

Swedencare Deal

In June 2023, after crossing the 30% threshold, Symrise launched a public offer for Swedencare, a producer of premium pet care products including supplements, pharmaceuticals, and oral health products for cats and dogs. The offer was at a small premium to VWAP and values the target at SEK6 billion or nearly 14x EBITDA 2023. The initial <30% stake was acquired at a much higher multiple. The share price of Swedencare more than halved from June 2022 due to significant operational disappointments, leading to a recognition of impairment by Symrise in its reporting.

Swedencare had previously disclosed ambitious mid-term targets for FY 2026 including sales of SEK4 billion or more than double 2022 levels and an EBITDA of SEK1.2 billion or almost quadruple vs. 2022 levels. These figures are yet to be confirmed by Symrise and do not include any potential synergies from the deal. We have a constructive outlook on the deal and believe it makes sense strategically and enhances Symrise’s capabilities in pet products, a very fast-growing business where Symrise is attractively positioned. The pet care business can be considered a crown jewel of sorts for Symrise and should comprise as much as 30% of sales in the upcoming years. While Symrise overpaid for the initial stake in Swedencare we believe the public offer was made at a reasonable price.

Cartel Investigation

Symrise has become the subject of a global antitrust regulators’ raid on concerns of participating in a cartel for fragrances. The Swiss competition authority announced it had raided Symrise, Givaudan, IFF, and Firmenich, in concurrence with EU, US DoJ Antitrust, and the UK Competitions and Markets Authority. Shares slipped 4%+ on the day of the announcement. Further details on the investigation are pending and based on historical precedents we may reasonably expect up to a few years until results are disclosed. We would suggest closely monitoring the situation as any potential adverse ruling could have a significant negative effect on Symrise (some previous EU cartel fines have been in the range of billions.) even though some of the impact is already priced in. The regulatory overhang will remain on the stock until there is clarity on the ruling.

Investment Thesis And Valuation

Symrise is a high-quality business in a consolidated and growing defensive industry benefiting from major competitive advantages including scale, know-how, and long-standing relationships. Moreover, prudent management has led to Symrise successfully leveraging its capabilities and pivoting towards promising high-growth verticals such as pet food, a key difference in comparison to other ingredients peers. Symrise’s well-diversified portfolio offering mid-single digits organic revenue growth combined with robust profitability in the range of 20-23% EBITDA margin is particularly attractive to investors.

However, we find Symrise fairly priced and given the room for negative revisions/error, we issue a Hold rating, preferring other names in the sector. We forecast €5.1 billion of sales in FY 2024e, broadly in line with consensus, €1 billion of EBITDA at 20% EBITDA margin, and an EPS of €3.4 also in line with consensus. This implies a forward EV/EBITDA multiple of 13.6x and a forward PE multiple of 26.6x. The PE is in line with Givaudan, but higher than both Kerry Group and IFF. Assuming 10% EPS growth in 2025, also in line with consensus and valuing Symrise at 25x EPS 25e, we arrive at a target price of €97.5 or $106, implying 7% upside. The margin of safety is very limited, and in our view, Symrise is trading at fair value.

Risks

Downside risks include but are not limited to worsening outlook on organic sales growth, margin pressures, lower consumer confidence, crop shortages for raw materials, higher raw material prices, longer than expected inflation pass-through lag, less willingness for innovation from clients, weaker than expected pet ownership trends, value destructive M&A, an adverse ruling from regulators regarding the cartel investigation resulting in major fines and penalties, operational risk, etc.

Conclusion

Symrise is an excellent business that has hit a few speed bumps recently. It is definitely a business to own at a cheaper valuation. At the moment we issue a Hold recommendation and prefer other names trading at more attractive valuations to get exposure to the sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here