Shares of Sysco (NYSE:SYY) have declined nearly 20% since my initial article in January and are fast approaching my $60 buy price so I’ve decided to revisit the stock. While Sysco has produced largely in-line results over the past nine months, the shares have been hit hard as:

- Consumer staples (XLP) have broadly declined due to weak volumes, waning pricing power, and a general decline in stocks considered to be ‘bond proxies’ as interest rates have continued to rise.

- Fears of a consumer slowdown have introduced concerns about restaurant spending going forward.

- Most notably, the surge in use of weight-loss/appetite reduction drugs such as Novo Nordisk’s (NVO) Ozempic have created fears of structurally reduced demand at restaurants.

As I discuss below, I don’t see Ozempic as having a sustained negative impact on Sysco’s business over the long-term. That said, I do have concerns about how resilient Sysco’s business will be in a less buoyant consumer economy. Below, I take a look back at the post-GFC period of 2009-14 to estimate the magnitude of a potential earnings decline in a tougher economic environment.

Ultimately, despite the cyclical risks, given my affinity for the business (as described in my initial article), have decided to retain my $60 buy price for Sysco and hope to become a shareholder (possibly soon!).

Ozempic Threat

Last week, Walmart’s CEO of US operations noted that the company is seeing an impact on shopper behavior and food sales from weight loss drugs like Ozempic. This led to a decline in many food industry stocks, including Sysco. While Ozempic was designed to treat diabetes, the drug is being prescribed off-label to promote weight loss. Anecdotally, having queried several friends about Ozempic over the past week, nearly everyone I spoke with knows several people who are now trying to lose weight with the drug.

While Ozempic works to regulate insulin production and control appetite by releasing a hormone which makes patients ‘feel full’ and consume fewer calories. However, as most everybody knows, eating habits have been developed over decades and in many cases, overeating is a psychologically driven responses to stress, anxiety, depression, boredom, etc.

Without treating the underlying psychology, people are less likely to see a behavioral change (i.e. take action to reduce stress, anxiety, etc) which can decrease the likelihood that people sustainably reduce their caloric intake. In addition, Ozempic is very costly (~$900 per month without insurance) and needs to be taken constantly (for the rest of your life) for continued benefits. There have been several reports of people putting on additional weight (beyond their weight when they started on Ozempic) after discontinuing use of Ozempic.

It is also worth noting that Ozempic has a litany of unpleasant side effects which could limit its use including:

- nausea in 15-20% of patients

- vomiting in 5-9% of patients

- diarrhea

- abdominal pain

- loss of muscle mass

In addition, there are more serious side effects including pancreatitis, gallbladder disease, and diabetic retinopathy among others.

While I expect Ozempic could continue to dominate headlines and impact near-term price action for food-related stocks like Sysco, ultimately I believe that in aggregate, people’s underlying eating habits will see little change and that long-term demand at restaurants will be largely unaffected.

Cyclical Concerns

While I am not too concerned about the impact of weight loss drugs like Ozempic on Sysco, I do have some concerns about the sustainability of Sysco’s current results coming off of record restaurant spending following the pandemic. Much has been made of restaurants and travel being beneficiaries in 2022-23 of the pent up demand created in pandemic years of 2020-21.

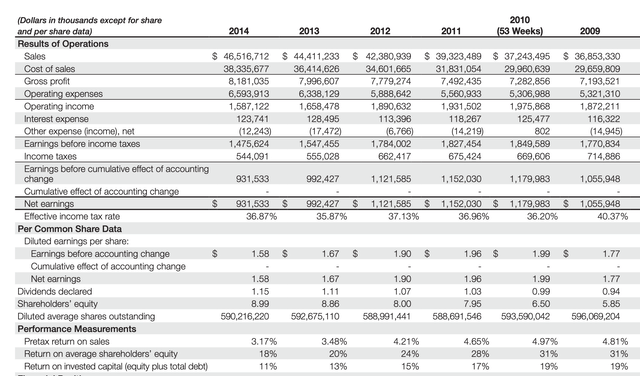

To help me think about what margins might look like in a tougher external environment, I looked back at the 5-year period following the GFC:

Sysco’s Financial Results 2009-14 (2014 Annual Report)

As shown above, Sysco saw operating profit decline 20% from 2010 to 2014 despite a 24% increase in revenue. Going back and reviewing the narrative provided during that time reveals several contributing factors:

- Relatively muted consumer spending led to heightened levels of competition amongst food distributors, leading to a 2% contraction in gross margins from 19.6% to 17.6%.

- A surge in fuel prices lead to higher costs of distribution.

- Sysco had been built via nearly 100 acquisitions in the preceding decade. These acquisitions hadn’t been properly integrated and there were excess costs in the system.

- Similar to the previous point, Sysco was undergoing an expensive multiyear SAP implementation project, which increased costs by $200-300 million annually.

As best I can tell, about half the profit decline from 2010-2014 was associated with one-off type costs related to its SAP project, with the remainder a result of a tough external environment and challenging competitive situation. Sysco eventually completed its SAP implementation (and was able to eliminate the transformation costs associated with the project) as well as finally reaping synergies from past acquisitions.

To get a sense of the downside here, assuming a 10-12% decline in operating profit as pent-up restaurant demand fades, fuel/cost increases continue to bite, and the overall competitive environment becomes more challenging and factoring in a rise in interest costs related to Sysco’s nearly $10 billion in debt, I estimate that EPS could decline 16-19% from 2023 levels to ~$3.30. At today’s price of $63 per share, this implies a value of 19x trough-ish earnings, which would be about fairly priced in my opinion (roughly equal to the current S&P 500 multiple).

Of course, it is possible that such a downturn may not occur or that the impact may not be as pronounced as I described above. Should Sysco achieve the midpoint of its current guidance ($4.30 in EPS) the stock would be selling for less than 15x earnings which is relatively inexpensive for a company with a leading market position which should only get stronger over time.

Conclusion

While I’m sanguine regarding the threat from weight loss drugs like Ozempic, I do have some concerns of how Sysco will perform in a tougher economic environment.

That said, given my affinity for the business, I plan to buy a small position in Sysco if the stock hits my $60 buy price and expect to gradually increase should the stock fall further as I believe that Sysco will continue to occupy a leading and improving position in the restaurant distribution business and that shares offer a margin of safety at or below $60.

Read the full article here