TC Energy Corporation (NYSE:TRP) investors have seen TRP make an incredible round trip toward its March 2020 COVID lows. Accordingly, investors de-rated TRP markedly after the announcement of the separation between its natural gas and liquids pipeline business. Analysts were mixed about the business separation, noting execution risks, but also stressed that it “aligns with the company’s strategic goals.”

TRP dip buyers returned after its July hammering, attempting to recover its downward spiral over the next two months. However, sellers came back with a vengeance over the last three weeks, digesting all the gains made as TRP broke below its July lows.

As such, I believe it’s opportune for investors considering adding exposure to this energy infrastructure play to assess whether it’s time to catch the falling knife. Or is it better for them to stay on the sidelines as the company works out its business separation? The separation isn’t expected to change “the growth rates of the two newly formed companies resulting from the split.”

In other words, while it’s expected to accelerate its deleveraging efforts, spinning off a highly contracted liquids pipeline business could increase execution risks for TC Energy. Management also emphasized that its liquid pipelines business has “stable and robust cash flows supported by long-term customers.”

An analyst on TC Energy’s second-quarter earnings call in July also highlighted possible execution risks, as he enquired how TC Energy can still “internally fund up to $7 billion in CapEx post-spin for both entities.” Management highlighted its confidence in maintaining its funding model, with debt reduction and a lower payout attributed to the liquids pipeline company. Notwithstanding management’s optimism, I believe the market is justified to assess higher execution risks, particularly for its liquids pipeline company, with investment grade credit ratings yet to be finalized, as it’s still not operational.

Management articulated that the debt reduction from the spin-off and the GIP transaction could bring TC Energy’s adjusted EBITDA leverage level down to 4.75x by the end of 2024. However, the recent surge in the 10Y Treasury yield (US10Y) could put more pressure on the company to lower its leverage ratio further or faster, potentially putting its earnings growth outlook at risk. As such, I believe the heightened execution and macroeconomic uncertainties could have caused investors to run for the hills over the past three weeks.

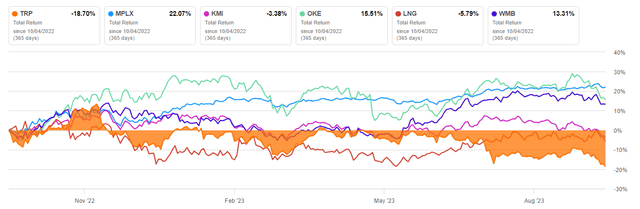

TRP Vs. Peers total return % (1Y) (Seeking Alpha)

Furthermore, TRP’s significantly weak performance against its peers suggests that the market has already downgraded its view on TRP for some time. I’m not sure whether management could have timed its business separation decision better, noting that the market could price in execution headwinds if it doesn’t anticipate a significant change in growth rates, as discussed earlier.

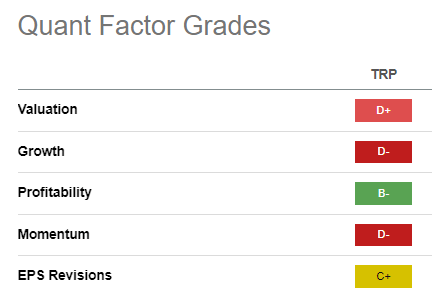

TRP Quant Grades (Seeking Alpha)

Seeking Alpha’s Quant rated TRP with a “D-” growth grade, notwithstanding its “B-” profitability grade. However, a lack of a best-in-class “A” rating in any factor is a yellow flag, in my opinion, suggesting there could be other more attractive energy infrastructure plays.

Moreover, its “C+” earnings revisions grade indicates that execution hasn’t been impressive. As such, the downward de-rating makes sense as infrastructure plays are often priced at a premium against their energy sector peers. With no expected significant changes in its overall growth rate and heightened risks to execute its business separation, caution is warranted at the current levels.

Takeaway

I assessed that TRP dip buyers from its July hammering have likely given up as the selling intensity over the past three weeks took them by surprise.

However, I assessed that a bottoming opportunity could occur for buyers looking to capitalize on a mean-reversion setup. Notwithstanding my optimism, I’m not convinced TRP offers investors a best-of-breed play among its energy infrastructure peers.

Investors must be cautious about their selections in more challenging market conditions, particularly for companies like TC Energy with a higher leverage exposure.

Rating: Initiate Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here