The house is like a bait inside a trap

The Toronto-Dominion Bank (NYSE:TD)(TSX:TD:CA) and Royal Bank of Canada (RY)(RY:CA) are Canada’s biggest banks. Royal Bank is the biggest by market cap and total assets, while TD has the largest U.S. banking segment.

Despite looking similar on the surface, there are important differences between TD and RY. For one thing, 40% of TD’s earnings come from U.S. retail banking, while Royal Bank earns a higher percentage of profit in Canada. For another thing, Royal Bank has a large and complex acquisition underway, while TD has no such major deals ongoing – its First Horizon (FHN) deal having been scrapped last year.

While there are many similarities between TD and RY, there are enough differences to make the two stocks non-identical. In one respect, though, they are the same:

They both have heavy exposure to Canada’s housing market.

Canadian mortgages make up 18% of Royal Bank’s assets, and 13.8% of TD Bank’s assets. Neither of these figures include U.S. mortgages or home equity lines of credit (“HELOCs”).

The state of Canada’s housing market has long been the centerpiece of short theses on Canadian banks. Canada’s ratio of housing costs to income is higher than in the United States. In fact, Canada’s ratio is the fourth highest among 40 countries surveyed by Statista. “Short Canadian banks” has been a relatively popular hedge fund trade for this reason. The theory is that Canadians spend too high of a percentage of their income on housing, making Canadian banks similar to U.S. banks before the Great Financial Crisis.

There are several problems with this thesis.

First, Canadian mortgage lenders generally enjoy full recourse to the borrower’s total assets. The vast majority of Provinces allow recourse mortgages, Saskatchewan allows non-recourse mortgages only when the property isn’t insured.

Second, although Canada’s house price to income ratio is higher than the same ratio for the U.S., the difference is not great (about 3.5 percentage points).

Third and finally, the actual loan-to-value ratios at Canadian banks are not that high – a point I will elaborate on in ensuing paragraphs.

When you take these three points together, you can see clearly that Canada’s housing market does not resemble the U.S. housing market in 2008. That crisis was marked by loans being issued to people who were not creditworthy, the situation in Canada is simply one where houses are expensive. There is no particular tendency for mortgages to be given to un-creditworthy people in Canada, as Canadian banks generally have conservative lending standards. Regulators require them to. We would expect, then, for Canada’s housing market to be dominated by wealthier than average people, and for most others to rent long term. That’s pretty much what is happening: homeowners in Canada skew older and wealthier than average. So, we’d expect the Canadian housing market to hum along OK.

For those who aren’t convinced, there is a major test case coming up. In 2024, 80% of all Canadian mortgages that were outstanding in March 2022 will be renewed. 60% of currently outstanding mortgages will be renewed in the next three years. In Canada, mortgages – including fixed rate ones – come up for renewal every five years. The 2024 renewals include a lot of ultra-low rate mortgages that were written in 2020 and 2021, when interest rates were near zero. Many people think that these renewals will lead to a wave of defaults, as they will dramatically increase homeowners’ financing costs. The factual claim here is correct (the renewals will increase costs to homeowners), but the inference (that these increased costs will stress homeowners) is not. In the ensuing paragraphs, I will explain why TD and Royal Bank are good stocks to hold, ahead of the coming mortgage renewals.

The Positive Side of the 2024 Renewals

One thing worth mentioning about Canada’s upcoming mortgage renewals is, that they contain a positive for bank shareholders: higher mortgage interest. If Canadians can absorb the increased cost, then bank earnings will rise. Although media coverage of the renewals generally focuses on the potential defaults, the banks are saying that, homeowners that renewed their mortgages in the 2022-2023 period absorbed the higher interest well. The banks also pointed out that the expected increase – about $400 a month on average – is not a crippling amount for most Canadian families.

TD and Royal Bank: Mortgage Exposure

Both TD and Royal Bank hold a lot of mortgages. You can see data on their Canadian mortgage portfolios in the table below (data from the banks’ financial supplements).

|

TD Bank |

Royal Bank |

|

|

Canadian mortgages as % of total assets |

13.8% |

18% |

|

Loan to value |

65% |

58% |

|

Median amortization period |

20 to 25 years |

Less than or equal to 25 years. |

A few things are worth noting here:

-

Canadian mortgages do not make up even one fifth of total assets at either TD or Royal Bank. The percentages grow somewhat higher if you include HELOCs, but those usually have lesser balances than mortgages, about $70,000 on average nation-wide.

-

Most lenders consider anything below 80% to be a good loan-to-value ratio; TD and Royal Bank are both comfortably below 80%.

-

Despite the mortgage amortization scare that has been hyped in the media, TD and Royal Bank customers mostly have amortization periods equal to or shorter than the traditional 25 years.

TD and Royal Bank fare better than other Canadian banks in terms of amortization periods. Over 60% of borrowers have amortization periods longer than 25 years, according to CMHC economist Tania Bourassa-Ochoa. For TD and Royal Bank, most mortgages are comfortably under 25 years, indicating that their mortgage portfolios are healthier than those of other lenders. To some extent, this is due to regulatory requirements: TD and Royal Bank are not allowed to issue subprime loans in Canada, because they are considered prime lenders. Smaller financial institutions can issue subprime loans, such loans do exist in Canada, but they are not a major concern for big banks like TD and RY.

TD Appears Safer Than RY

While I’ve argued that the upcoming mortgage renewal wave is not a major risk for TD and Royal Bank, I do not mean to say that it is no risk at all. When you have a collection of loans spread across millions of borrowers suddenly increasing in cost, you’d expect to see defaults rise – the question is by how much. I’ve so far argued that the coming renewals aren’t going to put Canadian banks in financial jeopardy. I stand by that, but nevertheless, I do think some defaults will come as a result of the renewals. Canadian banks usually have recourse to borrowers’ assets, but if a borrower has no assets other than home equity and collateral, then their defaulting is a loss for the bank. For this reason, I consider TD slightly safer than RY heading into 2024, as it is less exposed to Canadian mortgages.

Factors Other Than Mortgage Renewals

Apart from it having less domestic mortgage exposure than RY, TD has other qualities that make it more appealing to me than RY.

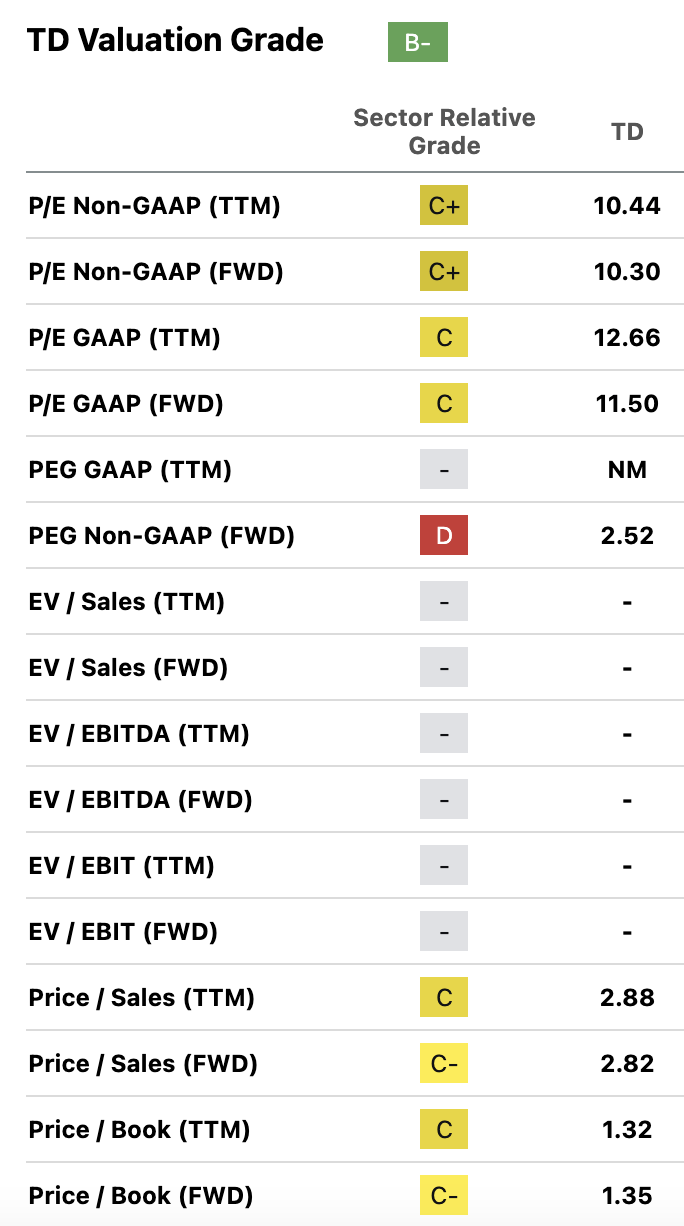

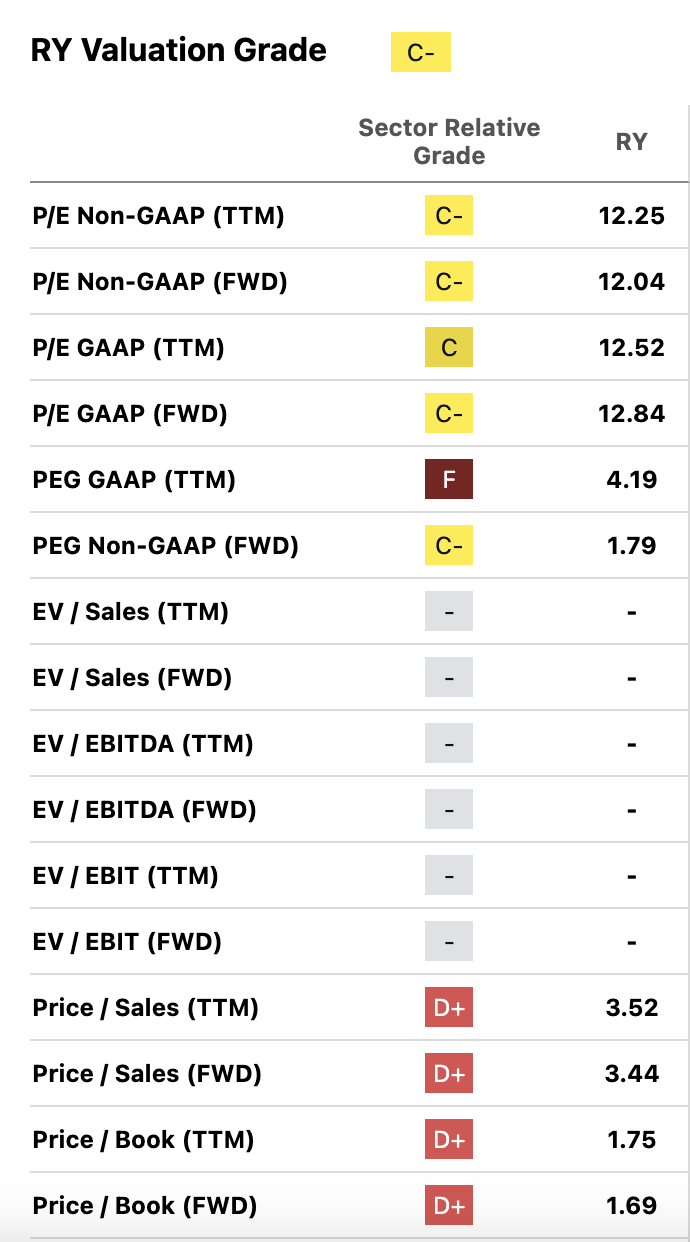

For one thing, it’s somewhat cheaper. You can see a collection of multiples for both TD and RY in the table below, courtesy of Seeking Alpha Quant. Every single multiple is lower for the former, than the latter, with the exception of the trailing GAAP P/E ratio. TD’s GAAP P/E ratio is higher than its adjusted P/E ratio, because its earnings were affected by non-recurring factors (e.g. FHN deal hedges) that don’t reflect the long term earnings trend. TD’s adjusted P/E ratio is therefore more instructive. Seeking Alpha Quant agrees that TD beats RY on valuation, as it gives TD a higher score (B- vs. RY’s C-).

TD Valuation multiples (Seeking Alpha Quant) |

RY Valuation multiples (Seeking Alpha Quant) |

TD also scores pretty well when you value it using a dividend discount (“DDM”) model. Normally I use discounted cash flow models to value stocks, but since free cash flow isn’t the most applicable metric for banks, I will use dividends in place of free cash flow here (DDM uses the exact same math as DCF, the only difference is the metric being valued).

TD pays C$1.02 in dividends per quarter, or C$4.08 in dividends per year. The five year CAGR dividend growth rate is about 8%. The company’s net interest income trended upward in the most recent quarter, and analysts expect earnings to grow 23% next year. The analyst expectation is corroborated by factors such as the presently high interest rates in Canada and the United States–which tend to produce higher interest revenue. Therefore, I would expect TD’s dividends to grow at the same rate in the future as in the recent past. So I will model for 8% dividend growth initially, followed by 3% annually following that (to reflect more uncertainty in the longer term future).

Using a 9% discount rate, we get a $86 price target ($64 on the NYSE). If we assume no growth but discount at the 10 year treasury yield, we get a $97 price target ($72.75 on the NYSE). Many different combinations of fairly modest discount rates and growth rates produce upside for TD–and remember, we’re only valuing dividends here, the company’s actual earnings are approximately double the metric being valued.

The same exercise doesn’t produce as much upside for Royal Bank. TD yields 5%, while RY only yields 4%, so the latter’s dividends do not produce as much upside as TD’s. For example, in the “0% growth, 0% risk premium” model, RY’s dividends (also C$1.02 per quarter, but at a much higher share price than TD) produce a present value estimate below the current share price.

Also, TD Bank faces less uncertainty today than Royal Bank does. Royal Bank has a major deal in the works. It just completed buying HSBC Canada from HSBC (HSBC). The deal has technically closed, but we won’t see its financial impacts until the next quarterly earnings release.

There will probably be some costs associated with the deal. It’s been nearly a year since TD’s First Horizon deal fell apart, and the bank is still taking charges related to that deal today. TD’s successful Cowen deal, which closed before the First Horizon deal collapsed, is also still incurring charges. For TD, these deal-related charges will stop affecting earnings in the coming quarters; RY on the other hand will probably keep incurring them for many quarters to come. The fact that TD’s most recent M&A is in the past, makes its earnings more predictable than RY’s. Broadly, we would expect TD to keep growing its revenue in the mid to high single digits, while growing its earnings at a faster pace. Analysts are expecting $5.79 in EPS for 2024, which will be 23% growth from the TTM earnings of $4.71. RY’s earnings are harder to predict because it’s not clear how many deal-related charges that the bank will take. So, TD is easier to analyze.

Nevertheless, when it comes to the upcoming mortgage renewals, they’re not too big of a risk for either one of these stocks. TD and RY are both prime lenders, they don’t write sub-prime loans, and they have full recourse to their borrowers’ assets. If anything, the coming renewals mean they’ll collect more interest income, and maybe even beat expectations on net interest income (“NII”) in the year ahead.

Read the full article here