The iShares U.S. Tech Breakthrough Multisector ETF (NYSEARCA:TECB) invests in companies believed to be at the forefront of major secular innovation trends. The attraction here is a passively managed exchange-traded fund (ETF) that goes beyond the “technology sector” to capture themes covering artificial intelligence and robotics, computing, cybersecurity, genomics, and fintech.

Indeed, the fund’s growth profile has performed well with a 41% return over the past year, even beating out the Nasdaq-100 (QQQ). What we like about TECB is its exposure to both mega-cap leaders and emerging players with a relatively balanced allocation approach making it a compelling alternative to more traditional tech ETFs. We are bullish on TECB and expect more upside going forward.

What is the TECB ETF?

TECB is intended to track the “NYSE FactSet U.S. Tech Breakthrough Index”. According to the methodology, the concept of innovation is screened based on industry classification. Companies identified as generating at least 50% of their revenue related to various breakthrough technologies are eligible for inclusion.

Notably, there is a $500 million minimum float-adjusted market capitalization as well as a daily trading volume liquidity threshold. Finally, the fund is rebalanced on a semi-annual basis.

source: iShares

Going through the underlying holdings, there are not many surprises with Meta Platforms Inc (META), Nvidia Corp (NVDA), Alphabet Inc (GOOGL), Amazon.com Inc (AMZN), Apple Inc (AAPL), and Microsoft Corp (MSFT) among to the top 10 stocks.

The entire portfolio currently features 169 stocks with representatives from various sectors like Healthcare, Financials, Consumer Discretionary, Communications, Industrials, and even Real Estate embedding through the “tech breakthrough” theme. Down the list, we find a variety of midcap names including U.S.-listed foreign stocks like MercadoLibre Inc. (MELI).

source: iShares

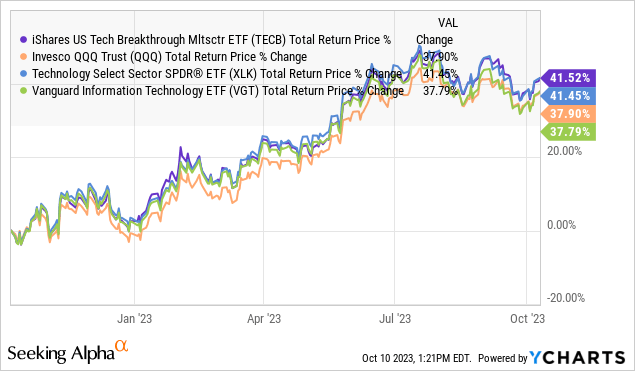

Here we can draw a comparison between TECB with some alternative “tech” ETFs like the Invesco QQQ Trust (QQQ) along with the Vanguard Information Technology Index ETF (VGT) and the Technology Select Sector SPDR Fund ETF (XLK).

The iShares U.S. Tech Breakthrough Multisector fund has some key advantages. The first point here is its specific capitalization-based weighting methodology which caps each holding at 4%. This measure ends up solving many of the perceived weaknesses of funds like VGT and XLK which are dominated by AAPL and MSFT, together representing more than 35% of those funds.

In the case of QQQ, the NASDAQ-100 is not expressively a “tech” index but does a bit better job on the side of concentration with AAPL and MSFT representing 20% of the fund, compared to VGT and XLK. Still, the smaller portfolio of 100 names is more “top-heavy” compared to TECB.

It’s difficult to claim one fund is “better” than another, but the argument we make is that TECB best embodies the idea of technological innovation where those high-level themes often blur the lines across sectors.

Naturally, these other funds should outperform in an environment where the mega-cap tech leaders like AAPL and MSFT are leading higher, but we see those excessive weights as nearly defeating the purpose of an ETF. TECB’s balanced approach may ultimately generate stronger returns over the long run.

Seeking Alpha

What’s Next For TECB?

With an optimistic macro perspective heading into 2024, we expect the environment to be positive for equities with the potential for tech stocks to lead higher. The way we see it playing out is that a continuation of a resilient U.S. and global economy, while inflation and interest rates stabilize lower, can support a rebound in both growth expectations. A rebound in the credit cycle could be a tailwind for market sentiment.

Heading into the upcoming Q3 earnings season, we see the underlying companies across the TECB portfolio as generally well-positioned to deliver strong reports. Considering indications that Q3 was otherwise a solid operating environment, trends over the past year among cost-cutting efforts and higher pricing initiatives should translate into firming margins as supporting profitability. Management teams offering positive guidance for the year ahead could be enough to work as a catalyst for equity prices.

In terms of risks, we believe it would take a deeper deterioration of the economic outlook under the possibility of a “hard landing” to open the door for a deeper selloff in stocks. By this measure, evidence that consumer spending is slowing significantly, or that inflation is re-accelerating forcing the Fed to tighten conditions even further, could represent the bear case for the market overall.

Final Thoughts

There’s a lot to like about TECB as a high-quality ETF we believe can work in the context of a broader diversified portfolio. Investors can use the fund as a core holding for exposure to both tech stocks and high-growth names across other sectors under the umbrella of breakthrough innovation.

The idea here is that the leading companies should consolidate their market share over the next several years and reward shareholders through underlying earnings momentum. The fund’s expense ratio of 0.4% is reasonable in our opinion within this category of thematic ETFs.

Read the full article here