Note:

I have covered Teekay Corporation (NYSE:TK) previously, so investors should view this as an update to my earlier articles on the company.

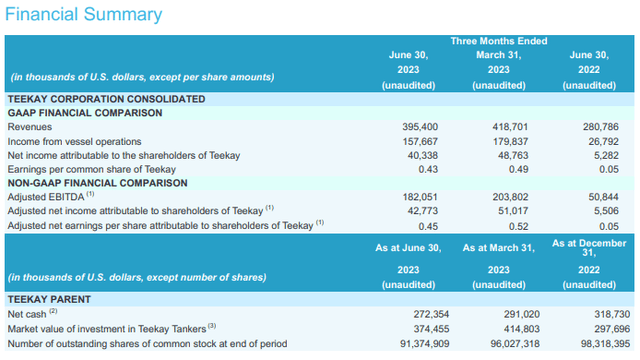

Earlier this month, Teekay Corporation (“Teekay”) reported strong second quarter numbers with results boosted by the consolidation of Teekay Tankers (TNK). While Teekay’s economic interest is below 30%, the company retains control of Teekay Tankers via supervoting Class B shares.

Company Press Release

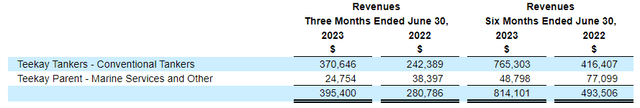

In Q2, Teekay Tankers contributed 93.7% of consolidated revenues as disclosed in the company’s quarterly report on form 6-K :

Regulatory Filing

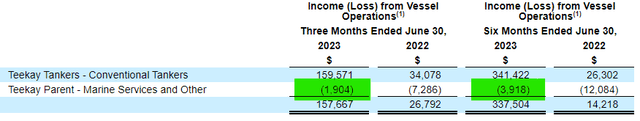

In addition, the consolidated entity’s entire profit was derived from Teekay Tankers as Teekay Corporation’s small marine services business was operating at a loss:

Regulatory Filing

During the quarter, Teekay utilized $4.8 million in cash for the acquisition of additional shares in Teekay Tankers. In aggregate, the company purchased 132,479 Class A common shares at an average price of $35.95 which has turned out to be a great investment so far.

As of June 30, the company owned 5,168,785 Class A common shares and 4,625,997 Class B common shares of Teekay Tankers, representing a 28.8% economic interest and the majority of its voting power.

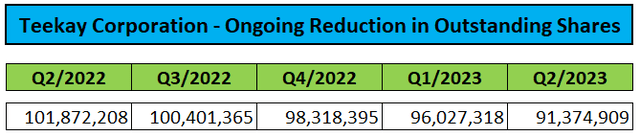

In addition, Teekay continued to repurchase its own common shares with outstanding shares reduced by close to 5% on a quarter-over-quarter basis:

Company Press Releases

At quarter end, Teekay’s total remaining share repurchase authorization was $26.7 million.

During Q2, the company received $12.1 million in cash dividends from Teekay Tankers.

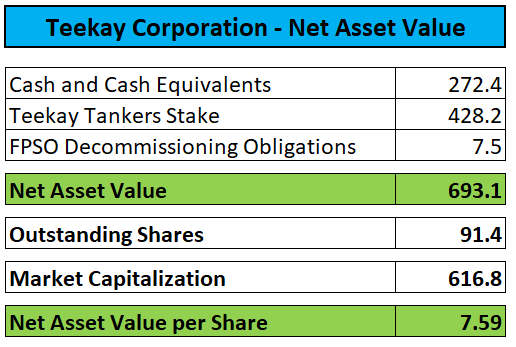

Teekay ended the quarter with $272.4 million in cash, cash equivalents and short-term investments, which are comprised of bank deposits and short-term debt securities issued by the United States government.

Despite shares trading near multi-year highs, they are still changing hands at a discount to net asset value (“NAV”):

Regulatory Filings

That said, the steady share price increase has resulted in the discount narrowing quite meaningfully from approximately 20% at the time of my last article in May to 11% as of today.

Given this issue, I would expect Q3 share repurchases to be rather muted, particularly given the fact that Teekay Tankers abstained from declaring another generous special dividend for Q2.

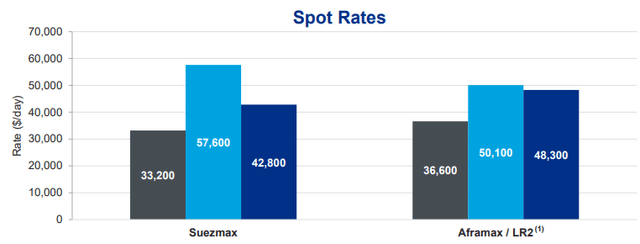

While seasonally lower, the crude tanker charter rate environment continues to be strong as very much evidenced by the daily average time charter equivalent (“TCE”) rates secured by Teekay Tankers quarter-to-date:

Teekay Tankers Presentation

However, on the recent conference call, Teekay Tankers’ management made clear that there won’t be any near-term dividend increases:

We announced just last quarter, a change to our capital allocation policy of $0.25 per quarter. I don’t think you’re going to see a change to that in the near term, something that we continue to think about, but I wouldn’t expect to see a change to that in the near term.

As you know, we’ve decided that we will use special dividends as the avenue for returning extra capital to shareholders and/or using the share buyback program, which we announced last quarter. But that’s something that we’re going to look at on a more periodic basis, not something that we’ll be doing on a quarter-to-quarter basis. So I think we’ll probably wait to see how the next few quarters unfold and then make a call in terms of what we want to do on that side of things.

While Teekay Tankers should continue to do very well in the current charter rate environment, I consider the company’s hesitant approach to dividends as somewhat disappointing for Teekay Corporation’s shareholders.

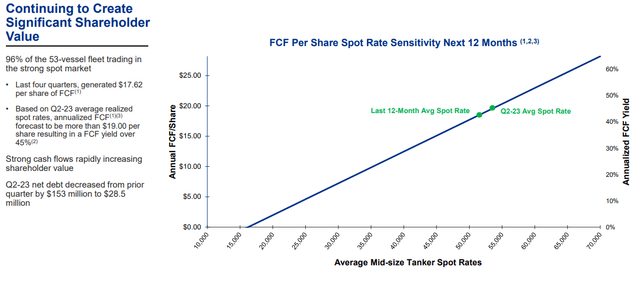

Over the past four quarters, Teekay Tankers has generated a whopping $17.62 per share in free cash flow. In addition, the company expects to end the third quarter in a solid net cash position:

Teekay Tankers Presentation

Should the tanker charter rate environment remain strong going into 2024, I wouldn’t be surprised to see Teekay Tankers declaring another generous special dividend alongside its Q4 and full-year 2023 report next year.

That said, with the narrowed discount to net asset value likely resulting in lower buyback activity this quarter and limited near-term prospects for increased payouts from Teekay Tankers, I am downgrading Teekay Corporation’s shares from “Buy” to “Hold“.

Downside Risks:

With the stock price heavily correlated to the performance of Teekay Tankers, investors in Teekay Corporation would be well served to keep a close eye on the crude tanker markets.

In addition, the company has made a number of less-than-stellar investment decisions in the past. A large-scale investment in a perceived speculative new business opportunity is likely to be met with heightened scrutiny by market participants.

Upside Risks:

On the flip side, an extended period of elevated tanker charter rates would likely result in Teekay Tankers and Teekay Corporation’s shares reaching new multi-year highs.

Bottom Line:

While Teekay Corporation’s own business remains nothing to write home about, the consolidation of Teekay Tankers is boosting reported results substantially.

Since my upgrade to “Buy” eleven months ago, Teekay Corporation’s stock price has appreciated by more than 75%.

Despite ongoing tanker market strength, I am downgrading shares from “Buy” to “Hold” based on my expectations for lower buyback activity and Teekay Tankers’ quarterly dividend to remain at subdued levels for at least the remainder of the year.

Read the full article here