Sleep well at night, stocks are few and far in between and are to be accumulated when they become attractive in price. Such may be the case with Terreno Realty (NYSE:TRNO), which I last covered with a ‘Buy’ rating here back in February, highlighting its high cash rent spreads in coveted markets.

While the stock is far from being a top performer this year, its performance has held up well against other REIT sectors, particularly compared to the net lease segment. As shown below, TRNO is up by 8.6% over the past 12 months, after taking a dip from the $60+ level in early September. In this article, I discuss recent updates and highlight why TRNO remains an attractive quality ‘Buy’ in this market, so let’s dive in!

TRNO Stock (Seeking Alpha)

Why TRNO?

Terreno Realty is a self-managed industrial REIT that owns and acquires properties in high-demand Tier 1 markets across the U.S. TRNO is more simplified than some of its peers in that it doesn’t pursue speculative greenfield development opportunities and has no joint ventures.

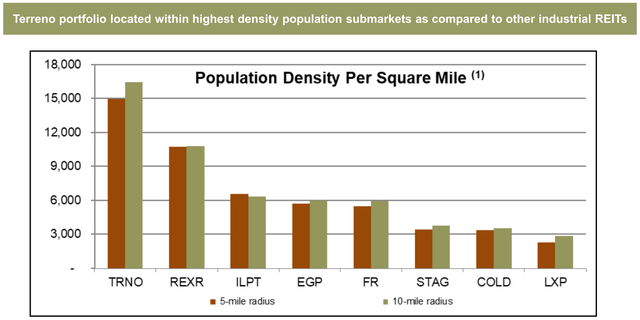

It prefers instead to acquire properties at a discount to replacement cost, giving itself a margin of safety should things turn south. TRNO also has favorable population demographics compared to peers. As shown below, its 5- and 10-mile radius population density ranks even higher than that of Southern California-focused peer, Rexford Industrial (REXR).

Investor Presentation

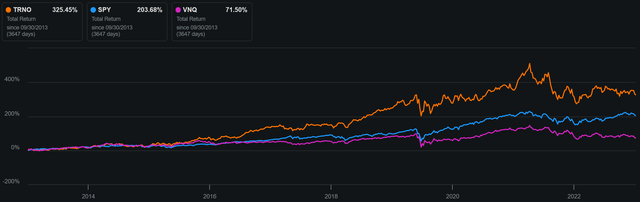

As most savvy investors know, a stock’s price in the short term is driven by market sentiment, while long-term performance is driven by the company’s underlying operating fundamentals. TRNO shines on the latter, as it’s generated an impressive 11.3% same-store NOI CAGR since IPO, and its investment strategy has resulted in a 12.8% unlevered IRR on 30 sold properties since its IPO in 2010. This has translated into strong shareholder returns, as demonstrated by its 325% total return over the past 10 years, far surpassing the 203% of the S&P 500 (SPY) and the 72% of the Vanguard Real Estate Index ETF (VNQ), and that’s not too shabby for a non-tech related ‘boring’ REIT.

TRNO Total Return (Seeking Alpha)

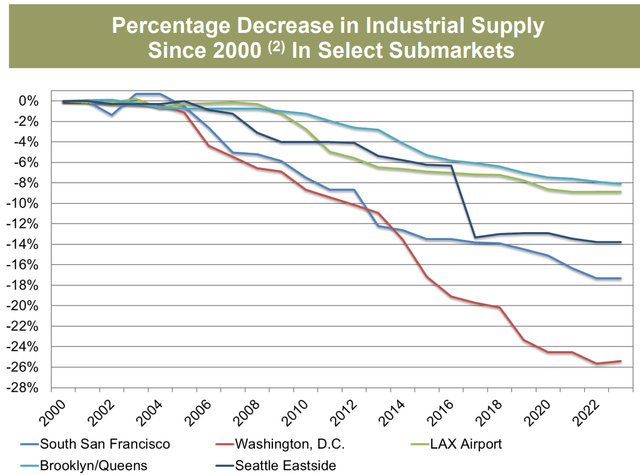

What also sets TRNO apart from its peers are the markets in which it operates. TRNO operates in just 6 coastal markets that serve as key port cities for U.S. and international trade, including Seattle, SF Bay Area, Los Angeles, New York City, Washington D.C., and Miami. These cities are supply-constrained due to a very tight real estate market. The shortage of industrial space has been further exacerbated by shrinking supply, with 47% of TRNO’s portfolio being in markets with no net new supply. As shown below, 5 of TRNO’s markets have seen material declines in supply over the past 2 decades, led by Washington D.C., San Francisco, and Seattle.

Investor Presentation

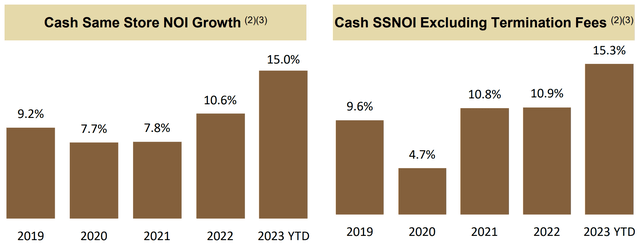

Meanwhile, TRNO continues to demonstrate strong results, with FFO per share growing by 15% YoY to $0.55. This was driven by strong SSNOI growth, which has accelerated so far this year to 15%, compared to 10.6% in 2022, when I last visited the stock in February.

Investor Presentation

The growth was driven by very strong demand for TRNO’s properties, with cash rents growing by 64.3% in the first half of this year, comparing favorably to the 49.5% cash rent spread in 2022. The same-store portfolio leased rate is also 130 bps higher than the prior year period, sitting at 98.4% at the end of Q2.

Beyond rent increases, TRNO also has external growth opportunities, as supported by its accretive acquisitions year-to-date, with cap rates ranging from 5.2% to 8.1%.

One of the benefits to commanding a premium valuation due to asset and management quality is the ability to raise capital at accretive rates. At the current price of forward P/FFO of 26, TRNO’s cost of equity is 3.8%, which compares favorably to the aforementioned cap rates on acquisitions, as well as its recent property acquisition in September in Santa Ana, California at a stabilized cap rate of 5.1%.

Risks to TRNO include a higher interest rate environment, which would raise its cost of debt. Also, a slowdown in the U.S. economy could result in less demand for rental space. This is especially true considering that the industrial segment is more cyclical than other REIT sectors such as net lease.

Notwithstanding near-term uncertainties, TRNO remains a compelling growth story, even if it encounters hiccups along the road. This is also supported by its strong balance sheet, with a low debt to adjusted EBITDA ratio of 4.1x, sitting far below the 6.0x level generally considered safe by ratings agencies for REITs. It also has very high interest and fixed charge coverage ratios of 8.6x and 7.4x, respectively.

As a sign of management’s confidence in the balance sheet and forward prospects, TRNO is one of a select number of REITs to raise its dividend this year, with a 12.5% raise in August to $0.45 per share. This comes with a 77.5% payout ratio and furthers TRNO’s 5-year dividend CAGR of 12.9% and 9 years of consecutive raises. That’s not bad for investors, who can get a 3.2% starting yield at the current price.

Turning to valuation, TRNO is admittedly not cheap at the current price of $56.80, but it is 9% cheaper than the $62 price at which I recommended it last in February. While the forward P/FFO of 26.05 may seem high, I believe it’s justified by TRNO’s very strong cash rent spreads and double-digit SSNOI growth. This is also considering TRNO’s strong balance sheet and forward analyst estimates for 9-11% annual FFO/share growth over the next 2 years.

Investor Takeaway

Terreno Realty has proven to be a strong performer in the competitive REIT market, with its focus on high-demand Tier 1 markets and its well-executed investment strategy. Demand for its properties has accelerated this year in spite of economic uncertainties. Terreno’s future growth is supported by its accretive cost of capital and strong balance sheet. With the stock having fallen in sympathy with the rest of the market, growth investors can get an appealing 3.2% starting yield with the potential for out-sized total returns over the long run due to TRNO’s coveted property profile.

Read the full article here