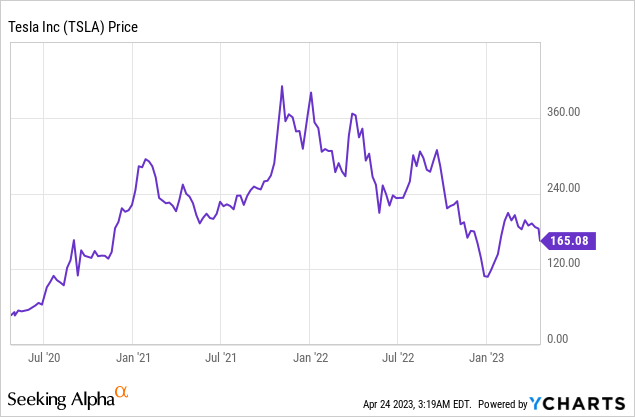

Tesla (NASDAQ:TSLA) has recently announced intriguing results for the first quarter of 2023. The company reported “record” production and delivery numbers, but still missed analyst forecasts for earnings and revenue, so what happened? Elon Musk announced plans to continue to reduce prices, in an effort to focus on a lower-margin mass-market product. This wasn’t taken well by Wall Street with firms such as Truist Securities, downgrading Tesla from a “Buy” to a “Hold” due to this concern. However, I believe this isn’t a new strategy for Tesla (and I will show examples later in this post). In addition, Tesla has racked up more autonomous driving miles than any other automaker (according to my estimates) and thus has a competitive advantage in this regard. In this post, I’m going to discuss why Tesla’s lower margin strategy could prove to be very lucrative long term thanks to its autonomous driving technology, before revealing my valuation model and forecasts for the stock, let’s dive in.

The “New Strategy” is Not New

The first part of my thesis makes the case that Tesla’s “new strategy” of focusing on “higher volumes and a large fleet”, as opposed to “lower volume and higher margin”, is not entirely new. Avid Tesla followers may recall that Elon Musk’s long-term vision has always been to create an affordable mass-market EV. In fact, I have discovered at least four quotes from Musk in the past where he stated just that;

- “I think the most important thing is to make cars that people can afford” – Elon Musk (May 2013, Bloomberg).

- “We must at least aspire to produce cars that are more affordable than the Model 3 in order to achieve our mission.” – Elon Musk (Tesla’s Q1 2017 earnings call).

- “Our long-term goal is to be able to create a $25,000 electric vehicle that is also fully autonomous.” – Elon Musk (Tesla Battery Day event, 2020).

- Our aspiration is still to try to make the cars as affordable as possible, and to ultimately make Tesla as affordable as possible.” – Elon Musk (Tesla Q3 2020 earnings call).

Therefore in 2023, when Elon Musk renewed his focus on cost-effective or “affordable” Tesla’s it wasn’t a surprise to me. In fact, this could also be perfect timing, as many analysts have forecast a “recession” and thus it would make sense to offer consumers the greatest value possible. In addition, as Tesla looks to have the largest manufacturing footprint of any pure EV maker (5 Gigafactories globally), then it could be assumed that Tesla could in fact offer a cheaper alternative, than its competitors due to economies of scale.

This strategy is also aligned with the key success strategy which helped Amazon dominate the e-commerce world. This was dubbed as “Scale economics shared”, in that it “gives back” savings made to its consumers by continually lowering prices. Of course, Tesla hasn’t completely given up on profits (that would be crazy). The company aims to “harvest significant profits” in the future through the sales of its fully autonomous self-driving software.

How far is Tesla from full self-driving?

Critics will say Elon Musk has been promising full self-driving for many years, and I can’t argue with that point. Back in 2015, Elon Musk promised full autonomy “within two years”, at an MIT Symposium. Then in 2019 at an Autonomy Day Event, Musk promised “full autonomy with regulatory approval in 2020”. However, I personally believe we are now very close. Over “150 million miles” have been driven in Full Self Driving beta mode and that number is “growing exponentially”, according to Musk in the Q1, 2023 earnings call. This number of miles is key, as anyone who understands AI models will tell you, the more training data, the greater accuracy can be achieved. If we compare this figure to the “just” 1 million self-driving miles reported by Google’s Waymo and Cruise, as of early 2023, Tesla looks to be very far ahead. Even if we compare this to “safety driver” miles, reports indicate Waymo racked up “just” 20 million miles in total, in 2020, which means Tesla likely has 7.5 times the number of miles. This also isn’t taking into account the 150 million miles Tesla has reported is just for its latest “beta” software, I believe.

Elon Musk also recently stated that to his “best knowledge” the “current hardware” can achieve full autonomy. Therefore, in theory, Tesla could do an over-the-air software update and turn almost every Tesla on the road (over 1 million vehicles) into a full self-driving vehicle. Of course, this would be done for a fee charged to those who choose to pay and this is where Tesla aims to capture back its margins.

The value of an autonomous vehicle should also be not understated, this isn’t just about being able to take long road trips without the achy arms, the potential is huge. For example, a fully self-driving vehicle could effectively replace the passenger railroad industry (a $250 billion market globally) by offering more personal point-to-point service. In addition, a new “third space” will likely be created in which one could use a Tesla as a home office, entertainment center, etc.

A fully autonomous vehicle can also be used to generate funds, for the individual when they are not using it. For example, you could be in the office and your Tesla could be doing ride-hailing around a city or doing food deliveries. Therefore the platform could disrupt Uber (UBER) which is valued at $62 billion, at the time of writing.

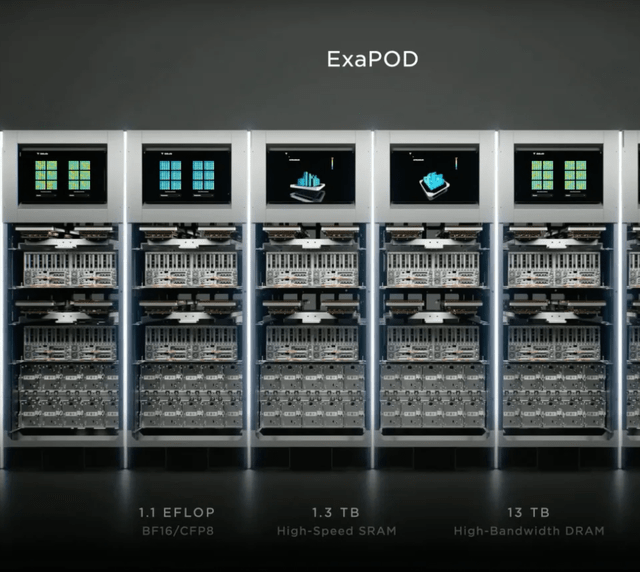

At Tesla’s AI day in 2020, the company revealed details of Dojo which it claimed to be the “fastest” AI training supercomputer in the world, which was so powerful it actually tripped the power grid in Palo Alto, California.

The Dojo platform has huge potential and could be utilized as a high-margin “sellable service” similar to AWS cloud. AWS is the profit engine of Amazon (AMZN), driving 188% of its operating income, despite generating just ~14.35% of its total revenue, as of Q4,22. I discussed details of this in my previous post where I made the case that Amazon should spin off AWS, its most lucrative business segment (in my opinion).

Tesla ExaPOD Dojo Supercomputer (Tesla AI Day 2022)

This Dojo platform and Tesla’s developed custom chips (such as the D1) are also expected to be key components for “Optimus” Tesla’s autonomous robot. An “affordable” robot in every home could become a reality and would be aligned extremely well with Tesla’s current business model, technology, and strategy. The robotics industry is forecast to grow at a 14.3% compounded annual growth rate [CAGR] and reach a value of $30.8 billion by 2027 thus the potential is huge for Tesla.

Tesla Robot Optimus (AI Day 22)

Financials and Valuation

Tesla reported $23.33 billion in revenue which missed analyst forecasts by $26 million, despite increasing by a solid 24% year over year. This growth rate has slowed down substantially from the 34% reported in Q4,22 and the 55.95% in Q3,22, which looks to have been driven by both the “recessionary” environment as well as increasing competition. The good news is a “price cut” by Tesla should help to solve both issues. It should also be noted that Tesla reported “record” production and delivery numbers for the first quarter of 2023. The company generated 422,875 deliveries, which was up from the 405,278 reported in Q4,22. However, its sequential delivery growth rate has declined substantially from 17.87% in Q4,22 to just 4.34% by Q1,23, due to the aforementioned reasons. A positive is Tesla’s production numbers have recovered with a record 440,808 reported for the first quarter of 2023, as the company resolved the issues at its Shanghai Gigafactory.

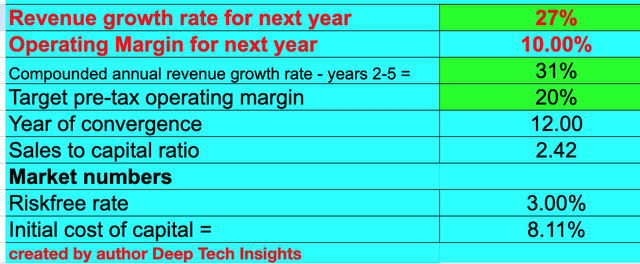

In terms of the valuation for Tesla, I have updated my model since my last post with the latest financials for Q1,23. In addition, I have adjusted my revenue growth rate from 26% to 27% for “next year” on the back of the planned decrease in prices which I believe should help to spur demand. I have also increased my forecasted revenue growth rate from 31% to 32% in years 2 to 5, due to my expected rebound in the economy and consumer demand (post-2023), plus the price reductions. Keep in mind, this isn’t taking into account the potential of Dojo and thus that would really add bonus optionality into the stock.

Tesla stock valuation 1 (Created by author Deep Tech Insights)

I previously forecast a 20% operating margin over the next 10 years, which I believe is still easily achievable. However, to be conservative and with Musk’s renewed focus on lower margins I have stretched this out to be achievable over 12 years. This is still fairly conservative and only represents a 4% increase from the 16% margin achieved in Q4,22 or a 2% increase from the 18% margin achieved with R&D expenses capitalized (as I have done in my model). Investors should be aware, that margins are likely to continue to dip as prices are slashed before we will see a reversion.

Tesla reported just a 12% operating margin in 2021 and 16.81% in 2022 and thus even with price cuts its margins are still solid at 11.42% reported for Q1,23, thanks to economies of scale. I believe we could see a further drop to around 8% or 10% (with R&D capitalized) to be extreme, so I have estimated that for “next year” in my model. Given these estimates, by year four I expect a 14.69% operating margin before expansion.

I believe Tesla will unlikely decide to go back into “unprofitable” territory again, due to investor sentiment and S&P 500 inclusion requirements.

It should also be noted that some of the price reduction is already baked in, as back in October 2022, Tesla announced its original price cuts by ~9% in China for the Model 3 and Model Y. Investors initially assumed this was just a response to competition (and it was to a certain extent). However, given the clarity of the long-term strategy, it’s not a crazy amount. Also, price cuts in the U.S. by around $5,000 for each model may help to boost eligibility for the IRS tax credit of $7,500 which could help to boost demand. According to Tesla’s website its Model S, 3, X, and Y qualify for this incentive (assuming other criteria are met).

In a best-case scenario, I believe Tesla’s operating margin could surpass 24% (with full self-driving and AI as a service) which is slightly higher than the 23% average for a software company.

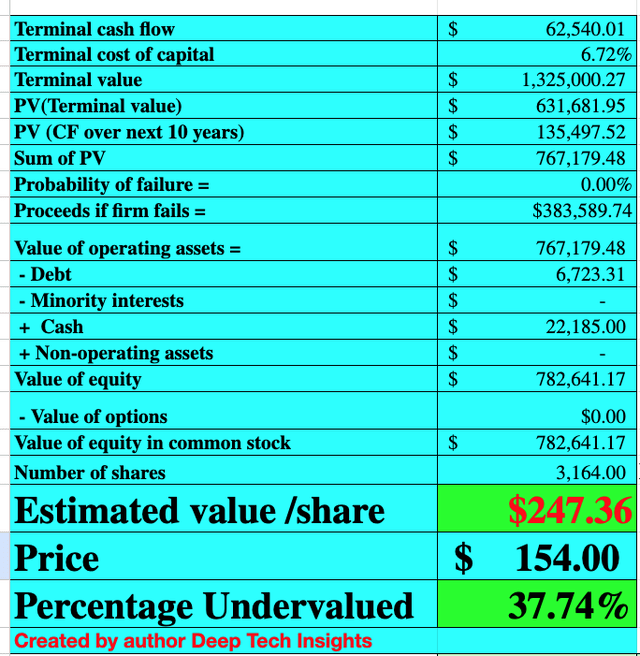

Tesla also has a strong balance sheet with $22.185 billion in cash and short-term investment, in addition, to $5.748 billion in long-term debt.

Tesla stock valuation 2 (Created by author Ben at Deep Tech Insights)

Given these factors, I get a fair value of ~$247.36 per share, and thus the stock is ~37.74% undervalued at the time of writing.

For the “best case” scenario, which includes the 24% operating margin for (full self-driving, AI as a service, and Optimus robots) I get a fair value of over $292.72 per share, which offers an even greater (47%) upside.

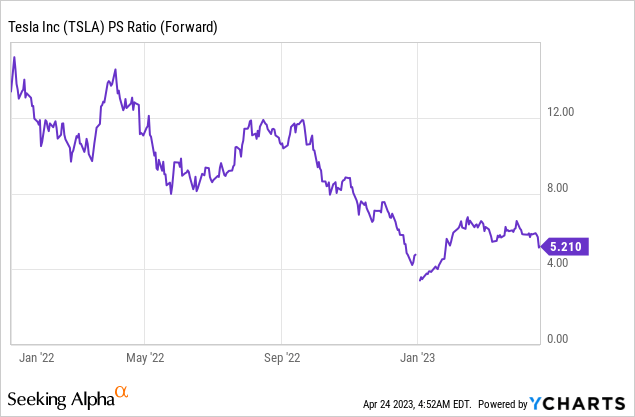

Tesla trades at a price-to-sales (P/S) ratio = 5.2, which is ~36% cheaper than its 5-year average.

Risks

Going Cheap could damage the brand

The first Tesla vehicles such as the Roadster were widely adopted by celebrities such as Leonardo Dicaprio, as a “do good” and “status” statement. I personally believe Tesla vehicles are still seen as aspirational with some “prestige”. Therefore if Tesla drops its prices too much it could devalue the brand and its pricing power long term. For example, the luxury automaker Ferrari broke its sales record again in 2022 and saw its calls sell out, despite its Portofino M being priced at $250,000 and its Purosangue SUV costing nearly $400,000 each. Now of course, I don’t put Tesla in the same category as a Ferrari but I consider them to be more closely aligned with Mercedes or Audi. Thus its brand positioning is just something for Tesla to be aware of as it continues to drop prices. There is also the “risk” of a race to the bottom in the EV industry. In fact, if history is to go by back in 1913, Henry Ford introduced the assembly line which the time to build and price of its Model T by 50-70% which resulted in hundreds of competitor car companies going bust and industry consolidation. This may seem bad at first glance but given Tesla and rival BYD’s immense scale, I believe these two will be left standing as the dust settles.

Final Thoughts

Tesla renewed focus on lower-margin, mass-market vehicles is a strategy that will likely result in short-term pain, but long-term gain. I believe this strategy is actually optimal given the forecasted recession, tepid consumer demand, and increasing competition. In addition, Tesla can continue to “future sell” the value of its full self-driving software and pending vehicles such as the Tesla Cybertruck (over 1.5 million pre-orders as of November 2022). If/when Tesla achieves full self-driving, this could offer huge optionality for the stock and actually change the world as we know it. But the good news is even from an investment standpoint, a base case scenario still indicates Tesla is undervalued intrinsically. Therefore I will deem the stock to be a “buy” for the long term.

Read the full article here