Investment Rundown

A transportation and logistics company might not be the most exciting one you have heard of, but when looking at the numbers for TFI International Inc (NYSE:TFII) one can’t read it without being impressed. Between 2019 and 2022 the company had an EPS CAGR of 42.5% and has grown its cash flow yield very well, right now sitting at 10.3%. There were many challenges during those years and seeing TFII still manage to surprise expectations and have such strong operational performance is remarkable.

The strength of the business is reflected in the market’s views on the company as the share price has risen 44% in just the last 12 months. But that doesn’t necessarily mean that the company is overvalued right now. Rather, it’s still valued below the sector’s average multiples and I think TFII is a buy at these prices. It’s a great way to get some exposure to the transportation industry, one which will benefit heavily from reshoring manufacturing back to the US.

Company Segments

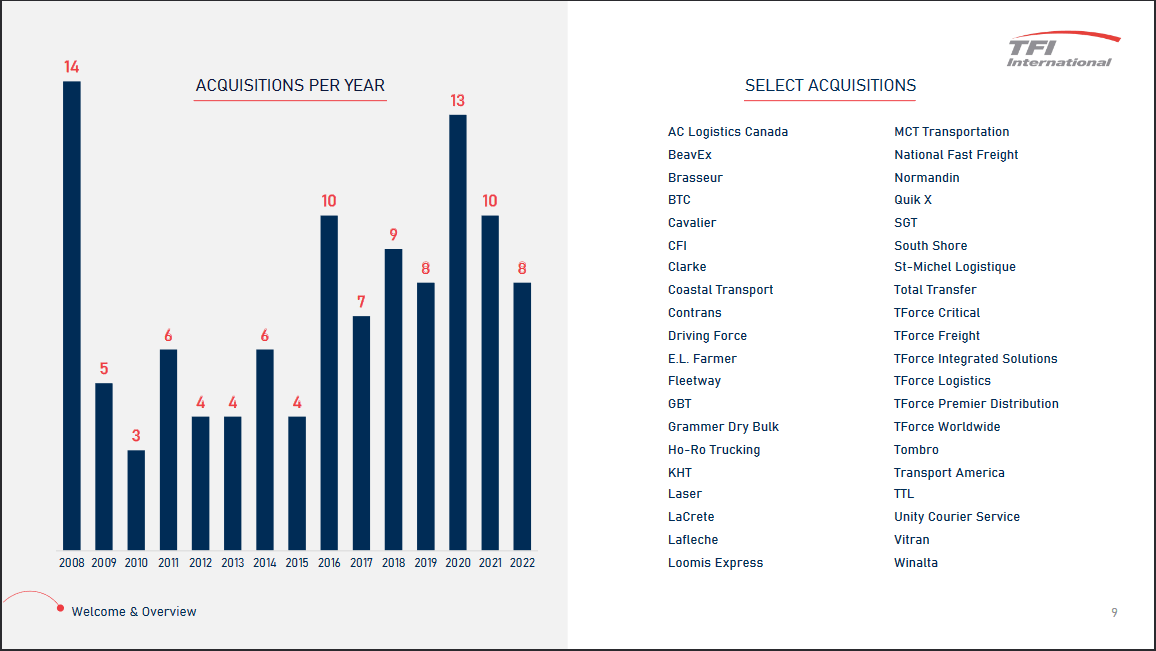

Within TFII there are four different segments right now, those being Package & Courier, Less-Than-Truckload, Truckload, and Logistics. The strength that the Canadian transportation company showed during the pandemic helped it fuel expansion and that is a key part of its business. Since 2008 the company has successfully acquired and integrated 111 individual companies. Just during 2022, the company acquired a near-record amount of companies. TFII didn’t see massive growth during that year but managed to maintain a positive bottom line which helped fuel this expansion of the business.

Acquisitions (Investor Presentation)

Apart from just focusing on delivering everything from smaller items to full truckloads, the Logistics segment of TFII also offers transportation management and asset-light logistics services. This diversified source of revenue has been a key point as to why TFII has been able to grow the way it has.

Out of all these segments, the one that has remained the most profitable is the Package & Courtier segment with a ROIC of 31.5% in Q1 FY2023. As for the segment generating the largest amounts of revenues that was the Truckload segment, netting over $70 million to the start of 2023.

As for the capital structure of the business, they reserve a significant amount for M&A, around $250 – $300 million annually, and aim to make large acquisitions every 2 – 3 years at least. As for the results that TFII seeks on these M&A they are quite ambitious, with around 15% – 25% over time as the aim. They seem to have been successful as looking at the company earnings they have grown very well over the years.

Earnings Highlights

I have been very positive about the growth that TFII has had, but they seem to have hit a hurdle right now as the last report showed a decrease in revenues across all of its segments. That is rarely a good sign and shows that the market is still somewhat under pressure and fewer shipment activity is taking place.

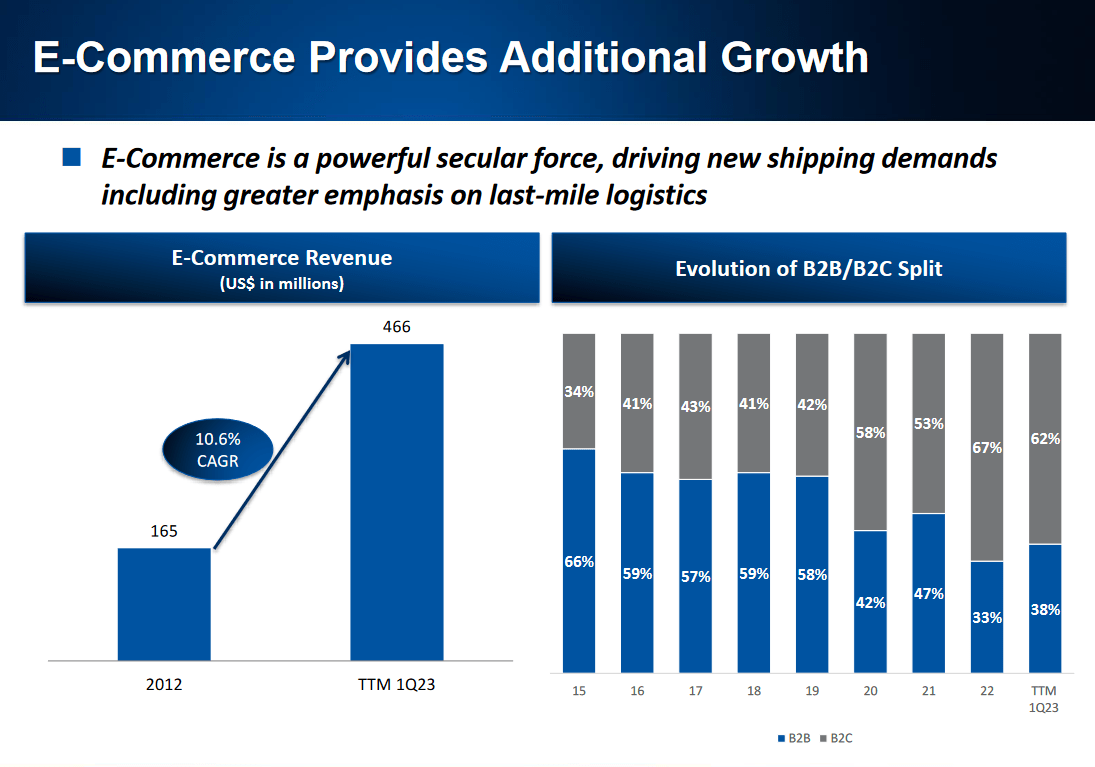

E-Commerce Market (Investor Presentation)

However, it seems that the current challenges that TFII face are short-term and that major tailwinds like e-commerce will be a key reason for continued growth. That and the long-term view the management has for its M&A are creating diversified streams of revenues. To put the current revenues that e-commerce generates for TFII, it reached close to $470 million in Q1 FY2023 accounting for both the Canadian revenues and the U.S revenues. Currently, TFII serves 80 various cities with e-commerce services. Seeing as e-commerce is primarily towards retail that is also the market that makes up the largest portion of the shipments for TFII, around 28%, followed by manufactured goods at 18%.

As for the outlook the company has, they see the North American market remaining somewhat subdued as a result of higher interest rates which discourages strong economic activity. The risk of a recession remains very high according to the company, and a slowdown across many of its end markets is likely if we enter one. Where I will be looking especially in the coming quarter is the resilience of the retail market. Seeing as the Less-Than-Truckload is the primary segment that serves retail, a sign that margins remain strong would be a major reassurance that TFII can once again weather the storm and come out ahead of peers. In Q1 FY2023 the EBITDA for the segment didn’t drop as much as the operating income, which shows to me that margins are resilient and unlikely to fall easily.

Risks

As for risks with TFII, I think there are a few. They aren’t company-specific but rather broad instead. A recession would very likely cause consumer spending to slow and likely for companies too. This lower economic activity brings down the shipment volumes and TFII sees their revenues impacted negatively. But as economic ups and downs like these come in cycles I view this as short-term pain and it doesn’t affect the long-term outlook. Investing in TFII is sort of like betting that the North American economy will continue to prosper, a bet I am willing to make.

Apart from a lower activity, the risk that gas and fuel expenses cut into earnings is very plausible. Gas prices are steadily climbing and if we see spikes in the prices expect to see some harsh margin declines in certain quarters for TFII.

Final Words

Transposition companies aren’t in the most exciting industry perhaps, the focus now for the markets seems to be on AI and semiconductor companies. But what the transportation and logistics industry does have is solid operational performance as seen with TFII. The companies here often have very strong FCF conversions and TFII is no different with its TTM of 88%. That aids them heavily in being able to perform substantial amounts of M&A each year. This has resulted in an EPS growth of around 44% CAGR between 2019 and 2022.

The valuation of TFII doesn’t necessarily reflect this strong level of growth, with a p/e under the sector average despite having a share price that has run up 44% in the last 12 months. In my opinion, buying into the company right now still looks very appealing and TFII will be rated a buy from me.

Read the full article here