The SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) is overvalued in our view and likely to underperform its historical performance average in the coming years. Moreover, it faces a plethora of potential negative catalysts that could further hamper total return performance in the near future. In this article, we will compare and contrast our outlook for SPY with those of some of the most popular investors right now.

Buffett Vs. Burry

Warren Buffett of Berkshire Hathaway Inc. (BRK.A, BRK.B) has amassed one of the world’s largest fortunes and built the world’s largest non-tech company by remaining net bullish on stocks over the course of many decades. His mantra is simple: “never bet against America.” As he recently stated in his 2022 annual letter to shareholders:

I have yet to see a time when it made sense to make a long-term bet against America. And I doubt very much that any reader of this letter will have a different experience in the future. We count on the American Tailwind and, though it has been becalmed from time to time, its propelling force has always returned.

While Mr. Buffett does have a substantial cash pile, he is not short the market and has the overwhelming majority of his company’s value invested in American stocks like Apple (AAPL) and direct holdings of businesses.

Furthermore, he has in the past stated that the S&P 500 (SP500) is an excellent investment for the vast majority of people and has even instructed his estate’s trustee to invest 90% of his money into the S&P 500 for his wife once he passes away.

However, not everyone agrees with him. Michael Burry of “Big Short” fame (who made a name for himself by betting big on and profiting handsomely from the Great Financial Crisis of 2008) recently placed a massive $1.6 billion bet – more than 90% of his portfolio – against the S&P 500 and Nasdaq (QQQ), with $866 million in put options against the S&P 500 and $739 million against the Nasdaq. Clearly, with so much invested on a sharp decline in the value of major American companies, Mr. Burry is “betting against America.”

In this article we will take a look at the demerits and merits of Mr. Burry’s bet against the S&P 500 in particular and then share our own approach to investing in the current environment.

Why Shorting SPY Is Foolish

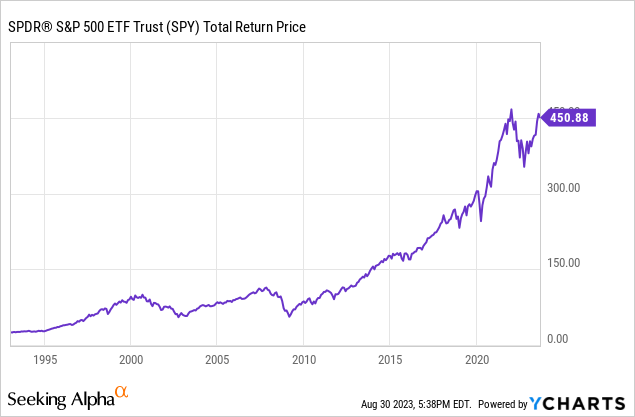

First and foremost, shorting SPY is foolish because the long-term chart shows that history weighs heavily against those who do so:

When you are shorting SPY, you are betting against the lion’s share of the U.S. economy faltering in a meaningful way and/or that some near-term black swan event will emerge from the shadows and instill fear and panic in the marketplace. History has shown that – despite periods of runaway inflation, terrorist attacks, massive lockdowns over fear of COVID-19, major regional and global wars, rumors of war, recessions, depressions, political unrest, financial crises, and rapidly rising interest rates – the value of SPY has marched relentlessly higher over the long-term.

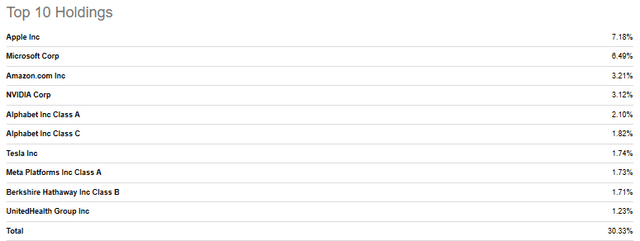

The productive and innovative power of the U.S. economy is unmatched in the course of human history and SPY provides investors with an easy, completely passive, and low cast vehicle for profiting from it. To bet against it seems nothing short of crazy. With artificial intelligence seeming to be on the cusp of fundamentally transforming the U.S. economy in tandem with several other powerful disruptive technologies, the market could potentially enjoy a further jolt higher. SPY is particularly well-positioned to benefit from this trend given that the majority of its top holdings are technology companies like AAPL, Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), Alphabet (GOOG)(GOOGL), Tesla (TSLA), and Meta (META) that are making major forays into artificial intelligence:

SPY Top Holdings (Seeking Alpha)

Why Shorting SPY Is Prudent

While the long-term bull case for SPY is compelling as always, there are also reasons to be concerned and see a short position as prudent.

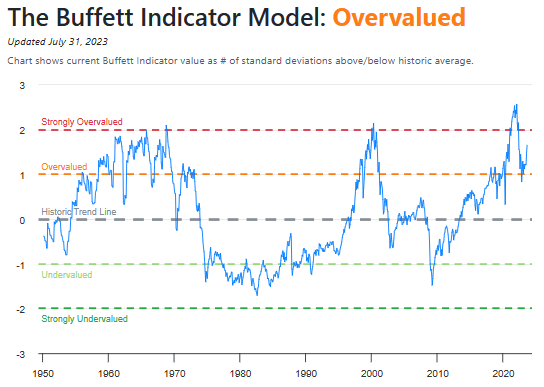

First of all, the market is clearly overvalued based on a plethora of metrics. For example, the Buffett Indicator’s current ratio of 182% is 51.35% ~1.7 standard deviations) above its historical trend line, indicating that SPY’s valuation has substantially outpaced the underlying GDP of the U.S. economy:

currentmarketvaluation.com

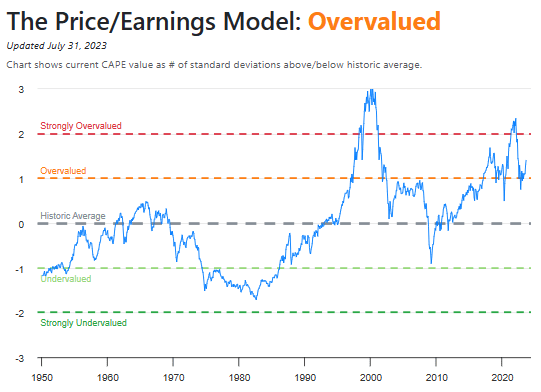

Second, the Price to Earnings model shows that SPY’s 10-year P/E Ratio of 31.4 is 55.7% above the modern-era market average of 20.2. As a result, it sits at ~1.4 standard deviations above the modern era average, making the market considerably overvalued:

currentmarketvaluation.com

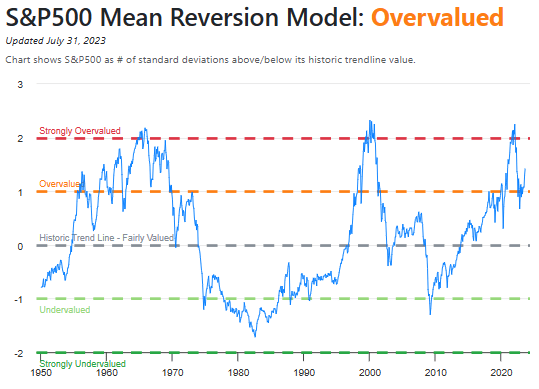

Third, SPY is currently sitting at ~50%/1.4 standard deviations above its modern-era historical trend value, also implying an overvalued market:

currentmarketvaluation.com

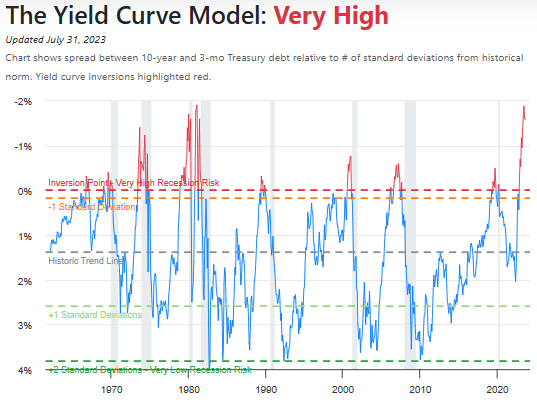

Last, but not least, the steeply inverted yield curve (i.e., short term interest rates are higher than long term interest rates) is a proven predictor of recessions. On average, SPY drops ~20% during recessions dating back to 1950. As a result, it appears that the odds are in favor of a sharp pullback in SPY moving forward:

currentmarketvaluation.com

In addition to these bearish signals coming from valuation models, SPY also faces a number of negative catalysts that could hammer it at any time. For example:

- The Russia-NATO showdown in Ukraine could boil over into other geographies at any moment and/or Russia could decide to take the conflict nuclear. If this happens, it is highly likely that the stock market would crash on fears of the conflict quickly spiraling out of control into World War 3.

- China could invade Taiwan at any time. Such a scenario would plunge the global markets into chaos and very likely lead to a global depression.

- North Korea is a total wild card and loose cannon and could start a conflict with the U.S., South Korea, and/or Japan at any time. This also would likely cause global markets to experience considerably volatility.

- Iran and Israel could see their ongoing proxy war expand into a hot war at any time, which would likely send the price of oil higher and hurt the global economy.

- The U.S. has an avalanche of corporate and commercial real estate debt coming due in the coming years. With interest rates at elevated levels, this could potentially lead to another financial crisis and deep recession for the U.S. economy.

- Meanwhile, if the Federal Reserve eases up in its fight against inflation too soon, the U.S. economy could suffer from a prolonged period of elevated inflation that would likely also be bearish for stocks.

With so much that could go wrong and valuations already stacked against the market, it is certainly understandable why someone would think shorting SPY is a prudent move right now.

Investor Takeaway

While we are not shorting SPY, we do agree with the bear case for SPY at the moment. As a result, we are steering clear of SPY and many of the overvalued names held within the ETF. Instead, we are pursuing a more strategic allocation to niche, deeply undervalued, and mostly defensive high-yield opportunities that should weather a recession and/or international conflict better than multinational corporations. Furthermore, we are also allocating a growing portion of our portfolio to precious metals related investments as we expect these to outperform in the event of a global conflict and/or a likely scenario of negative real interest rates for an extended period of time.

Read the full article here