The past year has seen one of the most aggressive rate hiking cycles in the Fed’s history and has left the investment case for cash as strong as it has even been. Periods of high interest rates have tended to occur alongside periods of strong return prospects for a mixed portfolio of stocks and bonds as rate hikes drive down valuations. This time around interest rates are far higher than the long-term returns available on stocks and bonds, making an excellent case for cash.

50-50 Basket Of Stocks And Bonds Priced For Below 2% Annual Returns

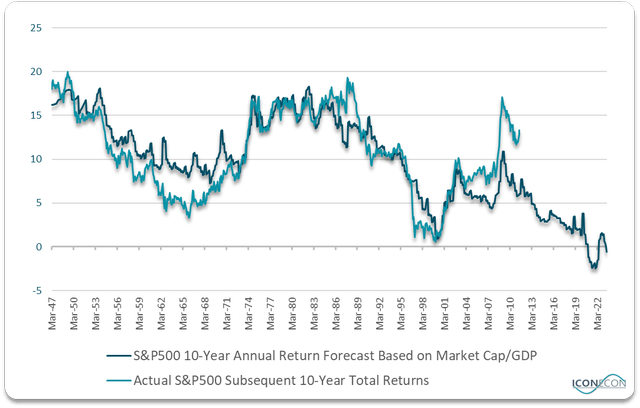

In the case of 10-year government bonds the annual return is reflected in the yield to maturity of 4%, whereas for stocks we can only estimate expected returns by looking at current valuations and the correlation between valuations and subsequent returns. Depending on the valuation metric one uses long-term return estimates can vary wildly, but the metrics with the strongest correlation with actual subsequent returns in the past have been those that strip out the impact of profit margins which are highly cyclical and mean reverting.

Bloomberg, Author’s calculations

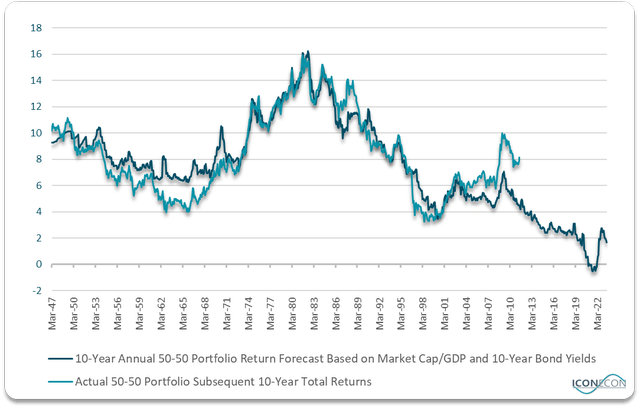

Using the so-called Buffett Indicator, current stock market capitalization as a share of GDP is now consistent with 10-year annual total nominal returns of -1%. When we add in the return expectations for bonds, the 50-50 basket is now priced for 10-year total returns of just 1.7%, fully 6pp below the post-WWII average. As the chart below shows, there has been a very close correlation between return expectations and actual subsequent returns over this period.

Bloomberg, Author’s calculations

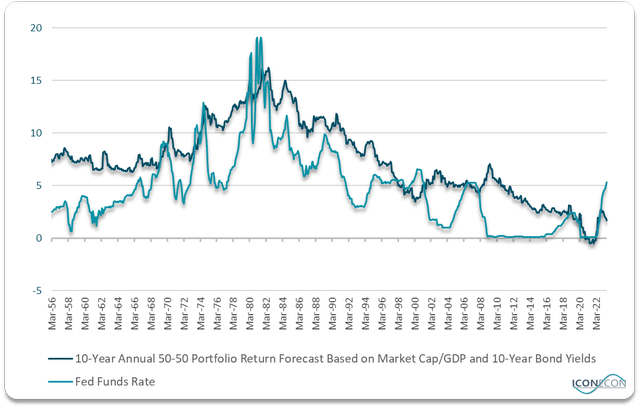

The next chart shows how this return outlook compares with the Fed Funds rate, with interest rates now at a record high relative to the expected return on an equally-weighted stock-bond portfolio. Periods of high interest rates in the past have occurred alongside periods of high prospective portfolio returns. This is not only because higher interest rates drive up 10-year bond yields, but also because during the 1970s and 1980s high rates also drove down equity valuations.

Bloomberg, Author’s calculations

The current period is a major anomaly. High interest rates have driven up 10-year bond yields but the yield curve remains deeply inverted, while the S&P500’s valuations have returned to near record highs. As a result, cash has never been more attractive when compared to the return outlook on a balance equity/bond portfolio.

Monetary Policy Acts With A Lag

Since the 1990s portfolio return expectations have actually been inversely correlated with interest rates as high rates have tended to reflect optimism about stock market prospects and vice versa. In effect, the stock market has driven rate markets, with optimism encouraging the Fed to tighten and pessimism causing the Fed to ease.

This creates a problem for the Fed in that it must react aggressively to lean against the prevailing market sentiment, which could mean that interest rates are forced to rise further from here, further strengthening their relative value case. Monetary policy acts with a lag and while investors are embracing a soft-landing view that should allow stocks to remain elevated, equity strength itself will ensure that the Fed continues to keep policy extremely tight, to the benefit of real returns on cash and to the detriment of real returns on stocks.

The Fed’s balance sheet continues to contract which is helping to drive down overall money supply, now in its deepest contraction since the Great Depression. It should be no surprise therefore that 1-year breakeven inflation expectation sit at just 1.6%, giving cash a real yield of almost 4%. At the same time, leading economic indicators continue to point to a slowdown, most notable of which is the Conference Board’s Leading Economic Indicator index, which at -7.8% y/y in June is consistent with a recession by early-2024.

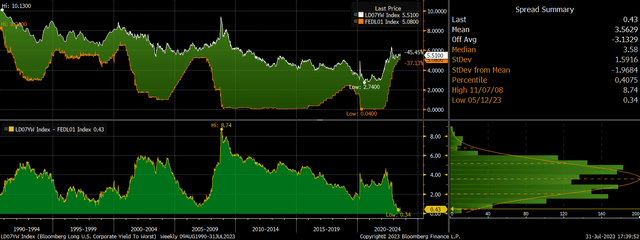

Fed Funds Rate Now On A Par With Long-Term Corporate Yields

The attractiveness of cash is perhaps best illustrated when compared against the yield on corporate bonds. Risk appetite is so strong and the yield curve so inverted that the Fed funds rate is now on a par with the yield on long-term US corporate bonds. Investors are so convinced that the Fed will ease and that a soft landing will occur that they are willing to lock in the yield on long-term corporate bonds despite the default risk and duration risk even when cash offers the same yield.

Fed Funds Vs Yield On Long-Term US Corporate Bonds (Bloomberg)

My sense is that many investors are taking on risk right now, either in stocks or long-term bonds or credit as they do not expect high rates to remain in place for much longer and once the Fed begins to ease, risk assets will rally. The problem is that interest rates cuts have never actually helped risk assets apart from when they have arrived after a crash has already happened. The 47% total return decline from 2000-2002, the 55% decline from 2008-2009, and even the 34% Covid crash all occurred alongside monetary easing. At some point, the long-term return outlook on stocks and bonds will improve sufficiently to warrant aggressive long positions, but until then cash is highly likely to outperform.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here