The Fed may be done with rate hikes in this cycle, meaning interest rates could soon begin to retreat. Should REIT investors rejoice? Not so fast.

Last year Nareit’s equity REITs index suffered its worst return of any non-recession year going back to 1972, losing more than 24% of its value, exceeded only by the 38% loss in 2008, the first full year of the Great Financial Recession. This dramatic loss occurred despite operating fundamentals remaining strong across most commercial real estate (CRE) sectors, with historically high rent levels and occupancy rates. However, the beleaguered office sector stands out as a notable exception, as I discussed previously.

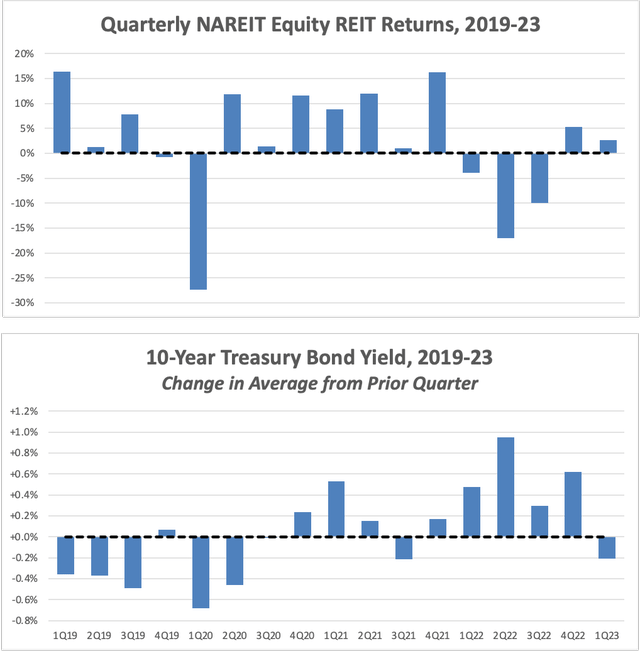

Quarterly NAREIT Equity REIT Returns vs Bond Yields, 2019-23 (Nelson Economics analysis of Nareit and Federal Reserve Bank data.)

What, then, accounts for the REIT decline last year? One easy answer is to blame the Fed and rising interest rates. The Fed hiked rates seven times in 2022, helping to push the yield on 10-year Treasury bonds from 1.63% at the beginning of the year to 3.88% at year-end. REIT returns are commonly thought to be inverse to interest rates, both because borrowing to finance acquisitions gets more expensive (supply-side factor) and risk-adjusted returns on alternative investments become more compelling, diverting capital from REITs to other investment options (demand side).

But is it right to blame rising interest rates for the REIT decline? Not according to recent history. Using the 10-year T-note as a proxy for interest rate movements, rates started increasing in the fourth quarter of 2020, and since then, the average interest rate has increased in eight of the last ten quarters. Yet REIT returns were negative in only three of those eight quarters of rising interest rates – all in 2022 – suggesting that the dynamics are more complex.

To be sure, rising interest rates by themselves will make CRE investment less profitable – all else being equal, as economists say. The issue is that interest rates do not move in isolation but reflect underlying conditions in the broader economy. Notably, the very conditions that lead interest rates to rise also tend to be favorable to CRE’s operating performance, namely an expanding economy with robust job growth.

We need to review the data over a longer period to suss out how the disparate impacts play out – and what they imply for REITs in the coming year.

Reviewing the REIT – Interest Rate Debate

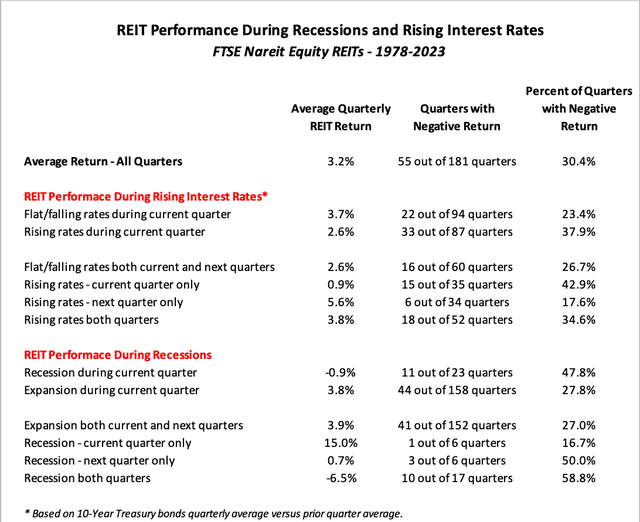

Over the last 45 years, REIT returns have been negative in over a third (38%) of quarters when the 10-year T-note rose vs. a fourth (24%) when the T-note was flat or falling. Also, quarterly returns average 2.6% during quarters of rising rates vs. 3.7% during flat or falling rates. That seems to broadly support the common intuition about REIT performance and interest rates, though the correlation is not as straightforward as many believe.

REIT investors – and really, all savvy investors – tend to be forward-looking. That is, current conditions should be less material than anticipated future conditions. We can test this proposition by looking at REIT performance compared to economic conditions in the present quarter versus the next quarter. (Ideally, we’d want to compare performance relative to expected, not actual, future conditions, but those figures are much tougher to reconstruct.) Here, a much different pattern emerges.

REIT returns average 2.6% in quarters when rates are flat or falling for both the current and following quarters versus just 0.9% when rates rise in the current quarter but not the next quarter. So far, so good. But returns increase to 3.8% when rates are rising in both the current and following quarters and jump to 5.6% when rates rise in the next quarter but not the current quarter.

REIT Performance During Recessions and Rising Interest Rates (Nelson Economics analysis of data from Nareit and the Federal Reserve Bank.)

Huh? Actually, there’s a logical explanation: commercial real estate often performs best near the end of economic expansions – which is precisely when interest rates are rising as the Fed tries to cool the economy with rate hikes. If rates are rising in the current quarter, but not the following quarter, that could signal that the economy is softening – yielding lower returns. Conversely, if rates increase in the following quarter but not the current quarter, the interest rate movements suggest the economy is heating up, which is generally favorable to CRE – yielding greater returns.

Otherwise stated, real estate market conditions are more likely to be weak or slumping when rates are flat or falling than when rates are rising. Indeed, the economy contracts almost three times more often in quarters when interest rates are flat or falling than when they are rising, when underlying conditions for CRE are likely to be stronger.

Last Year Was An Aberration

Returning to recent history, interest rates rose in four of five quarters starting in 4Q20, and yet REITs also increased every quarter, with the weakest returns in 3Q21 when interest rates fell. Overall, REITs registered their highest annual gain in 2021 since 2005, and the second highest in over 40 years. REITs then declined sharply for three straight quarters to start 2022 as interest rates continued to rise, but REITs posted moderately strong gains in 4Q22 despite further interest rate increases.

What does this mean? We need to ditch the simple rule that rising interest rates are bad for REITs. While higher interest rates make REITs less compelling and profitable by themselves, the very fact that interest rates are rising may well mean that it’s a good time to invest in REITs because the economy is strong.

But before we predict what the Fed’s likely end of rate hikes may portend for REITs, let’s first consider how REITs perform during different phases of the economic cycle. Surely, REITs must perform better during expansions than in recessions, right? Sort of.

Recessions Not Always Bad for REITs and Expansions Not Always Good

Logic suggests that REITs should outperform during expansions (when occupancies and rents rise) and sag during recessions (when operating performance falls). And indeed, quarterly returns on equity REITs average 3.8% during expansions but fall to -0.9% during quarters when the economy is in recession. Moreover, REIT returns are negative in almost half (48%) of quarters during recessions, but only a fourth (28%) of quarters during expansions. So those figures seem to support intuition.

But as with interest rate movements, the reality is more nuanced due to the impact of expectations. As reflected in the adage to “buy the rumor, sell the news,” REIT investors look to where the economy is going, not where it is now, for signs of future property performance.

Referring back to the table above, quarterly returns on equity REITs average 3.9% when the economy grows for two consecutive quarters and lose -6.5% when the economy contracts for two straight quarters. Those opposites represent when the economy is in the middle of an expansion and a recession, respectively. These results are very much as expected.

The more interesting results are when the economy shifts from recession to expansion or vice versa. REITs gain just 0.7% on average in quarters when the economy is currently expanding but then falls into a recession in the next quarter; however, gains jump to 15.0% in quarters when the economy is presently contracting but then falls starts to expand in the next quarter. In other words, investors buy into a rising market but are cautious about softening markets.

That helps explain REIT returns over the last few years. REITs soared in 2021 – despite rising interest rates – as the economy bounced back from the brief pandemic recession. But REITs tanked in 2022, when investors started to assume that the Fed’s unrelenting rate hikes would eventually sink the economy. That recession never arrived, demonstrating once again the fallibility of investors and economists in predicting the economy’s direction.

Now What?

Optimistic REIT investors counting on more accommodative Fed policies to fuel a REIT rebound will be disappointed. The Fed has since given its strongest hints to date, if not actually confirming, that rate hikes are near over, and yet REIT returns have been negative for two of the last three months.

More important now is to focus on what the end of rate hikes implies for the economy and property markets. The Fed will only end rate hikes if it believes the economy has cooled enough to reduce inflation to acceptable levels. The April inflation report should reassure the Fed and investors that the economy continues to decelerate.

But now what? For over a year now, Fed Chair Jerome Powell has been assuring markets that the Fed can slow the economy into a soft landing without throwing us into a full-fledged recession, and he’s still preaching that view. In his remarks after the May rate hike, Powell said that “the case of avoiding a recession is, in my view, more likely than that of having a recession.”

Fewer and fewer economists seem to agree. The latest Wall Street Journal poll of economists pegs the probability of recession in the next 12 months at 61%. More ominously, the Conference Board sees a recession as a virtual certainty, with a probability of 99%. Of course, many economists have been predicting a recession for over a year now, ever since the Fed started to tighten. Eventually, the prediction will come true, much like the broken watch that will eventually tell the correct time, but will the downturn come soon?

Already economic growth appears to be slowing, as revealed in the anemic first-quarter GDP estimate, in addition to a host of indirect factors like consumer confidence, economic activity by manufacturers, small business optimism, and consumer spending, among others. So far, the labor market has exhibited remarkable resilience in the face of the Fed’s concerted effort to cool the economy, though even here, leading indicators like job openings are falling and layoffs are rising in the latest JOLTS report. Weaker or even negative job growth will likely follow, to the detriment of tenant space demand. Job growth is the most critical demand driver across most property sectors, so declining job growth will almost certainly reduce space absorption and ultimately hit operating performance.

Whenever the downturn begins, and whatever its severity, the impacts will be more consequential for real estate investors and owners than the recent interest rate hikes. The foregoing analysis of REIT returns over the last 40 years of business cycles shows that recessions have much greater impacts on property returns than interest rate movements.

REITs took a beating in 2022, at least partly driven by the anticipated recession. But with most property sectors still achieving strong rents and occupancies, the full impact of the coming downturn on operating performance is not yet fully baked into REIT prices. The coming hit to REITs will be broad but not universal, however, a topic I’ll return to in my next article on countercyclical investment REIT opportunities.

Read the full article here