By Peter Vanden Houte

The economy has come to a standstill

It seems that not much has to happen to push the eurozone into recession. According to the flash estimates, the economy shrank by 0.1% in the third quarter, implying only 0.1% year-on-year growth. The fourth quarter has already started on a weak footing, with the composite PMI output index falling back to 46.5 in October, a 35-month low. Eurozone economic sentiment also lost ground in October and is now 0.6% below the third-quarter average.

Order books deteriorated in both industry and construction, an indication that further production cuts are to be expected. Some counterweight is offered by the services sector, where sentiment improved slightly, according to the European Commission. However, services sentiment also remains below its long-term average, and in the Purchasing Managers’ Survey, there was even a deterioration in confidence.

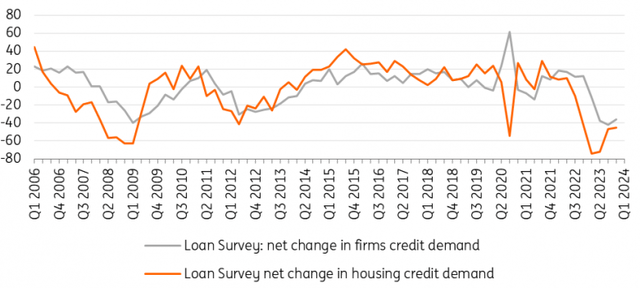

Loan demand has fallen to recession levels

LSEG Datastream

Geopolitical uncertainty could translate into weakening sentiment

The increased uncertainty on the back of the tensions in the Middle East might lead to more cautious behaviour from both businesses and households. At the same time, monetary tightening will be increasingly felt. Third-quarter bank lending surveys indicated that credit standards became tighter across the board, even more so than initially expected. And for the fourth quarter, further tightening is expected.

Not surprisingly, borrowing for fixed investment dwindled, indicating that investment in the eurozone economy is likely to soften in the quarters ahead. The fact that capacity utilisation in industry fell below its long-term average in the third quarter is a further indication of future weakness in business investment.

As for households, real income growth is certainly supportive of consumption, though the weakening labour market and higher interest rates will probably increase the savings ratio, thereby tempering consumption growth. All in all, we expect flat to slightly negative GDP growth over the next two quarters, followed by a timid recovery from the second quarter of 2024 onwards. By then, the impact of monetary tightening should gradually peter out. This results in 0.4% GDP growth for 2023 and – as a result of the weak base effect – only 0.2% growth for next year.

Inflation downtrend continues

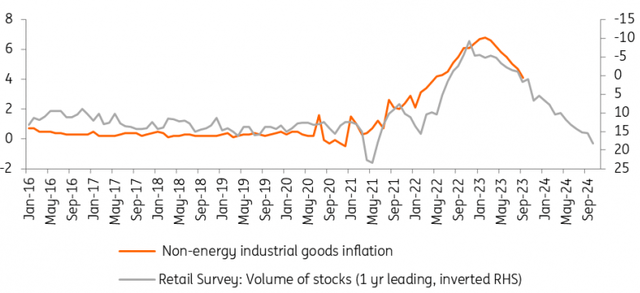

HICP inflation fell more than expected in October to 2.9%, the first sub-3% reading since July 2021. With retail inventories at unusually high levels, we expect disinflation in the goods sector to continue over the next 12 months. However, at 4.6%, services inflation remains high and selling price expectations in the services sector are still firmly above the pre-pandemic level. There is also an increase in both natural gas and oil prices over the last months that will contribute to headline inflation.

That said, with the economy coming to a standstill, second-round effects might be more muted this time. Overall, the downtrend in inflation is likely to continue, though not in a straight line, and we still expect inflation to average 3% in 2024.

High inventories will push down goods inflation

LSEG Datastream

Case for additional rate hike is fading away

The European Central Bank (ECB) also acknowledges that growth is weaker than it pencilled in. At the same time, the increase in bond yields has further tightened monetary conditions. In that regard, additional rate hikes are no longer needed. But that doesn’t mean that the ECB is in a hurry to cut rates. Both President Christine Lagarde and Chief Economist Philip Lane emphasised that they first need to have a good view of wage agreements in the first half of 2024 before giving the all-clear on inflation.

We don’t expect any rate cuts before the summer of 2024. At the same time, a growing number of the members of the Governing Council want to stop the reinvestment of the pandemic emergency purchase programme holdings before the end of 2024. We think that this will indeed happen in the second half of next year, but since it will be accompanied by rate cuts, potential tensions in the bond market should remain limited.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Read the full article here