This article was published at iREIT® on Alpha on Monday, June 26, 2023.

I just finished my new book, REITs For Dummies, and in the introduction, I explain,

“My more than three decades of experience as a real estate developer, investor, and analyst provides me with a unique perspective about REITs that I’m more than happy to pass on to you.”

Having lived through multiple recessions does not make me an expert, but I can certainly vouch for the fact that commercial real estate is resilient and can provide generational wealth. Last week I wrote an article (“What My 30+ Years As A Real Estate Investor Taught Me”) in which I examined a few of my mistakes and lessons learned.

I’m looking forward to sharing more of these stories, and I’ll soon be relaunching my YouTube channel, “The Ground Up by Brad Thomas.” As I’ve learned, value creation is a journey, and it simply boils down to learning from your mistakes. As Benjamin Graham explained,

“The intelligent investor dreads a bull market, since it makes stocks more costly to buy. And conversely, you should welcome a bear market, since it puts stocks back on sale.”

In this article today, I would like to point out why recessions can be strong entry points for REITs (real estate investment trusts), with historical returns on a next 12-month basis of greater than 10%.

In fact, as you will find out below, the best entry points historically for REITs come early cycle, when they produce more than 20% next-12-month returns.

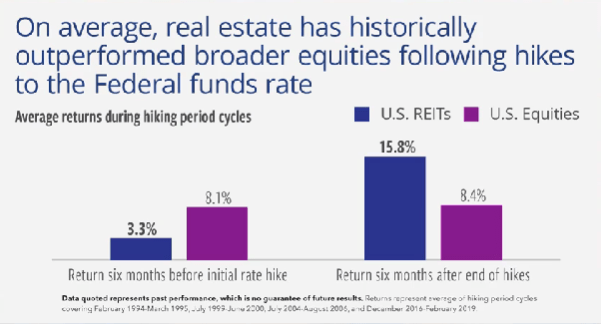

The Federal Reserve is finally doing its job, and it’s now very likely that they will stop hiking rates sooner rather than later. Typically, it’s a good environment for REITs where they produced 15%+ returns over the next six months following the end of a Fed hike.

Cohen & Steers

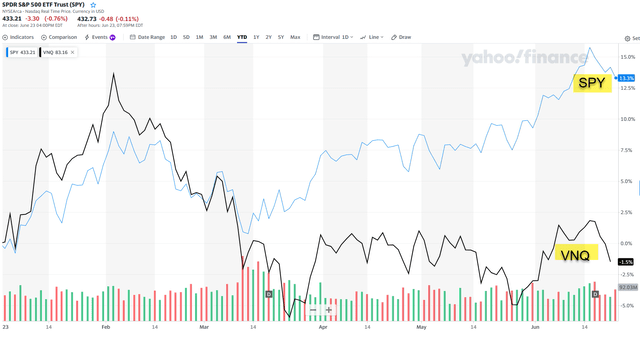

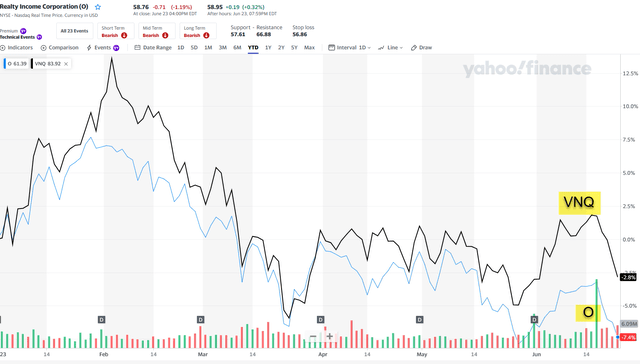

So why are REITs underperforming the S&P 500 (SP500) if this is such an attractive environment?

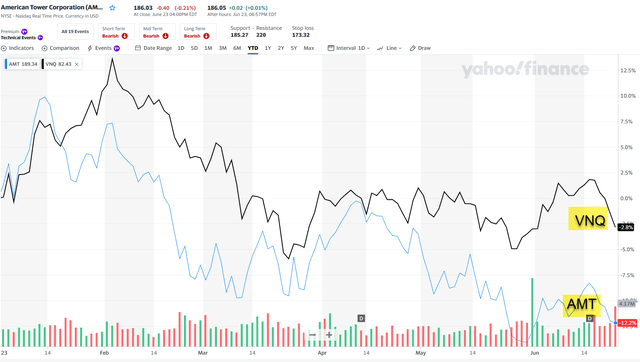

Yahoo Finance (YTD)

While many investors are fearful of the work-from-home conundrum that many office landlords are facing, the weakness creates an opportunity for office REITs, since they can capitalize on the lending conditions.

Keep in mind that the office sector is just around 3.5% of the overall REIT sector.

Commercial lending has tightened substantially, yet most REITs are insulated from these concerns. REITs have less than 35% loan to values (LTVs) and they’re 86% fixed for an average term of around 6 years.

As we enter the next cycle, in which the wave of private real estate loans matures, we believe that the strongest REITs – with quality balance sheets and experienced management – will be able to capitalize on opportunities in the form of M&A (see my article here), development, and acquisitions.

Mr. Market is pricing in significant declines for REITs in 2022 and YTD 2023, however, instead of running for the exits, the smart investor greets downturns as chances to find great investments.

As Benjamin Graham explained, “Buy when most people, including experts, are pessimistic, and sell when they are actively optimistic.”

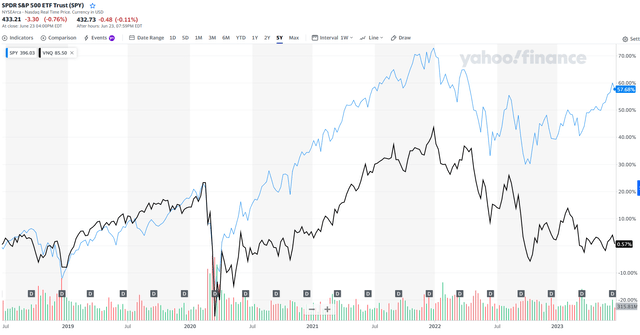

Yahoo Finance (5 year)

Now let’s explore a few of my high conviction picks…

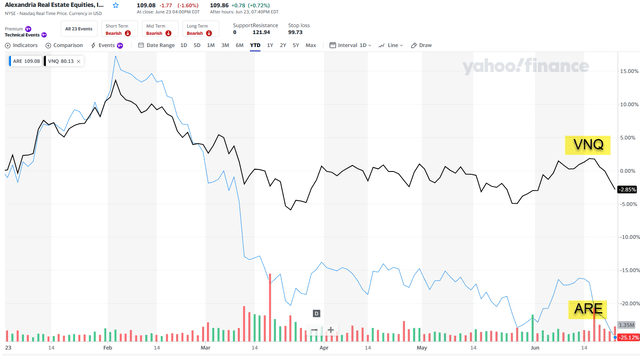

Alexandria Real Estate Equities, Inc. (ARE): -25% YTD

Alexandria Real Estate, the pioneer in life science office properties, has sold off significantly year-to-date, with the stock falling 25% since January. The selloff intensified after Jonathan Litt, the CEO of Land & Buildings, announced a short position in the stock last week.

His rationale is largely based off of cell phone data that shows that cell phone presence in ARE’s life science office buildings is down 50% when compared to pre-pandemic cell phone presence levels, according to the data his firm collected.

Yahoo Finance

The cell phone data at the center of the short thesis basically implies that occupancy is down 50% when compared to pre-pandemic levels and that ARE should be priced more in line with the rest of the office sector, which is trading at an average P/FFO of 6.42x vs. ARE, which is trading at a P/FFO of 12.57x.

I have several issues with that reasoning.

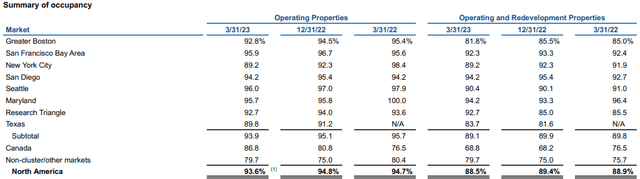

For one, his claim that occupancy is down 50% runs contrary to ARE’s reported occupancy levels. As of the end of the first quarter, ARE reported a 93.6% occupancy rate for its North America operating properties and an 88.5% occupancy rate for its operating and redevelopment properties.

Unless occupancy levels drastically decreased from March 31st to when the cell phone data was gathered, it doesn’t seem possible that both ARE’s reported occupancy levels and the implied decrease in occupancy from the cell phone data can both be correct.

ARE – IR

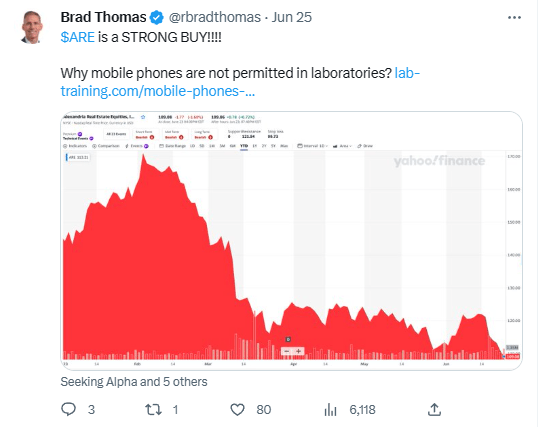

Also, as I posted on Twitter this weekend, cell phones are not permitted in laboratories…

Twitter: @rbradthomas

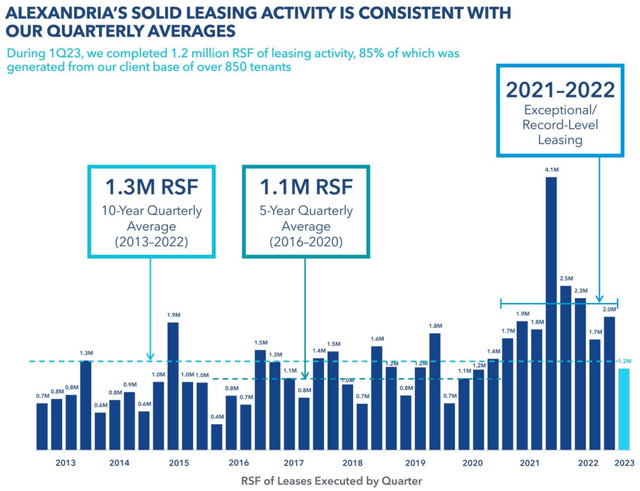

Another issue I have with the short thesis is that ARE had record levels of leasing in 2021 and 2022.

Why would there be such high levels of leasing activity if tenants only needed half the space?

ARE – IR

Finally, the argument that ARE should be priced in line with the rest of the office sector implies that it is the same as the other office REITs, but that is simply not the case.

ARE properties contain laboratories where research and drug development takes place by multinational pharmaceutical and biotechnology companies and these processes cannot be done from home…they’re MISSION CRITICAL.

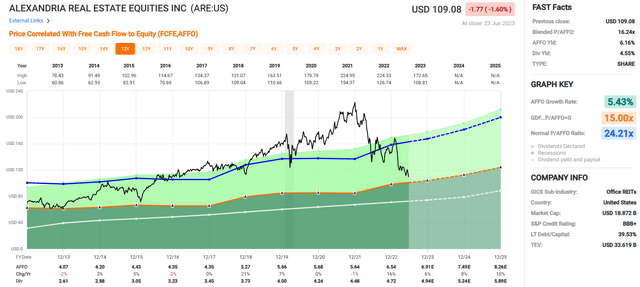

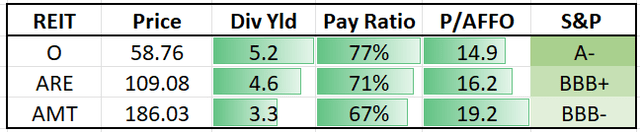

The recent selloff has presented a very compelling buying opportunity, as ARE is currently trading at a P/AFFO of 16.24x compared to its normal AFFO multiple of 24.21x.

They pay a 4.55% dividend yield that is secure with an AFFO payout ratio of 71% as of the end of 2022.

Additionally, ARE has a fortress balance sheet (BBB+) with a net debt and preferred stock to adjusted EBITDA of 5.3x, a fixed charge coverage ratio of 5.0x, and a long-term debt to capital ratio of 39.53%.

Their debt is 96.1% fixed rate and has a weighted average remaining debt term of 13.4 years and a weighted average interest rate of 3.73%. They have no debt maturities until 2025 and currently have $5.3 billion in total liquidity. At iREIT®, we rate Alexandria a STRONG BUY.

FAST Graphs

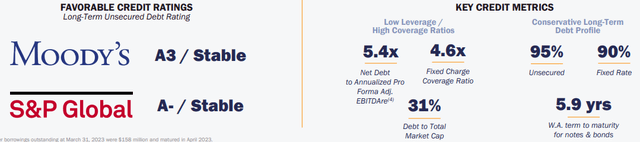

Realty Income Corporation (O): -7.4% YTD

Realty Income, the standard-bearer in the triple-net lease space, has not been immune from the selloff in the real estate sector, as its stock price has declined 7.4% year-to-date.

The rate at which inflation has been increasing along with increasing interest rates has hurt the stock, in part due to the long-term nature of their leases. Unlike apartments or self-storage, Realty Income’s triple-net leases are long term and cannot be re-priced as easily in order to keep up with rising prices.

This short-term headwind has presented a buying opportunity for a long-term investor, as Realty Income has been one of the most consistent REITs since their public listing in 1994.

Yahoo Finance

Realty Income has delivered consisted earnings and dividend growth. In 26 out of the last 27 years, they have had positive AFFO growth, with a median AFFO per share growth rate of 5% since 1996.

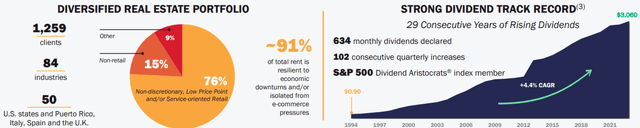

They’re a Dividend Aristocrat and have increased the dividend for 29 consecutive years. Additionally, Realty Income has declared 634 monthly dividends and has increased the dividend for 102 consecutive quarters.

They’re not the fastest growing REIT, but they are one of the most consistent REITs (if not the most) in delivering positive earnings and dividend growth year after year.

Realty Income – IR

Along with their excellent management team, Realty Income has been able to deliver consistent results due to the scale and diversity of their properties and tenants.

They have over 12,400 properties that cover approximately 236.8 million leasable square feet in all 50 states and the U.K., Spain and Italy. They have 1,259 tenants doing business in 84 industries and have a 99.0% occupancy rate and a weighted average remaining lease term of 9.5 years.

Realty Income is one of only 7 REITs to hold an A- or better credit rating from S&P Global. They have a net debt to pro forma adjusted EBITDAre of 5.4x, a long-term debt to capital ratio of 41.21%, and a fixed charge coverage ratio of 4.6x.

The debt is 90% fixed rate, 95% unsecured, and has a weighted average term to maturity of 5.9 years. Additionally, they have minimal debt maturities in 2023 and approximately $3.1 billion in liquidity.

Realty Income – IR

Realty Income pays a 5.22% dividend yield that is well covered with an AFFO payout ratio of 77% as of the end of 2022.

They have excellent credit and debt metrics and are one of the most stable and consistent REITs you can buy. For the long-term investor that wants to own high quality commercial real estate and receive monthly rent checks, the recent stock price decline provides an excellent entry point.

Currently the stock is trading at a P/AFFO of 14.85x, which is well below their normal AFFO multiple of 18.86x. At iREIT®, we rate Realty Income a BUY.

FAST Graphs

American Tower Corporation (AMT): -12.2% YTD

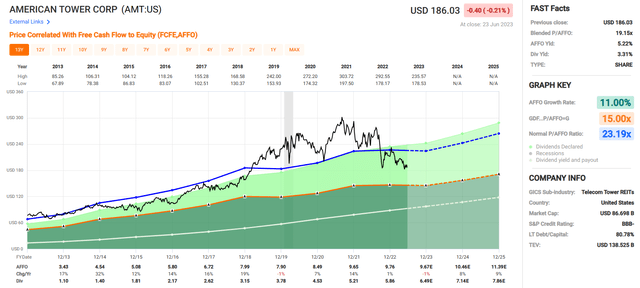

American Tower has had a rough start to 2023, as the stock has fallen -12.2% year-to-date. AMT’s stock has seen multiple compressions recently, as AFFO growth has slowed in recent years.

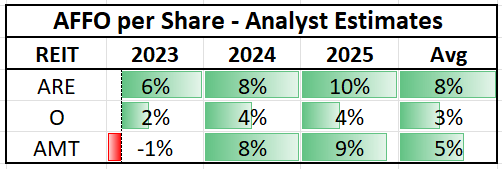

Over the last 10 years, AMT has had an average AFFO growth rate of 12.77%, but only grew AFFO by 1% in 2022 and analysts project AFFO to decline by -1% in 2023.

While investor sentiment has soured recently, I believe this is short-sighted, since AMT’s real estate is set to benefit as e-commerce continues to grow. Analysts seem to agree, and project AFFO growth to come in at 8% and 9% in the years 2024 & 2025, respectively.

Yahoo Finance

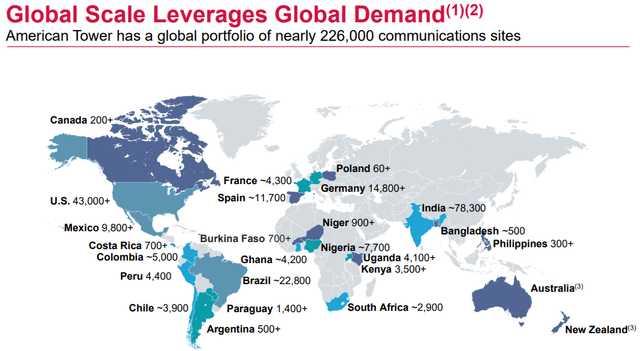

AMT is a cell tower REIT that was founded in 1995 and is currently one of the largest REITs by market capitalization. They own, develop, and operate multitenant communications sites that are located both domestically and abroad.

The portfolio consists of approximately 226,000 communication sites that includes over 43,000 properties in the U.S. and Canada and over 182,000 sites internationally.

Cell towers are critical to e-commerce and are part of what I like to call the “e-commerce” trifecta. At a very basic level, anytime a mobile device is used to order products online, the signal is sent to a cell tower, which then directs it to a data center to process and route the information to a fulfillment / distribution center.

E-commerce would not be possible without cell towers, and as e-commerce continues to grow, so will the demand for cell tower space.

AMT – IR

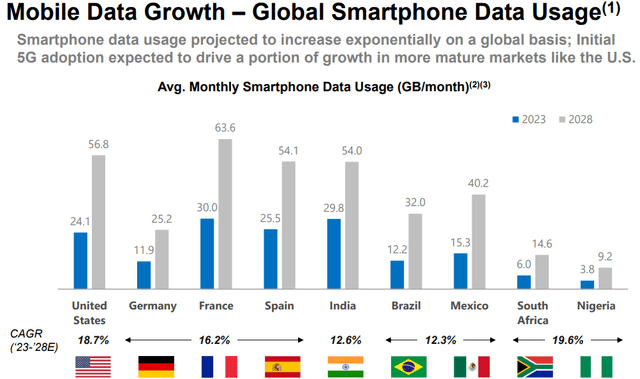

From 2023 to 2028, smartphone data usage is expected to grow significantly across the globe with an expected compound annual growth rate of 18.7% in the U.S., 16.2% in Germany, France, and Spain, 12.6% in India, 12.3% in Brazil and Mexico, and 19.6% in South Africa and Nigeria.

In addition to the expected growth in e-commerce, the increasing availability of more affordable smartphones in emerging markets and the adoption of 5G in more mature markets will continue to serve as a catalyst to drive growth.

AMT – IR

AMT has historically delivered rapid growth in AFFO, but as previously mentioned, AFFO growth has slowed in the last several years. Long-term investors should look at the bigger picture and realize that e-commerce is not going anywhere and will only continue to grow in the future.

AMT has an international presence and is poised to benefit from this trend. I fully expect their earnings growth to revert back to their long-term average over time, so the recent price decline could present an attractive entry point.

Currently AMT pays a 3.31% dividend yield that is very secure with an AFFO payout ratio of 67% and trades at a P/AFFO of 19.15x vs their normal AFFO multiple of 23.19x. At iREIT®, we rate American Tower a BUY.

FAST Graphs

In Closing

Most investors know that you should act greedy when others are fearful, because it’s the short-term events that create the opportunity set that I’m writing about today. That’s why Warren Buffett famously said, to be “fearful when others are greedy, and greedy when others are fearful.”

iREIT®

As you can see above, the three REITs I’m recommending have solid growth prospects in 2024 and 2025, which means they should easily be able to continue growing their dividend. All three REITs have stable tenants that drive internal growth, regardless of a potential recession.

The dividend payouts for these three REITs are also well-protected by low payout ratios and solid investment grade balance sheets.

iREIT®

I know that many of you are wondering when the best time is to get on the REIT train, recognizing that the Fed is still at work…

My advice on that topic is to put a plan in action and prepare, because at some point, rate increases will permanently pause, and that’s the time when REITs are going to rebound…

It’s not a matter of IF, but WHEN…

As I said earlier, my 30+ years as an investor has taught me many valuable lessons and the most important words of advice is to recognize that Mr. Market has a tendency to overreact, and when this happens, it’s time to Buy.

Warren Buffett famously said,

“The most important quality for an investor is temperament, not intellect… You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”

Good luck and Happy SWAN investing!

Read the full article here