The set-up

This cautionary article is written at a time when there is what seems like market euphoria, so it needs to set the stage for further discussion. So, before discussing my analysis, let’s state the fact:

- The major stock market index Dow Jones Industrial Average (DIA) is up by 3.8% YTD, essentially flat for the year.

Yes, Nasdaq 100 (QQQ) is up 44% YTD, led by the 7 megacap tech stocks or the Magnificent 7. But, these two things reveal the following:

- Billionaires and corporate execs have dumped $9 billion worth of stock this year amid the market’s latest rally, selling mostly tech stocks.

- Retail investors are “aggressively” chasing the stock market rally with the monthly net inflows into US equities now averaging $1.4 billion per day, close to the all-time record- buying mostly the tech stocks, the Magnificent 7, with the most popular investment Tesla (TSLA).

So, what kind of market do we have? Mostly flat, but the retail investor is heavily buying the megacap tech stocks, while the billionaires and insiders are selling the tech stocks.

Why are billionaires dumping stocks?

I didn’t ask them, but I assume billionaires are dumping stocks because we have a deeply inverted yield curve, which will likely produce a very deep recession. On top of that, broadly, stocks are overvalued at the forward PE ratio well over 20 for S&P500 (SP500) and nearly 30 for Nasdaq 100.

Why are retail investors buying?

First, the expected recession is still not obvious, although the earnings are already in a major correction, with expectations for -9% yoy for Q2 2023. Second, inflation has been falling since the peak at over 9%, and thus some analysts kept predicting the Fed would pause, pivot, and/or cut.

Thus, some analysts are suggesting that the Fed would pause the interest hiking cycle, and possibly cut – before the recession arrives, essentially denying the recession.

So, let’s ignore for the moment the technical breakouts, the momentum, the genAI hype, and focus on two macro variables: inflation and growth.

Inflation

The headline CPI Inflation has been falling since peaking at 9.1% in June 2022, and reached the 3% level in June 2023.

So, what’s next for inflation? Is the inflation problem solved? No, the June 2023 reading of 3% is the bottom of the disinflationary trend, the headline CPI is likely rise towards the end of 2023.

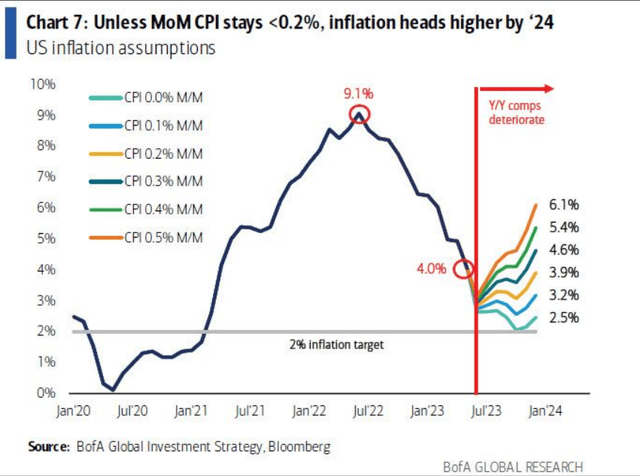

Here is the chart provided by Bank of America. The headline CPI will continue falling only if the month-over-month in inflation is 0% for next 6 months. A very unlikely scenario.

The expected month-over-month headline CPI for July is 0.34, which, if that trend continues, puts the headline CPI right at 5% by the end of 2023. The month-over-month headline CPI for June was 0.2%, and if that trend continues, the headline CPI will rise to 4% by the end of 2023.

Based on these numbers, it is likely that the headline CPI will be somewhere between 4-5% by the end of 2023, much higher than the 3% print in June 2023 – which was likely the last good news on inflation.

Bank of America

Growth

Although we could be in a recession already based on real GDI measures, the “real recession” becomes obvious only when consumption starts to contract, given that consumption counts for 70% of the US economy.

The thesis here is that higher interest rates will eventually cause consumption to contract, but monetary policy tightening operates with long and variable lags.

So, when are we going to see the contraction in US consumption? In July, that’s the answer (that’s happening now).

Specifically, I am tracking the weekly data for the Redbook Index which is “a sales-weighted of year-over-year same-store sales growth in a sample of large US general merchandise retailers representing about 9,000 stores. By dollar value, the Index represents over 80% of the equivalent ‘official’ retail sales series collected and published by the US Department of Commerce.”

So, the Redbook Index had the first negative yoy reading this week, falling by 0.4%. The historical data on the Redbook Index closely tracks the recession cycle – and turns negative only in recessions.

Trading Economics

If you look at the May readings for the Redbook Index, retail sales grew about 1.6% in May and 1.3% in April. If you look at the official data for retail sales from the chart below, the government numbers also show similar numbers, 1.23% growth in retail sales in April and 1.6% growth in May.

Trading Economics

The official retail sales for June will be released on Monday next week, and it’s likely the number will show a growth of less than 1%, based on the Redbook data. But more importantly, the retail sales for July, to be released in August, are likely to be negative – which will confirm the “real recession” for Q3 2023.

So, this is the first evidence of the upcoming “pain” that Powell warned us about in August 2022. I believe the lagged effects will finally start to show.

Implications

The recommendation to sell stocks during the euphoria takes courage. But, somebody has been selling – the insiders and the billionaires.

The fact is, we are likely in a new high-inflation period, given the demographics and geopolitics.

- The oil prices are rising due to supply restrictions, and this is not going to stop anytime soon.

- Russia is contemplating exiting the grain-deal agreement, which would increase the price of food again.

- Add to that re-shoring and on-shoring.

- There is a serious labor shortage in the US, partially due to demographics, but also restrictive immigration laws, and this is likely not ending anytime soon.

- The fiscal spending keeps growing.

The inflation problem is not solved, which suggests the Fed will have to keep to “higher for longer”. On top of that the economy is stalling and potentially about to enter a real recession.

The S&P500 is overvalued, led narrowly by selected tech stocks, supported mostly by inflows from retail investors, while billionaires and insiders are selling. So, yes, the momentum can continue – it’s a concentrated bubble. But the prudent advice is to sell. Regarding shorting, that’s dangerous on the way up.

But, it’s interesting to see what news will keep triggering the market higher. The good inflation news is likely behind us. The bad economic news is likely approaching. The Fed will need to keep monetary policy tight. The AI hype seems to be fading. The earnings must support the hype. It will come down to the technicals.

Read the full article here