The Coca-Cola Company (NYSE:KO), a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. It is safe to say that Coke is probably one of the most well-known and most iconic brands in the world.

In today’s article we will be taking a look at Coke’s business, focusing primarily on profitability, efficiency and returns to shareholders. We will elaborate on the main reasons that make the company an attractive investment opportunity in our eyes.

First, we will discuss the firm’s net profit margin over the past five years, then we will look at the company’s asset turnover ratio and leverage. Last, but not least, we will write about the firm’s dividends and why it may be attractive for dividend and dividend growth investors.

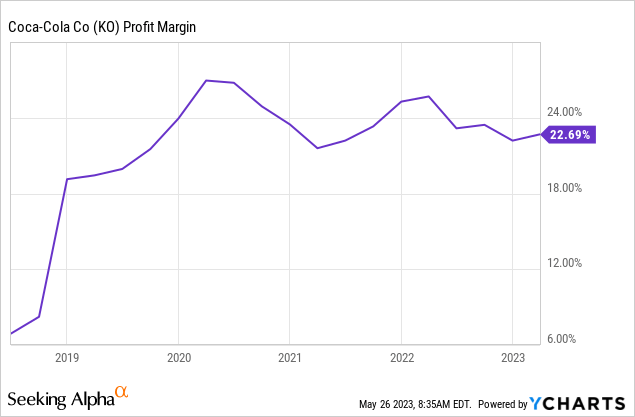

Net profit margin

Net profit margin is often defined as a measure of how much net income or profit is generated as a percentage of revenue. It indicates how profitable a firm is. In general, we like to invest in companies that have stable or improving profit margins over the years. Among many things such a trend can indicate effective cost controls (even during inflationary periods), the ability to pass on price increases to customers and brand loyalty.

The following chart shows that KO’s net profit margin has improved substantially over the past five years.

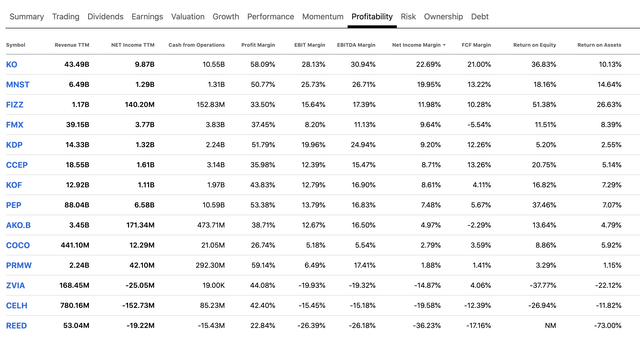

To put this figure into perspective, the table below compares KO’s profitability measures with those of other firms in the soft drink space.

Profitability comparison (Seeking Alpha)

KO clearly has the highest net profit margin, EBITDA margin and FCF margin. We believe this is a clear indication that KO has a competitive advantage over its rivals. In our opinion this is especially important in the current uncertain macroeconomic environment, as it may be an indication that despite the poor consumer sentiment and the recessionary fears, the demand for Coke’s products may remain high.

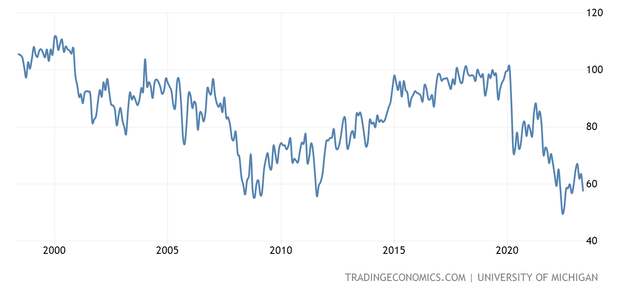

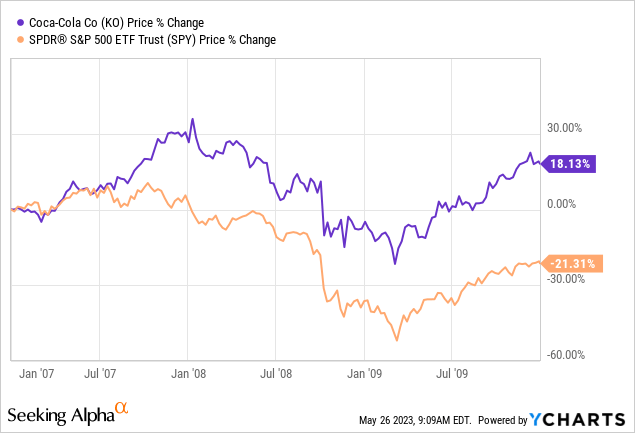

In fact, during the period of 2008 – 2009, when consumer confidence has fallen significantly, KO has outperformed the broader market by almost 40%.

U.S. Consumer confidence (Tradingeconomics.com)

For this reason, we believe that KO could be an attractive stock investment opportunity for investors looking to enter the soft drink space, even in the current macroeconomic environment.

Before we move forward, however, we also have to highlight a negative point here with regard to the latest quarterly earnings results.

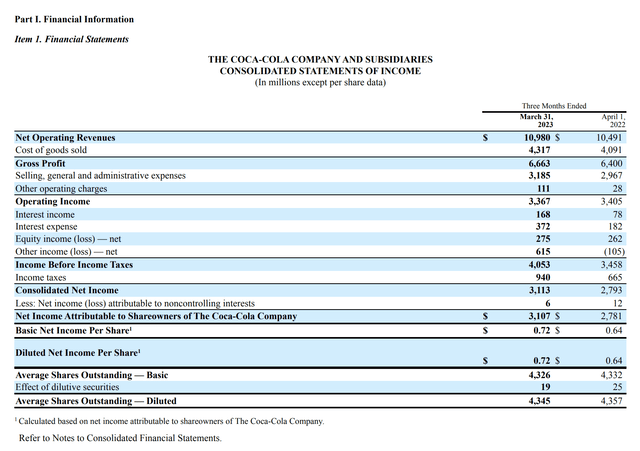

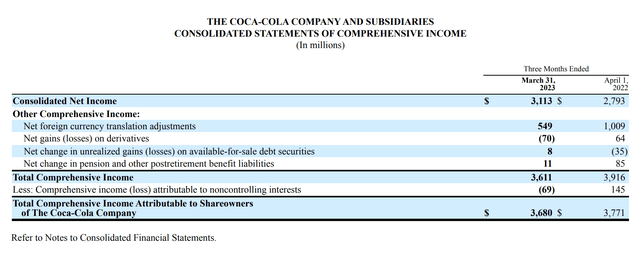

Income statement (KO)

The reason why in Q1 2023 the net income has been higher than in the same period a year ago was the increase in “other income”, which is not necessarily a sustainable source. Further, when looking at the other comprehensive income statement, we can see that the foreign currency translation adjustments have given a significant boost to the net income in Q1 2023.

OCI (KO)

Asset turnover

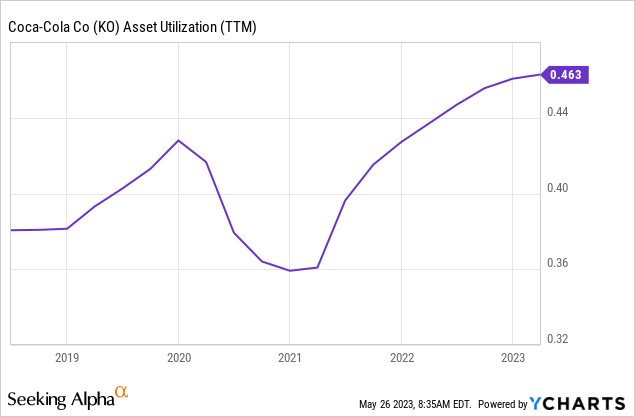

Asset turnover is a measure of efficiency and also one of the components of return on equity. Asset turnover is defined as the ratio of sales to total assets. The higher the asset turnover, the more efficient the firm is in using its assets to generate revenue.

The upward trend of asset turnover over the past five years also appears appealing and may be an indication that KO’s efficiency has been improving over the period.

This is another reason why we believe that KO may be a good investment opportunity.

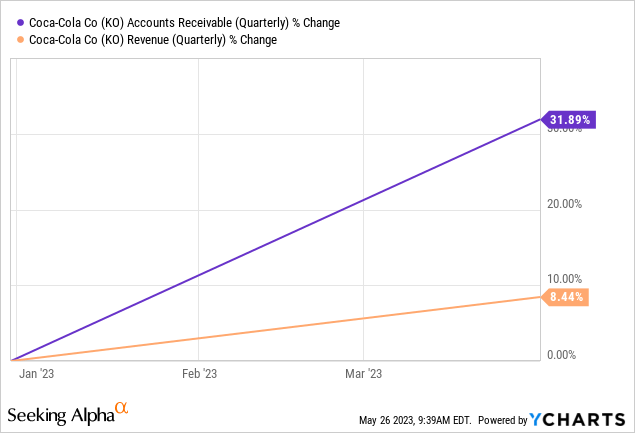

But once again, before we move ahead, we would like to point out something that you need to pay attention to, which is the increase in accounts receivable.

Accounts receivable have been increasing at a much faster pace than revenue, which may be an indication that KO is selling more on credit or has modified its revenue recognition practices in order to make its results look better.

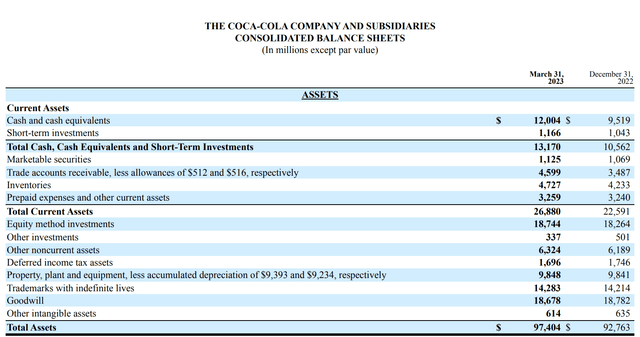

Assets (KO)

Going forward, we would like to see the growth in accounts receivable slow.

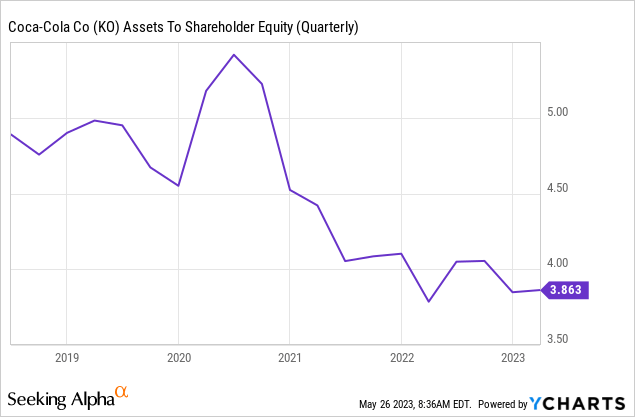

Equity multiplier

The equity multiplier is a measure of leverage. It indicates how much of the total assets is supported by equity. In KO’s case this figure has been declining gradually, except in 2020, over the past five years.

This is an indication that the firm is reducing the percentage of debt in its capital structure. On one hand, we believe this is an attractive development as with rising interest rates the cost of debt would likely increase for the firm, when some portions of the debt need to be refinanced. On the other hand, it may make the weighted average cost of capital higher for the firm, as the cost of equity is generally higher than the cost of debt.

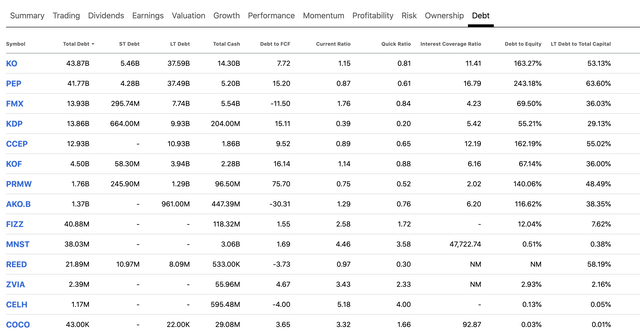

The following table shows the amount of debt for KO and its rivals.

Comparison (Seeking Alpha)

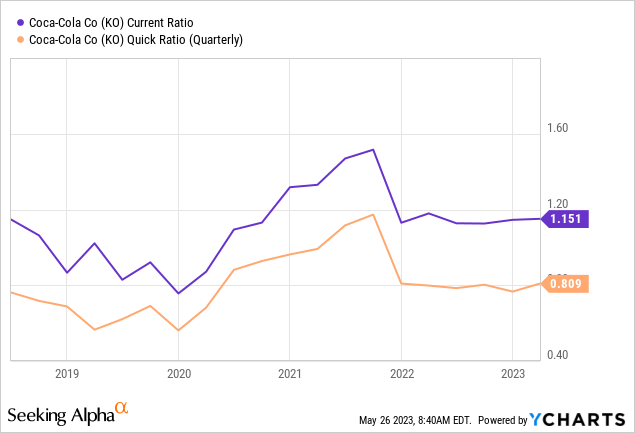

Despite the gradual decline, KO still has the highest amount of debt (in absolute terms) in its capital structure. LT debt makes up more than 50% of the firm’s total capital. While this may appear to be too high, the firm has relatively attractive liquidity measures, including the interest coverage ratio, current ratio and quick ratio.

Last, but not least, let us take a look at the returns to shareholders over the years.

Dividends

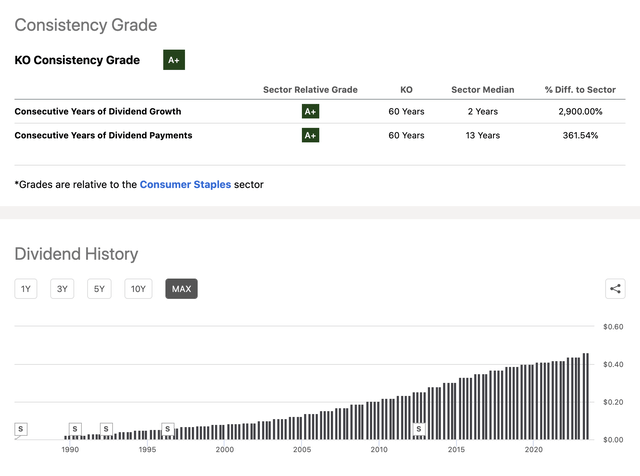

KO has been paying dividends and has been increasing these payments each year in the last 60 years. This is by all means a convincing track record for investors looking for safe dividends.

Dividends (Seeking Alpha)

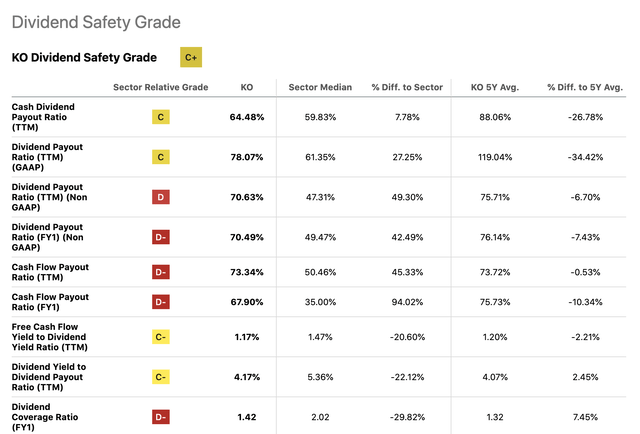

While the dividend payout ratio and dividend coverage ratio may compare unfavourably to the sector median, it is about in line with the firm’s own 5Y averages. For this reason, we are not concerned about the sustainability of the dividend payments in the long term.

Dividend safety (Seeking Alpha)

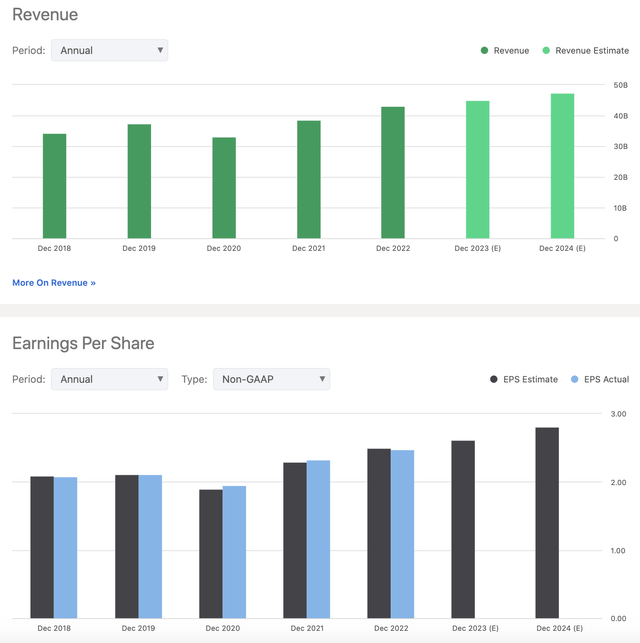

Further, analysts are expecting both the revenue and earnings to increase in the coming years, giving us further confidence that the firm will be able to keep paying dividends to its shareholders.

Revenue and earnings forecast (Seeking Alpha)

The last question that remains for us, is the current share price an attractive entry point?

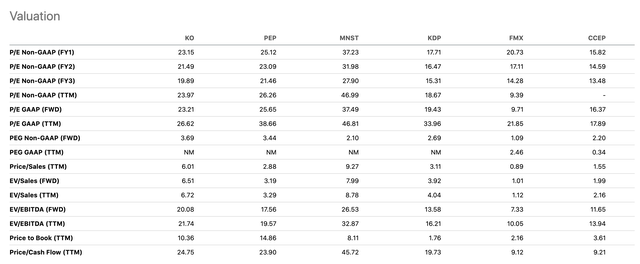

Valuation

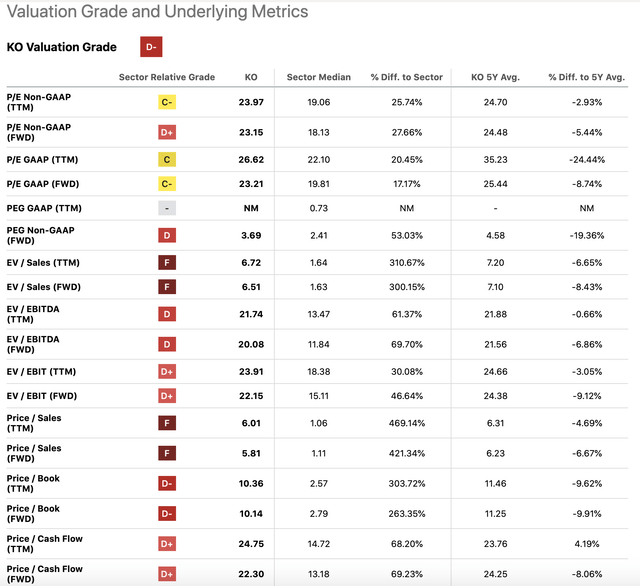

To answer this question, we will use a set of traditional price multiples.

Valuation (Seeking Alpha)

According to most multiples, KO appears to be trading at a significant premium compared to the consumer staples sector median. On the other hand, the current multiples are slightly lower or are in line with the firm’s own 5Y averages.

If comparing KO’s multiples to some of its closest competitors, we can see that the firm’s multiples are actually not extraordinarily high.

Valuation (Seeking Alpha)

All in all, we believe that the current price is justified, due to Coca-Cola’s extraordinary brand recognition, industry leading profit margins, improving efficiency and outstanding track record of dividend payments.

For these reasons, we rate KO’s stock as a “buy” today.

Read the full article here