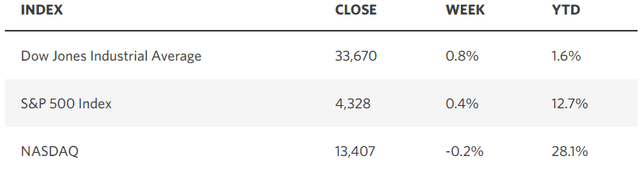

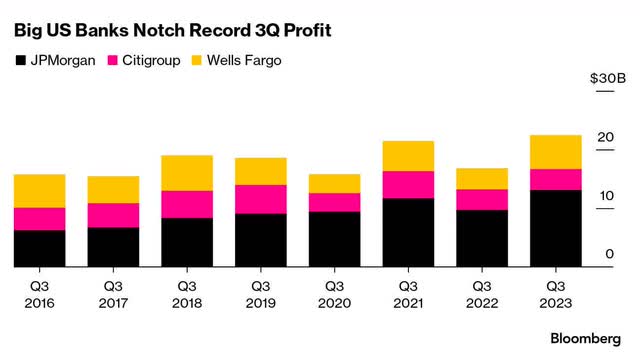

I have been increasingly critical in my writings this year of the overwhelmingly negative take on just about everything related to the economy and markets. There has been relentless focus on a recession that never materialized, constant calls for a retest of the 2022 bear-market lows, growing concerns about another credit crisis, and a near certainty that the American consumer will collapse. Perhaps this is because negativity seems to sell way better than a positive message in a world that measures value based on the number of likes, clicks, or eyeballs a piece of content can garner. I was reminded of this in a statement from CEO Jamie Dimon that accompanied JPMorgan’s earnings news release. He said, “this may be the most dangerous time the world has seen in decades,” which is odd when coupled with the nation’s largest bank raising guidance after beating profit and revenue estimates for the third quarter.

Edward Jones

I’d be concerned about such a dire warning, but Dimon has a history of hyperbole. He warned one year ago, as the bear market bottomed, that “this is serious” in reference to runaway inflation, rising interest rates, quantitative tightening, and Russia’s war with Ukraine. He also said the economy was likely to tip into recession in six to nine months with the S&P 500 having downside of another 20%. One year later, three of our largest banks saw profits soar 34% to a combined record of $22.5 billion, which was their best third quarter in history. Can you imagine the results if things get less “serious?” Positive rates of change from what was very bad to what is not as bad have been my base case for the past year, fueling my optimism.

Bloomberg

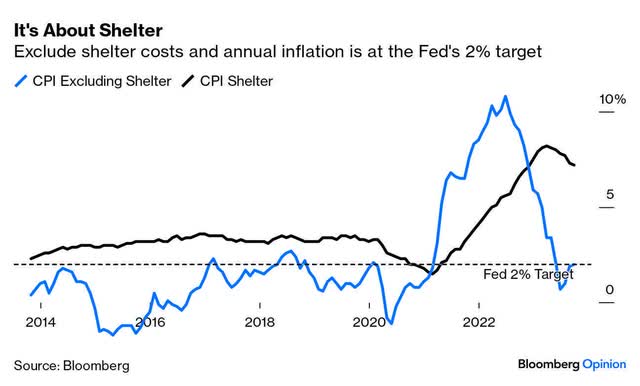

Leading the charge in what has been less bad is the rate of inflation, which we learned last week continues to decelerate, despite the hawks looking for components of the index that may not cooperate from one month to the next. The rate of inflation has fallen from 8.2% to 3.7% over the past year. If we exclude shelter costs, which are uniquely calculated with a tremendous lag, the rate has fallen to the Fed’s 2% target. This has been a hugely positive rate of change, which explains the bull market run for stocks alongside it. It also strongly suggests that short-term rates have peaked with rate cuts coming in 2024, which would be another positive rate of change.

Bloomberg

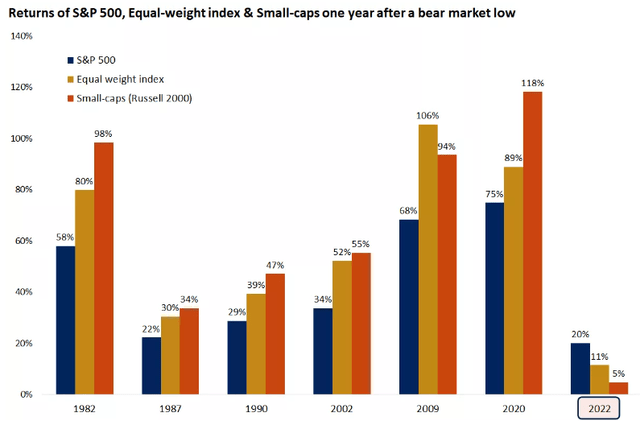

The primary headwind to affect this positive rate of change has been the tightening of financial conditions by the Federal Reserve, which resulted in higher interest rates and less market liquidity. That has weighed on valuations, which is why the recovery in the average stock has been well below what we typically see during the first year of a bull market.

Edward Jones

Despite lower rates of inflation and continued economic growth, the equal-weighted S&P 500 index (average stock) has only returned 11% over the past 12 months, while small-cap stocks have returned just 5%. This is an opportunity as interest rates peak, and participation broadens with improving breadth. Companies aggressively cut costs and improved operational efficiencies to battle the surge in inflation from 2021 to 2022. That should now be paying dividends as the rate of inflation falls and earnings growth is restored.

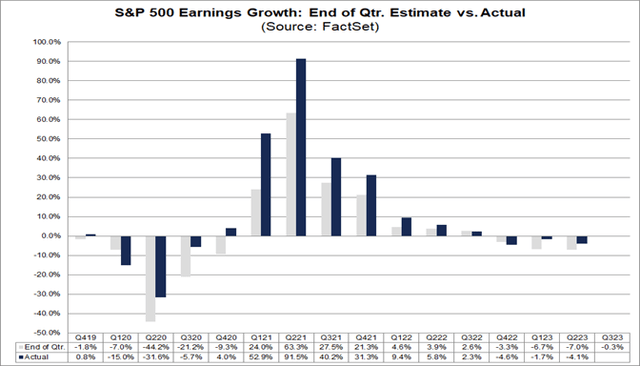

With earnings season having started last week, it is looking very likely that we have returned to year-over-year profit growth. The consensus estimate at the end of the third quarter was to see S&P 500 earnings decline 0.3%, which would be a large improvement from the 4.1% decline in the second quarter. According to data aggregator FactSet, the 32 constituents of the index that have already reported beat estimates by an average of 10.1%. That moves the consensus estimate for the overall index from a decline in earnings to growth of 0.4%. This is a very good sign, albeit early, that profits are now a tailwind for the stock market.

FactSet

In no way am I trying to diminish the importance of the ongoing conflict in Israel, the leadership vacuum that exists in the House of Representatives, or any of the other geopolitical and economic headwinds we face today. There are always headwinds, but this is hardly one of the most dangerous or difficult times we have faced as investors. I think the tailwinds are growing stronger, which is why I continue to see a soft landing in 2024 and a continuation of the bull market that started one year ago.

Read the full article here