Disappointments are to the soul what a thunderstorm is to the air.”― Friedrich Schiller.

Today, we put the spotlight on a small medical device concern called Pulmonx Corporation (NASDAQ:LUNG) for the first time. The company reported solid Q3 results at the end of October. Where will the shares go from here? An analysis follows below.

Seeking Alpha

Company Overview:

Pulmonx Corporation is headquartered just outside of San Francisco in Redwood City, CA. This small device manufacturer provides minimally several invasive devices for the treatment of chronic obstructive pulmonary diseases. The stock trades around $9.50 a share and sports an approximate market capitalization of $370 million.

November 2022 Company Presentation

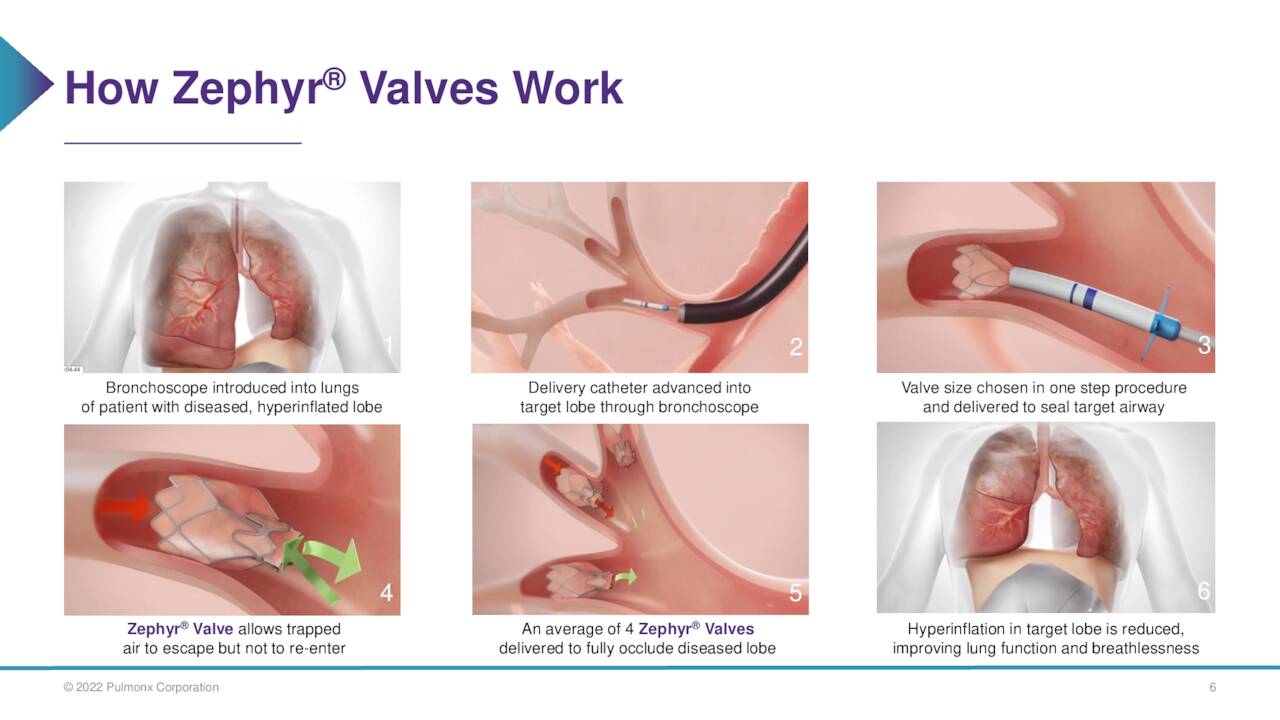

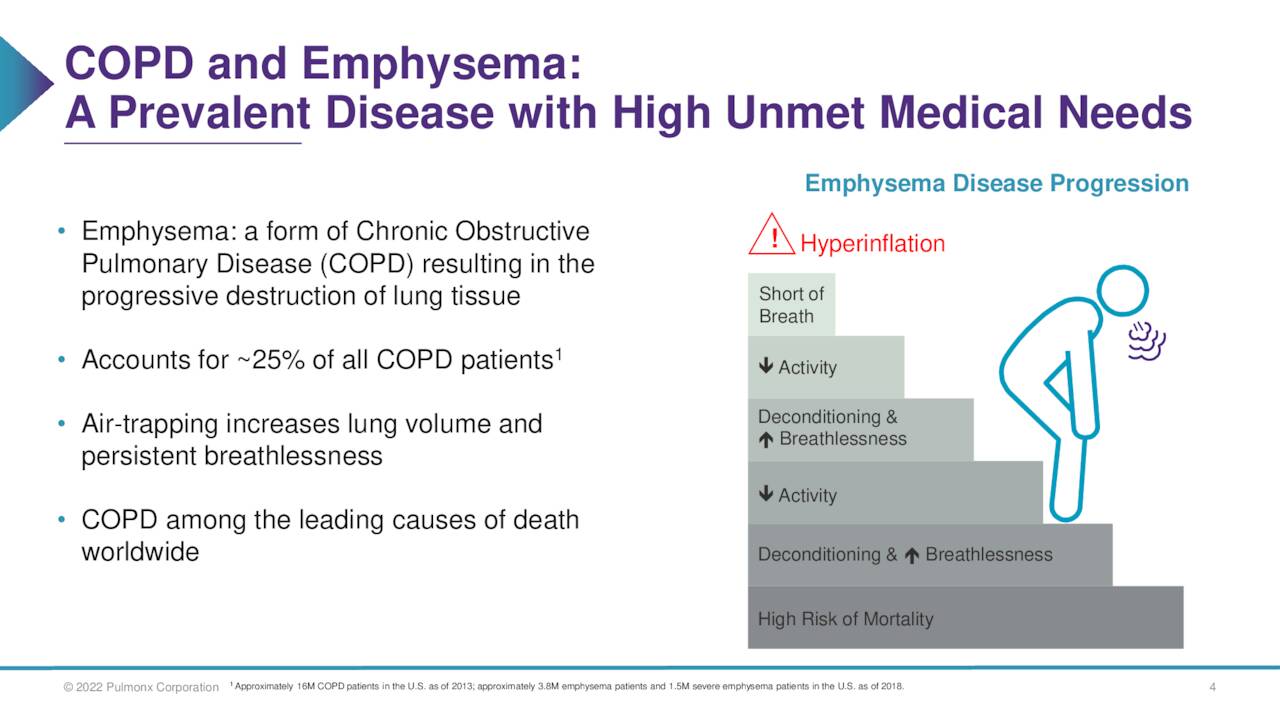

The company offers the Chartis® Pulmonary Assessment System and StratX® Lung Analysis Platform that are designed to assess and treat patients with severe emphysema/COPD. However, Pulmonx’s key growth driver is its Zephyr Endobronchial Valve. This is a solution for the treatment of patients with hyperinflation associated with severe emphysema. These are used during a minimally invasion bronchoscopic procedure developed by the company for the treatment of severe emphysema/COPD. 3-5 valves are used during this 30-to-60-minute procedure.

November 2022 Company Presentation

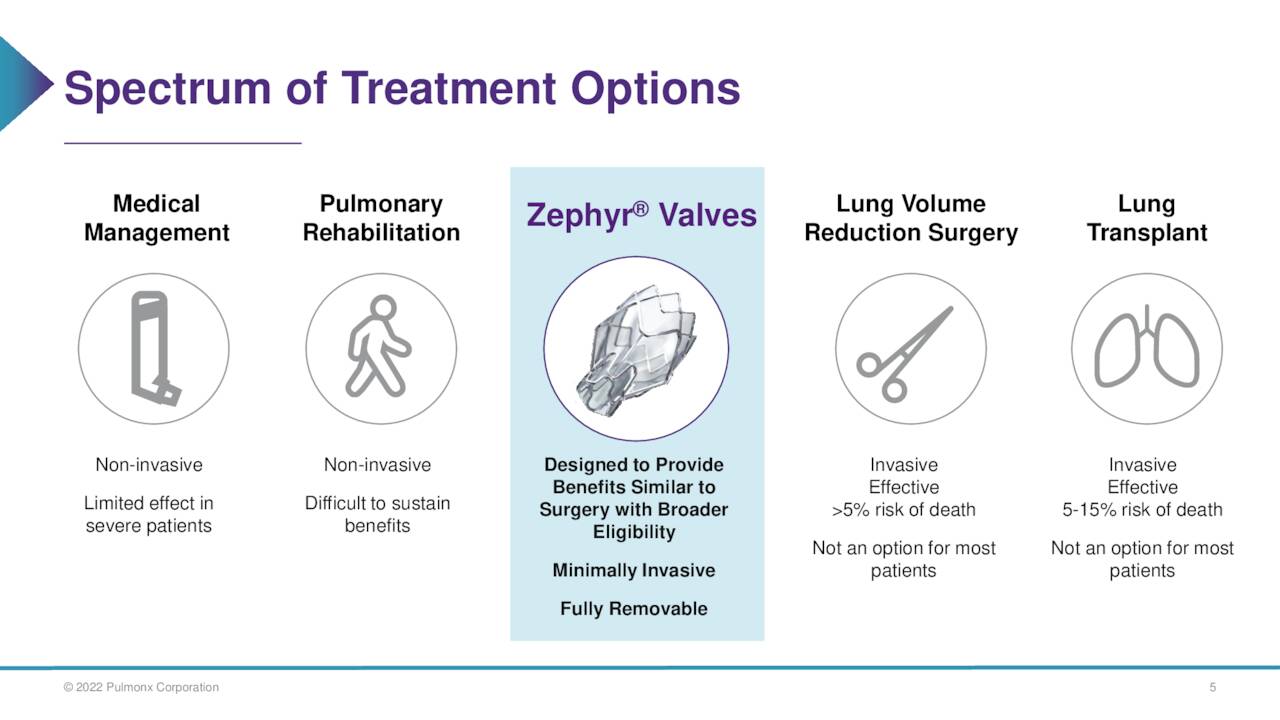

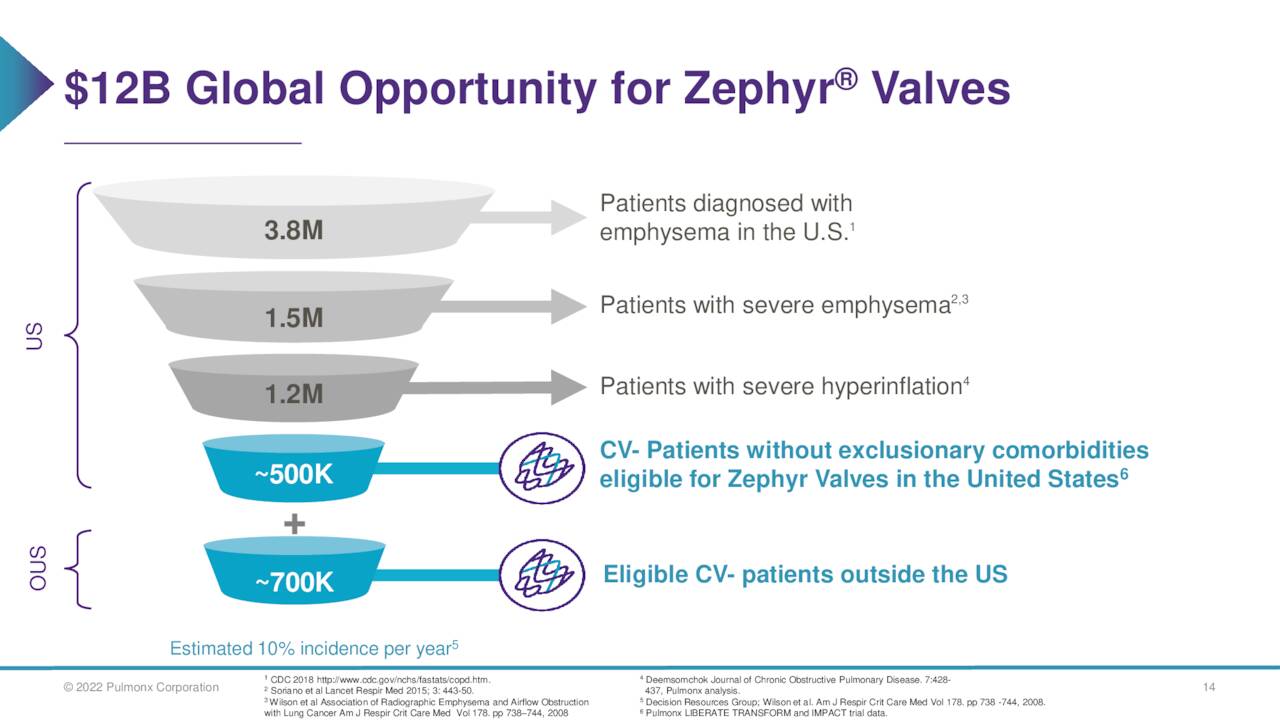

This is a large potential market, and the procedure competes against other forms of therapy, all of which have their own limitations.

November 2022 Company Presentation

Third Quarter Results:

Pulmonx Corporation posted its Q3 numbers on October 30th. The company delivered a GAAP loss of 39 cents a share as revenues rose just over 31% on a year-over-year basis to $17.7 million. Both top and bottom-line numbers came in slightly above expectations. U.S. based revenue rose 41% from 3Q2022 to $11.8 million and the company added 15 new treatment centers than can now install the Zephyr system. This brings the total of treatment centers to just over 320. Each center currently does approximately 1.5 procedures a month. The procedure was also approved for reimbursement in Japan by the Japanese Ministry of Health during the quarter.

October 2023 Company Presentation

Management bumped up FY2023 revenue guidance to $67 million to $48 million from $64 million to $66 million previously. This would be 26% year-over-year sales growth at its midpoint. Leadership also sees total operating expenses for the year falling in the $112 million to $114 million.

Analyst Commentary & Balance Sheet:

Since third quarter results were posted, five analyst firms including Craig-Hallum and Piper Sandler have reiterated Buy ratings on the stock with price targets proffered ranging from $12 to $16 a share. Notably, Canaccord Genuity took down its price target all the way to $12 from $20 a share previously while maintaining its Buy rating on the shares.

Several insiders have been consistent but small sellers of the shares throughout 2023. Since the beginning of September, they have sold nearly $200,000 worth of equity collectively. Just under four percent of the outstanding float in the shares are currently held short. Pulmonx ended the third quarter with just under $140 million worth of cash and marketable securities on its balance sheet after posting a net loss of $14.9 million for Q3. The company burned through just under $8 million of cash during the quarter but management feels good about their pathway to cash flow break even status.

Verdict:

Pulmonx Corporation lost a $1.59 a share on just over $53.6 million of revenue in FY2022. The current analyst firm consensus has losses increasing to $1.71 a share in FY2023 even as sales increase to just under $66 million. In FY2024, they see $1.60 a share of losses on sales growth in the high teens.

November 2022 Company Presentation

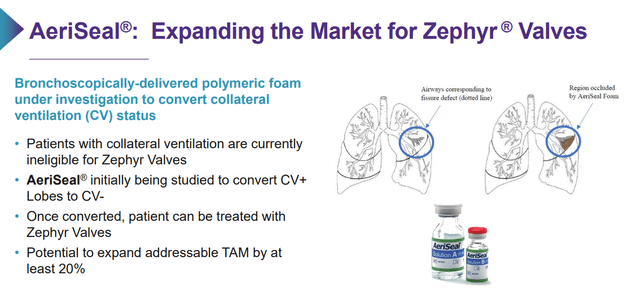

The company seems to be executing well and are targeting a large potential market. The firm’s balance sheet is in good shape compared to quarterly cash burn and Pulmonx is seeing solid sales growth. The company is also working on a form called AeriSeal that could expand the company’s potential target market. The company is in the process of launching a study which will form the basis for their U.S. AeriSeal PMA submission.

October Company Presentation

All that said, Pulmonx Corporation is likely to remain unprofitable for several years. Unprofitable small cap concerns haven’t been “en vogue” in recent quarters as interest rates continue to rise. Therefore, LUNG only merits a small “watch item” holding by patient long term investors at this time. This is a story we will return to in the coming years as it is intriguing.

I do not expect riches from words of truth, only wisdom.”― Anthony T. Hincks.

Read the full article here