By Bradley Krom, Lonnie S. Jacobs and Brian Manby, CFA

This blog post is the final installment of a four-part series that examines the tactical and strategic case for investing internationally despite a multi-year period of U.S. equity outperformance.

While European equity market performance has been top of mind this year for many investors as a result of dollar weakness, we believe they would be remiss in not taking a closer look at some of the positive catalysts we think may just be getting started in Japan.

Comprising over 20% of the MSCI EAFE Index,1 Japanese markets, as measured by the MSCI Japan Index, are breaking out to new all-time highs. However, this is only true for indexes denominated in their local currency.

This fact underlies one of our key views about how investors should disentangle their international equity allocations from their views on the values of foreign currencies versus the U.S. dollar.

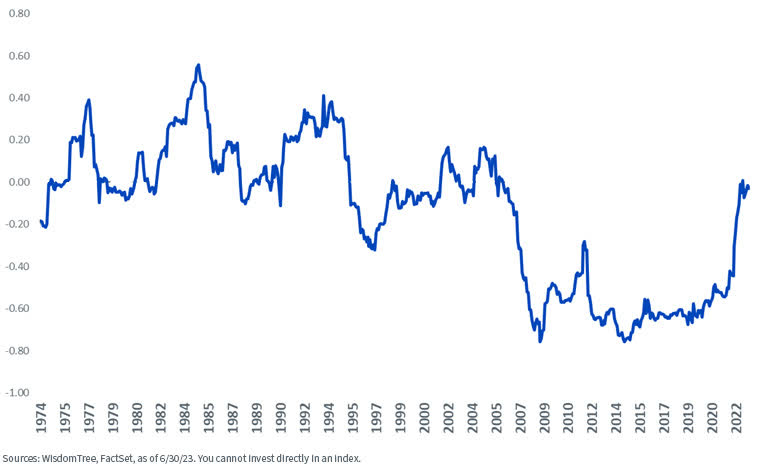

Rolling 36M Correlation: Yen & MSCI Japan (Local)

For much of the last 20 years, the Japanese yen has been negatively correlated with the returns of Japanese equity markets. For U.S.-based investors, the result has been the challenge of getting the macro call correct about a rise in Japanese equity prices while at the same time seeing those returns eroded through a stronger USD/JPY exchange rate.

Thoughts on Currency Hedging

For this reason, we believe that investors seeking to maximize returns in Japan on a tactical basis should do so with currency-hedged exposures on account of the negative relationship between Japanese equity prices and the value of the yen. But what about the broad-based exposure to developed international equities?

Changes in foreign currency values can have a substantial impact on returns of foreign investments. Investing in securities with appreciating currency can boost returns while depreciating currency may reduce profits.

Over the long-term investment horizon, currency exposure contributed little to excess returns with higher volatility. In the short run, it routinely detracted from performance while providing significantly higher volatility, except for the most recent one-year period.

This raises a fair question: If one doesn’t have a strong conviction about the direction of the currency, why take the risk?

Annualized Total Returns

Annualized Volatility

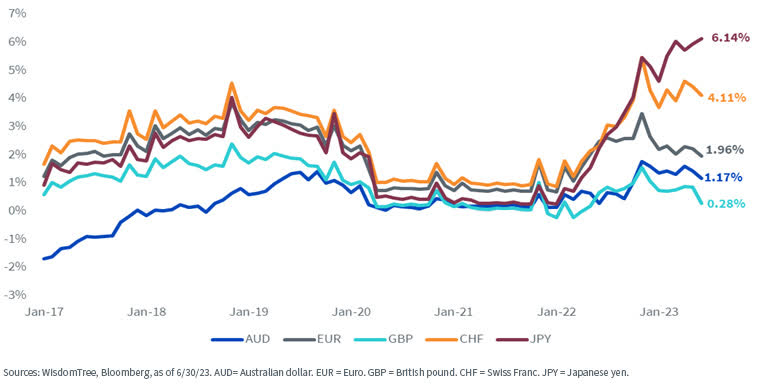

One of the most common misconceptions about currency hedging is that it’s costly. Although this concern is valid for emerging markets currencies, it doesn’t hold true for developed markets.

The carry trade profits for the U.S. dollar actually make hedging profitable for U.S. investors, as the interest rate in the U.S. currently far exceeds rates in Europe and Japan.

Interest Rate Differentials in Developed Markets

Top Allocation Ideas

For investors seeking broad-based allocations to developed international, we continue to be strong advocates of a higher-quality approach to the market.

Apart from that, since a majority of investors continue to benchmark to global indexes that don’t currency hedge, the WisdomTree International Quality Dividend Growth Fund (IQDG) could be a good option for those who believe the previous cycle of dollar strength may have peaked and who would like to potentially benefit from a weakening dollar as the Federal Reserve shifts to a more balanced outlook for rate hikes and the U.S. economy.

For longer-term, strategic investors, we continue to advocate for currency-hedged exposures such as the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG).

With currency volatility poised to increase on account of central bank policy divergence in the coming months, isolating equity returns from currency returns could be an effective method of risk management.

Finally, one of our top ideas relates to increasing exposures to Japanese equities.

Given the fairly persistent negative relationship between Japanese equities and the yen, we continue to believe the WisdomTree Japan Hedged Equity Fund (DXJ) could be one of the most intuitive ways to over-weight in Japan versus global benchmarks while at the same time neutralizing potential downdrafts in performance on account of a weakening yen versus the U.S. dollar.

1 Source: MSCI, as of 6/30/23.

Important Risks Related to this Article

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Bradley Krom, Head of U.S. Research

Bradley Krom joined WisdomTree as a member of the research team in December 2010. He is involved in creating and communicating WisdomTree’s thoughts on global markets, as well as analyzing existing and new fund strategies. Prior to joining WisdomTree, Bradley served as a senior trader on a proprietary trading desk at TransMarket Group. Bradley is a graduate of the Wharton School, University of Pennsylvania.

Lonnie S. Jacobs, Associate Director, Research Content

Lonnie S. Jacobs joined WisdomTree in August 2006 as Senior Index Analyst overseeing creation, maintenance and reconstitution of the firm’s passive indexes and actively managed ETFs. In her current role as Associate Director, Research Content, she is focused on supporting the research pipeline and analyzing the impact of global markets on WisdomTree strategies. Lonnie has B.A. in Economics and M.S. in Information Systems.

Brian Manby, CFA, Associate, Investment Strategy

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.

Read the full article here