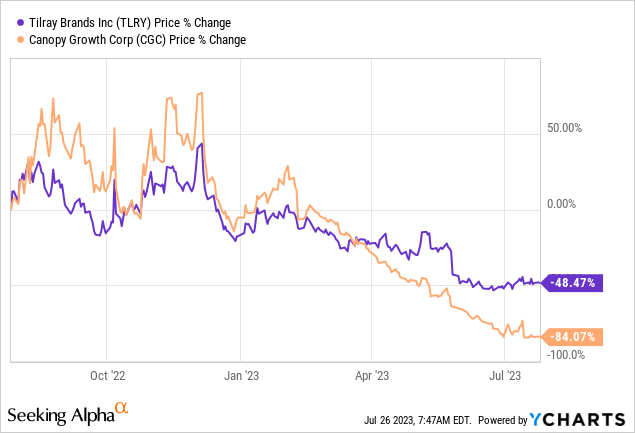

It has been a while since we wrote about Tilray Brands, Inc. (NASDAQ:TLRY). At the time, while the cannabis space was rife with problems, TLRY did seem one of the better ones able to cope with this. We recognized that and gave it a passing grade.

Current valuation is not too demanding for Tilray and it remains easily the leader in the Canadian space. Unlike Canopy Growth Corporation (CGC), another stock we cover, we will not give this a sell rating as its adjusted gross margins are good and balance sheet is far better. We are initiating coverage at neutral/hold and think this should be on investor watch lists for a longer term opportunity down the line.

Source: International Growth Not Enough To Offset Canadian Headwinds

Well there was a relative victory in that call.

We look at the recently released Q4-2023 (fiscal year-end is May 31) and see if we have the elements of a long case.

Tilray Q4 2023 Earnings Results

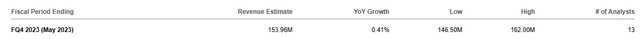

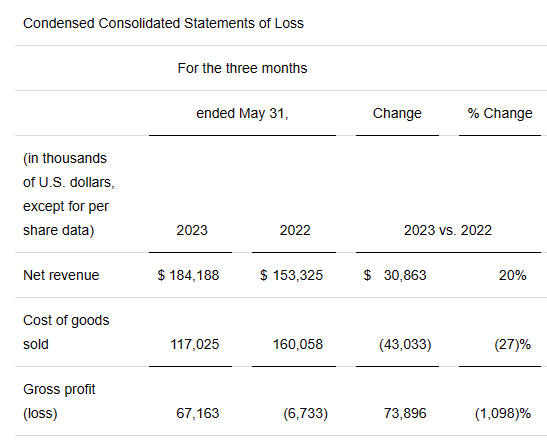

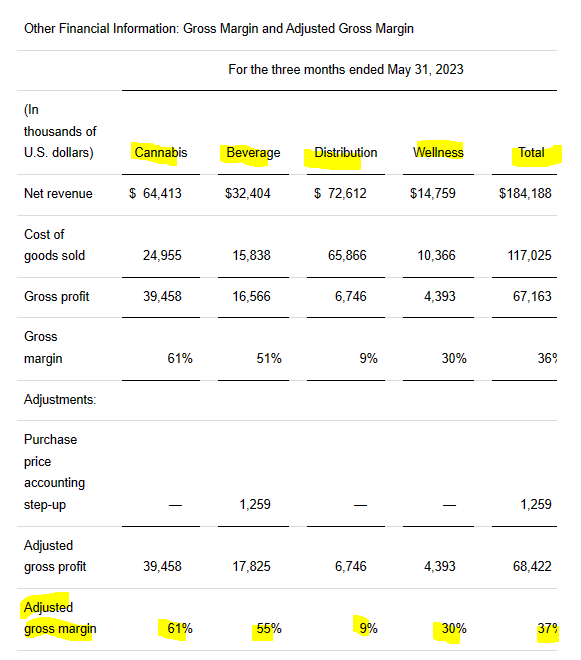

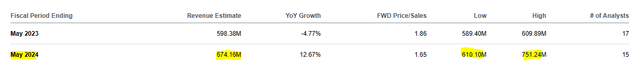

By any rational measure, the Q4-2023 results were spectacular. Revenues increased by 20% to $184 million and were up 24% if you stripped out currency impact. What is even more surprising is that the 13 analysts covering the stock were nowhere in the ballpark of the final number. Even the high estimate had thrown in the towel.

Seeking Alpha

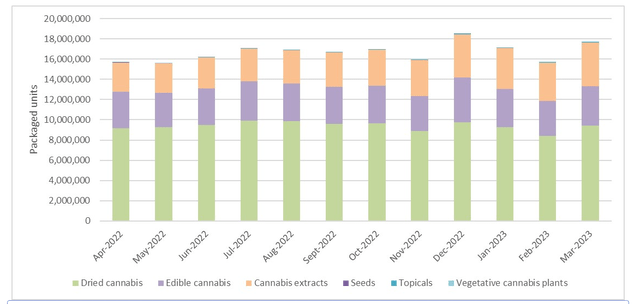

Ok, so top line hit it out of the park, but were they able to make money of it? The Cannabis sector, especially in Canada, has been characterized by too many dollars chasing too few opportunities. Ever since the legalization of this market, everyone assumed that the entire country would be getting high on a regular basis. The reality turned out to be radically different as we all collectively we figured out that dope, was not dope.

Canada Health

Making money in a flat sales market with billions of dollars of investments chasing down the last penny, is very difficult. TLRY managed to do that, sort of.

TLRY Q4-2023

The company showed $67 million of gross profits in the fourth quarter, a remarkable change compared to last year where they had an almost $7 million loss. Gross profits might sound like a low hurdle but those that have followed some other stocks like CGC, would know that even that bar in this sector is difficult to clear. TLRY not only cleared it but actually made gross profits on every single segment.

TLRY Q4-2023

Some of this improvement came from the acquisition and integration of the HEXO segment, but there is definitely an underlying momentum for TLRY’s sales and profits.

Outlook

TLRY is making more inroads within the Canadian market and its share has now reached about 13%. The company has the number 1 market share three different categories and is second in pre-rolls. For the year ending May 31, 2024, TLRY expects a growth rate of 11% to 27% for its adjusted EBITDA. These are likely the best set of numbers you can find in the Cannabis sector. Estimates for next year’s sales are all over the place, but we think the company likely exceeds these figures based on the Q4-2023 strength.

Seeking Alpha

The company also has one of the most formidable balance sheets in the sector with about $450 million in cash and cash equivalents. Some investors may confuse the low stock price with bankruptcy risk, but that seems rather farfetched for TLRY. Case in point, the company issued convertible debt at a just a 5.2% interest rate.

The leading global cannabis-lifestyle and consumer packaged goods company, today announced the pricing of its registered offering of $150 million aggregate principal amount of 5.20% Convertible Senior Notes due 2027 (the “Notes”). Tilray also granted a 30-day option to the underwriters of the Notes offering to purchase up to an additional $22.5 million aggregate principal amount of Notes, solely to cover over-allotments. The offering is expected to close on May 31, 2023, subject to customary closing conditions.

Tilray intends to use a portion of the net proceeds from this offering to finance the concurrent repurchase of a portion of its outstanding 5.00% Convertible Senior Notes due 2023 and 5.25% Convertible Senior Notes due 2024, as described below, and the remainder of the net proceeds for general corporate purposes.

The Notes will be senior unsecured obligations of Tilray. The Notes will mature on June 15, 2027, unless earlier repurchased, redeemed or converted. Interest will accrue on the Notes at a rate of 5.20% per year and will be payable semiannually in arrears on June 15 and December 15 of each year, beginning on December 15, 2023.

Noteholders will have the right to convert their Notes into shares of Tilray’s common stock at their option, at any time, until the close of business on the second scheduled trading day immediately before June 15, 2027. The initial conversion rate is 376.6478 shares per $1,000 principal amount of Notes, which represents an initial conversion price of approximately $2.66 per share.

Source: New Cannabis Ventures

Yes, they are convertible and yes there is an embedded option value in those notes which makes the real cost higher than the stated 5.2%. They are still incredibly cheap for this sector in light of over 5% risk-free rates. The key questions from an investment point though, come down to valuation.

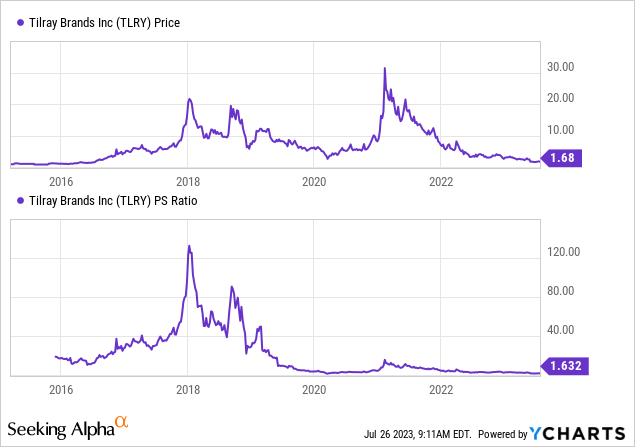

TLRY Stock Valuation & Verdict

TLRY’s performance should be a good reminder for those buying “AI” stocks today at 40 times sales and above. TLRY actually peaked at close to 90X sales and has now dropped about 99.3% from that peak. Most charts that you can find have been distorted with the reverse merger with Aphria. But the price to sales has become very reasonable and TLRY is likely to be one of the survivors of this space.

The key risk here is excess capacity within the segment coming to bite during the next recession. Most companies are focused on stream lining and improving gross margins but a price war cannot be ruled out when everyone overestimated the maximum market size so badly. TLRY is also quite far from GAAP profitability. We can adjust and massage the numbers all we like but ultimately to make a long case, you need real profits. Those won’t be coming in 2024 and possibly not even in 2025. We rate this a hold for now and think that anyone wanting some Cannabis exposure take a hard look at this fallen angel. With a strong balance sheet and disciplined spending, It might still be one of the better plays in the global market. On shorter time frames, a short squeeze might be in the works as bears might have overplayed their hand.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here