Welcome to the Autumn 2023 update of my top UK dividend stocks list.

Before we get to the list of stocks, I just want to point out a couple of things that you (assuming you’re a UK dividend investor) are probably already aware of.

UK dividend yields are unusually high

The UK is doomed, we’re a pariah and the economy will never recover. At least, that seems to be the narrative among those investors who have abandoned the UK stock market for the glamour (and low yields) of the US market.

This aversion to UK stocks has pushed UK share prices down, which makes investors sad, but it has also pushed dividend yields up, which should make income investors rejoice.

The FTSE 250, for example, is having an especially torrid time at the moment and is about flat over one year, three years, and five years (it’s actually down about 10% over five years).

This has made investing in the UK something of an unpleasant slog in recent years. However, just look at the impact that’s had on the overall dividend yield of UK mid-cap stocks.

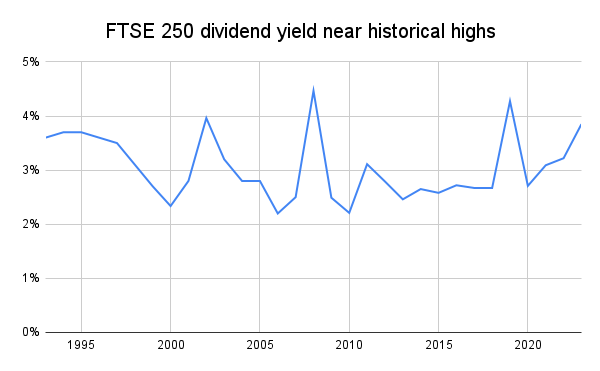

The FTSE 250’s dividend yield at the beginning of October was 3.9%. That’s comfortably above the long-term average of 3% and it’s about as high as the index’s dividend yield ever gets (other than in the depths of the 2008-2009 crash).

This is good news because, despite its simplicity, dividend yield is actually a fairly reliable indicator of value and future returns. In other words, when dividend yields are high, expected future returns are also high.

For example, in the chart above, you can see that dividend yields were high in the early 1990s, 2002, 2008, and 2020. Investors who focused on share prices were depressed because prices were falling, but investors who focused on dividend yields were happy because yields were rising.

The yield-focused investors were right to be happy because in each case, the stock market did produce excellent returns over the next few years.

Whether that will happen this time around is impossible to know, but history suggests that this should be a good time to buy UK stocks.

Dividend yields for some individual UK stocks are through the roof

While the FTSE 250’s 3.9% dividend yield is historically impressive, there are far higher yields available across a wide range of individual stocks.

For example, the average dividend yield across this top 40 list of relatively large, high-yield stocks is 6.5%. The average yield across the top 10 stocks is 8.6%. If that isn’t high-yield then I don’t know what is.

Of course, there is an elevated risk of dividend cuts and suspensions when yields are so high, but in many cases, that seems unlikely.

Although Vodafone (VOD) seems like a basket case, other stocks like British American Tobacco (BTI) and Legal & General (OTCPK:LGGNY) (both of which are in the UK Dividend Stocks Portfolio and my personal portfolio) seem to be well-placed to maintain and even grow their dividends (although, of course, no dividend is ever guaranteed).

Overall, I would say that the UK does offer rich pickings to dividend investors, and on that note, you’ll find the full top 40 list of UK dividend stocks below.

You can also download a PDF version of this list.

| No. | Company (Links to Review) | Symbol | Index | Sector | Share Price | Dividend Yield (%) |

| 1 | British American Tobacco PLC | BTI | FTSE 100 | Tobacco | £25.07 | 8.7 |

| 2 | Rio Tinto PLC | RIO | FTSE 100 | Industrial Metals and Mining | £50.35 | 8.1 |

| 3 | Vodafone Group PLC | VOD | FTSE 100 | Telecommunications Service Providers | £0.76 | 10.3 |

| 4 | Glencore PLC | OTCPK:GLCNF | FTSE 100 | Industrial Metals and Mining | £4.53 | 7.8 |

| 5 | Anglo American PLC | OTCQX:AAUKF | FTSE 100 | Industrial Metals and Mining | £21.58 | 7.8 |

| 6 | Legal & General Group PLC | OTCPK:LGGNY | FTSE 100 | Life Insurance | £2.13 | 9.1 |

| 7 | Imperial Brands PLC | OTCQX:IMBBY | FTSE 100 | Tobacco | £16.25 | 8.7 |

| 8 | Aviva PLC | OTCPK:AIVAF | FTSE 100 | Life Insurance | £3.76 | 8.3 |

| 9 | National Grid PLC | NGG | FTSE 100 | Gas, Water, and Multi-utilities | £9.32 | 6 |

| 10 | Phoenix Group Holdings | OTCPK:PNXGF | FTSE 100 | Life Insurance | £4.63 | 11 |

| 11 | BT Group PLC | OTCPK:BTGOF | FTSE 100 | Telecommunications Service Providers | £1.13 | 6.8 |

| 12 | SSE PLC | OTCPK:SSEZF | FTSE 100 | Electricity | £15.21 | 6.4 |

| 13 | M&G PLC | OTCPK:MGPUF | FTSE 100 | Investment Banking and Brokerage Services | £1.93 | 10.2 |

| 14 | NatWest Group PLC | NWG | FTSE 100 | Banks | £2.25 | 6.1 |

| 15 | Lloyds Banking Group PLC | LYG | FTSE 100 | Banks | £0.43 | 5.6 |

| 16 | Taylor Wimpey PLC | OTCPK:TWODF | FTSE 100 | Household Goods and Home Construction | £1.14 | 8.3 |

| 17 | Barratt Developments PLC | OTCPK:BTDPF | FTSE 100 | Household Goods and Home Construction | £4.19 | 8.1 |

| 18 | WPP Group PLC | WPP | FTSE 100 | Media | £7.17 | 5.5 |

| 19 | HSBC Holdings PLC | HSBC | FTSE 100 | Banks | £6.45 | 4.1 |

| 20 | abrdn PLC | OTCPK:SLFPF | FTSE 250 | Investment Banking and Brokerage Services | £1.54 | 9.5 |

| 21 | Barclays PLC | BCS | FTSE 100 | Banks | £1.54 | 4.7 |

| 22 | GSK PLC | GSK | FTSE 100 | Pharmaceuticals, Biotechnology and Marijuana Producers | £14.85 | 4.1 |

| 23 | St James’s Place PLC | OTCPK:STJPF | FTSE 100 | Investment Banking and Brokerage Services | £7.94 | 6.7 |

| 24 | BP PLC | BP | FTSE 100 | Oil, Gas, and Coal | £5.16 | 3.9 |

| 25 | Burberry Group PLC | OTCPK:BURBY | FTSE 100 | Personal Goods | £18.26 | 5.3 |

| 26 | Unilever PLC | UL | FTSE 100 | Personal Care, Drug and Grocery Stores | £40.54 | 3.6 |

| 27 | Schroders PLC | OTCPK:SHNWF | FTSE 100 | Investment Banking and Brokerage Services | £3.96 | 5.4 |

| 28 | Shell PLC | SHEL | FTSE 100 | Oil, Gas, and Coal | £25.78 | 3.4 |

| 29 | DS Smith PLC | OTCPK:DITHF | FTSE 100 | General Industrials | £2.76 | 6.5 |

| 30 | J Sainsbury PLC | OTCQX:JSNSF | FTSE 100 | Personal Care, Drug and Grocery Stores | £2.48 | 5.3 |

| 31 | Tesco PLC | OTCPK:TSCDF | FTSE 100 | Personal Care, Drug and Grocery Stores | £2.60 | 4.2 |

| 32 | Kingfisher PLC | OTCQX:KGFHF | FTSE 100 | Retailers | £2.14 | 5.8 |

| 33 | ITV PLC | OTCPK:ITVPF | FTSE 250 | Media | £0.67 | 7.4 |

| 34 | United Utilities Group PLC | OTCPK:UUGRY | FTSE 100 | Gas, Water, and Multi-utilities | £9.13 | 5 |

| 35 | Investec PLC | OTCPK:IVTJF | FTSE 250 | Banks | £4.51 | 6.9 |

| 36 | Intermediate Capital Group PLC | OTCPK:ICGUF | FTSE 250 | Investment Banking and Brokerage Services | £13.00 | 6 |

| 37 | Smurfit Kappa Group PLC | OTCPK:SMFTF | FTSE 100 | General Industrials | £26.52 | 4.6 |

| 38 | Vistry Group PLC | OTCPK:BVHMF | FTSE 250 | Household Goods and Home Construction | £8.32 | 6.6 |

| 39 | Reckitt Benckiser Group PLC | OTCPK:RBGPF | FTSE 100 | Personal Care, Drug and Grocery Stores | £57.66 | 3.2 |

| 40 | Mondi PLC | OTCPK:MONDF | FTSE 100 | General Industrials | £13.32 | 4.6 |

Keep an eye out for the next update, which will be in January.

Disclosure: British American Tobacco, Legal & General, WPP, Unilever, Schroders, and ITV are in the UK Dividend Stocks Portfolio and my personal portfolio.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here