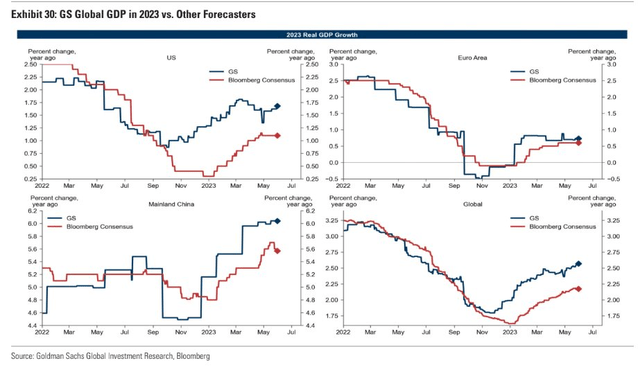

Global growth outlooks are ebbing. While the expectation isn’t for a drastic second-half recession, a sputtering economic recovery in China and some recent unsettling data points out the Euro Area cast doubts on the demand picture. Moreover, despite yet another robust US jobs report, oil prices hover near their recent lows, down more than 40% from the high in WTI and Brent from a year ago.

2023 Global Growth Outlook

Goldman Sachs

And more troubling demand news crossed the wires on Sunday. According to reports, OPEC+ is considering another round of production cuts. A supply reduction of 1 million barrels per day is on the table as the cartel seeks to stem the energy price fall. That bodes ominously for shares of TORM plc (NASDAQ:TRMD), and we saw downside price action last time OPEC+ slashed output targets.

I am initiating coverage with a hold rating given emerging technical trends and weaker global tanker rates compared to the second half of 2022.

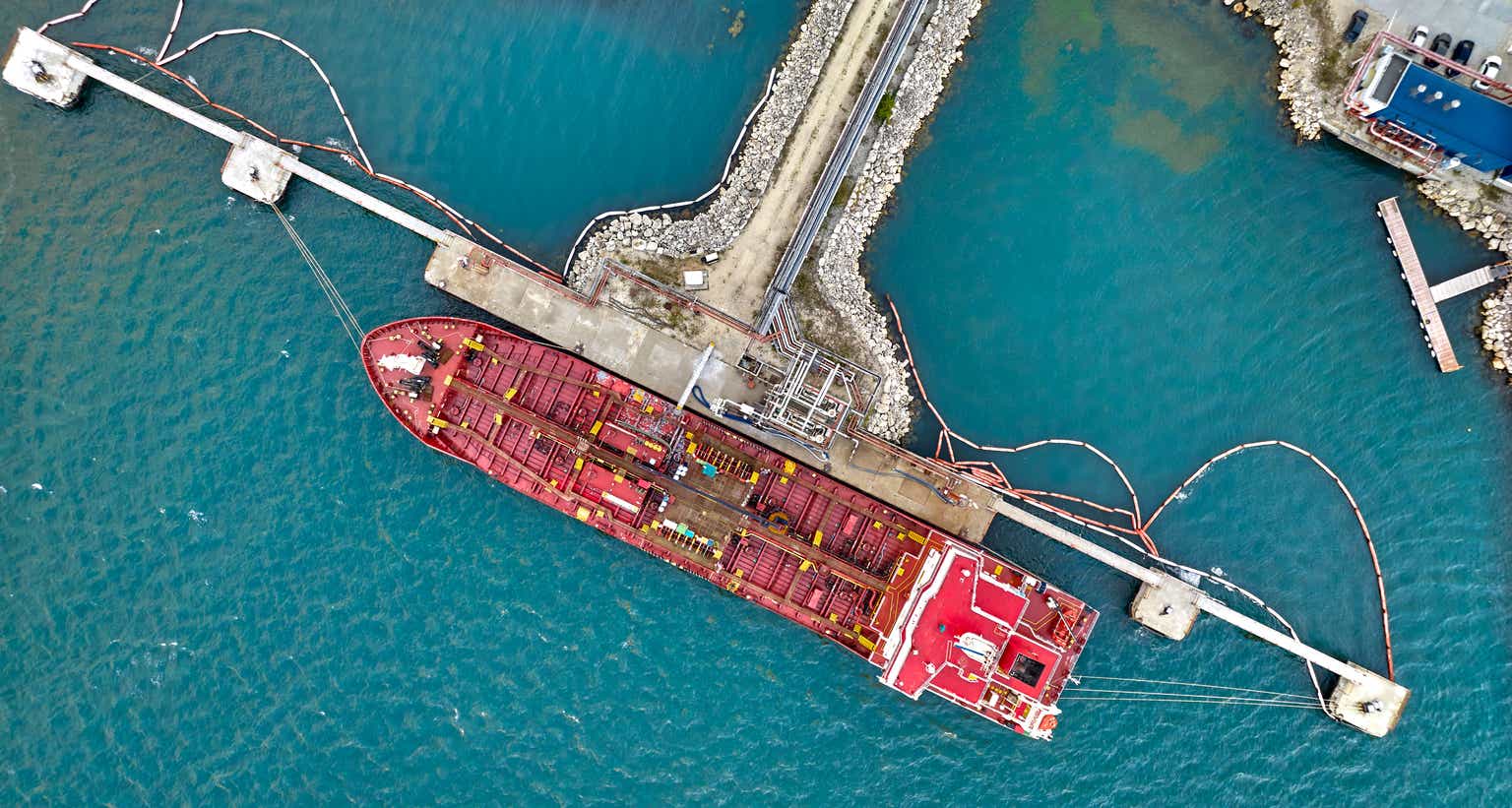

According to Morningstar, TRMD operates as a shipping company. The company owns and operates product tankers. It is primarily engaged in the transportation of refined oil products. The company transports clean petroleum products including gasoline, jet fuel, naphtha, and diesel oil, as well as other clean products. Its segments include the Tanker segment and the Marine Exhaust segment. TORM’s customers worldwide rely on its fleet of product tankers to move the gasoline, naphtha, diesel, and jet fuel that keep businesses running every day.

The $2.2 billion market cap Oil and Gas Storage and Transportation industry company within the Energy sector trades at a low 3.0 trailing 12-month GAAP price-to-earnings ratio and pays a high 23.6% dividend yield, according to The Wall Street Journal.

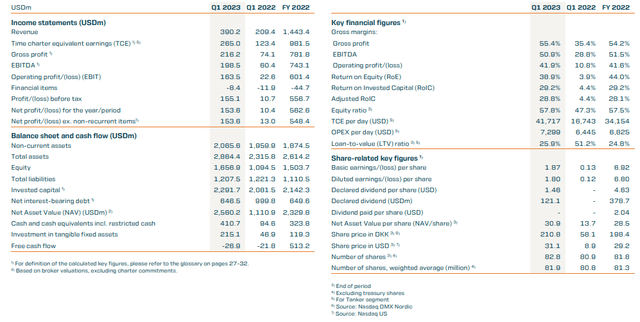

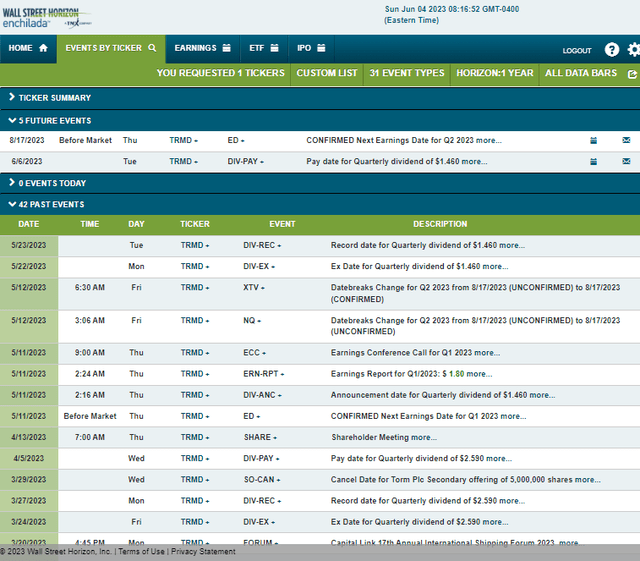

Investors are no doubt attracted to this low P/E, high-yield tanker name. But I see some future profit concerns given macro risks and firm-specific earnings trends. Last month, TORM reported a before-tax profit of $155 million, up from $10.7 million in the same period last year. A dividend pay date of June 6 is confirmed for the $1.46 per share payout.

During the quarter, the company completed acquisitions of second-hand LR1 vessels and three second-hand MR vessels, increasing TORM’s total fleet size to 88 vessels on a fully delivered basis. Particularly strong was the Q1 2023 Time Charter Equivalent (TCE) per day rate of $41,717 compared to just $16,743 last year.

TORM: Q1 Profit Results & Key Financial Figures

TORM

But with generally falling tanker rates today, it is unlikely that future earnings will be rosy. For the full year, TORM expects TCE earnings in the $1.025 to $1.375 billion range with EBITDA of $750 million to $1.1 billion. Downside risks to earnings include global economic growth contraction, refinery shutdowns, lower oil prices, political instability, and, specifically, the EU’s ban on imports and transportation of Russian crude oil and related products.

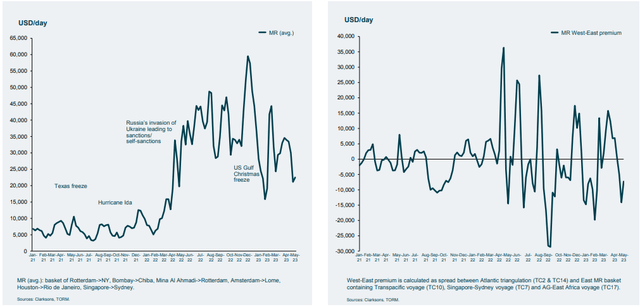

In my view, the key thing for investors to watch is freight rate trends. At the latest check, the dollar per day average global rate when diffusing together key paths is down significantly from the average seen in the back half of 2022. Should the trend continue TORM’s profits will be negatively impacted.

Geopolitical tensions leading to higher freight rate volatility

TORM

Digging into TORM’s financial position, the firm reduced its loan-to-value ratio from 51% at the end of Q1 2022 to 26% at the end of this past quarter. What’s encouraging for this firm that is somewhat reliant on debt financing is that it has extended maturities from 2026 to 2028-29, so its maturity wall is not going to hit anytime soon, providing leeway for capital allocation decisions. TORM’s debt is spread across European banks and leasing houses out of Asia, so as long as those areas remain generally stable, the firm should have no issues tapping capital markets later on.

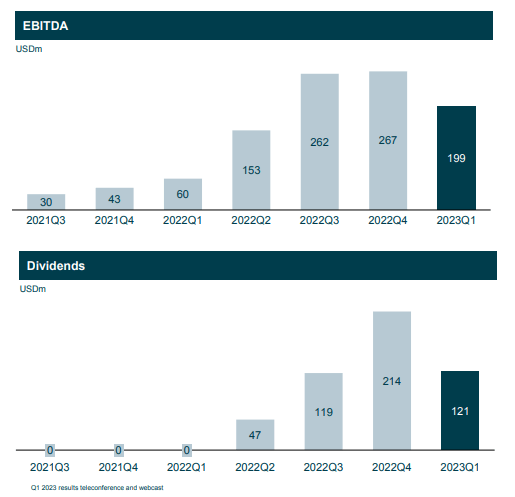

Based on the company’s Q1 cash position, $121 million in dividends are earmarked for distribution. Investors need to recognize that the firm’s payout policy can vary based on its cash balance and what is reserved for its vessels. As such, a key risk is that global demand for its fleet declines, leading to reduced operating cash flow, and a smaller dividend percentage.

Somewhat concerning is a sequential drop in quarterly EBITDA from $267 million in Q4 last year to $199 million this past quarter. Dividends were lighter compared to late last year as a result. But on a year-on-year basis, EBITDA rose from $60 million to $199 million with a surge in EPS from $0.1 to $1.9, according to TRMD’s filings.

Easing Profits, But Still Growth YoY

TORM

On valuation, $9.22 of EPS is expected in the next 12 months but should normalize future profits for a reversion to the mean in tanker rates. If we assume $4 of per-share profits, care of already-declining freight rates, and use an 8x P/E (its 5-year normal is 10), then shares should be near or just above $30 (often, higher P/Es are applied during low parts of earnings cycles as its assumed better profitability trends will begin). A lower-than-average earnings multiple is warranted during this bullish part of its market cycle. Moreover, a high margin of safety should be applied for this volatile stock in an uncertain industry.

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Thursday, August 17 BMO after this Tuesday’s dividend pay date.

Corporate Event Risk Calendar

Wall Street Horizon

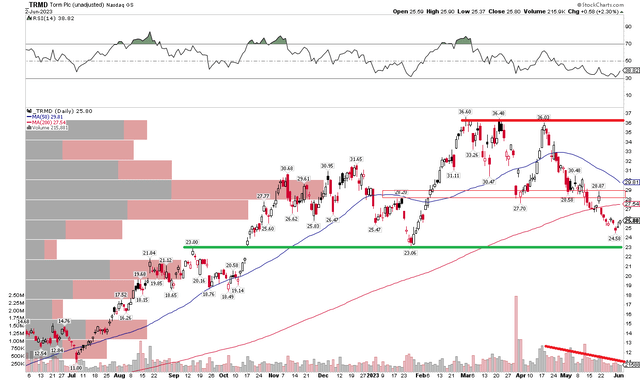

The Technical Take

With high earnings uncertainty ahead, the technical situation has turned less bullish compared to the steep uptrend investors enjoyed for much of 2022. Notice in the chart below that TRMD failed to rise above $37 on three trips up to that level. But there is also support, in my view, around $23. With shares dipping under $25 last week, that key spot is in play right now. The 200-day moving average has been sloping upward, indicating the bulls have been in charge, but it’s now flattening out while the 50-day moving average has turned decidedly downward. A bearish death cross whereby the shorter-term 50-day crosses below the 200-day would not be a sanguine technical signal.

But take a look at the volume trend – this is one indicator for the bulls to like. During this pullback, volume has generally been moving down. That tells me that the correction is just that – a correction in a longer-term uptrend.

Overall, I foresee a trading range ensuing with buyers dipping their toes in the $23 to $25 range while profits should be taken in the low to mid-$30s. So, we are near the low-end of that range today.

TRMD: $23 Support, $37 Resistance

Stockcharts.com

The Bottom Line

I have a hold rating on TORM stock. The valuation should be scrutinized given global tanker market trends and the likelihood for lower day rates to persist. With its variable dividend policy, it’s important to recognize that the currently astronomical payout will almost certainly retreat in the coming quarters. With a neutral and uncertain valuation and trading range on the chart, I see sideways and volatile price action this summer.

Read the full article here