Introduction

You are reading my 4th article on TORM plc (NASDAQ:TRMD) – one of the world’s largest transporters of refined oil products, operating in various vessel segments from Medium Range to Long Range 2 tankers.

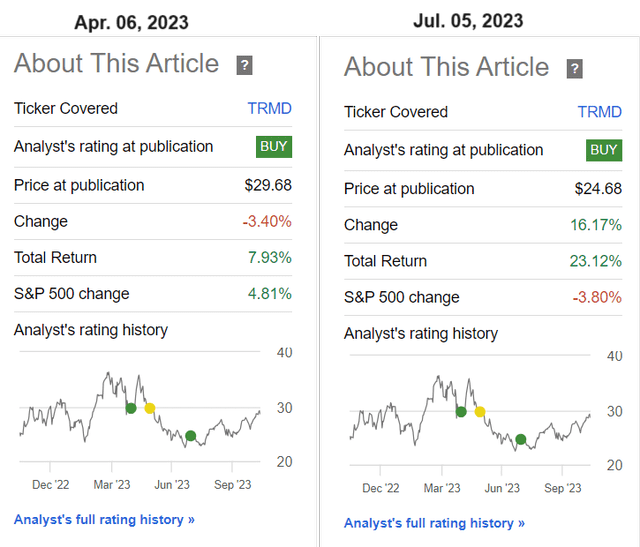

I first wrote about TORM in early April 2023, calling the stock a solid “Buy”. The last time I published an article on the company was in July 2023, after TRMD’s share price fell $5, or ~16.8%. At the time, I argued that TRMD was poised for a comeback, and as the past few months have shown, that has indeed been the case: the stock’s total return has significantly outpaced the market return even since my first article was published.

Seeking Alpha data, my TRMD coverage

Today, I’d like to update my coverage again as the tanker transportation market is changing quite dynamically and the company has managed to release its Q2 FY2023 results.

Still Strong And Getting Stronger

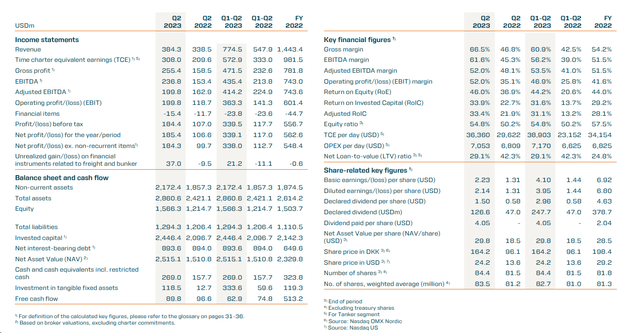

In Q2 FY2023, TORM reported its strongest performance ever, building on a strong 1st quarter. They achieved a TCE of $308 million, with an EBITDA result of $237 million (with a margin of 61.6% vs. 45.3% last year). After adjusting for unrealized gains, EBITDA increased by 23% to $199 million, and profit before tax increased by 72% to $184 million compared to Q2 FY2022:

TORM’s IR materials

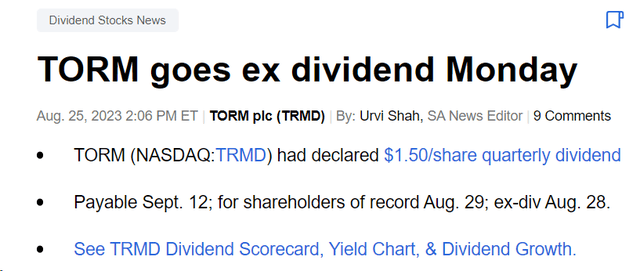

As the management noted during the earnings call, TORM’s return on invested capital amounted to 33.9% in Q2 [vs. 22.7% last year], and its balance sheet remained strong with a net LTV ratio of 29% and available liquidity of ~$497 million. The board of directors approved a dividend of $1.5 per share based on the second quarter results (already paid out):

SA News

TORM has taken delivery of several vessels and entered into collaborations to enhance their fleet’s performance. They mentioned the impact of geopolitical conflicts, EU sanctions on Russian oil products, and the shift in trade flows, – all that increase demand for product tankers and make them transport goods over greater distances.

The executives emphasize the importance of the product tanker order book, which is currently at 10% of the fleet. It’s spread across 3.5 years of deliveries, translating to a relatively low annualized growth rate (any new orders won’t be delivered before 2026). This implies that the market may not see significant new supply in the near term, supporting current rates.

So the financial outlook for the remainder of FY2023 was “bullish,” so to speak, as TORM expects significant earnings day coverage at favorable rates. As of August 14, 2023, the company had already secured 72% of its full-year earning days and 74% of its Q3 earning days. While these rates provide a foundation, TORM acknowledges the potential for market rates to vary significantly, given the low visibility of unfixed TCE rates. Their outlook for FY2023 anticipates TCE in the range of $1,050-1,175 million and EBITDA ranging from $775-900 million. These projections reflect the current fleet size, considering vessel acquisitions and divestments.

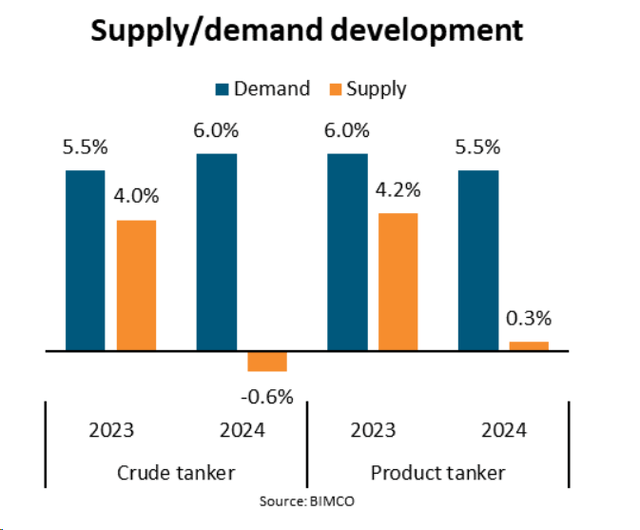

I like to check management’s statements for realism by comparing their forecasts with third-party research, and if we’re talking about shipping, BIMCO analysts, whose research is regularly publicly available, are one of the leading representatives of independent opinion [as far as I know]. Analyst Niels Rasmussen updated BIMCO’s tanker forecast for Q3 FY2023, pointing to a serious imbalance of supply and demand in this market.

BIMCO data

While time charter rates are below their late 2022 peak, they are still well above 2022 levels, and used vessel prices have increased, underscoring the strength of the market and positive future expectations. Given the limited supply growth expected in 2024 and rising cargo volumes, BIMCO’s outlook stayed optimistic. However, risks remain, with Chinese demand and economic indicators playing a key role in shaping future market conditions.

The strength of the market can be seen in the latest data and in the behavior of fleet utilization: According to Vortexa, MR utilization rates are currently at all-time highs [as of October 15]:

Vortexa [shared by Ed Finley-Richardson on Twitter]![Vortexa [shared by Ed Finley-Richardson on Twitter]](https://indebta.com/wp-content/uploads/2023/10/49513514-16977992087122316.png)

From this, I conclude that TRMD’s internal outlook is close to reality and that the company will indeed be able to achieve its projected EBITDA of $837.5 million for FY2023 [the mid-range].

Then what about valuation?

TRMD Stock Is Still Cheap

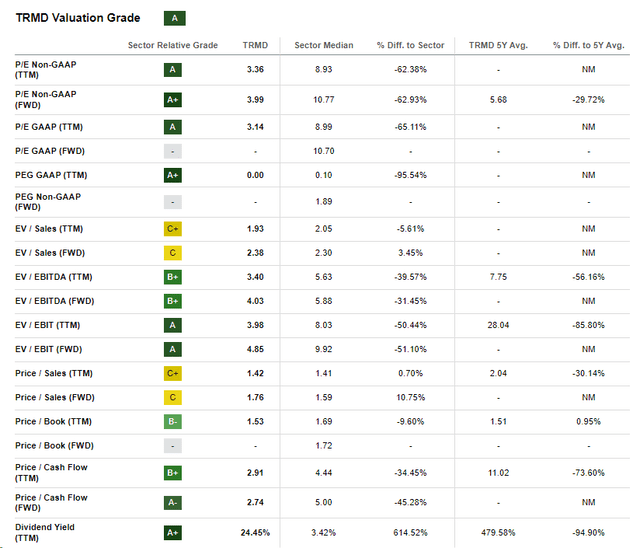

Just like a few months ago, Seeking Alpha’s Quant System, which is truly capable of picking promising stocks, gives TRMD stock an “A” Valuation grade, which is absolutely solid:

Seeking Alpha, TRMD’s Valuation

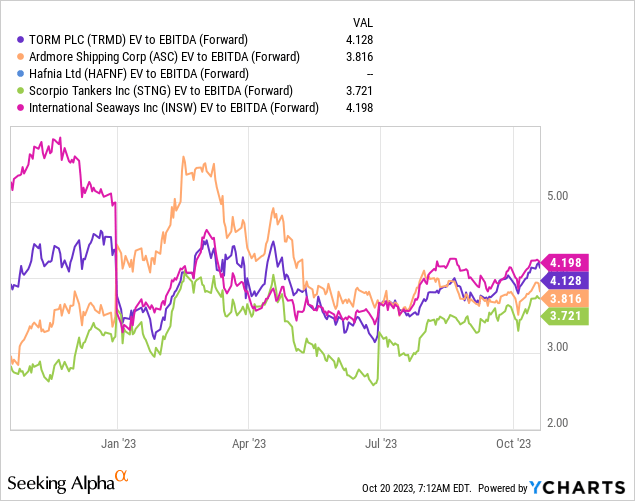

At the moment, TRMD is trading at about 4x of next year’s EV/EBITDA. Is that a lot or a little? In absolute terms, that looks cheap. But compared to the rest of the industry, it’s slightly above average:

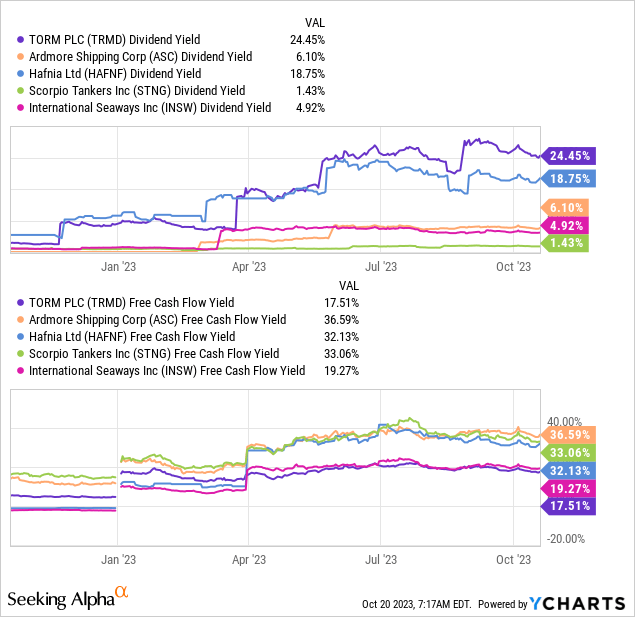

In terms of dividend yield, however, TRMD outperforms its peers, although its double-digit FCF yield is the smallest of all:

Given its huge dividend yield, TRMD still appears to be a fairly cheap option among clean tankers, and as the positive trends in the industry continue, I expect that dividend yield to be quite well protected. This should ultimately attract more income-seeking investors and drive the share price higher – those who buy early will see a much higher total return, in my opinion.

The Bottom Line

Of course, investing in TRMD stock carries several inherent risks that every investor should take into account. First off, the shipping industry’s susceptibility to market volatility and cyclicality means that TORM’s performance can be greatly influenced by fluctuations in freight rates, economic conditions, and oil prices. Regulatory and environmental compliance requirements may lead to increased operating costs, and TORM’s substantial debt could pose financial risks, especially during extended periods of low rates. Intense competition, geopolitical instability, and the potential impacts of changing interest rates and exchange rates further underscore the risk profile of investing in TRMD stock. So prior to investing in TRMD or any stock, diligent research and consideration of one’s risk tolerance are crucial.

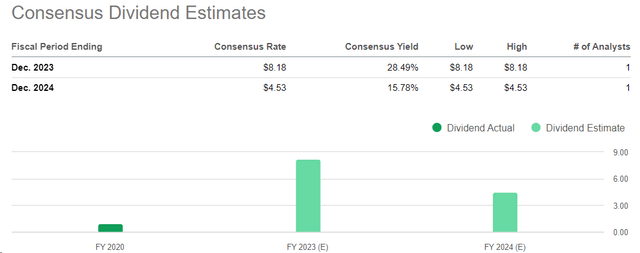

However, despite the associated risks, I remain confident that the stock rebound I anticipated for TRMD back in July is still in progress, and it is far too premature for it to halt. The current dividend yield is a result of market strength, but even if it falls to the range expected by Wall Street analysts, it is still over 15% in FY2024, which is very, very generous at the company’s current valuation of 4x EV/EBITDA.

Seeking Alpha data, TRMD’s dividend estimates

Therefore, I reiterate my “Buy” rating and expect a double-digit total return from TRMD stock over the next 12 months.

Thanks for reading!

Read the full article here