Note:

I have covered Toro Corp. (NASDAQ:TORO) previously, so investors should view this as an update to my earlier article on the company.

Last week, junior tanker operator Toro Corp. or “Toro” published its first quarterly report following the spin-off from Castor Maritime Inc. (CTRM) in early March.

Not surprisingly, the company’s Q1/2023 results have been decent as crude tanker charter rates remained strong for most of the first quarter.

In fact, Toro’s daily time charter equivalent (“TCE”) rate almost quadrupled on a year-over-year basis to $45,252 thus resulting in EBITDA of $24.1 million.

The company generated $28.6 million in cash from operating activities. Total cash and cash equivalents increased by almost 60% quarter-over-quarter to $67.9 million while debt was a paltry $11.4 million at the end of Q1.

Subsequent to quarter-end, there have been substantial changes in the company’s ownership structure and fleet composition:

On April 17, Toro sold 8.5 million new shares to an entity controlled by its Chairman and Chief Executive Officer, Petros Panagiotidis, at a purchase price of $2.29 per share for gross proceeds of $19.5 million:

Following the completion of the transaction, the Company will have 17,961,009 common shares outstanding. As a result of the transaction, Toro’s controlling shareholder, Chairman and Chief Executive Officer, Mr. Petros Panagiotidis, will, directly or indirectly, hold 47.4%of the Company’s common shares in addition to his existing holdings of 100% of the Company’s Series B Preferred Shares and, accordingly, will control 99.8% of the outstanding voting rights of Toro.

(…) Pursuant to the Subscription Agreement, Pani Corp. may not dispose of any of the Purchased Shares for a period of 180 days after the closing date of the Subscription Agreement. (…)

While diluting shareholders by 40% at a massive discount to net asset value (“NAV”) is certainly bad corporate governance, raising funds in the public markets would have likely been much worse as the CEO neither demanded a massive discount to prevailing share prices nor the issuance of warrant sweeteners.

Moreover, with the newly issued shares being subject to a 180-day lock-up, additional near-term dilution appears unlikely at this point.

On April 27, the company surprisingly announced the en-bloc acquisition of four small LPG carriers from StealthGas (GASS) for $70.7 million:

Toro Corp. (…) announces that on April 26, 2023, the Company, through four wholly owned subsidiaries, entered into agreements with an unaffiliated third-party to acquire three 2015 Japanese-built 5,000 cbm LPG vessels and one 2020 Japanese-built 5,000 cbm LPG vessel.

The aggregate purchase price for the four LPG vessels is $70.7 million.

The acquisitions are expected to be consummated upon Toro taking delivery of the vessels in the second and third quarters of this year and are subject in each case to the satisfaction of certain customary closing conditions. The Company expects to finance the acquisitions with cash on hand.

Last week, Toro took delivery of the first LPG carrier, the 2020-built Dream Terrax.

So far in May, the company has announced the sale of the vintage Aframax/LR2 tankers Wonder Avior, Wonder Polaris and Wonder Bellatrix for an aggregate purchase price of $101.6 million thus resulting in an eye-catching gain of $62.5 million which will be recorded in the company’s second quarter results.

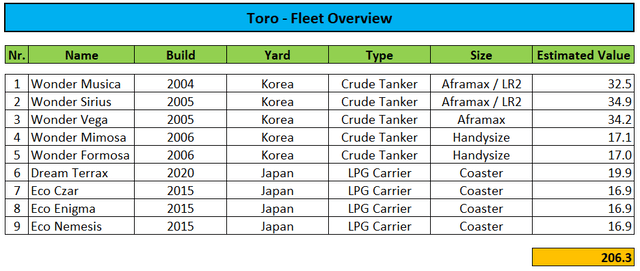

Going forward, Toro’s fleet will look as follows:

Company Press Releases, MarineTraffic.com, Tradewinds

With the earnings power of the small LPG carriers currently being a fraction of the disposed Aframax/LR2 tankers, Toro’s top- and bottom line will be impacted quite meaningfully going forward.

That said, second quarter results will include the above-discussed $62.5 million gain. In combination with net income from operations, I wouldn’t be surprised to see basic earnings per share eclipse $5.

Company Press Release, MarineTraffic.com

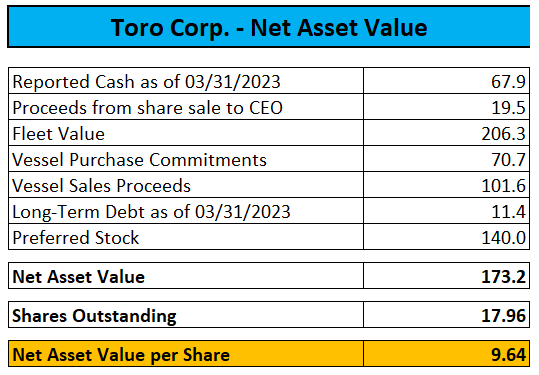

At prevailing share prices, Toro trades at a 65%+ discount to estimated net asset value which isn’t exactly a surprise given the company’s corporate governance issues outlined above.

Bottom Line

While Toro Corp. reported anticipated, strong Q1/2023 results with decent free cash flow generation, future earnings will be impacted by recent changes in the company’s fleet composition as Toro decided to take advantage of the still red hot second hand tanker market by disposing of three vintage Aframax/LR2 vessels.

At the same time, the company entered the LPG carrier market with the acquisition of four modern, but fairly small vessels from StealthGas.

As a result, Toro’s second quarter results will include a massive $62.5 million gain but earnings and cash flows are likely going to suffer in the second half of the year and beyond.

Shares continue to trade at a large discount to net asset value as market participants remain wary of the company’s corporate governance issues and potential further dilution down the road.

As I do not expect the company to reward equity holders by paying a dividend or buying back shares, I would advise long-term investors to remain on the sidelines.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here