Townsquare Media’s digital first strategy is standing out from peers.

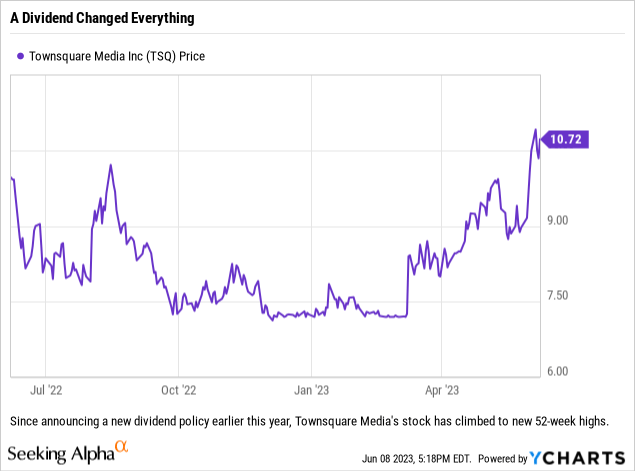

One of the best performing stocks in our portfolios this year is Townsquare Media (NYSE:TSQ), which has totally flipped its narrative and become a very intriguing story…and maybe even multiple stories. As those who read our articles know, the company has spent the last few years focusing on markets outside the top 50 metro markets in the U.S. and shifting to a digital first strategy. Earlier this year, after growing frustrated with other attempts to boost the share price over the years (via share repurchases and debt paydown), the company announced a new annual dividend of $0.75/share – to be paid quarterly at a rate of $0.1875/share.

The dividend story is nice, but Townsquare Media continues to transform itself and actually has multiple drivers behind its business now. While digital is the driving force for bringing the company into the future and growing the top and bottom lines, management has been smart to develop a multi-pronged approach to this strategy which paid off in the latest quarter.

As we covered in our last article on Townsquare Media, 2023 is going to be a year of growing pains and setting the company up for its next phase of growth. With that said, let’s look at recent results:

The Key Takeaway(s)

Townsquare’s digital transformation continues, and this quarter it was helped by the slowdown on the broadcast side of the business (broadcast revenues declined during the quarter while digital increased, thus increasing digital’s share of the company’s total revenues). It is important to first note that Townsquare Media actually saw year-over-year (or YoY) top-line growth in Q1 2023 of 2.9%. At a time when most peers are seeing both revenues and EBITDA decline, Townsquare was able to ride the strength of its digital businesses to be able to report growth in a difficult time for the ad market. Due to broadcast seeing net revenues decline 4.8%, and some issues with Townsquare Interactive on the digital side, the company did report EBITDA which was down 11.9% YoY.

It was not all good news for the company. As mentioned before, Townsquare Interactive ran into some headwinds in Q1 and saw net revenues fall 1.3% with profits falling 12.1% YoY. While this was more than offset by the Townsquare Ignite side of the digital business, which saw net revenues increase 15.4% and profits up 22.9% YoY, it is still troubling as it was never part of the plan to see the Interactive division have shrinking revenues. Yes, the expectation was that margins and profits would be compressed due to the opening of the Phoenix location which will help open new markets, but the headwinds the business was supposed to be facing were on the margin and profitability side of the business, not on the revenue side.

Analysts noticed this and when asked, management noted that they had issues with retaining some clients in the quarter. They had given some price adjustments to customers who were facing rising costs (and thus hardships), but the fact of the matter is that the company is not facing new competitors or threats which are siphoning off customers, but rather some of their small business clients are going out of business. Management mentioned that this is their number one cause for losing customers.

So while Townsquare’s broadcast advertising revenue comes under pressure like their peers (although not nearly as bad due to their large local client base (90%) v national (10%)), the digital side also faces headwinds of its own. It appears that Townsquare Ignite will carry the banner for now, but we do expect that the Interactive segment will pick back up later this year, especially on the revenue side as Phoenix ramps up operations.

Balance Sheet Adjustments

Townsquare Media’s management has done a lot in the last 12 months which we really like. Although the repurchase of bonds at prices below par was a great move in our opinion, and certainly one of the bright spots this quarter, we think the management team’s best move was simplifying the balance sheet and getting back to basics. What are we talking about exactly?

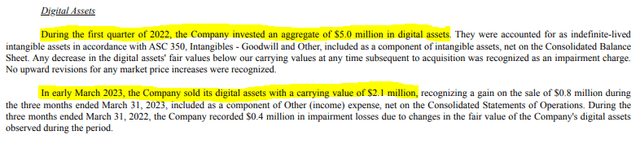

Townsquare appears to have sold off their crypto currency holdings in Q1, which is a move we have called for over the last year. (Townsquare Media Form 10-Q)

Well it looks like the company has decided to move on from the decision to hold digital assets (crypto) on the balance sheet and take the losses now to redeploy the cash back into the core business segments. Sure, the company lost over half of the investment value (initially $5 million) but this cash can now get put back to work immediately and help further optimize the balance sheet. Townsquare has a lot going for it right now, and moving on from the crypto investment is not only the right move, but shows a management team and board willing to move on from distractions that do not move the needle for the company overall. We have stated before our belief that the company should move on from this investment, so we wanted to applaud this move now that Townsquare has in fact moved on.

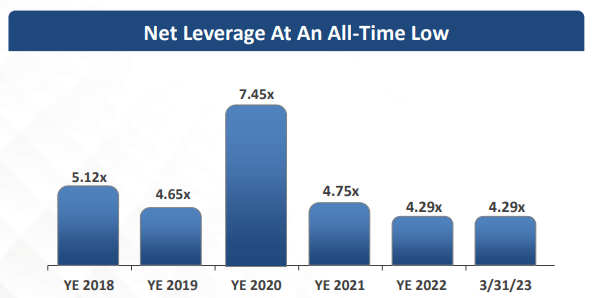

Even with TTM EBITDA declining this quarter, TSQ generated enough cash and repurchased enough debt to maintain their all-time low net leverage. (TSQ Q1 2023 Investor Presentation)

The repurchase of $12.2 million of the company’s bonds below par will save the company almost $850,000 per year in interest expense and helped keep net leverage at 4.29x (the lowest level ever for the company), even as EBITDA declined on a trailing 12-month basis. With management explaining that they would be comfortable running the company with $20 to $25 million cash on hand, and the company currently having $42 million, we think that investors might see the company buying back more of their debt in the coming quarters. Yes, the ad market is weak, but with 90% of the company’s ad dollars derived locally, and with the digital business still growing, we suspect that the company will continue to generate strong cash flows which will allow management (and the board) to continue to repay debt, reward shareholders via the strong dividend policy, and continue to invest in the overall business while some peers may be pulling back.

Moving Forward

We still think that Townsquare’s stock has room to move higher. Is it still the most compelling name in the industry that we follow? Probably not after the massive run, but it does have less risk in our opinion. We think that the market has already started to revalue the name, but that the valuation is still cheap based solely on the businesses they have today. However, we think that Barrington Research’s Jim Goss asked the question (on the quarterly conference call) that could lead many to begin to debate whether Townsquare Media should be valued more like a tech company and less like a terrestrial radio broadcast company.

Mr. Goss asked about the possibility of the Ignite business being marketed to smaller competitors outside of Townsquare’s markets. Townsquare’s CEO, Bill Wilson, explained that right now they are not focused on that, but will continue to evaluate it. We suspect that Ignite is actually the crown jewel of Townsquare and could one day make this a $1 billion+ market cap company. The only problem might be that Townsquare’s first party data component is not large enough to deliver upon this, in which case the company might have to acquire other media assets or enter joint ventures with some of the larger players in order to create the ad inventory needed to scale up and build a platform large enough to attract significant ad dollars.

The company’s guidance also looks strong, especially considering the pullback from advertising everyone is seeing from the national category. Adjusted EBITDA for the year is expected to be $100-$110 million, with net revenue in the range of $450-$470 million. So while EBITDA will be down YoY, net revenue could actually end the year higher – which would be due to the growth on the digital side. So if management’s guidance holds up over the next few quarters, then Townsquare will once again have proven to investors how resilient its business is.

Our Take

We continue to hold our Townsquare Media shares and add from time-to-time as new money comes in. We are less aggressive buyers at these levels, but recognize that getting paid a dividend which yields 7-8% (the yield in recent weeks) is quite rewarding and highlights how undervalued the shares are. If management and the board continue to deliver on their plans we do think that this stock could rise up to $20/share on improving results and the market assigning the company a higher multiple based upon the fact that about 20% of the company’s revenues are subscription based and 30% are truly tech/ad related. The moon shot is if the management team can figure out how to optimize the Ignite business and monetize it using others’ properties – which might lower margins for the business overall but would provide significant leverage to revenues and earnings going forward – only if they can scale the offering.

We remain bullish on this name, but think investors might want to buy on dips rather than buying their entire position at once. This stock does not trade on a lot of volume and even small orders can move the price during the day.

Read the full article here