It’s a very interesting time for the car industry with massive change underway. For those not paying close attention, this can mean that all is not what it seems. I’m beginning to think that we may be starting the see how major manufacturers like GM (GM) and Ford (F) may end up disappearing from the scene. I don’t think that it’s a solution for major manufacturers to lose their nerve about electrification as seems to be happening in the US.

One company, Toyota (NYSE:TM), stands firmly outside of acceptance of the coming dominance of the BEV (Battery Electric Vehicle), with Chairman Akio Toyoda claiming yesterday that penetration of BEVs will not exceed 30%. This is a pretty bold call considering that in China in 2023 BEVs made up 26% of new car sales and this is based on dramatic increase in BEV sales in 2023. Norway has 80% BEV sales. Does Chairman Toyoda think that China will suddenly stop expanding the BEV market? Toyota seeks to have it both ways with a big focus on hybrids and a currently barely existent market for hydrogen powered cars. Toyoda is a strong believer in the internal combustion engine. Toyota is riding high with reinforcement of its leading global position (top manufacturer again in 2023) and significant recovery of its share price. Here I analyze whether Toyota’s stance is sustainable and where it sits with the global shift to electrification.

Toyota does a brilliant job of marketing, but my take is that reality inevitably is going to bite even if this reality comes a little late to the US market.

Toyota claims in its “Beyond Zero Vision” that “we currently offer more low and zero emission vehicles than any other automaker.” Since Toyota offers virtually no zero emissions vehicles (just a handful of BEV vehicles and fuel cell vehicles), the way it gets to make this claim is to include conventional hybrid vehicles (no plug-in so entirely powered by gasoline) in its “electrified” low emissions vehicles category.

Toyota’s competition in the BEV market

From a US perspective the obvious competition re electrification for Toyota is Tesla (TSLA). Globally the picture is changing rapidly as China dominates global BEV manufacture. Hence I see it differently. BYD (OTCPK:BYDDF) is clearly the company that competes most closely with Toyota as it makes affordable cars that are well engineered for mass markets. Tesla will get there, but at the moment its market is at a higher price point.

BYD: I think those with a sense of history might reflect on the rise of the Japanese car industry and Toyota in particular. When Toyota first came to the US its vehicles were looked at skeptically, but with a focus on quality Toyota eventually came to a dominant position in the US market. I argue that China (many new market entrants) and South Korea (Hyundai (OTCPK:HYMTF)) are doing globally what Toyota did in the past. The new BEV entrants are clear about making quality cars that are fully electric. BYD is a key company. It isn’t bothering about the US (yet) and this means that the US electric vehicle market is a bit stranded with more expensive BEV vehicles, even as the rest of the world is adopting cheaper but yet quality BEVs. BYD has three key BEV vehicles beginning to attack global markets, initially the Atto 3 SUV, but coming now is the small Seagull town car and the compact Dolphin. The growth of these vehicles globally will be interesting as they attack cheap vehicle markets with a quality BEV.

BYD is targeting markets that Toyota expected to own with its hybrid cars. BYD is opening manufacturing in Thailand now and is following with car manufacturing facilities in Hungary and Indonesia

Tesla (TSLA): It’s easy to look at the past as a harbinger of the future and typecast Tesla as a premium vehicle maker that isn’t interested in mass markets. The point is that Tesla’s goal is to produce 20 million cars annually by 2030. This requires them to be in mass markets. I’ve argued elsewhere that Tesla has done the innovation needed to manufacture a $25,000 mass market BEV.

Toyota: Toyota’s 2023 US vehicle sales of 2,248,477 included just 14,715 BEVs; this makes clear that Toyota is not a competitor in the BEV market in the US (or anywhere else).

Toyota and “electrification”

Toyota’s strategy to manage its absence from the BEV developments is by strong marketing to seek to represent that it’s in fact a player.

Toyota claims that its 2023 sales included 657,327 “electrified” vehicles or 29.2% of its total sales of 2,248,477 vehicles. Let’s start by pulling out true “electric” vehicles (BEV, Battery Electric Vehicles), which most other manufacturers mean when they talk electric. In 2023 Toyota sold 9,329 BEVs, plus a further 5,386 Lexus BEVs, to bring the total to 14,715 BEVs or 0.7% of its total sales… that is a long way short of 29.2%. Then there were ~40,000 plug-in hybrids sold. This leaves ~600,000 hybrids sold by Toyota in 2023. Hybrids are entirely powered by gasoline. They’re not “electrified” vehicles, although they may have some electrification due to regenerative braking. Any battery in a hybrid gets charged primarily by gasoline, so forget emissions reduction in relation to hybrids, even if they are more fuel efficient.

Toyota and their contribution to emissions reductions

Toyota has superb marketing, with much of their advertising focusing on their brilliant branding which has no reference to the products that they sell, and instead asks people to buy their products based on how they view the company. It works for a lot of people. My preference when I buy a vehicle is to look into the details of what I’m buying. This led to me purchase a BYD Atto 3 BEV instead of a Toyota RAV4 hybrid. The BYD is a modern electric vehicle, with no fuel costs to me as I charge the car from my solar panels. It was cheaper to purchase than the RAV4 hybrid and it will have a much lower maintenance cost. The BYD has a robust LFP (Lithium Iron Phosphate) battery which will probably outlast the car.

Toyota has made a lot of their contribution to emissions reductions and they have produced striking graphics which makes their hybrid (not electric) vehicles seem to make a much bigger contribution to emissions reductions than a BEV does. People often accept the simple summary without understanding the logic behind it. This argument by Toyota is so entrenched that I think it’s worth making clear the assumptions behind the claims.

“Electrified diversified and beyond”

Toyota uses the above heading on its website, where it seeks to explain how its hybrid vehicles make a much greater contribution than BEVs to emissions reductions.

The image is striking with just 3.7 tons of carbon-emissions reduction from using resources to create 1 BEV. The next image shows 19 tons saved in making six plug-in hybrids, while the star of the show is conventional hybrids (entirely powered by gasoline!) where a saving of 130 tons is claimed. While it isn’t easy to discern this, the whole image and calculations are about resources used to manufacture the battery in the different vehicles. Clearly hybrids have small batteries so the battery resources used to make a hybrid are much smaller than for the battery required for a BEV. So what? To seek to relate this to emissions reductions is nonsense.

The figure is a striking marketing image but there’s no information about issues related to driving the car and how the fuel source changes emissions. The fine print leads one to a 2019 paper concerning electric range of plug-in hybrid vehicles. Frankly it is gobbledegook. I’m amazed that no one seems to have addressed this. Instead when this image is produced at a conference everyone seems to nod wisely.

The obvious point is that the resources used to manufacture a vehicle battery are a very small fraction of the emissions resulting from powering a gasoline car. Every time a hybrid is filled with gasoline the result is a significant amount of emissions that will be released. Once a BEV vehicle is built, if it’s powered from solar PV, there are no further emissions. Even if electricity comes from a very dirty coal powered grid the emissions are substantially lower than using gasoline.

I conclude that this is a figure made by a clever marketing team that bears barely any relationship to the question at hand. The point is that ~14% of global emissions come from wheeled transport and these emissions will largely disappear when cars with an Internal Combustion Engine disappear.

Toyota Australia head of Sales and Marketing Sean Hanley describes the elevator pitch about this issue for an article late last year. Hanley claimed that hybrid vehicles are a “better fit” for Australian motorists and he claims Toyota has data that shows that hybrids have better environmental benefits than BEVs. The core of the Toyota argument is about the amount of battery material in a hybrid versus a BEV (obviously less) and then that cars powered from a coal grid have more emissions. Both of these claims can be easily contested. Sean Hanley finished with the view that BEVs are “impractical” for drivers. Not surprisingly Tesla and the clean energy industry were quick to respond.

What is Toyota doing?

There’s an old saying “actions speak louder than words.” This applies to Toyota. Australia is a small market but an important one for Toyota. It’s clear that Toyota is delaying its entry into the BEV market as long as possible. The release of the bZ4X has been delayed but it will come to Australia soon. BYD entered the Australian market with the Atto 3 in the second half of 2022 (now priced at $A48,000-$A51,000) and now has two further models available, the Seal (a Tesla Model Y competitor priced at $A50,000- $A69,000) and the Dolphin (a small town car priced at $A39,000 – $A50,000). All of these vehicles are modern BEVs that are competitively priced, costing substantially less than a Tesla.

The Toyota bZ4X has been coming to Australia since 2022 and it seems that the car will finally arrive in February 2024 pitched as a challenger to the Tesla Model Y (which is priced at $A65,000-$A91,400). The price of the Toyota bZ4X is not yet known, but Sean Hanley, the Australian Toyota VP Sales and Marketing, makes clear that the company does not plan to sell aggressively in the Australian market, with 1,500 units expected in 2024. The Tesla Model Y was the best-selling car to private buyers in Australia in 2023 with 20,577 units sold. There were 13,109 Tesla Model 3 sold. The BYD Atto 3, which was launched in the second half of 2022, sold 10,794 units in 2023.

Toyota’s view seems to be that the BEV is a new thing in the market and it will take time to get serious. The price will be expensive to match the Tesla Model Y ($70,000 – $80,000?). My take is that the bZ4X might find itself competing with the BYD Atto 3 which is priced at $A51,000 (long range version). Toyota see the b4ZX as a town car, which is not how I view the BYD Atto 3 as an owner.

Overall 87,217 BEVs were sold in 2023 in Australia, up 161% from 2022. This is not the start of a long road like the Prius was. The end of the ICE (Internal Combustion Engine) is being discussed all over the world.

Toyota in Australia has a web site for the bZ4X. In a section “Transforming for a better tomorrow” there’s a section “Innovation in alternative fuels” with the following text: “Toyota’s first hybrid-electric battery vehicle was launched over two decades ago, and the technology has allowed us to produce more vehicles with reduced tailpipe emissions. Today, the second generation Toyota Mirai is powered by hydrogen fuel cells and emits only water from its tailpipe.” This statement comes in a section promoting its first BEV. Go figure…

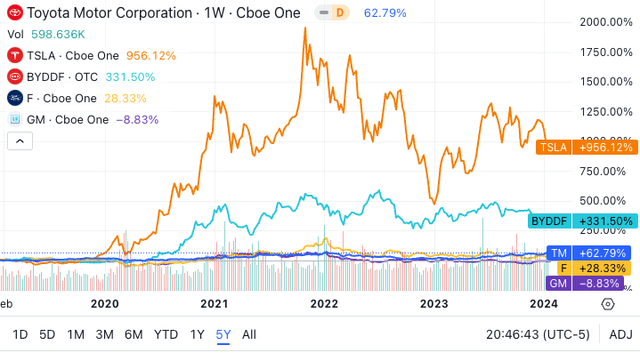

Timing is important when you look at charts

There are lots of myths about statistics and so I’m cautious about showing them. If for example you choose a five-year horizon for comparing Toyota, BYD, Tesla, Ford and GM, you see two companies (Toyota and BYD) that outperform dramatically.

5 year performance of TM, TSLA, BYDDF, GM and F (Seeking Alpha)

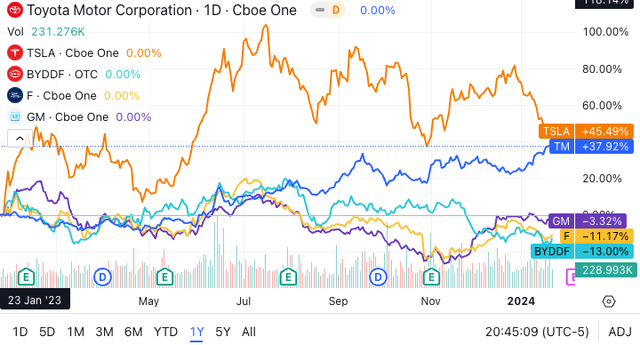

On the other hand a one-year comparison provides a different view.

1 year performance of TM,TSLA, BYDDF, GM & F (Seeking Alpha)

Tesla is still the best performer, but Toyota breaks from the pack too. BYD has performed poorly. I’m certain that the poor recent performance of BYD relates to the issues with China, especially in the US. In 2023 BYD became serious about becoming a significant global player (excepting the US) in the personal transport BEV space. In my view that means opportunity for investing in BYD although I appreciate that many US investors are cautious about investment in Chinese companies.

A word about Tesla

In comparing car companies it’s important to consider whether comparisons make sense. I don’t see Tesla as just a car company. Its CEO is a highly eccentric individual. The company doesn’t spend money on advertising, it relies on its products to sell themselves. Elon Musk does enter the public fray and it is often argued that his tweets can impact the company negatively. This seems to be happening at the moment as Musk is engaging in very public bargaining to revise his remuneration/shareholding to reflect the role he has in driving the company. Specifically he wants to increase his shareholding to 25% to reflect the contribution he sees that self-driving is going to have on the company. The alternative is to hive of the self-driving stuff into a separate company. It’s hurting the share price but for me personally it might present another opportunity for an attractive entry price. I’ve benefited in a previous Tesla investment by timing investment based in dramatic price fluctuation over a short period (245% achieved gain over seven months in early 2023).

The bigger deal for me is where Tesla’s grid-scale battery business goes. It looks interesting. Also my hunch is that things might get interesting when Tesla releases a cheaper mass market BEV. All of this is out there and I’ve discussed it elsewhere in relation to the Tesla third Master Plan day.

What the market thinks

It’s interesting that, apart from Seeking Alpha’s “strong buy” Quant rating, there is a wide range of views about Toyota, with 1 “strong buy”, 3 “buy”, 1 “hold” and 1 “sell” rating by Seeking Alpha authors in the past 90 days. The Wall Street ratings for the past 90 days is similar with 1 “strong buy”, 2 “hold” and 1 “sell”.

Conclusion

There’s a lot about the current US car market that gives a distorted view of what’s happening in the car industry. Here I’ve given my interpretation of several marketing issues surrounding electrification that Toyota has developed which might confuse investors not paying attention. I acknowledge that things appear to look different in the US and that Toyota has been successful at generating an illusion of its engagement in electrification of transport.

For reasons I’ve developed in a number of articles and reinforced here, I remain very cautious about the hype currently surrounding Toyota. I’ve addressed elsewhere why I think that two eccentric geniuses (Elon Musk (TSLA) and Wang Chuanfu (BYD)) have made unstoppable the rapid full electrification of transport. It’s a critical time as full electrification of transport starts to bite. I don’t think that this is a time for investors to be confused concerning marketing hype about the need to delay the transition.

I’m not a financial a financial advisor but I follow closely the electrification of transport. I hope that my comments might be of interest to you and your financial advisor as you contemplate investment in Toyota.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here