Recommendation

My bullish view and buy recommendation remain the same for TransDigm Group (NYSE:TDG) as one of the best businesses to own. TDG’s streak in beating consensus figures continues as investors continue to underestimate how strong the demand is for travel. This dynamic further strengthens TDG’s pricing power and its stronghold in its product as they continue to be the vendor of choice (in most cases they are the monopoly) for required parts. As such, the stock also exhibits the defensive characteristics that many investors are looking for today – which I believe is a key reason why the stock is so well-supported and reacts very aggressively to positive results (the stock went up 10% post-earnings after a 30% rally since the start of the year). While valuation appears to be at the higher end of the range, I believe TDG will continue to see support as underlying demand remains very strong.

Commercial AM

TDG’s commercial AM revenue was up 38%, which is a strong sign of the health of the travel demand recovery. Air travel grew by 43%, and business aircraft AM grew by 22%, contributing to the strength. Volumes increased by 14% quarter over quarter, and bookings surpassed shipments, further solidifying the recovery demand trend. I view the point where bookings outpace shipments as a forward-looking indicator that 3Q23 growth will continue to be strong. This is consistent with the upward trend in air traffic volume, which is still 10-15 percent below 2019 levels (as noted by management), indicating that TDG has plenty of room to expand. In fact, many qualitative factors are supporting my take that growth will continue to stay strong in the near term. However, I do believe that the global economic environment is a source of uncertainty for the Commercial AM recovery. The world has not experienced a deep recession in over a decade, and with rising prices and a healthy job market, the odds of this happening are growing daily (as the Feds are forced their hand to continue raising rates). In the worst-case scenario, TDG would be negatively affected because of the collapse in demand for air travel.

Pricing power remains strong

Because of its near-monopoly in several key aircraft-parts markets, TDG enjoys substantial pricing power that has enabled it to steadily increase prices over time. This pricing power has shown its importance in the recent inflationary macro backdrop, where it has allowed TDG to raise prices easily and sometimes even more than cost inflation, as seen from gross margin expansion, albeit margin expansion is also partially driven by consistent productivity improvements. Consistent price increases, critics say, will scare off TDG’s clientele. But the correct perspective is that consumers have little wiggle room and must inevitably accept price hikes. TDG has a monopoly on many of the aircraft parts essential to the mission, and it has a stellar reputation for reliability and on-time product delivery, both of which are highly valued by its clientele.

Capital allocation

TDG is well-known for its successful M&A strategy, in addition to its organic growth. After lulls in M&A activity, management has pointed out that things have picked up considerably in the M&A pipeline over the past few months and years. In addition to several possible asset divestiture opportunities from larger entities, there are assets in the small and medium private supplier market. TDG’s M&A strategy has historically been successful because it is highly disciplined to its framework, which requires 20%+ IRR for an acquisition. By sticking to this framework, it ensures that capital is put to return 20% IRR, which is a very attractive return profile from a shareholder’s point of view. It’s important to note that TDG has roughly $3 billion in cash on the books, and I fully expect management to put that money to good use.

Valuation

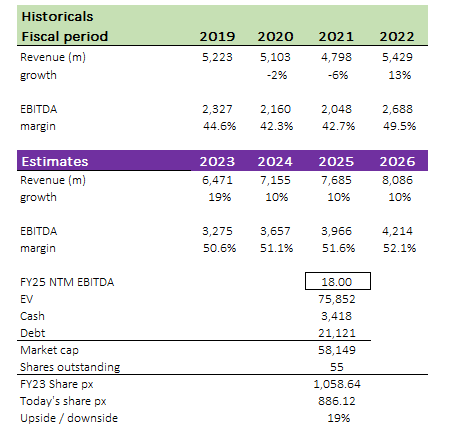

Although the upside may not be as appealing as it should be given that multiples have already been re-rated to 18x NTM EBITDA, I believe it is still attractive in the current market context. My model is based on the same FY23 estimates as management, with my own assumptions from FY24 to FY26. I expect TDG to continue growing in tandem with air travel demand and its own pricing power, allowing it to grow at a 10% annual rate. Margins should also improve as fixed cost leverage (primarily from price increases) kicks in.

Author’s model

Risks

The risk as stated above is a steep recession that decimates near-term air travel recovery, thereby putting a lid to revenue growth. This will likely cause multiples to revert down from 18x to possibly below average, resulting in a sharp drop in share price – akin to what happened during covid.

Summary

Despite the strong rally, I reiterate my buy rating for TDG. The strong demand for travel and TDG’s position as a vendor of choice in the aircraft parts market contribute to its pricing power and defensive characteristics. The commercial AM revenue growth and positive trends in air traffic volume indicate a strong outlook for TDG. Although valuation multiples have already been re-rated, TDG remains attractive considering its growth prospects. The main risk lies in a severe recession, impacting air travel demand.

Read the full article here