The last time I looked at Transocean (NYSE:RIG) in June, I said while its debt burden was an issue, that there was a path for it to repair its balance sheet as day rates rise, albeit not an easy one. As such, I thought the stock was best suited only to more aggressive investors. My “Hold” rating was based more on less indebted companies having similar day rate upside with better balance sheets. Since that time, the stock is up nearly 40%. Let’s catch up on the name.

Company Profile

As a refresher, RIG owns a fleet of drillships and semisubmersibles that are contracted out by offshore drillers. Semisubmersibles are deployed in rough sea conditions, while drillships are better for operations in calmer seas.

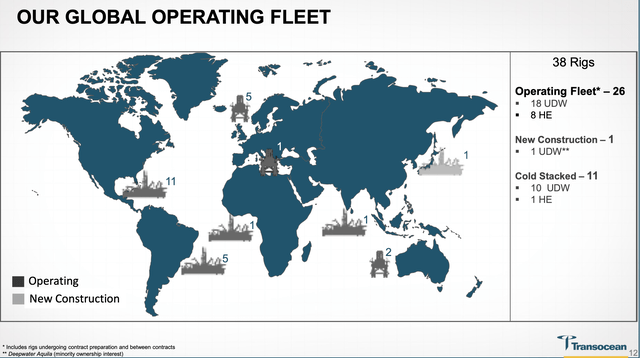

The company owned 37 vessels at the end of Q2 with an average age of about 10 years, including a vessel being built, but excluding one being sold. It had 28 ultra-deep water vessels, and 9 harsh environment vessels in its fleet. Note that 26 of its vessels are operating, 11 are cold-stacked, and one is under construction. Also one if its vessels it only has a 33% JV interest in.

Company Presentation

Offshore Drilling Recovery and Q2 Results

How RIG performs will largely be based on day rates and the continued recovery of the offshore drilling market. Between 2014 through the pandemic, the industry has had a difficult time, but with oil prices more stable and a smaller global fleet, rates have been nicely going up since 2021, when drillship fixtures averaged $232,555.

For Q2, RIG saw its average day rate climb 16% year over year to $363,000 per day, up from $312,000 per day a year ago. In Q1, its average day rate was $364,000, which was helped by a bonus conversion.

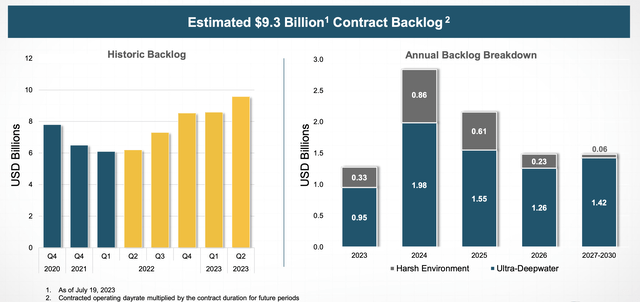

More importantly, RIG said that based on its current backlog, it expects its average day rates for Q2 2024 to be $433,000 per day. That would be a 19% increase compared to current levels.

Company Presentation

Commenting on current market conditions on its Q2 earrings call, CEO Jeremy Thigpen said:

“Not only have we increased average day rates for our ultra-deepwater fleet, we’ve also experienced a rapid tightening of the high-specification harsh environment semisubmersible market. As recently confirmed by Westwood Global Energy Group, this asset class is now effectively sold out with committed utilization at 100% for the first time since 2014. We first highlighted the emergence of new harsh environment regions on our third quarter 2022 earnings call. At that time, we predicted that the exodus of high-specification semisubmersibles from Norway would lead the Norwegian market undersupplied in 2024. Even so, we underestimated the speed and magnitude of this migration. Since then, 3 of our rigs, the Transocean Barents, the Transocean Equinox and the Transocean Endurance have moved or are preparing to move to new markets, including Australia and Lebanon. And we see more movement on the horizon as opportunities for these assets continue to develop, deepening our conviction that this market will remain tight for the foreseeable future. Compounding these supply constraints, expected demand for the Norwegian market may be nearly 20 rigs by 2025. If this work materializes, Norway will be significantly short of supply as only 12 high-specification harsh environment semisubmersibles are anticipated to remain in country through this period. As a natural consequence, day rates for harsh environment semisubmersibles have meaningfully increased since the beginning of the year and are now rapidly approaching $500,000 per day for firm work with certain price options already above this threshold.”

In addition to rates going up, contract durations have also been on the rise. Year to date, the company is seeing contract lengths for drillships of 495 days, compared to 310 days last year, a 60% increase. Semisubmersible fixtures contract durations, meanwhile, are up 18%.

With the market tightening and little newbuilds on the horizon, the company is currently looking to deploy its cold-stacked vessels by actively bidding on open tenders or through direct negotiations. RIG has 10 ultra-deepwater rigs and 1 harsh environment semisubmersibles that are currently cold stacked, 8 of which are more desirable sixth- and seventh-generation drillships. There are currently only 12 of these vessels cold stacked globally, as well as 4 stranded newbuilds without an owner. It is estimated it will cost between $75-125 million to reactive a cold-stacked vessel, compared to $200-300 million to commission one of the stranded vessels.

Debt And Balance Sheet Recovery

RIG ended Q2 with nearly $6.6 billion in net debt. Adjusted EBITDA in Q2 was only $237 million, and the analyst consensus for this year is for adjusted EBITDA of $864 million. That’s a lot of leverage, equating to about 7.5x at year-end 2023. In addition, the company is still not generating cash flow. Operating cash flow was a $157 million in the quarter, while free cash flow was $81 million for the quarter. For the year, OCF is $110 million, and FCF is -$47 million.

Interest expense was $168 million in the quarter, which was equal to over 70% of its EBITDA. The company forecasts interest expense to be $470 million for the year, which is over half its EBITDA.

Now with average day rates going up by $70,000 next year, and ~25 vessels operating, you could see Q2 2024 EBITDA rise to nearly $400 million next year, which would be a $1.6 billion run rate. That by itself would bring leverage to a more reasonable 4x.

It would also get the company to around $800 million in free cash flow, and that is an amount that would start to make a dent into its debt load.

Valuation

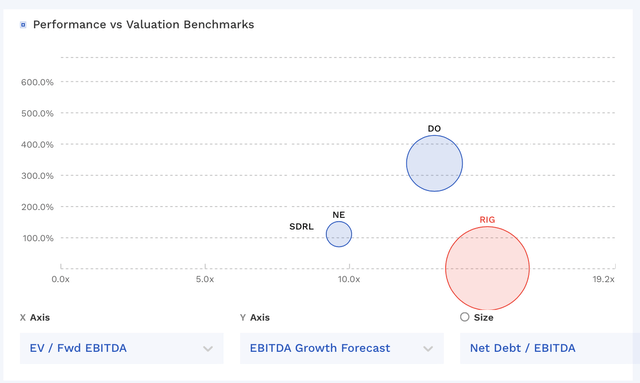

RIG stock currently trades at nearly 15x the 2023 consensus EBITDA of $864 million and 8.5x the 2024 consensus of $1.53 billion.

It trades at a forward P/E of 19.4x the 2024 consensus of 44 cents. Adjusted EPS is expected to be negative in 2023.

It’s projected to grow revenue by nearly 15% this year and over 26% in 2024.

RIG is one of the more expensive stocks among its peers, and has a higher debt/equity level than most of its peers.

Through debt reductions via free cash flow, the stock could be worth $10+. That would keep the stock around its current enterprise value, with its equity value taking the place of reduced debt. Being able to reactivate vessels from cold-stack could push that target price higher. Note that at 25 new drill ships would cost around $15 billion, just above the $13 billion EV for RIG.

RIG Valuation Vs Peers (FInBox)

Conclusion

At this point, it has become much clearer that the RIG deleveraging story is likely going to work and that the company should be in much better shape by the end of 2024. With where its backlog is showing day rates, its EBITDA and FCF should increase substantially and it will able to start making nice progress reducing debt. It could also have a nice opportunity to bring some of its vessels back from cold stack, which could further boost results.

The key risks to the name would be a negative shift in day rates, which seems unlikely in the near term at this point, and the company’s debt load. RIG operates in a cyclical industry, so it will really need to work on lowering its debt to reduce a risk that has seen companies in this space go under during past periods of cyclical weakness. Given the drillship supply-demand dynamics and current oil prices, the market remains on an upswing, but a crash in oil prices could change that.

Its valuation is one of the highest in the sector, despite its higher debt load. The deleveraging story works, although its valuation does partly reflect this at this time. RIG is eventually an over $10 stock over the next couple years if it just keeps its EV where it is as debt come down. That’s just not a big enough return for me to change my rating at this time. How the stock wins from here is getting those cold-stacked vessels back into service, so that is something to watch out for going forward. I could move to a “Buy” at a cheaper valuation or on signs that it is able to start reactivating these cold-stacked rigs.

Read the full article here