Introduction

Last month, I wrote an article titled Republic Services (RSG): Turning Trash Into Wealth, which highlighted the company’s efforts to turn an emerging commodity into an even bigger source of income: trash.

In this article, we’ll dive into the biggest waste management company in the United States, Waste Management (NYSE:WM). This company isn’t just a trusted dividend growth stock with a phenomenal track record, but it is also a company that is about to perfect the art of turning trash into gold.

I believe that WM offers a compelling investment case for conservative dividend growth investors.

With that said, let’s dive into the details!

Turning Trash Into Gold

With a market cap of $67 billion, Waste Management is the largest company in its industry. The company manages waste at every stage, from collection to disposal, with a focus on recycling and resource recovery.

WM owns or operates 259 landfill sites, the largest network in North America, and manages 337 transfer stations that facilitate efficient waste transportation.

The company also utilizes waste-to-energy technology by recovering landfill gas and converting it into electricity. This technology is increasingly important, as waste isn’t just a direct source of income for companies like WM, but a commodity that can be value-adding when treated properly.

Earlier this year, the Wall Street Journal highlighted Waste Management’s plans to become a natural gas producer. In this case, renewable natural gas (“RNG”) from the waste it collects.

Wall Street Journal

The paper noted that WM announced plans to invest $825 million over the next four years to convert methane from garbage dumps into biomethane, a renewable natural gas substitute. The company aims to bring 17 new projects online across the United States and Canada by 2026, in addition to the 16 projects it currently operates.

- Waste Management plans to utilize the investment to power its fleet of natural-gas vehicles with biomethane by 2026, thereby reducing its own emissions.

- The company also intends to sell the gas to utilities, industrial firms, and organizations seeking to enhance their environmental credentials. The demand for renewable natural gas is strong among companies and governments aiming for decarbonization, and pricing premiums vary, with landfills typically offering the least expensive source.

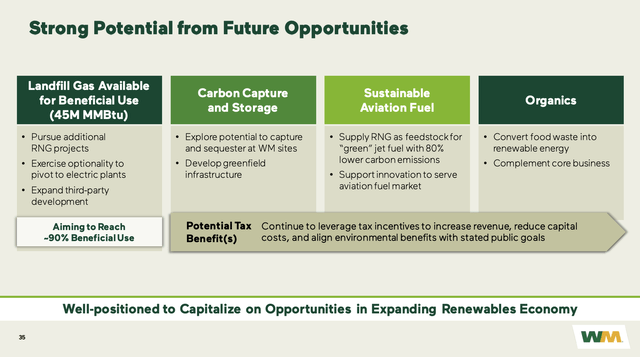

Furthermore, RNG can be used in a wide range of other uses like sustainable aviation fuel.

Waste Management

So far, 75% of the company’s fleet runs on compressed natural gas (“CNG”), with approximately 35% of that running on RNG. As Waste Management brings new RNG plants online, it aims to close the loop on a significant portion of its fleet, potentially reaching over 90% CNG utilization.

With that said, the company’s investment requirements are part of its bigger capital allocation plan, which favors dividend investors as well.

Dividend Investors Remain In A Great Spot

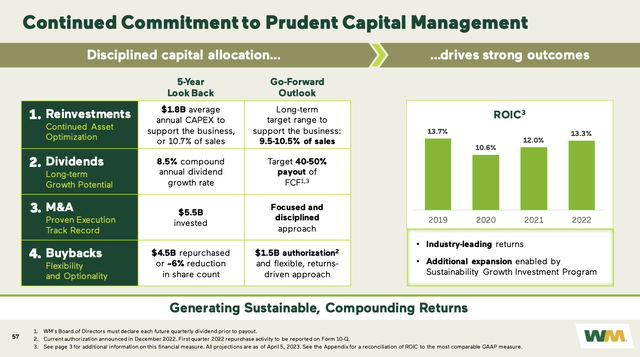

When it comes to capital deployment, Waste Management follows a consistent approach.

- The dividend payout ratio is considered paramount, with a target payout ratio range of 45% to 50%, which is a common payout ratio.

- Once that has been taken care of, the company focuses on mergers and acquisitions (M&A) and share buybacks.

- With regard to the aforementioned investments in RNG, Waste Management has allocated over $2 billion to sustainability investments, with a significant portion dedicated to renewable energy projects.

- These investments include RNG plants, with a conservative payback period of approximately three years, and recycling plants, with a payback period of five to six years.

- While predicting M&A is tricky (read: impossible), recent cost pressures, supply chain issues, and labor challenges have created potential opportunities for acquisitions as some market participants explore fleet recapitalization or divestment.

Waste Management

With that said, Waste Management is also prone to higher inflation. However, the company is managing these things very efficiently.

In the first quarter, adjusted operating EBITDA grew nearly 4%, and operating EBITDA in the collection and disposal business grew 7%. Pricing exceeded expectations, with a strong core price and improvement in collection and disposal yield.

Thanks to these developments, free cash flow and free cash flow before sustainability growth investments are on track to meet full-year guidance. According to the company:

For the remainder of 2023, our outlook remains consistent with the full-year guidance provided at the beginning of the year, including adjusted operating EBITDA growth of 7% at the midpoint and between 40 and 80 basis points of adjusted operating EBITDA margin expansion, driven by our collection and disposal business.

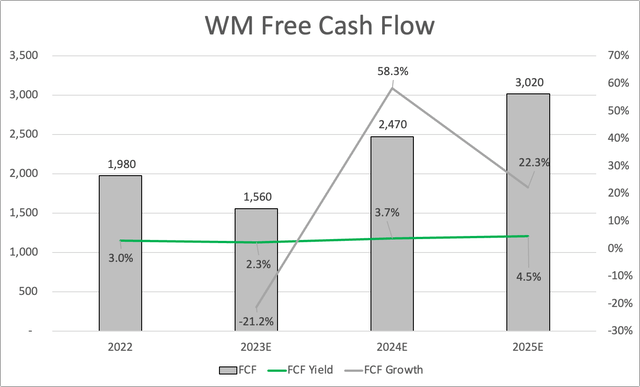

The only reason why free cash flow is expected to fall on a full-year basis is a boost in CapEx from $2.6 billion in 2022 to $3.1 billion in 2023. After this year, free cash flow is expected to rise rapidly to $3.0 billion, which would be 51% above 2022 levels and imply a 4.5% free cash flow yield.

Leo Nelissen

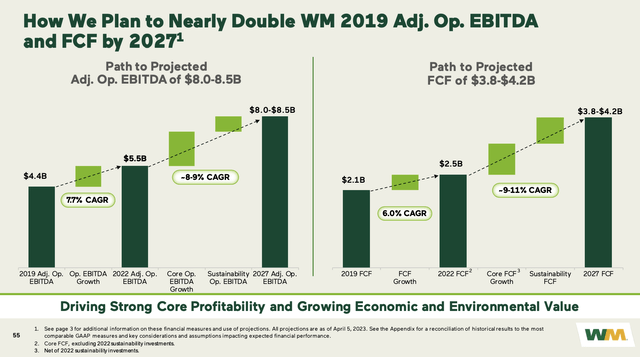

Even better, management expects free cash flow to rise to at least $3.8 billion by 2027, which implies at least 9% annual compounding free cash flow growth using 2022 as a starting point. Please note that the 2022 free cash flow number in the chart below differs from the number used in my chart (the one above). The difference is that WM excludes investments in sustainability projects.

Waste Management

These numbers, including strong organic growth, not only mean that despite investments in renewables, the company can maintain strong dividend growth to support its investors.

After all, the company has a healthy balance sheet with leverage below its guidance. This means it does not have to prioritize debtholders over shareholders. According to the company:

Our leverage ratio at the end of the first quarter was 2 times, which is well within our target ratio of between 2.5 and 3 times. About 18% of our total debt portfolio is at variable rates and our pretax weighted average cost of debt for the quarter was about 3.7%. Our balance sheet is strong, and we remain well-positioned to fund growth investments.

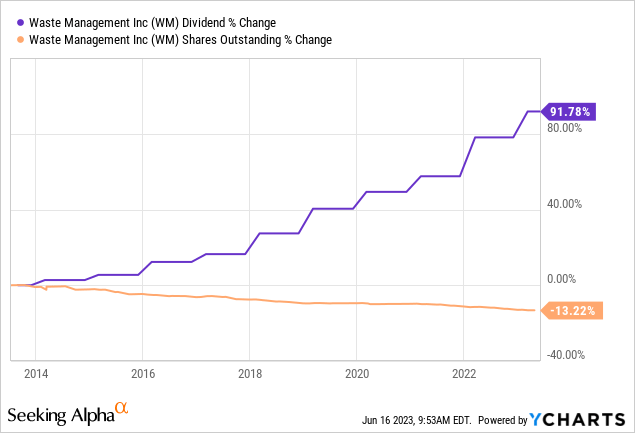

With regard to its dividend, the company has a 1.7% yield. That yield isn’t something to write home about for income-oriented investors. However, it’s backed by a 47% payout ratio, steadily increasing free cash flow (we just covered that), and a management that is willing to stick to its payout ratio. Hence, over the past five years, this dividend has been hiked by 8.7% per year – on average. On February 6, the company announced a 7.7% hike.

Furthermore, in December, the company announced a $1.5 billion buyback program. Since 2013, the company has bought back 13% of its shares.

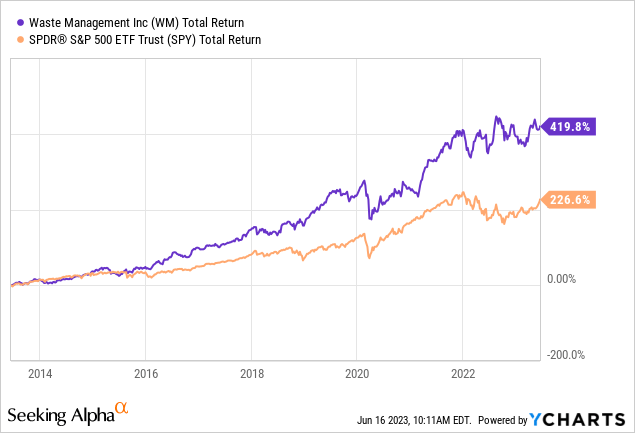

The bulletproof business model and consistently rising shareholder returns have allowed the company to outperform the market by a wide margin in the past. I expect that to continue.

So, what about its valuation?

Valuation

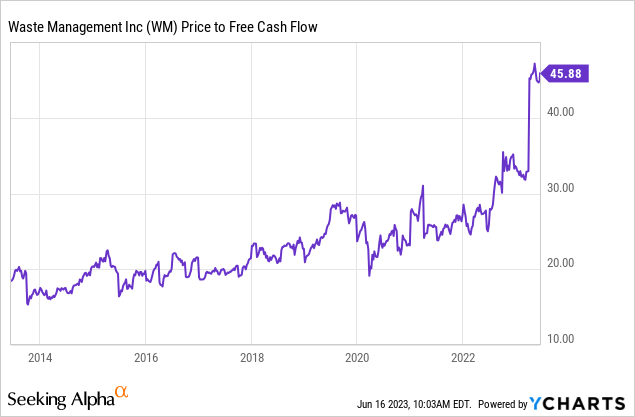

Using free cash flow multiples, the company has become increasingly expensive over the past ten years, with the LTM free cash flow multiple reaching 46x, as a result of higher investments in sustainability projects.

However, incorporating the benefits of these investments and moderation in CapEx needs, the company is expected to generate close to $2.5 billion in free cash flow next year. This would lower the free cash flow multiple to 27x. Using 2025 numbers, that valuation drops to 22x FCF.

In other words, the current expected trajectory in free cash flow shows that shares are fairly valued. The problem is they are not attractively valued.

With that said, the current consensus price target is $176, implying a 6% upside. I think that’s fair, given the current valuation.

However, personally, I want to see shares come down before considering buying them. As much as I like this business model with secular growth potential, I’m not a fan of paying fair value for something. I want better deals. Even if that sometimes means missing out on opportunities.

I put the stock on my watchlist, as I would love to add them to my portfolio at some point.

Takeaway

In conclusion, Waste Management presents a compelling investment case for conservative dividend growth investors. As the largest waste management company in the United States, WM has established itself as a trusted dividend growth stock with a phenomenal track record. However, what sets WM apart is its innovative approach to turning trash into gold.

By investing in renewable natural gas projects and embracing waste-to-energy technology, WM is capitalizing on the growing demand for sustainable solutions.

Furthermore, WM’s capital allocation strategy prioritizes dividend payouts, mergers and acquisitions, and share buybacks, ensuring favorable returns for investors.

The company’s robust financial performance, strong organic growth, and manageable leverage provide a solid foundation for dividend growth and shareholder returns.

While the current valuation may not be attractive, with shares considered fairly valued, I’m keeping an eye on WM for potential buying opportunities down the road.

Read the full article here