A Quick Take On Tremor International

Tremor International Ltd (NASDAQ:TRMR) reported its Q2 2023 financial results on August 17, 2023, missing both revenue and EPS consensus estimates.

The firm operates an online advertising system for both the buy side and sell side of the market.

I previously wrote about Tremor with a Hold outlook.

Given the recent forward revenue guidance drop and ongoing challenges in advertising spending, I remain Neutral [Hold] on Tremor International Ltd stock.

Tremor International Overview And Market

Israel-based Tremor helps advertisers and website owners to buy and sell online advertising capacity via its automated marketplace.

Management is headed by CEO Ofer Druker, who has been with the firm since November 2017 and was previously CEO of Matomy Media Group.

The company’s primary offerings include:

-

DSP – Demand Side Platform.

-

DMP – Data Management Platform.

-

SSP – Supply Side Platform.

-

Analytics.

The company seeks customers with large global brands, ad agencies and publishers across various major industries including financial, consumer, healthcare, entertainment, retail, and others.

According to a 2023 market research report by Mordor Intelligence, the global market for online advertising was an estimated $210 billion in 2022 and is expected to reach $390 billion by 2028.

This represents a forecast CAGR of 10.9% from 2023 to 2028.

The main drivers for this forecasted rise are an increase in internet penetration and wider adoption of smartphones amid an ongoing shift from traditional to digital advertising by brands.

The COVID-19 pandemic also shifted demand forward after an initial slowdown.

Major competitive or other industry participants include:

-

Roku.

-

Viant Technology.

-

Samsung.

-

MediaMath.

-

Magnite.

-

PubMatic.

Tremor International’s Recent Financial Trends

-

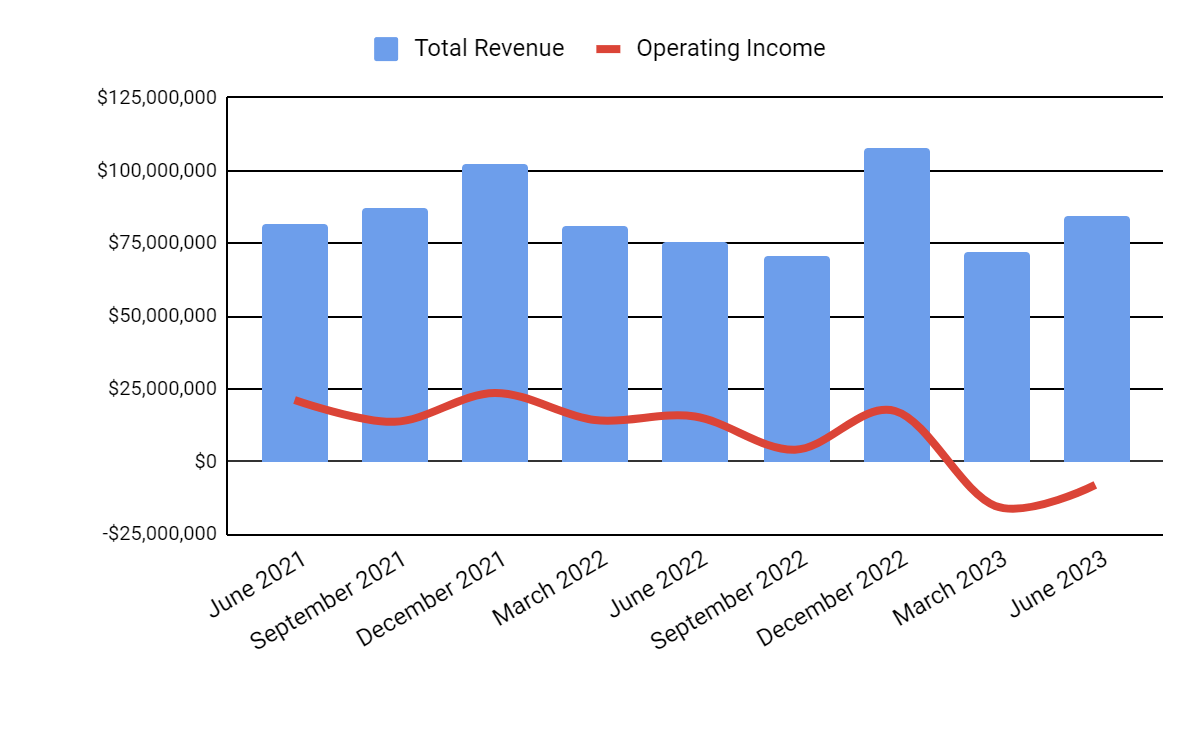

Total revenue by quarter has grown unevenly in recent reporting periods due to faltering advertising budgets from customers; Operating income by quarter has turned materially negative in recent quarters as SG&A expenses have remained elevated:

Total Revenue and Operating Income (Seeking Alpha)

-

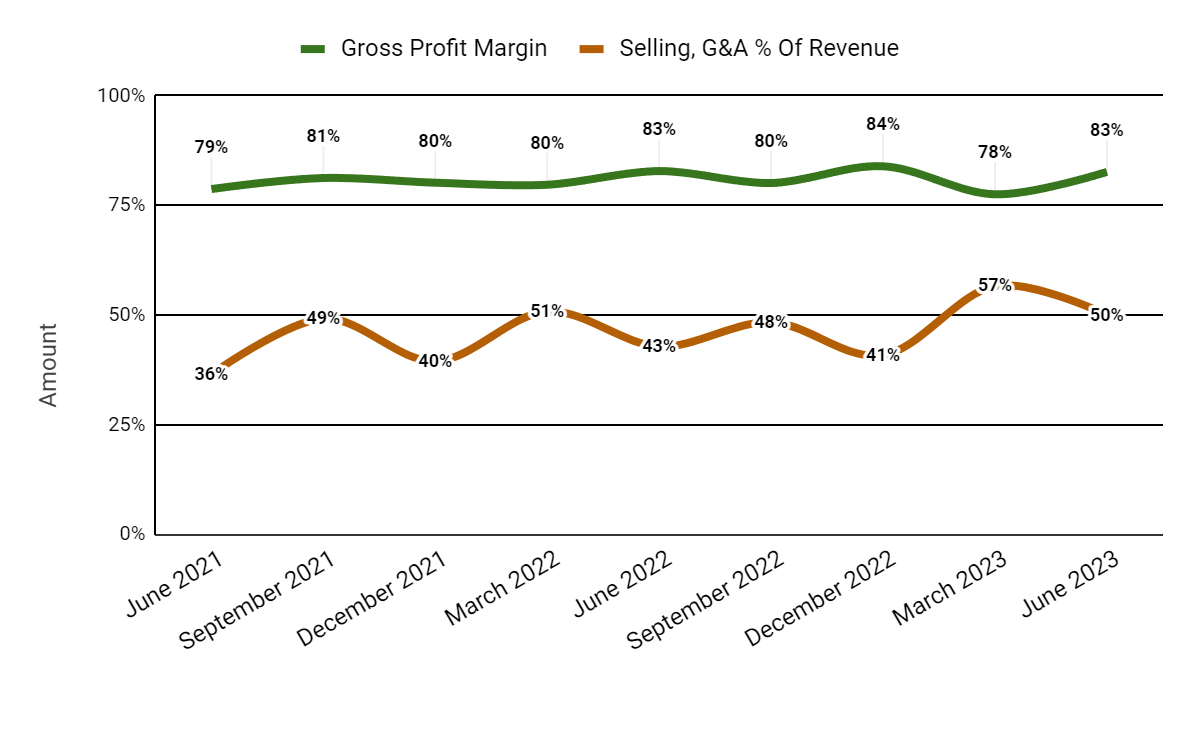

Gross profit margin by quarter has varied within a narrow range; Selling and G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarters, indicating reduced efficiency in generating incremental revenue.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

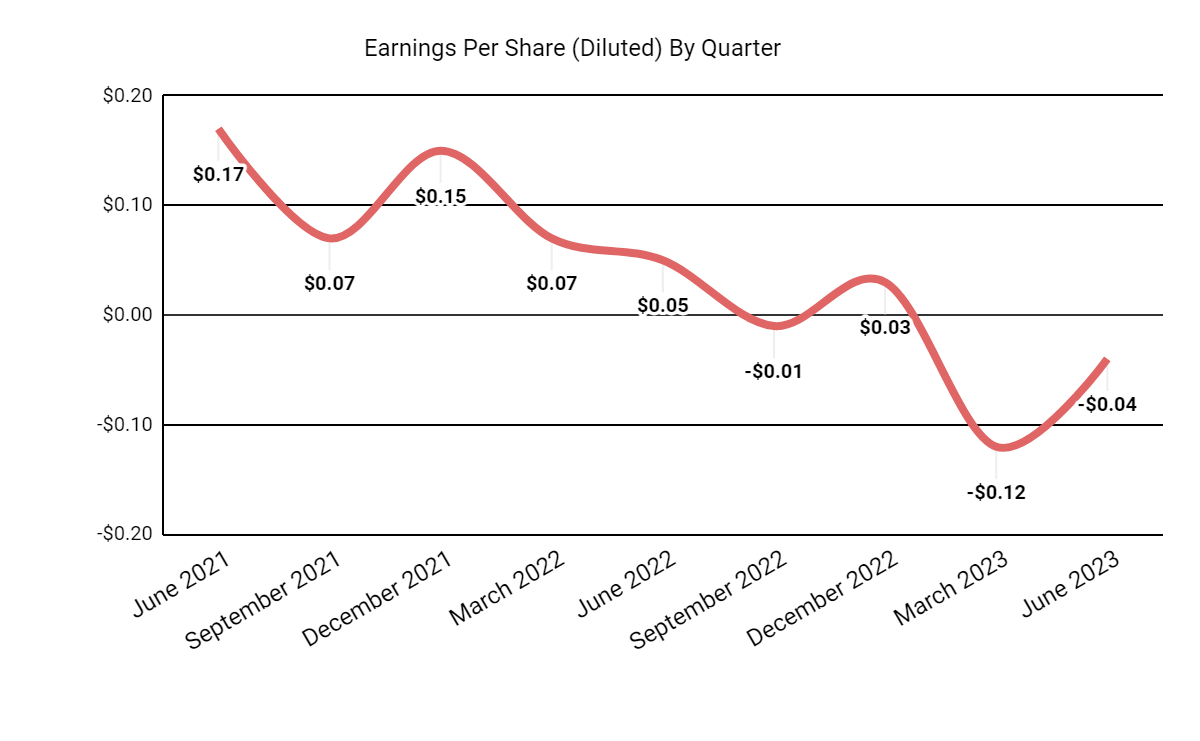

Earnings per share (Diluted) have trended lower into negative territory in recent reporting periods due to worsening operating results and lower client spending budgets:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is IFRS).

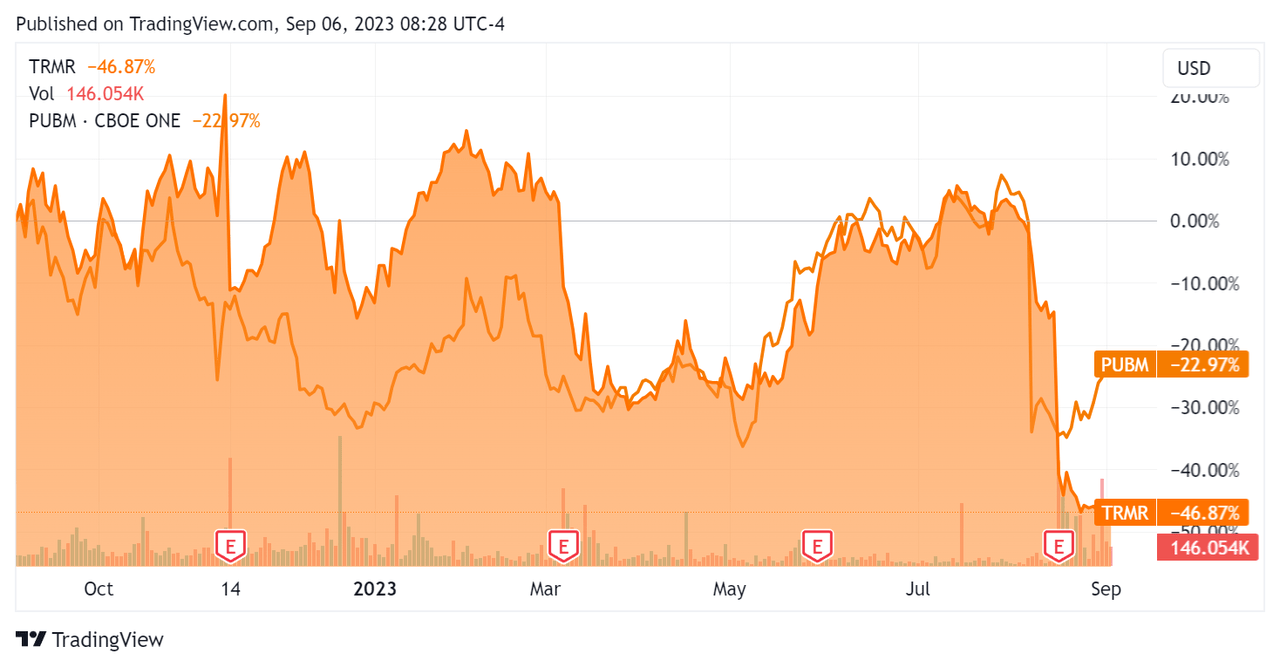

In the past 12 months, TRMR’s stock price has fallen 46.87% vs. that of PubMatic, Inc.’s (PUBM) drop of 22.97%:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $195.0 million in cash and equivalents and $98.8 million in total debt, none of which was classified as current.

Over the trailing twelve months, free cash flow (“FCF”) was $32.8 million, during which capital expenditures were $7.7 million. The company paid $32.7 million in stock-based compensation (“SBC”) in the last four quarters, the lowest trailing twelve-month figure since Q3 2021.

Valuation And Other Metrics For Tremor International

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.7 |

|

Enterprise Value / EBITDA |

4.8 |

|

Price / Sales |

0.9 |

|

Revenue Growth Rate |

-3.4% |

|

Net Income Margin |

-5.8% |

|

EBITDA % |

14.1% |

|

Market Capitalization |

$282,340,000 |

|

Enterprise Value |

$227,010,000 |

|

Operating Cash Flow |

$40,540,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.14 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be sell-side only company PubMatic; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

PubMatic |

Tremor Int’l |

Variance |

|

Enterprise Value / Sales |

2.2 |

0.7 |

-69.1% |

|

Enterprise Value / EBITDA |

17.2 |

4.8 |

-72.1% |

|

Revenue Growth Rate |

2.5% |

-3.4% |

–% |

|

Net Income Margin |

1.8% |

-5.8% |

–% |

|

Operating Cash Flow |

$76,030,000 |

$40,540,000 |

-46.7% |

(Source – Seeking Alpha)

TRMR’s most recent unadjusted Rule of 40 calculation dropped to 10.7% as of Q2 2023’s results, so the firm is in need of improvement, per the table below:

|

Rule of 40 Performance (Unadjusted) |

Q4 2022 |

Q2 2023 |

|

Revenue Growth % |

2.0% |

-3.4% |

|

EBITDA % |

23.4% |

14.1% |

|

Total |

25.4% |

10.7% |

(Source – Seeking Alpha)

Sentiment Analysis

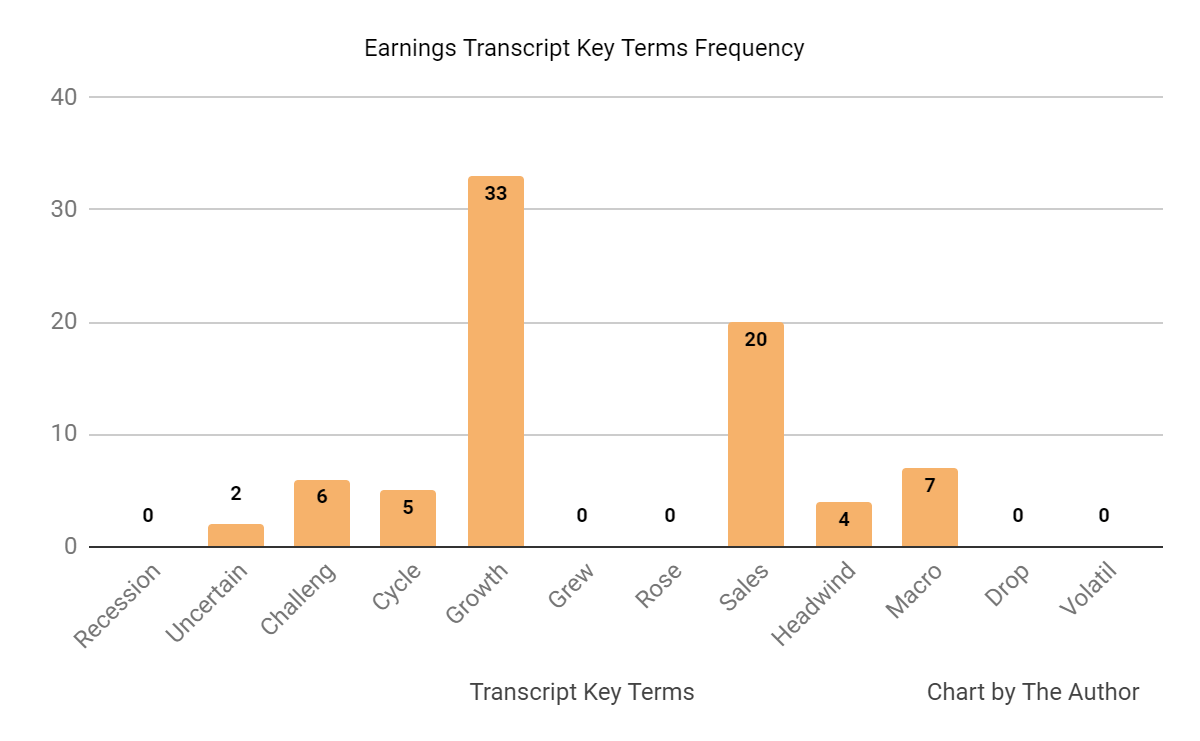

The chart below shows the frequency of keywords in the firm’s most recent earnings conference call:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

The earnings transcript showed a number of instances for various negative terms such as Uncertain, Challeng[e][es][ing], Headwind, and Macro, indicating the company is facing various challenges.

Analysts asked company management about how the macro environment was affecting the firm’s business.

Management responded that the company was seeing advertisers delaying campaigns and media budgets being reduced.

Also, the integration of its Amobee acquisition was recently completed, but that process has lengthened sales cycles. Demand-side customers and supply partners take longer to ramp up versus supply-side customers.

However, longer sales cycles for demand-side customers have the usually beneficial effect of greater lock-in and more stable and predictable revenue over the longer term.

Management believes that while the firm is more quickly susceptible to macroeconomic condition-driven pullbacks by advertisers, it can also bounce back more quickly from a recovery.

Commentary On Tremor International

In its last earnings call, covering Q2 2023’s results, management highlighted the rebranding of its major products and platforms under the name “Nexxen” in order to ‘simplify our story to the market.

Leadership believes that with the integration of the larger Amobee acquisition, it has had success in optimizing its cost structure and intends to make additional cost reductions in the second half of 2023.

The firm has also focused its efforts on adding new connected TV capabilities to its platform and continues to add hundreds of new supply partners in several verticals and formats “including CTV, broadcast TV, live sport and gaming.”

Leadership is also continuing to invest in VIDAA and its growing relationship with Hisense.

Management didn’t disclose any company, customer, or revenue retention rate metrics.

Total revenue for Q2 2023 rose 11.1% year-over-year and gross profit margin fell 0.2%.

Selling and G&A expenses as a percentage of revenue increased 7.1% YoY and operating income was negative ($8.0 million).

The company’s financial position is solid, with plenty of liquidity, some long-term debt and materially positive free cash flow.

TRMR’s Rule of 40 performance has worsened from Q4 2022.

Looking ahead, management reduced its full-year guidance substantially, with consensus estimates of revenue growth at only 2%.

Regarding valuation, in the past twelve months, the firm’s EV/Sales valuation multiple has produced high volatility, as the chart from Seeking Alpha shows below:

EV/Sales Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include improved customer and prospect acceptance of its new capabilities and rebrand.

However, TRMR’s exposure to the fickle advertising market and its recent sharp reduction in forward guidance means the upside potential for the stock is unlikely in the near term.

My outlook for Tremor International Ltd in the near term is Neutral [Hold].

Read the full article here