Introduction

I believe TSMC (NYSE:TSM) is a buy ahead of the company’s earnings report on October 19th. In August, I had a buy rating on the company, and at the time my argument was that the broader semiconductor market is recovering creating a potential tailwind for TSMC as TSMC has a unique and integral position in the semiconductor fabrication market. I continue to stand by this argument. TSMC still holds a unique and vital position in the industry, but I would like to update the state of the semiconductor market and its implications for TSMC as the market has shown a more definitive sign of recovery. Numerous data, including Taiwan’s export data, industry peer forecast, and monthly sales data, all indicate that the downtrend in the semiconductor business cycle is over. As such, because of TSMC’s dominant position in the market, I believe the company will enjoy a strong recovery tailwind in the coming quarters. Therefore, I am reiterating my buy rating on the company ahead of the earnings report as I believe the results and the management’s views will be bright.

Emerging Positive Data

In my previous article, my opinion was that the semiconductor industry trough is behind us, citing the management team’s future expectations along with industry peer’s future expectations. However, there were not many data points that have pointed to back this claim, as the business cycle was still in the transition phase. However, as of today, initial firm data pointing towards the recovery taking shape is starting to arise.

First, Taiwan’s September export data rose for the first time in 13 months. Due to the global decline in demand for durable goods especially consumer electronics, Taiwan, heavily reliant on TSMC for its economic growth (15%), has experienced a lackluster export data. However, as semiconductor demand through consumer electronics, AI, and data centers increases, the country’s monthly export results are showing firm signs of recovery. Regarding the initial signs of recovery, the Taiwanese government has said that they expect “exports would return to growth as early as September or as late as November” on expectations of rising demand for “artificial intelligence, high-performance computing, data centers, and automotive electronics.”

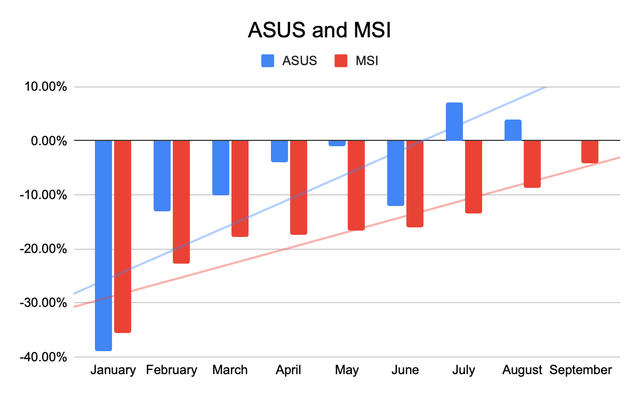

Further, monthly sales data are showing that consumer demand is recovering. Consumer electronics companies in Taiwan, MSI and ASUS, release monthly sales data. As the chart below clearly shows, both companies have been continuously recovering since the demand trough in late 2022 to early 2023, which is shown by the trend line.

ASUS and MSI

[MSI: Source, ASUS: Source]

As such, the consumer electronics demand has also been showing signs of recovery, which complements Taiwan’s export data to show that the semiconductor demand trough could already be history. Therefore, I believe these data show that the industry is progressing in the right direction for TSMC.

Continuously Positive Industry Forecast

Along with a firm positive data starting to arise, TSMC’s industry peers are also continuing to provide a positive forecast for the semiconductor industry, likely supporting the case for an end to the trough and a start of an uptrend in the industry business cycle.

Samsung (OTCPK:SSNLF), on October 11th, reported a preliminary earnings report data, which came in higher than expected. In absolute numbers, the numbers seem bad, as the company’s profit declined by 78% year-over-year. However, looking at the expectation, the company’s guidance is about 0.3 trillion won higher than the 2.1 trillion won guidance of 2.4 trillion won. Regarding the beat, an analyst in Korea for Daol Investment said that the results are “better than expected. Although the situation is not great in the chip business… the decline in memory prices is easing, and further drops will be limited.” Thus, the positive reaction by the market from the current report was the result of positive signs starting to emerge in the semiconductor business.

Moving on to Micron (MU), the company has also signaled at a positive outlook in the near future during the company’s earnings call on September 27th. For 2023, the management team has said that “DRAM demand has been in line with expectations, NAND growth expectations have increased due to stronger than expected demand.” Then, for 2024, the company’s management team has given an extremely positive outlook, saying that the company “expect[s] robust year-over-year bit demand growth in calendar 2024 for both DRAM and NAND.” In fact, the “calendar 2024 bit demand growth is expected to exceed the long-term CAGR for DRAM and to be near the long-term CAGR for NAND.” Therefore, Micron’s memory chip business is expected to show a strong recovery in the coming few quarters. Considering that memory chips are often more sensitive to macroeconomic conditions than logic chips, I believe these positive commentaries to be relevant for the entire semiconductor industry.

Overall, TSMC’s industry peers are forecasting a brighter future as the demand is starting to signs of recovering. Naturally, as TSMC commands a 55.5% market share in the fabrication industry, the recovery of the semiconductor market will create a tailwind for the company. Not only will TSMC potentially benefit from increased demand, but the company will also be able to enjoy better pricing power as the industry recovers and returns to growth. Therefore, given that the industry peers are reporting positive forecasts for the semiconductor market, I believe TSMC will be able to enjoy the tailwind as the industry recovers.

Risks

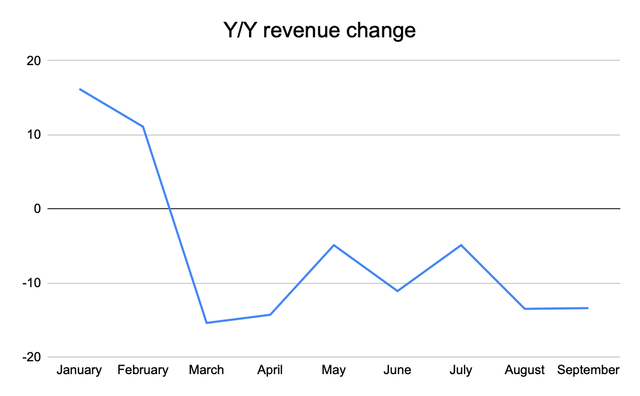

Although numerous data points suggest that the industry is on the verge of recovery and return to sequential growth, TSMC’s own monthly sales data have not reflected this positive trend seen in the industry. As the chart below shows, the company’s sales trend has yet to rebound, which diverges from my bullish arguments.

TSMC

[Source – Chart created by author using source]

Although it is concerning, I believe there is an explanation for this phenomenon: lag effect. Consumer electronics vendors or even data center customers could be working through their existing inventory before putting in greater-scale orders with TSMC, as the industry recovery is still in the very early stages. If this is the case, which is what I believe it to be, the risks associated with TSMC could be minimal; however, if it is the case that TSMC is not able to enjoy the industry’s demand recovery due to ever-increasing competition, then a more structural risk could arise for TSMC potentially dwarfing the industry tailwind.

As such, although it is highly likely that TSMC will benefit from the industry recovery due to the current market share the company enjoys, investors should note that TSMC’s own data have not yet reflected the positive factors the market is starting to enjoy.

Investor Takeaway

The semiconductor industry is likely entering the early stages of recovery and sequential growth after multiple quarters of contraction. Numerous data points including Taiwan’s export numbers, monthly consumer electronics demand, and TSMC’s industry peers’ outlook are pointing in this direction. As such, in the coming quarters, I strongly believe that an industry tailwind will benefit TSMC as the company is the leading semiconductor fabrication company in the industry. Therefore, ahead of an upcoming earnings report, I continue to believe TSMC is a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here