By Muhammet Mercan

With monthly inflation at 4.75% (close to our call of 4.7% and the market expectation of 4.9%), annual inflation continued to rise in September, reaching 61.9%. This compares to the government’s full-year estimate of 65% as laid out in its medium-term plan and the central bank’s forecast of 58%, which it announced towards the end of July. The last inflation report of the year on 2 November will provide further insights into how the central bank assesses the inflation outlook and whether it will change the forecast for 2024.

The data reflects a continued broad-based deterioration in price dynamics as both food and non-food prices, excluding the housing group, increased above the level seen last September. The rise in energy prices and continuing pressure in services are also attracting attention. Core inflation (CPI-C) came in at 5.3% month-on-month, rising to 68.9% on an annual basis. This was attributable to exchange rate developments, changes in administered prices and commodity prices. Accordingly, the underlying trend in the headline rate (as measured by the three-month moving average, annualised percentage change, based on a seasonally adjusted series) increased further in September though at a slower pace thanks to goods inflation. The services group has maintained its elevated trend due to continuing pressure in rent, catering and transportation services. This supports the Central Bank of Turkey’s observation in the September rate-setting statement that the underlying trend is likely to decline in the period ahead.

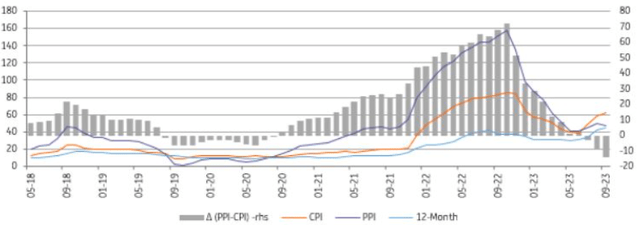

September PPI, meanwhile, stood at 3.4% on a monthly basis, translating into 47.4% year-on-year. This elevated annual figure reflects a significant acceleration in the Turkish lira equivalent of import prices due to commodity and exchange rate increases and it implies that cost pressures have gained strength in recent months. While a slight decline from 49.4% YoY a month ago is a positive development, still-strong domestic demand at the end of the third quarter suggests that producers are likely to continue to pass on their cost increases i.e. recent electricity and natural gas hikes to consumers.

Inflation outlook (%)

TurkStat, ING

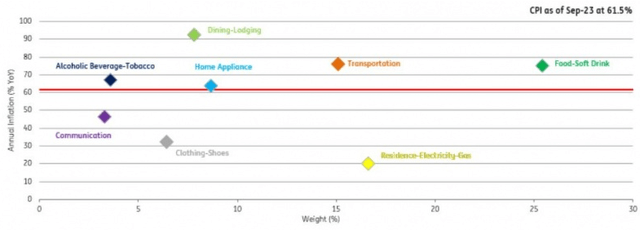

In the breakdown, all of the main expenditure groups positively impacted the headline. Among them, food turned out to be the major contributor, adding 0.88ppt, as both processed and unprocessed food products witnessed significant price increases. With the September figure, annual inflation in the group reached 75.1% vs. the CBT’s assumption of 61.5% in the July inflation report. This was followed by transportation at 0.78ppt, on the back of rising energy prices and adjustments in transportation services. Housing, meanwhile, pulled the headline up by 0.71ppt due to rent, water fees and coal prices. Among non-food groups, education, alcohol-tobacco and household goods groups recorded strong increases. As a result, goods inflation rose to 52.4% YoY showing a moderate move from 51.5% YoY a month ago. Annual inflation in services, which is significantly influenced by domestic demand and minimum wage hikes, maintained its strong uptrend and reached another peak of 86.5% YoY.

Annual inflation in expenditure groups

TurkStat, ING

Overall, given the deterioration in pricing behaviour, exchange-related effects, widespread increase in wages and tax adjustments, continuing strength in domestic demand and the upward reversal in global commodity prices, particularly oil prices, inflation will likely remain under pressure in the near term, as we have already seen a significant jump since the elections. However, a continuation of recent stability in the lira will likely keep the currency-related impact on the CPI basket under control. In this environment, the CBT has taken steps towards normalising interest rates and its exchange rate policy after the elections. The latest rate hikes in August and September were significant and likely raise expectations for the end of the current cycle. These moves and the impact on deposit and loan rates along with other macro-prudential decisions will be important in tightening financial conditions and controlling domestic demand.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here