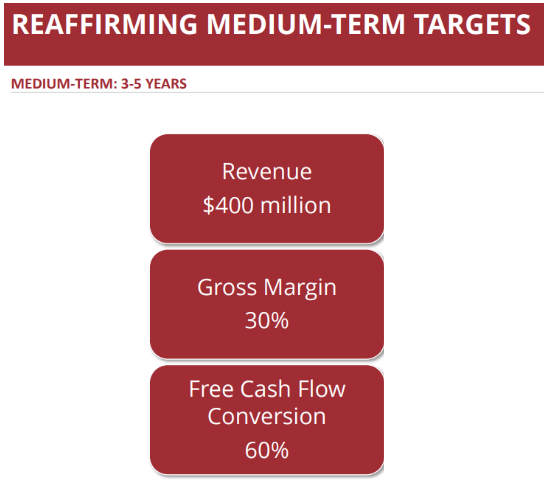

Twin Disc (NASDAQ:TWIN) recently reaffirmed its medium-term targets, including future gross margin close to 30% and most importantly the FCF conversion close to 60%. Besides, recent redesign of business structures in Belgium may improve efficiency and competitiveness, which could, in the long term, improve FCF growth. Risks from problems related to steel supply, lower manufacturing quality, lower productivity, or changes in international regulations could affect the stock price. However, I believe that TWIN remains undervalued.

Twin Disc

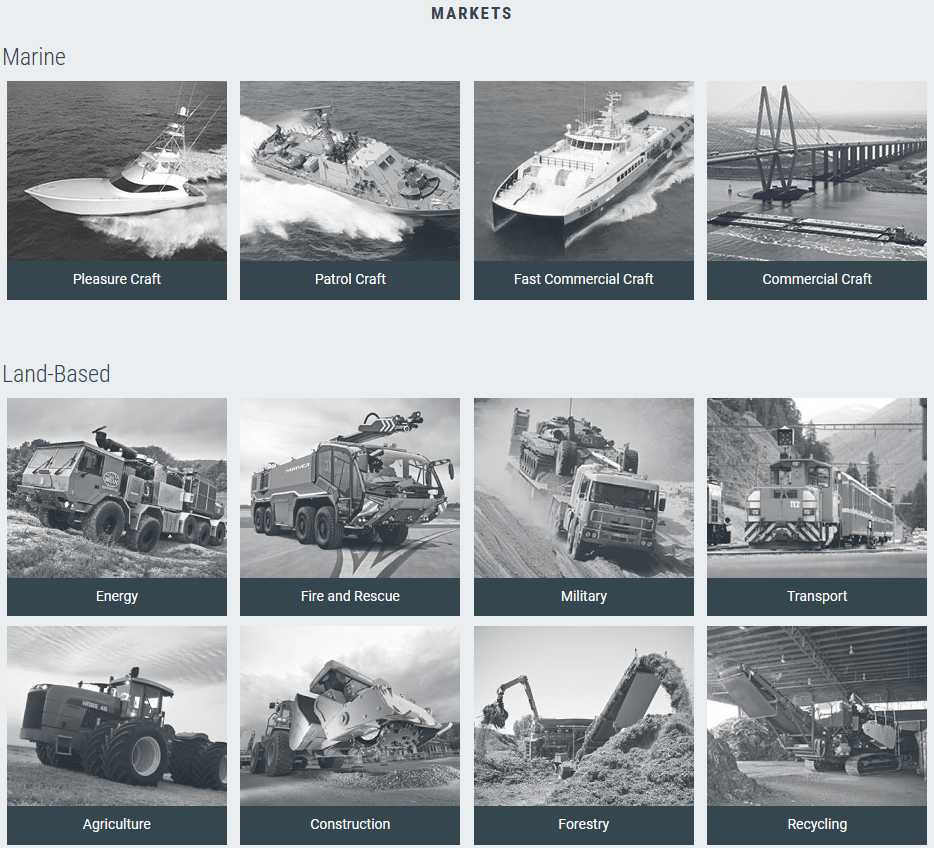

Twin Disc, founded in Wisconsin in 1918, designs and manufactures heavy-duty off-highway and marine power transmission equipment.

With facilities in multiple countries including the US, Belgium, and China, the company offers a full range of products from marine transmissions to vessel management systems and industrial clutches.

Source: Company’s Website

Its solutions, which account for more than 90% of revenue in the last three years, serve customers in sectors such as recreational boating, military, energy, and resources. Through direct sales and distributors, Twin Disc has established itself as a leader in the transmission industry. With that, about the business model, I believe that investors may want to learn first about the expectations delivered in the most recent quarterly report. I believe that this information is optimistic. Management expects revenue of close to $400 million in the medium term, from 3 to 5 years. Future gross margin would stand at about 30%, and most importantly the FCF conversion may be close to 60%.

Source: Investor Presentation

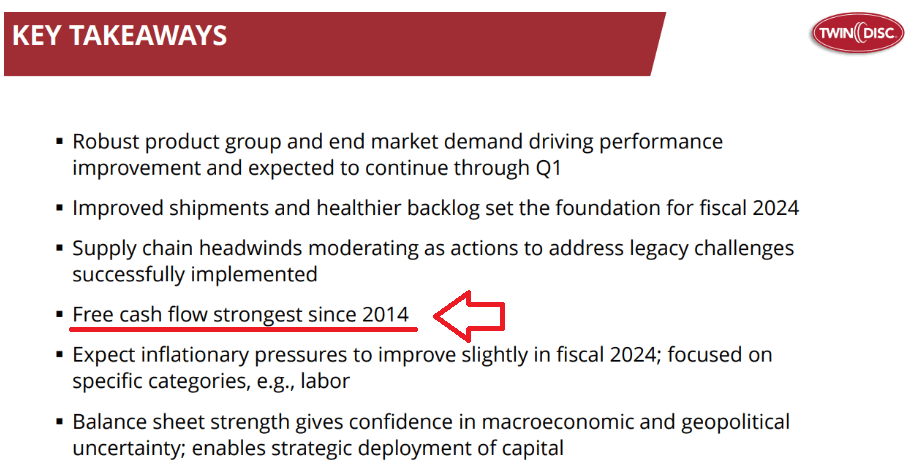

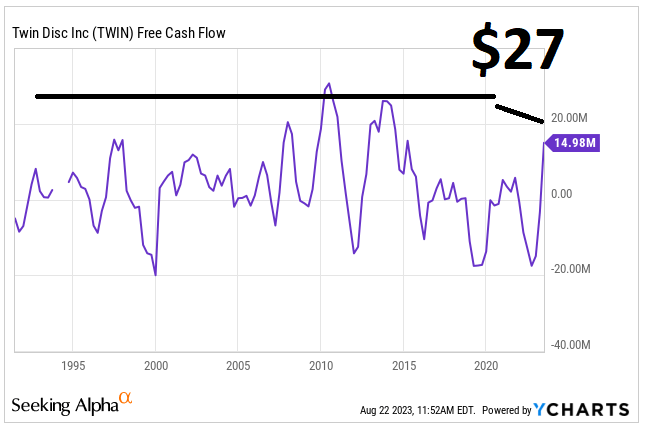

It is also worth noting a few ideas from the last quarter. First, the company noted that FCF is the strongest since 2014. Besides, The company noted improved shipments and healthier backlog, which are expected to have beneficial effects for 2024. Finally, inflationary pressures are expected to get better in 2024. With these ideas in mind, I believe that taking a closer look at the future financials makes a lot of sense.

Source: Investor Presentation

Solid Financial Situation

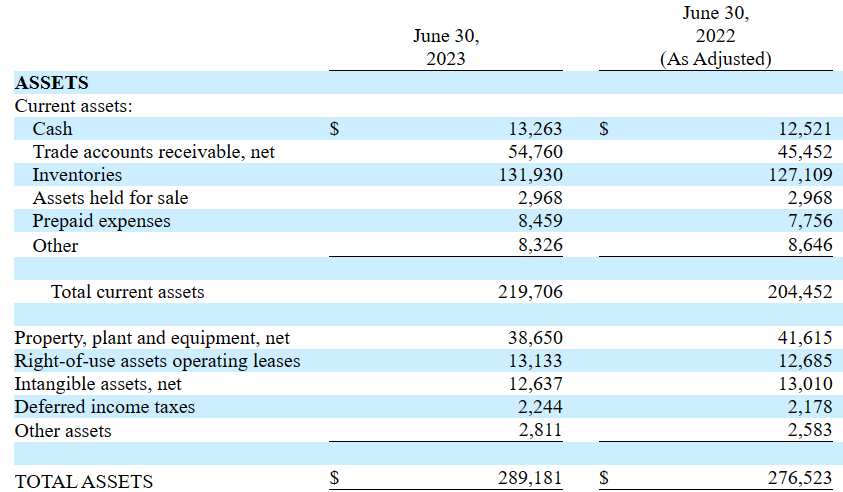

As of June 30, 2023, the company reported cash worth $13 million, which is a bit larger than the amount reported in 2022. Trade accounts receivable were equal to $54 million, with inventories of $131 million, prepaid expenses close to $8 million, and total current assets worth $219 million.

The list of assets includes property, plant, and equipment worth $38 million, right-of-use assets operating leases close to $13 million, and intangible assets of about $12 million. Total assets were equal to $289 million, and the asset/liability ratio stands at about 2x, so I believe that the balance sheet is solid.

Source: 10-Q

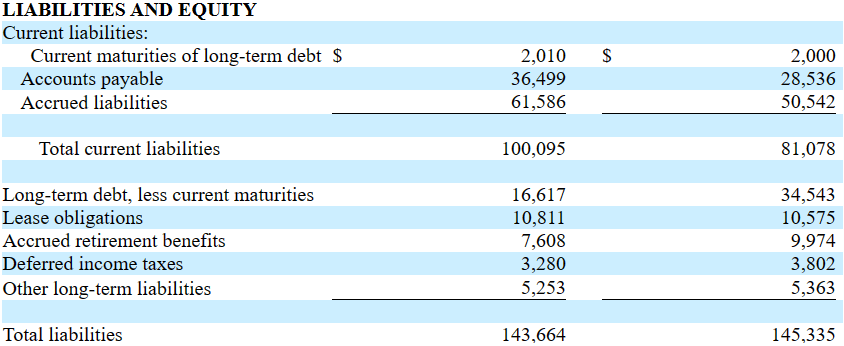

I would really not be afraid of the list of liabilities. The most relevant liabilities include accounts payable worth $36 million, total current liabilities of $100 million, and long-term debt, less current maturities of close to $16 million. Finally, with other long-term liabilities worth $5 million, total liabilities stood at $143 million.

Source: 10-Q

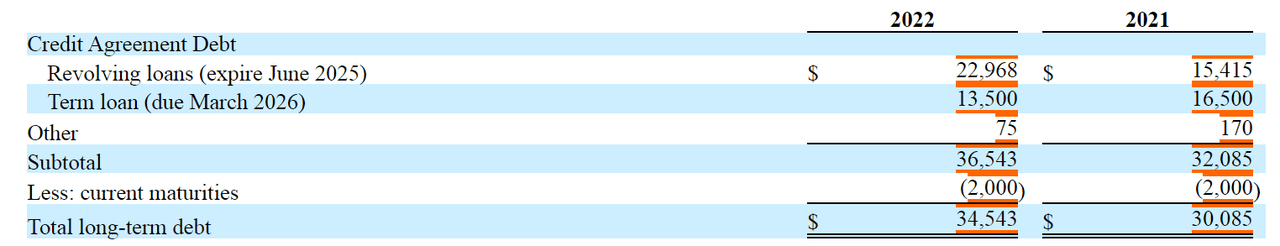

Agreements With Financial Institutions And Contractual Obligations Do Not Seem Worrying

The company has entered into a number of amendments and credit agreements, which regulate lending and financial commitments. The agreements cover term and revolving loans with limits of $20 million to $40 million, letters of credit, and adjusted interest rates based on SOFR and EURIBOR. The agreements also establish financial covenants, including limits on total financed debt to EBITDA and tangible equity. Amendments extend forbearance periods due to EBITDA defaults, and allow asset sales. In the event of non-compliance, the bank has immediate payment and termination rights. The guarantees involve various assets and shares of subsidiaries. With that being said, I really would not be afraid of the agreements and contractual obligations reported by management.

Source: 10-Q

Cash Flow

I am quite optimistic about the Hybrid/Electric solutions offered for marine and land-based applications. Additionally, expansion of Veth product to new geographies could be a catalyst for revenue growth. As a result, I would be expecting an increase in demand, which would lead to beneficial FCF growth.

In addition, I believe that further improvements in efficiency and customer response, further development of controls, and system integration could bring improvements in the FCF margin. Finally, taking into account the current balance sheet, I think that Twin could present to the market new acquisitions to incorporate industrial and marine technology. Banks would most likely support inorganic growth.

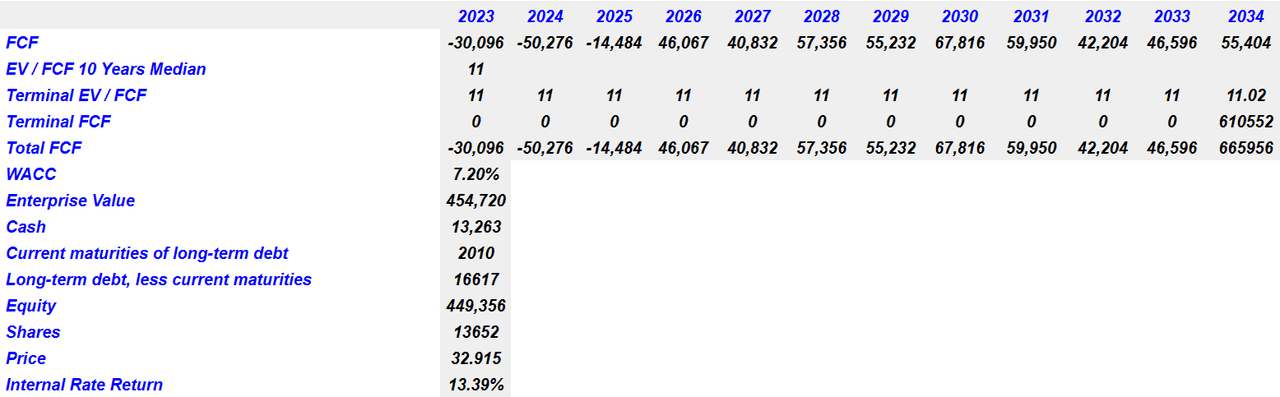

Eventually, under my DCF model, I assumed that the ongoing restructuring at the company’s Belgian operation to optimize resources and costs will most likely have a beneficial effect on FCF generation. With a $1.0 million investment in turnaround charges, it focused on the core manufacturing process, enabling savings by outsourcing non-core processes.

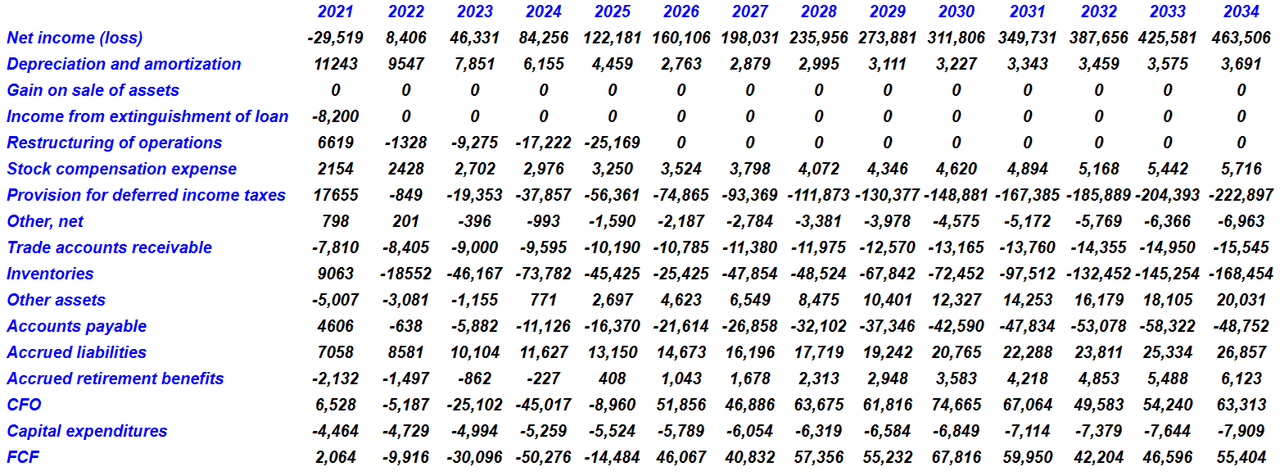

My financial model includes 2034 net income close to $463 million, depreciation and amortization worth $3 million, no gain on sale of assets, no restructuring of operations, and stock compensation expense worth $5 million.

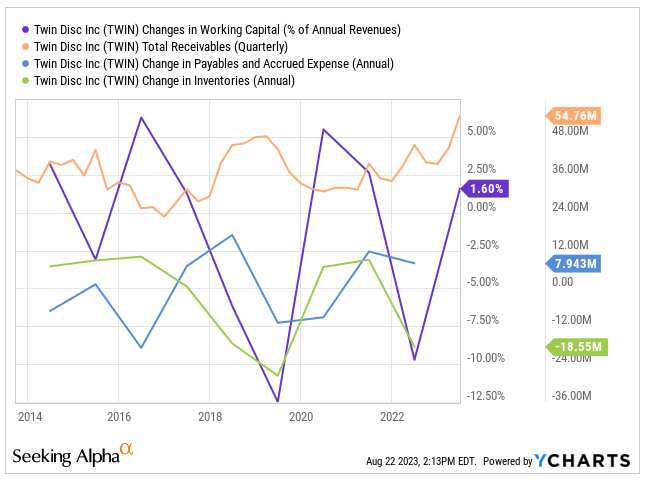

Note that my figures are based on previous observations of changes in accounts receivable, changes in accounts payables, changes in inventory, and D&A. I believe that I was conservative while choosing future forecasts.

Source: Ycharts

Besides, with changes in trade accounts receivable of close to -$16 million, changes in inventories of -$169 million, and changes in accounts payable close to -$49 million, 2034 CFO would be about $63 million. Finally, if we also assume capital expenditures of about -$8 million, the implied FCF would stand at $54-$55 million.

Source: My Estimates

With respect to my free cash flow results, I believe that they are in line with previous FCFs reported from 1995. The FCFs used ranged from -$50 million to about $67 million.

Source: Ycharts

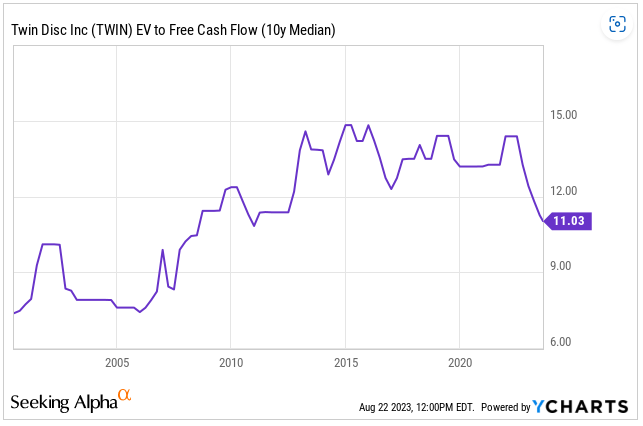

If we use an EV/FCF of close to 11x, which is close to the EV/FCF 10 years median, and a WACC of 7.2%, the implied enterprise value would be about $454 million.

Source: Ycharts

With cash of about $13 million, current maturities of long-term debt worth $2 million, and long-term debt of $16 million, the implied equity would be about $449 million. Finally, the implied price would be close to $32.9 per share, and the IRR would be 13.39%.

Source: My Estimates

There Are Risks

In my opinion, the company faces significant risks due to the cyclical nature and sensitivity to unpredictable factors of its markets. Economic fluctuations and volatile conditions can negatively affect financial performance. There is also the fact that Twin operates with a significant number of actors in regions in Europe or Asia. Changes in the labor conditions in these countries, changes in the regulatory framework, changes in exchange rates, or changes in import tariffs could diminish the free cash flow margin in the coming years.

Sales to customers outside the United States approximated 67% of the Company’s consolidated net sales for fiscal 2022. The Company has international manufacturing operations in Belgium, Italy, the Netherlands and Switzerland. In addition, the Company has international distribution operations in Singapore, China, Australia, Japan, Italy, Belgium, and India. The Company’s international sales and operations are subject to a number of risks. Source: 10-k

The company may also suffer from lower productivity, lower performance, or lower quality, which may lead to declining sales due to a deterioration in customer relationships. Failed introduction of new products could also lower the FCF margin and the valuation of the company. In this regard, management offered certain commentary in the last annual report.

As a manufacturer of highly engineered products, the performance, reliability and productivity of the Company’s products are some of its competitive advantages. While the Company prides itself on implementing procedures to ensure the quality and performance of its products and suppliers, a significant quality or product issue, whether due to design, performance, manufacturing or supplier quality issue, could lead to warranty actions, scrapping of raw materials, finished goods or returned products, the deterioration in a customer relationship, or other action that could adversely affect warranty and quality costs, future sales and profitability. Source: 10-k

Demand can also be influenced by the general economy, government spending, fuel prices, interest rates, or global demand for steel. Lack of supply, shortages, or delays could also be very detrimental for the operations and production offered by Twin.

With the continued development of certain developing economies, in particular China and India, the global demand for steel has risen significantly in recent years. The Company selects its suppliers based on a number of criteria, and the Company expects that they will be able to support its needs. However, there can be no assurance that a significant increase in demand, capacity constraints or other issues experienced by the Company’s suppliers will not result in shortages or delays in their supply of raw materials to the Company. Source: 10-k

Revenue is influenced by the top ten customers, which contributed around 50% and 48% of consolidated sales in 2022 and 2021 respectively. An authorized dealer accounted for 10% of sales in 2022. I believe that concentration of clients may bring problems in the future. If some of them are willing to renegotiate agreements, I think that the company may suffer a deterioration in the FCF margins.

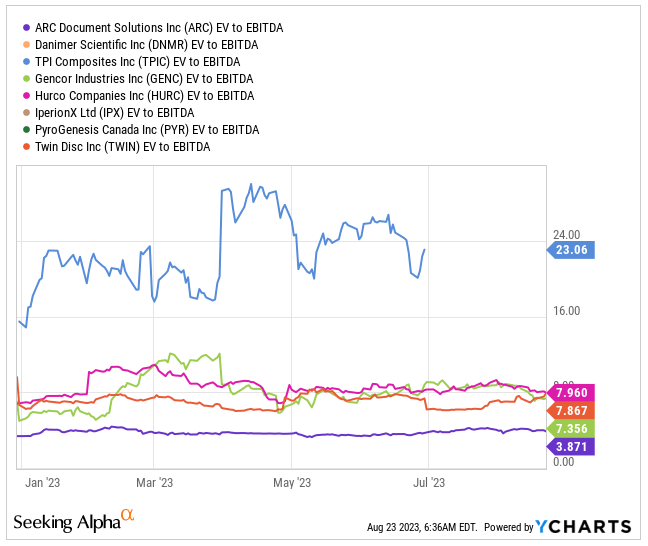

Competitors

Competition is a constant challenge for Twin Disc. It faces rivalry from both larger independent manufacturers and key customer divisions that make parts. The company’s products stand out for their design, technology, performance, price, service, and availability. Competition encourages innovation and strategy to stay competitive in the marketplace.

I took a look at the peers, which do not seem to trade at more expensive or much cheaper levels than Twin. In any case, I believe that my cash flow model offers a better image of the correct fair price of Twin. Competitors may have different sizes, or they may conduct different activities that Twin does not conduct.

Source: Ycharts

My Opinion

Twin shows solid growth, driven by demand and operational efficiency. Restructuring in Belgium may improve efficiency and competitiveness, but cyclical risks in its markets require careful management. With that, the sensitivity to economic conditions and constant competition pose challenges, and the reliance on the top ten customers highlights the need for diversification. Overall, the company shows progress, but risk management and continuous adaptation are crucial. In any case, I believe that the company could trade at higher price marks.

Read the full article here