Written by Nick Ackerman, co-produced by Stanford Chemist

Tortoise Energy Infrastructure Corp (NYSE:TYG) is a closed-end fund that provides investors exposure to a basket of energy-related infrastructure investments, as its name would imply. The fund has a large weighting primarily toward natural gas infrastructure, but also has exposure to renewable and power infrastructure. TYG also carries a meaningful sleeve of master limited partnership (“MLP”) exposure.

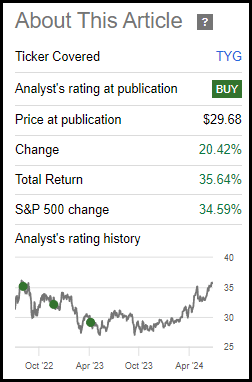

It’s been a while since our prior update on TYG, but the fund has done quite well during this time. In fact, with a strong push higher, more recently favoring value-oriented sectors, it has pushed TYG to even surpass the total returns of the S&P 500 Index, albeit only slightly. It also required the CEF’s discount to narrow quite materially during this time to push it to that level as well.

TYG Performance Since Prior Update (Seeking Alpha)

That said, the discount here continues to make this an attractive energy-related fund to consider for an investor’s portfolio. We all know that energy, whether it be from production or transmission, is critical infrastructure for everyday life. So, there is certainly a long-term reason one would want to hold some energy exposure in their portfolio. Some further good news for income investors is that the distribution could be due for a raise when they make their next quarterly announcement in August.

TYG Basics

- 1-Year Z-score: 1.61

- Discount/Premium: -14.34%

- Distribution Yield: 7.97%

- Expense Ratio: 1.75%

- Leverage: 19.38%

- Managed Assets: $555.742 million

- Structure: Perpetual

TYG mentions that the fund is designed to have “exposure to energy infrastructure, long-lived and essential, midstream power and renewable assets.” These companies include those that “generate, transport and distribute electricity as well as process, store, distribute and market natural gas, natural gas liquids, refined products, and crude oil.” It also has an investment objective to seek a “high level of total return, emphasizing current distributions.”

In the closed-end fund structure, there is no K-1 or unrelated business taxable income (UBTI). That means they can be more appropriate for “IRA and tax-exempt suitability.”

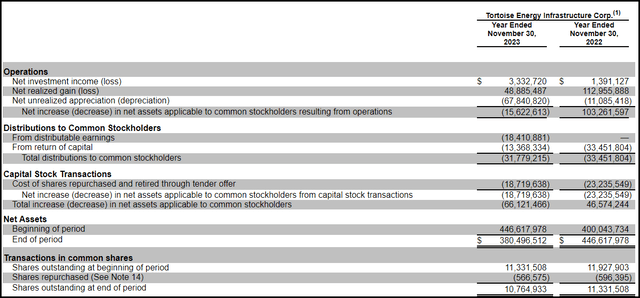

One of the negatives for this fund is the expense ratio is high. When including the leverage expenses, it gets pushed up to 3.04%. TYG was previously taxed as a c-corp and not a regulated investment company (“RIC”), which the majority of closed-end funds are. However, beginning in the fiscal year ending November 30, 2023, they are expecting going forward to qualify as a RIC.

Performance Could Push Distribution Bump

Since our prior update, the discount has narrowed quite meaningfully, which has pushed the 1-year z-score to a more elevated level of 1.61. Though that generally means it isn’t excessively overvalued in the short term, it does indicate it is a bit rich.

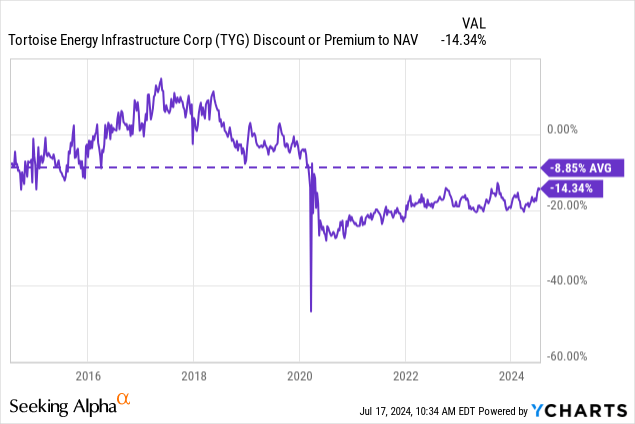

For the longer-term average discount level, we also see that it could indicate it is still undervalued. I believe that it does have appeal at this time, but certainly not as much as it did when we covered it last. Additionally, there’s also no getting around the damage the fund experienced in 2020 — which prompted the fund to trade at such a deep discount as investors, for good reason, became skeptical of leveraged closed-end funds in the energy space. These funds were crushed during Covid, which was only made worse by the fact that prior to Covid, the fund flirted with a premium to its NAV.

Ycharts

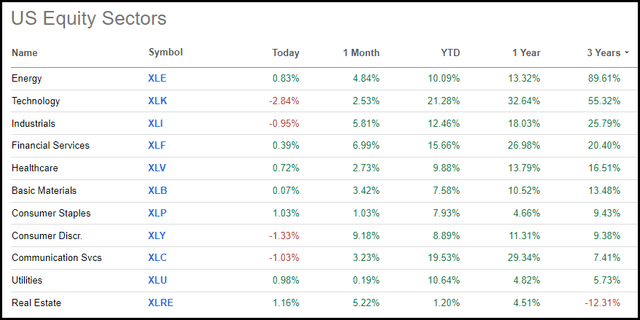

Of course, those who invested after or during the Covid collapse were richly rewarded for their bravery in jumping into the space. Despite a monster tech rally that has seemingly been unending over the last few years, it is actually the energy sector that continues to lead in gains over the last 3 years.

U.S. Sector Performance (Seeking Alpha)

As we saw above, the fund’s performance has been quite strong since our update, although it has been quite some time, admittedly. Even despite some of this performance coming from a narrowing discount, the underlying portfolio was still performing well during this time, too.

That’s an important consideration due to the fund’s distribution policy. Thanks to this policy that means we could see a distribution increase as the fund’s NAV rate sinks below 7%. More precisely, the distribution rate on the NAV is 6.82%. Thanks to the fund’s sizeable discount, the distribution rate comes to 7.97%.

It also just happens to be that under their distribution plan, it gets reassessed in February and August; with August coming up, investors could get some good news.

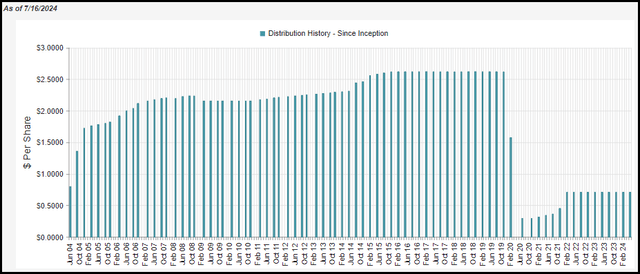

The fund has adopted a managed distribution policy (“MDP”). Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts in May and November.

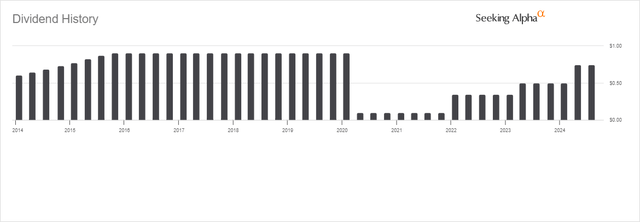

Of course, this is no guarantee, as it is still ultimately up to the Board to approve a distribution. This policy isn’t set in stone, so they have some flexibility here. They may see it fit to continue on with the same $0.71 quarterly distribution that they have for the previous 10 quarters now.

TYG Distribution History (CEFConnect)

They could then reevaluate during February, should the fund continue to perform well and stay above the 7% low end of the NAV rate.

To help support the distribution, the fund will rely on the income generated from the underlying portfolio, which can include the return of capital distributions generated by the underlying MLP and energy investments they hold. That means we can look at the net investment income and add back the ROC distributions that are subtracted out. For TYG, that would have brought the total distributable cash flow to $14,644,200 or coverage at around 46%.

TYG Annual Report (Tortoise)

With the underlying portfolio continuing to increase its own distributions and dividends, coverage has likely also climbed—as long as TYG hasn’t seen expenses climb similarly to offset this. So, for the next report, we could see better DCF coverage. Though this can still be where the higher relative expense ratio comes in as a negative for the fund.

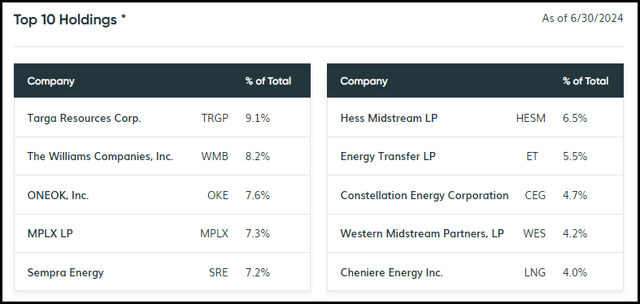

At the same time, as a fund that invests relatively heavily in equities, it isn’t too bad of a coverage either. Not all of their portfolio names really have higher yields either, as they hold a number of utility names that pay relatively lower yields compared to their MLP names. In fact, most of their top holdings pay less than 5% yields.

TYG Top Ten Holdings (Tortoise)

When looking at the fund’s largest holding, Targa Resources Corp (TRGP), that name doesn’t actually pay a high yield. It comes in at around 2.22% and is a significant allocation of the fund. Instead of having a high yield, the company instead has been able to grow its payout aggressively.

TRGP Dividend History (Seeking Alpha)

The second-largest holding here, The Williams Companies, Inc (WMB), also doesn’t come with a monster yield as it comes to 4.49%.

Some of the utility names here are also lower yielders — including names like Sempra (SRE), at a 3.25% yield and Constellation Energy Corporation (CEG), which comes with a yield of 0.69%.

It is more of the MLP plays that are the outliers that could be considered high-yield plays. That includes MPLX (MPLX) at 8.05%, Energy Transfer (ET) at 7.76%, and Western Midstream Partners (WES) with an 8.38% yield.

Conclusion

TYG continues to trade at a relatively attractive discount. Thanks to some strong performance that we’ve been getting in this fund, it has pushed the fund’s NAV higher. This is notable because it has now pushed the fund’s distribution NAV rate below the 7-10% NAV rate indicated by the managed distribution policy. With August coming up—one of the two months they noted as when they would reevaluate the payout—we could see a lift in the distribution.

Read the full article here