Tyra Biosciences (NASDAQ:TYRA) develops precision medicines using fibroblast growth factor receptor (FGFR) biology. These are small molecules. Lead asset is TYRA-300, the first oral FGFR3-selective inhibitor in human trials. There are a number of other FGFR inhibitors in the market, including pemigatinib, futibatinib, erdafitinib and infigratinib. However, these are all pan-FGFR inhibitors, an approach which creates unwanted off-target side effects, which create frequent dose interruptions and reductions, and where acquired resistance makes the drug effects less durable.

For example, FGFR1 inhibition may cause hyperphosphatemia. Between 60 and 90% of toxicities in these 4 molecules are caused by hyperphosphatemia. FGFR2 inhibition drives stomatitis and nail toxicity, and between 30 and 60% of toxicities are caused by this. FGFR4 causes gastrointestinal and liver toxicity, and between 20 and 60% of toxicities are related to these two. FGFR3 inhibition, on the other hand, produces bone growth in children.

Thus, an FGFR3 specific molecule is useful, however, the challenge is that all the different FGFR3 family sites are nearly identical. There are subtle but distinct differences, which have been utilized by Tyra to develop TYRA-300. TYRA-300 is targeting some of the urothelial cancers, where the company identifies a large unmet need. There are nearly 40,000 US patients per year, and current therapies only address around 5000 of them, and that too at a very small duration of treatment.

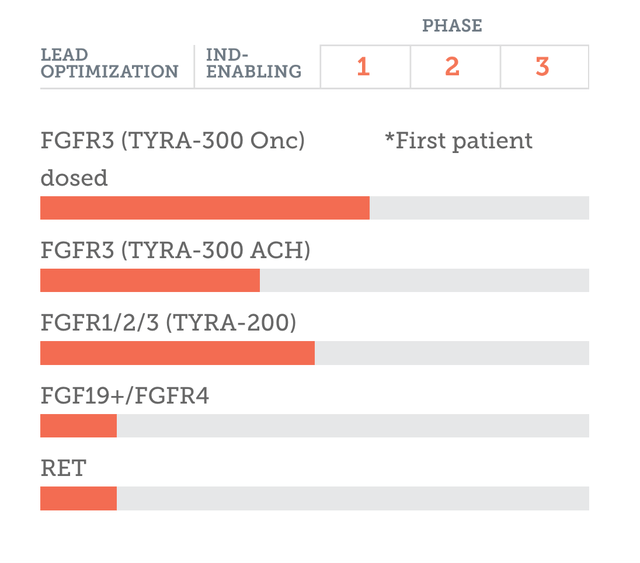

The company’s pipeline looks like this:

TYRA PIPELINE (TYRA WEBSITE)

In preclinical trials, TYRA-300 showed a number of benefits over other pan-FGFR inhibitors. In a rat model, it did not raise phosphate levels as much as erdafitinib, minimum plasma phosphate level of which was more than the maximum plasma phosphate level of TYRA-300. Interestingly, higher doses of TYRA-300 saw lower phosphate levels than lower doses; while higher doses of erdafitinib saw higher phosphate levels than its lower doses. Thus, there was a dose dependent relation here, inverse for TYRA-300 and directly proportional for erdafitinib.

Importantly, TYRA-300 demonstrated activity in in vivo bladder cancer models. In two different xenografts, TYRA-300 demonstrated better tumor volume reduction than erdafitinib. In one of the xenografts, the difference was very stark – there was a 77% TGI (tumor growth inhibition) in TYRA-300 while it was only 12% for erdafitinib. TYRA-300 also regresses tumor up to 91% in key xenograft models.

Despite all of that, though, there is no clinical data yet. The molecule is being run through a phase 1 trial whose intent is to discover RP2D and MTD. There is also a phase 2 component in this 310 patient target open label trial, whose primary completion date is in 2026. However, the phase 1 portion will certainly be over much sooner than that. Other assets and programs are in preclinical stages. There is an IND being planned for a second indication for TYRA-300 in 2024. This indication is achondroplasia, where BridgeBio has a molecule with the same FGFR3 selectivity.

However, as Evaluate noted:

It could be argued that a project with far greater FGFR3 selectivity [than BridgeBio’s molecule – author] could have a wider therapeutic window, and by being dosed higher could show an even better effect on achondroplasia than infigratinib. This is where Tyra’s TYRA-300 and Lilly’s LOXO-435 come in: these are said to have up to 63 and 361-fold respective selectivity for FGFR3 versus other FGFR isoforms, according to preclinical data.

The same article goes on to note a number of other FGFR3 selective inhibitors. Many of these are big pharma. Most are focused on cancers. Tyra does claim to be the first FGFR3 molecule in the clinic.

Another asset, TYRA-200, cleared an IND and will start early stage trials targeting bile duct and solid tumors in 2H 2023. This is “an FGFR1/2/3 inhibitor with potency against FGFR2 fusions, molecular brake mutations and gatekeeper resistance that TYRA is developing initially in intrahepatic cholangiocarcinoma.”

Financials

TYRA has a market cap of $596mn and a cash balance of $241mn. First quarter 2023 research and development expenses were $10.4 million while general and administrative expenses were $3.9 million. At that rate, they have cash for over 10 quarters, keeping in mind that they will expand their expenses as more and later stage trials are undertaken.

The company stock is largely held by PE/VC firms, followed by institutions. Key holders are RA Capital, Boxer Capital, and Canaan. Insider transactions were mostly buys two years ago. Now, those have stopped, and there are only option exercises. There is just a single sell transaction in the last 2 years.

Bottom line

TYRA is a promising name, as demonstrated by its relatively high market cap despite being so early stage and without data. It has a leading molecule with considerable promise, and it also has a development platform and expertise. What it doesn’t have is clinical data, without which none of its claims can be taken too seriously. I will continue to watch this name until they produce data.

Read the full article here