By James Knightley, Chief International Economist

ISM manufacturing index signals 10 months of contraction

US ISM manufacturing index rose more than expected in August to stand at 47.6 versus 46.4 in July (consensus 47.0), but this is the tenth consecutive month it has come in below the break-even 50 level i.e. indicating contraction.

The ISM surveys asks companies a range of questions on employment levels, orders, output, supplier delivery times and price pressures in order to come up with a broader picture of the state of the sector rather than measuring output alone such as in the industrial production report. The output index improved to 50 from 48.3, but new orders slipped back to 46.8. Prices paid moved higher to 48.4 from 42.6 but because this is below 50 it merely means that the rate of price declines are slowing rather than prices are moving higher. As such inflation pressures emanating from the manufacturing sector remain minimal and are consistent with goods consumer price inflation slowing closer to zero.

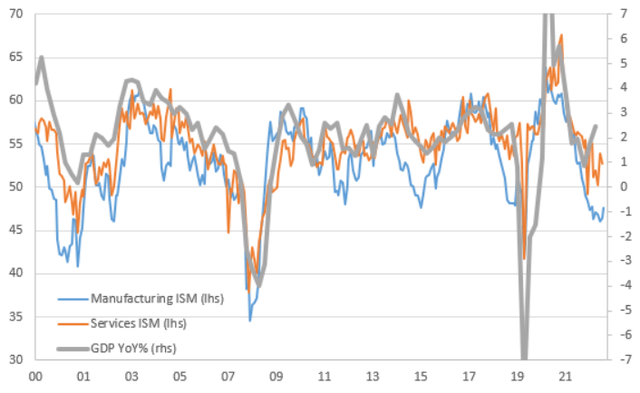

ISM reports suggest the economy is weaker than the GDP report has been signalling

Macrobond, ING

Construction boom is a clear positive

Meanwhile, construction spending rose 0.7% month-on-month versus the 0.5% consensus, with June’s growth rate revised up to 0.6% from 0.5%. The housing market was a source of concern at the start of the year, but even with mortgage rates at 20-year highs and mortgage applications having halved, prices have stabilised and are now rising again nationally. Home supply has fallen just as sharply, with those homeowners locked in at 2.5-3.5% mortgage rates reluctant to sell and give up that cheap financing when moving to a different home and renting remains so expensive.

This rise in property prices has boosted builder sentiment and lifted new home construction, with residential construction rising 1.4% MoM in July after gains of 1.5% in June and 3.5% in May. Meanwhile, infrastructure projects under the umbrella of the Inflation Reduction Act are supporting non-residential construction activity, which posted the 14th consecutive monthly gain to stand 16.5% higher than 12 months ago.

Slower GDP growth ahead

Construction is the standout performer in the US right now, but next week’s service sector ISM is predicted to slow to 52.4 from 52.7 and the combination of the two ISM series has historically been consistent with US GDP growth of 0-1% YoY, rather than the 2.5% the US posted in the second quarter (see chart). Just as the jobs report did earlier today, the ISM indices suggest little need for any further interest rate rises from the Federal Reserve.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here