By James Knightley

209,000, the increase in non-farm payrolls in June.

Jobs undershoot expectations

The June US jobs report has come in on the softer side of expectations in most respects, but this will do nothing to alter the outlook for another interest rate rise at the 26 July FOMC meeting. Non-farm payrolls rose 209k in June, and there were a net 110k of downward revisions to the past two months. Consensus forecasts centered on a gain of 230k, but the ‘whisper’ number was closer to 300k following yesterday’s ADP payrolls number and the ISM services employment index. As such, we are seeing a fair bit of reversal from yesterday’s market moves that saw government bond yields surge and interest rate expectations move higher.

Weakest private jobs gains since December 2020

Private payrolls rose only 149k versus the 200k expected, which is the biggest surprise within the report with manufacturing rising 7k, construction gaining 23k while private services rose only 120k. Education/health services continues to be very strong within that component, rising 73k. However, retail sector employment actually fell 11k while transport and warehousing fell 7k, indicating that the love of physical goods continues to wane. However, we have now had three consecutive months of 26k or below employment growth in leisure and hospitality, which contradicts a lot of the narrative about robust growth here, primarily linked to strong travel numbers. In fact, it is more in line with the Opentable and STR hotel numbers that point to YoY falls in restaurant demand and hotel occupancy. Government hiring continues to run hot, with 60k jobs added.

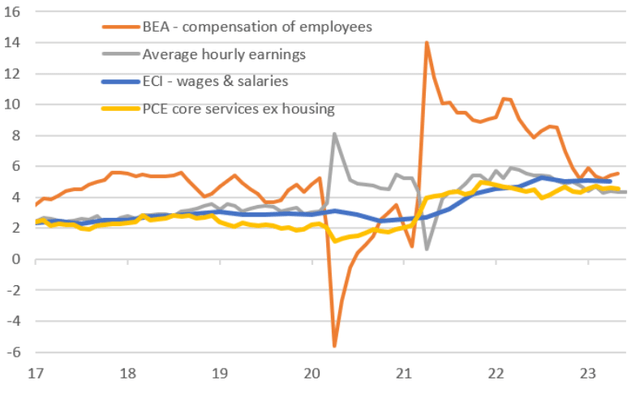

Labour costs and the Fed’s inflation focus (YoY%)

Macrobond, ING

Areas of firmness to keep the Fed cautious

There are areas of relative strength in the report though, the wage numbers (0.4% month-on-month versus 0.3% consensus) were stronger and there were upward revisions meaning that we have the annual rate of wage inflation remaining at 4.4%, rather than slowing to 4.2% as expected. The unemployment rate also dipped back to 3.6% having jumped from 3.4% to 3.7% in May – the household survey showed employment rising 273k while the number of people classifying themselves as unemployed fell 140k. The average work week also ticked modestly higher to 34.4 hours.

Jobs are a lagging indicator

Today’s data takes some of the heat out of building rate hike expectations, but 209k jobs is still a lot and with wages staying elevated and unemployment moving lower it should solidify the case for a July rate hike. Importantly, jobs data is the most lagging of lagging indicators, so this tells us nothing about the future. Much more important in that respect are lending conditions, business sentiment indicators and new orders surveys – note the leading index has fallen for 14 consecutive months. Note also yesterday’s National Federation of Independent Business hiring intentions survey showed only a net 15% of small businesses expect to make hirings in the next few months, having averaged above 20% last year.

Next week, eyes will turn to inflation data. Expect to see big falls in the annual rate of CPI to 3.1% from 4% while core should slow from 5.3% to 5%. That latter figure is still too hot for the Fed, but PPI should slow to just 0.4% year-on-year with core PPI at 2.5% YoY, indicating that pipeline price pressures are moderating quickly.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Read the full article here