EIA reported a mixed oil inventory report today. Total implied oil demand trended lower following a material uptick last week. Crude saw a relatively large build as our modified adjustment jumped to ~1.7 million b/d. Product inventories were mixed with gasoline lower, distillate flat, and jet fuel higher. Total liquids saw a build of ~5.2 million bbls.

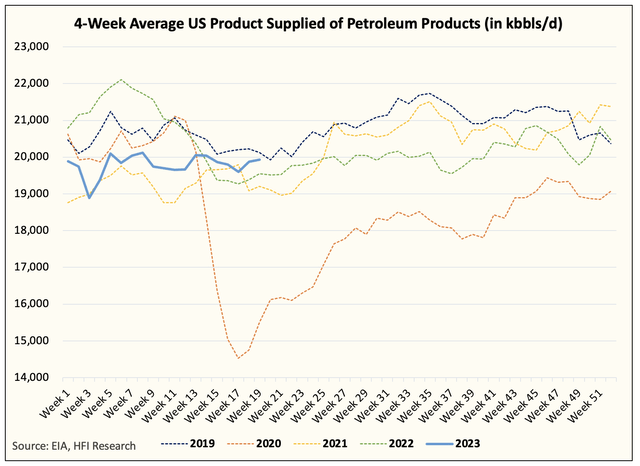

Taking aside the weekly noise/volatility, U.S. implied oil demand continues to trend in the right direction.

EIA, HFIR

Relative to 2019, oil demand this year is much better than in the previous two years. The strength in demand this year is fueled by higher gasoline and jet fuel consumption.

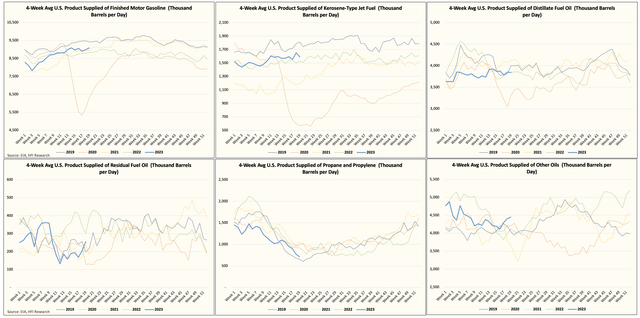

EIA, HFIR

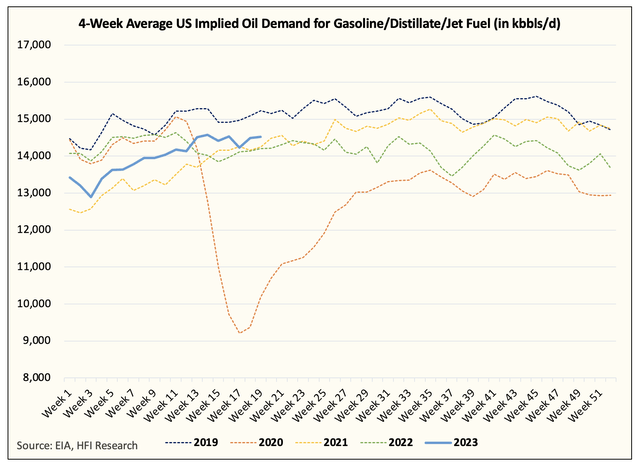

And in aggregate, we are seeing the big 3 trend in the right direction.

EIA, HFIR

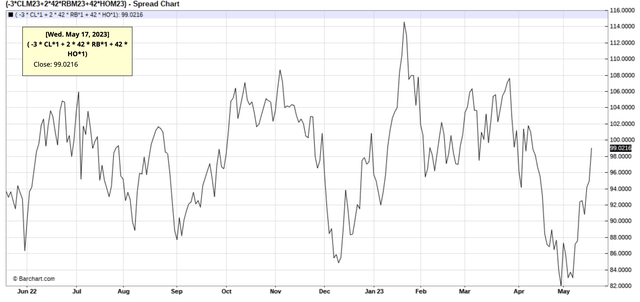

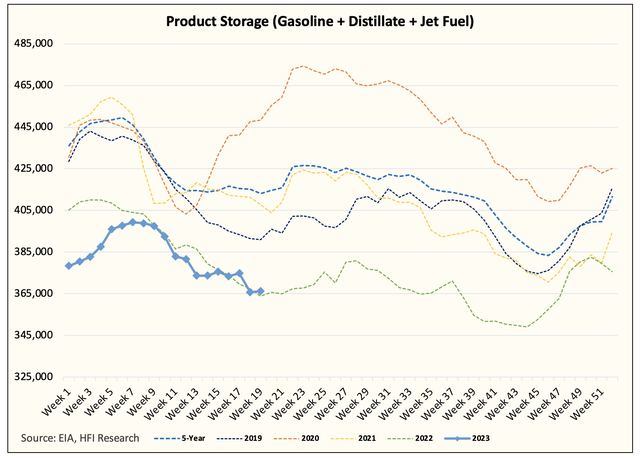

In our view, the key to this figure will be how we trend over the coming weeks. Given the recent performance in the 3-2-1 crack spread, I believe that product inventories should further decline as consumer demand continues to improve.

Barchart.com

As a result, we could see product storage move into a steeper deficit going forward.

EIA, HFIR

As of today, gasoline, distillate, and jet fuel are sitting right around 2022 levels. But remember that in 2022, we started to see much lower demand by the June timeframe. We think this year will be the opposite.

On the refining margin front, we don’t expect refining margins to get anywhere close to what we witnessed last year. In H2 2023, we will see +2 million b/d of refining capacity come online, which would keep refining margins rangebound. In addition, Mexico’s Pemex is starting up its refinery in June, which will take away some of the product export demand for the U.S. All-in-all, we see a rangebound scenario for refining margins, which should further aid consumer pricing.

This is why I believe that U.S. oil demand going into this summer could surpass an all-time high. Directionally speaking, we are moving in this direction, so it’s only a matter of time.

Rangebound for now, but not for long…

We don’t see how the oil market can remain in this tight range for long. There are three important reasons why we believe this:

- US oil demand is clearly performing better than what we saw going into the summer of 2022.

- China’s oil demand recovery is real, and when it finishes draining its excess product inventories, crude buying will return.

- OPEC+ appears to be committed to reducing supplies to the market. Saudi’s crude exports look to be lower by ~800k b/d m-o-m for May.

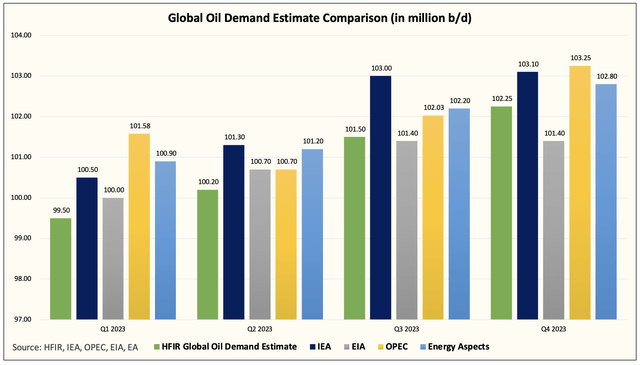

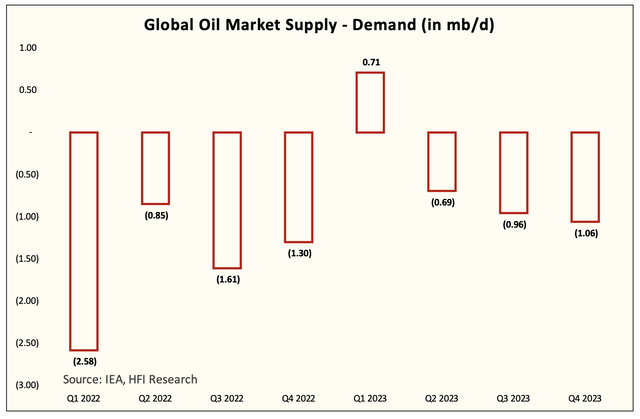

And if you circle these three points back to our global oil supply and demand model, you will note that we have one of the lowest oil demand assumptions, and yet, we still assume a draw in H2 2023.

HFIR, IEA, OPEC, EIA, and EA

S&D Model

IEA, HFIR

In my view, the margin of safety is there for oil prices. The risk is asymmetrically positioned to the upside because I don’t think the market is pricing in any scenario where demand surprises to the upside. In fact, we still assume OECD demand to be lower y-o-y (-0.29 million b/d), and this is despite the fact that US oil demand is already higher y-o-y.

This is why I believe, if global oil demand continues to trend the way it is, it is only a matter of time before oil breaks out of this range.

Read the full article here