Uber Technologies, Inc. (NYSE:UBER) stock has outperformed my expectations, significantly outperforming the S&P 500 (SPX) (SPY) since my previous update, attracting momentum investors back into the fray.

UBER bottomed out in late April after consolidating constructively for over two months before surging through its early August highs. However, UBER’s upward momentum has stalled since the release of its second-quarter or FQ2 earnings scorecard, as it delivered GAAP EPS profitability.

Accordingly, UBER has been consolidating below the $50 level. However, I gleaned that buyers have failed to muster sufficient momentum to break through that resistance zone since then, which shouldn’t surprise its holders.

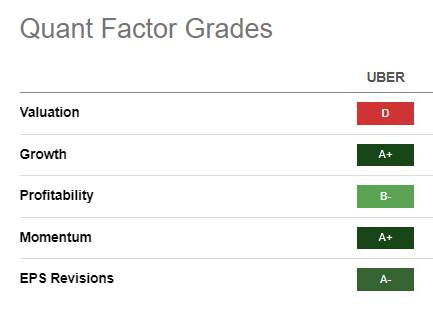

UBER Quant Grades (Seeking Alpha)

Astute dip buyers who accumulated UBER at its lows in 2022 or early 2023 have done well. However, that doesn’t necessarily mean that late buyers should continue to chase UBER’s surge if they missed those moments.

Accordingly, UBER’s “D” valuation grades suggest relative overvaluation compared to peers. However, Uber Bulls could argue that its best-in-class “A+” growth grade justifies its premium valuation. Management is confident of delivering robust operating leverage and free cash flow or FCF growth over the medium term.

Furthermore, analysts’ estimates are increasingly optimistic, as they expect Uber to post an adjusted EBITDA of $5.71B in FY24, well above the $5B annualized run rate projected by Uber.

Uber’s business model moat is supported by its network effect, which has demonstrated its resilience over the past year. Consumer spending has also remained robust, notwithstanding the elevated inflation rates. In addition, the company has astutely capitalized on its platform strategy to cross-sell its services across its mobility and delivery platform, strengthening its network effect moat.

In addition, Uber has reported encouraging membership growth through Uber One, improving retention and spending levels, and providing more visibility into its earnings growth profile.

As such, Uber has transformed itself into a respectable platform company, leveraging on its massive trove of first-mover data advantage and network effect moat. Therefore, the upward valuation re-rating on UBER is likely predicated on the company’s ability to execute its FY24 outlook of $5B in adjusted EBITDA, suggesting near-term optimism could have been priced in.

UBER last traded at an FY24 adjusted P/E of 25.2x. It’s well above its sector median of 17.2x (forward adjusted P/E), suggesting investors have likely baked in significant optimism. Given Uber’s robust growth metrics, buying sentiments are expected to remain strong, supported by its “A+” momentum grade. However, investors shouldn’t rule out the possibility of a steep pullback to normalize its surge over the past few months as dip buyers continue taking profit and rotating out.

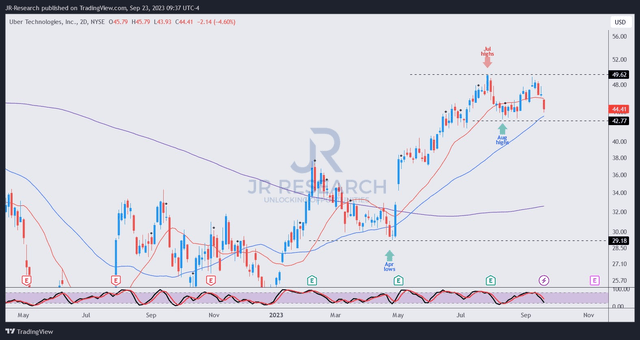

UBER price chart (2-Day) (TradingView)

As seen above, UBER has failed to clinch a decisive breakthrough above its $50 resistance level over the past two months.

Another failed attempt in mid-September led to a further selloff last week, forcing UBER down closer to its August lows ($43 level). That level must be defended for UBER’s near-term uptrend bias to remain intact.

Losing that level could see UBER falling below its 50-period moving average or MA (blue line), potentially forcing more momentum buyers to throw in the towel, leading to a steeper pullback.

As such, I assessed that now isn’t the time to add aggressively to UBER, given the rejection assessed at the $50 level. Investors shouldn’t throw caution to the wind if they want an improved risk/reward profile following its sharp surge from its April lows.

I suggest staying on the sidelines while awaiting the current levels to be resolved before assessing another buying opportunity.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here