Summary

In May, I analyzed UiPath Inc. (NYSE:PATH) and concluded that while the company’s growth had slowed as customers reorganized IT strategy and budgets to incorporate AI, RPA (robotic process automation) could see an acceleration in demand and is a tool that AI can utilize. The company founder came back as CEO and began to make commercial changes with a focus on accelerating new contracts. However, this could require some time to execute, and the stock would tread water until a clearer path was formed.

Quarter Result

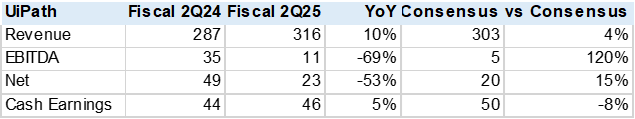

The fiscal 2Q25 results were in line with revenue growth of 10% but a decline in operating margins and flat cash flow. The company stated in its analyst call that it’s beginning to see the “confusion” surrounding AI and RPA begin to dissipate, but they are not ready to make longer-term guidance. This suggests to me that the “problem” is still a work in progress and PATH will need to educate/demonstrate to its current and future clients that its products are essential to make AI reach the productivity levels envisioned.

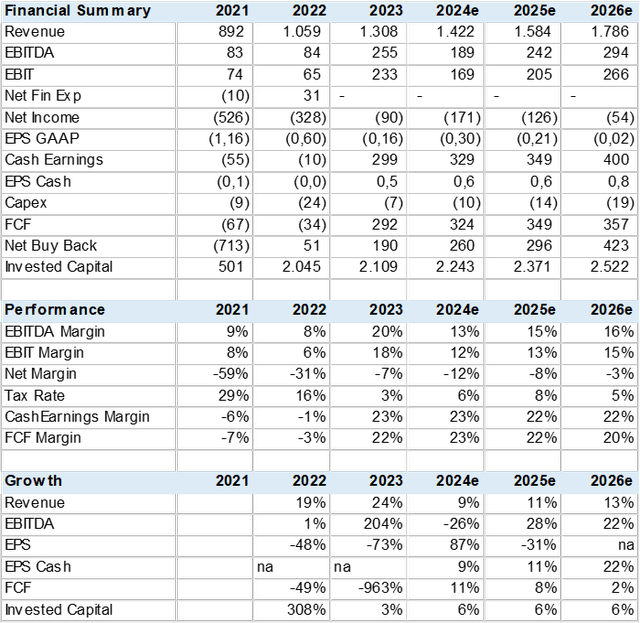

In my May article, I saw that consensus had not yet adjusted for the company results and headwinds with revenue growth still around 19% while the price target of US$27 seemed optimistic. The current guidance and consensus for fiscal 2025 have largely merged into an 8% revenue growth rate, with margins declining and EBITDA down 25% YoY. The current price target has moved to US$15 which seems reasonable as the company eventually gets past the doldrums.

Created by author with data from Capital IQ Created by author with data from Capital IQ

Valuation Reset

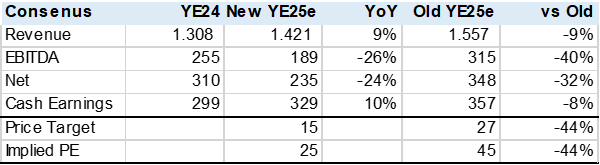

The stock has suffered a valuation reset or downgrade and where it was once priced at around 45x cash earnings (the add-back stock-based compensation & depreciation) the market has now taken this down to 25x with an implied PEG ratio of 1.5x, in line with the NASDAQ 100-Index (NDX). Using the 25x target on calendar 2026 estimates I arrive at a potential upside of 63% or US$20 if the company can increase top-line growth to 15%.

Estimates now appear to incorporate a slow growth business model factoring in competition and most likely lingering “confusion” surrounding PATH’s automation integration with AI. On the positive side, the company generates over US$300m in free cash flow that can be used in M&A or buybacks.

Created by author with data from Capital IQ Created by author with data from Capital IQ

Risk

The long-term risk is if AL can replace RPA making the company obsolete. In the midterm, it is possible that competition from other IT service providers begin to craft their own RPA with the help of AI. New technology can interrupt all companies, no one is 100% safe in my view.

Conclusion

I rate the PATH a hold. The quarterly results are positive, management is engaged in rebooting growth and the stock and estimates have largely factored in a slower growth scenario with upside risk if management can execute better than expected.

Read the full article here